How Snoop Leverages Their Tech Stack to Jumpstart Growth, Build Consumer Trust, and Optimize Messaging

Published on January 21, 2022/Last edited on January 21, 2022/11 min read

Sunny Manivannan

VP & GM, Global SMB, BrazePowered by open banking, Snoop is an award-winning, consumer-focused business that helps people spend, save, and live smarter.

I spoke with Cara Norton, Head of Operations and Cofounder at Snoop, to better understand how they use Braze to achieve business goals. Norton shared how the Snoop team collaborates across marketing and engineering, increased campaign sophistication, and utilizes a cross-channel strategy.*

Can you tell us a little bit about Snoop? I know you are one of the cofounders, so certainly would love to hear about the conception of the business.

A number of us left our previous roles together and decided that we were going to found Snoop with Jayne-Anne Gadhia as our executive chair. We were horrified to understand how many consumers pay for their inertia and apathy around switching products and services. In the UK, it costs consumers around 12 billion pounds every year, and that's known as the “loyalty penalty.” We really believe that an open banking-driven proposition would deliver profoundly better outcomes for consumers.

With Snoop, you connect your bank accounts and credit cards so you can see your information in one place, which gives you a sense of control and empowerment. You are able to keep track of your regular bills, and we’ll alert you when those bills change and when we think you'd be better off making a different decision. We also provide a whole heap of money-saving tips and insights, not just deals but broader than that around like I said, how to spend smarter and to try and encourage people to spend in a different way. And that's what we're all about.

Banks have a transactional relationship with their customers. They're always going to promote their own products, they're never going to promote someone else’s because it's in their interests, right? We're trying to create an experience layer between the consumer and the bank to provide a kind of independent view of what they should be doing.

What has your growth been like since you partnered with Braze?

We have 47 employees today—with three of us working in Braze day-to-day. When we first started, there were 10 cofounders, and when we first signed with Braze, I think we were up to about 15 employees in total. So we’ve grown huge amounts in 18 months.

We have two native apps, iOS and Android, and have continued building up and improving the product ever since we launched. We landed our Series A in July 2021, so that was a really big milestone for us. Since then we've carried on building and are actually rolling out a web channel this week as well.

We have over half a million downloads now, and over 400,000 logins per month. It's gone from zero to where we are today. It’s changed massively, and Braze has been critical in that.

Tell us about your evaluation process that ended up with you choosing Braze.

Having come from a big bank previously, we knew what we wanted and what we didn't want. We knew we wanted to go with a lightweight, capable, functional, feature-rich, easy-to-use platform. We didn't have time to spend months integrating a platform into our evolving tech stack at that point, we needed something that was going to be easy to use and get started with.

So we assessed Braze on six dimensions:

- Functional capabilities that we tested against a range of day-one aspirational use cases.

- Cost. Obviously, as a startup, you haven't got a lot of money. So, although it was going to be a big cost whatever we chose, the cost was obviously a big factor for us.

- How easy it is to integrate and configure. Obviously, that's important since we had limited development resources. We can’t spend forever integrating one piece of the tech stack.

- Data privacy and security, which was critical as a new platform in an industry where consumers have security and privacy top of mind.

- Ease of use. Again: Limited time, limited people. We needed to have something that we understood, that was intuitive and easy to use.

- The people. I know that sounds a bit kind of fluffy, but it is important. We're gonna work with the company on such a critical part of our stack helping us deliver outcomes and experiences to customers, we needed to know we’d have people on our side at the company we chose.

We assessed a number of different platforms, and Braze ticked every box.

Turn back the clock a bit and tell us about your first few months with Braze. What was that like? And what resources did you use to help you get started?

We selected Braze really early on in our journey. In fact, it was the second tech decision we made after we decided to go all-in with cloud and all-in with AWS. We knew the pieces we needed to put in the jigsaw, and we just needed Braze early on so that we could get going.

We used some of the Braze learning modules that are available online. They were really helpful because we were not only trying to learn how to use the system and configure it in the way we wanted, we were designing the business at the same time.

Additionally, we called on a few favors with our lovely Braze team in the UK office, who were incredibly helpful. We just needed a little bit of reassurance that we had done it in the right way and it was gonna work. They spent a couple of hours with us just walking through everything, over and above what they needed to do contractually. It’s so helpful for any small business, especially a startup, to just have a company that doesn't go “Well, that's not in the contract, we don't wanna do that.” Here they said “Come into the office, grab a coffee, let's go through it for a couple of hours, and we’ll help you with what you need.” And that's what they did brilliantly. So that was very reassuring for us.

Have you added any additional channels over time? And if you remember your first use case within Braze, I'd love to hear about that as well.

I'm not telling you a lie here, we were so excited to just get a push message on our phone! It was amazing, genuinely, because we’d gone through so many things in our previous roles trying to get these big systems integrated, we never quite managed to get it done. And this time it was like “Oh my God, it actually just works. This is fantastic.”

Our first true use case was really around our welcome process and our onboarding process and trying to understand as soon as someone downloaded Snoop, where did they drop out? How can we encourage them to complete registration? How could we explain what the product was as soon as they’ve launched? Does it work? Do people like the emails? So it was Canvases that we used very early on there to try to get that in place.

