Here’s How 6 FinTech Startups Are Finding Success With Braze

Published on September 07, 2022/Last edited on September 07, 2022/8 min read

Mary Kearl

WriterLess than 20% of FinServ brands achieve the highest level of customer engagement performance, according to our 2022 report on the state of customer engagement for financial service brands. That means most companies within the industry have the opportunity to improve their efforts and foster stronger customer relationships and business outcomes. That’s something the following 6 FinTech startups have accomplished since teaming up with Braze. Leveraging our customer engagement platform and in-house expertise, these businesses have accelerated conversions and revenue-generating activity. Here’s how.

1. Instant payments platform Branch creates more customized campaigns, encourages deeper user engagement, and drives productive innovation with Braze

When Minnesota-based Branch, a company that enables organizations to pay their workers faster, was looking for a lifecycle automation and customer engagement platform, Braze was a clear choice for amplifying the team’s cross-channel messaging and personalization efforts. Using the Braze platform has been a game changer for Branch, enabling the team to create tailored messages that encourage users to move from one step of the funnel to the next and to improve the overall user experience.

“On the data science team, we're constantly analyzing user funnels and their behavior and where we can improve,” explains Kayla Dostal, User Behavior Engagement Manager at Branch. “Other ideas come from the product team as well. As they add new product features or see that we're not getting the adoption of certain features that we want, they'll come to me and we'll come up with a plan of how we can improve adoption using Braze.”

Today Branch is able to personalize the customer experience based on an individual user’s workplace and their specific engagement with the Branch platform, which in turn benefits the company’s onboarding efforts and overall engagement.

Keep reading to see How Branch Personalizes the Worker Experience with Braze.

2. The maker of top-rated personal budgeting software and apps, YNAB uses Braze to keep the brand’s large number of monthly active users engaged, drive subscribers, and increase activity within the company’s cross-device and cross-platform apps

With apps available via the web and compatible with iPhone, Android, iPad, Apple Watch, and Amazon Alexa devices, YNAB—short for You Need a Budget—has a range of audiences they need to keep engaged. They do it all with a team of one, tasked with overseeing the company's email marketing and cross-channel strategy, thanks in part to capabilities that foster agility and efficiency.

“Braze has helped me streamline processes,” says Barry James, Marketing Automation Specialist at YNAB. “I think of myself as a technical marketer from a lifecycle perspective, but Braze has allowed me to take off my technical hat in a lot of instances and do the work. The Braze platform's intuitive UI enables me to do my work in a way that's thoughtful.”

James takes advantage of the Braze platform’s no-code solutions to get more done without having to ask for engineering support, and leverages Braze permissions controls to enable other departments to check in on what they need to monitor, freeing up some of James’s time.

Thanks to these benefits and more, YNAB is not only better able to engage customers on their journey toward meeting their financial goals, they’ve grown their number of subscribers and increased the high-value actions completed within the platform.

Keep reading to see How You Need A Budget Drives High Value Actions and Revenue With Braze.

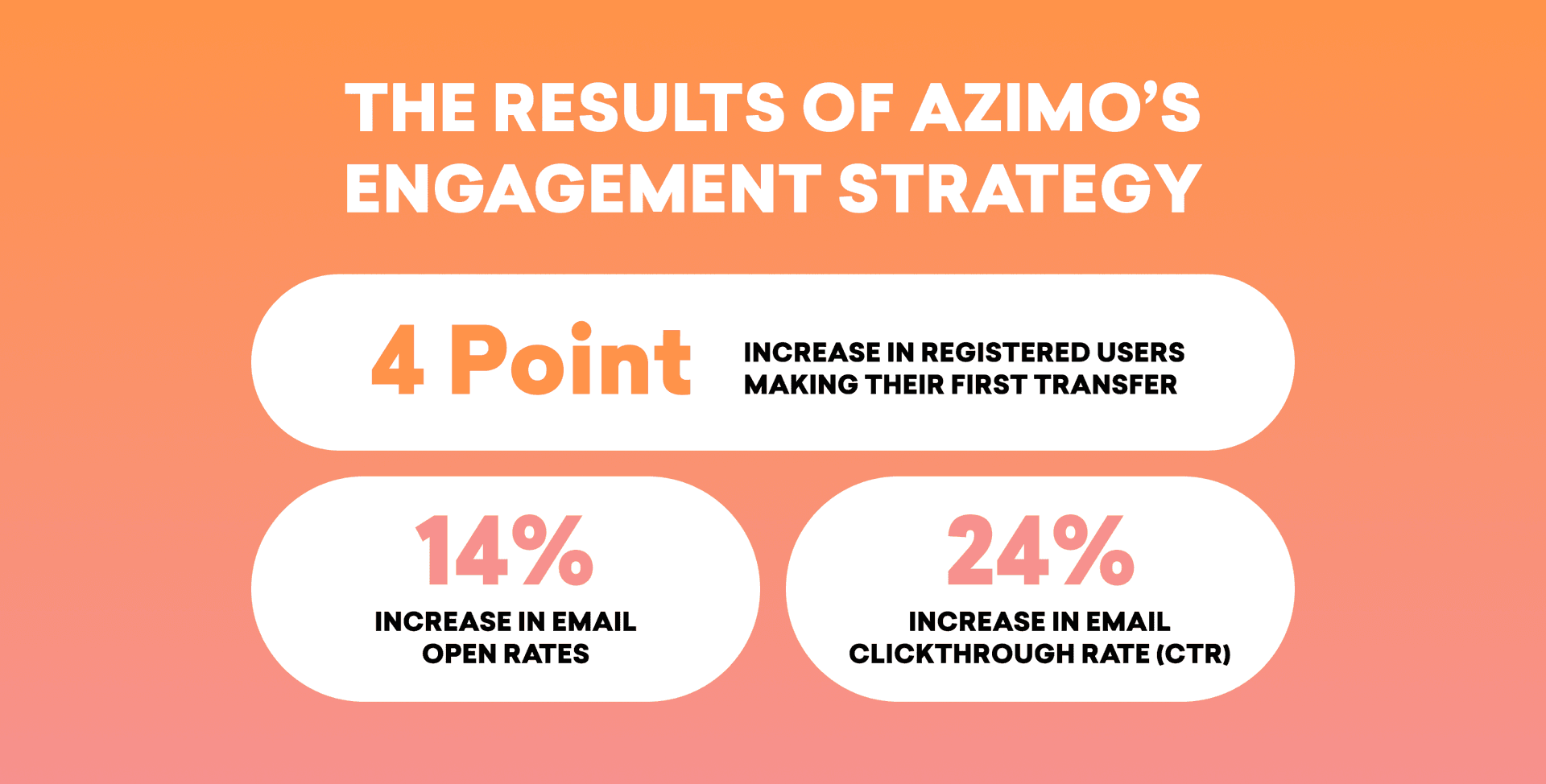

3. Since selecting Braze as the brand’s customer engagement platform, global money transfer company Azimo has boosted email open rates by 14% and CTR by 24%

Azimo gives consumers a faster, cheaper way to send money internationally, democratizing access to financial services, instant world transfers, and strong exchange rates. The company’s old CRM, however, was holding the brand’s efforts back. On top of adding cross-channel capabilities to the mix, because Azimo decided to team up with Braze, the company also benefited from weekly check-ins with their dedicated