Have you added additional channels over time since that initial period?

We use push and email predominantly, but in-app messages have been critical to us. We use them all the time, both the custom HTML ones as well as the out-of-the-box ones Braze provides. And Snoop is actually just rolling out a web channel, so we're going to start using web notifications as well.

Tell me a little bit about your tech stack as well. I assume you’ve gone beyond AWS and Braze. What are some of your other main solutions?

We are cloud-native—we started with AWS, then Braze. We made a tech decision at the start: Where we thought something could really make a difference to us to be bespoke, we would make that our own intellectual property (IP) and we'd be deliberate about it. But in many cases, we knew there was no point building something if there was a SaaS platform somewhere that could do it better for us—we knew we weren’t gonna benefit from trying to rebuild Braze, for example. In addition to Braze, we use Segment, which was suggested at the start. We use Amplitude as well for our app tracking, and Appsflyer for attribution tracking.

Tell me about a cool or innovative use case you’re most proud of.

We ran what we called a “Golden Quote'' campaign, and it was all about trying to get customers to give our switching services a try. Customers got an entry into a weekly draw where all they have to do is click out, have a look, get a quote from another provider. On Friday afternoon, we’d send a message to check in to the app to see if they’re a winner and we used a Braze custom animated HTML in-app message to tell whether they're a winner or not. And we also knew what prizes would resonate with the winners based on their transactions—so if you shop more at Amazon than Tesco, we would say we're going to give you an Amazon voucher. We were able to harness the power of the data that we have in our platform and deliver an amazing user experience as well.

Another one that comes to mind is that when you use Snoop, you connect your bank or credit card to the app and you have to re-approve that connection every 90 days. We also find that banks have some problems, which can lead to a bad experience for our customers. Braze allows us to quickly deploy messaging in the app or tell customers when there's a problem—like if a bank doesn't connect properly, or something's wrong where it's not refreshing accounts correctly. It's not particularly interesting, but it's really important because it smooths the process for customers onboarding and connecting accounts.

How has Braze helped Snoop work more effectively and efficiently?

It’s essential for us to be nimble. With so many different product categories in the app, our team needed the ability to build experiences around each of them, and try and bring them together as cohesive experiences for customers. Braze empowers our team to get messaging out to customers in the way we want. If we were dependent on development resources, we would never have been able to drive engagement with our revenue-generating categories to the level we have.

As a result, our engagement rates have increased: We find customers logging in more and interacting more with the services we offer. Having in-app messages for us has been absolutely critical to us hitting targets in the last year. It's allowed us to test and learn and optimize so we can figure out what works before going anywhere near a developer.

How do you envision Braze will help you as you continue to grow?

Braze is going to be critical to us growing further because—in addition to improving and developing the product—we’re all about optimization. If you can make everything work 5% better, that's a game-changer for us. Just keep going by 5% and you gradually improve.

What advice would you give somebody that is in your shoes from two years ago in terms of Braze and this whole area of the world?

In our previous experience, we've seen a lot of poor tech decisions made. We've seen the impact of legacy on a business. We didn't want to make that mistake with Snoop. Our ethos is “start well, go well.” It's very easy to say, “Oof, quite a high cost for year one of a startup, do we really want to do that now? Can we not do it later?” And most small businesses start with lots of string and tape to try to keep things going as best they can. But we knew that engagement was going to be critical to Snoop, and that we needed a really robust, flexible, nimble platform to allow us to do that. What we didn't want to do is create a legacy for ourselves from day one. And that's why we picked Braze and implemented it so early.

Final Thoughts

Hundreds of innovative small and growing companies like IDAGIO, Branch, and Grover are using Braze to disrupt their categories and achieve success within their industries. See for yourself why Braze is the secret weapon startups turn to gain a competitive advantage, engage thoughtfully with their users, and ultimately drive business outcomes like user growth, conversions, revenue, retention, and more.

*This conversion has been edited for length and clarity.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

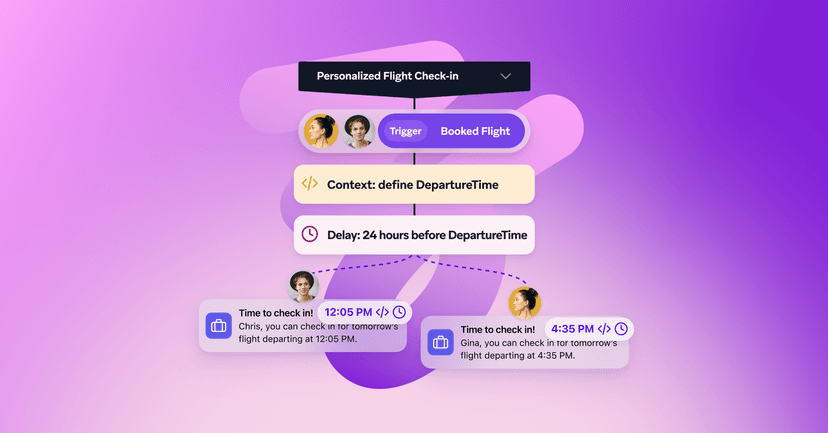

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026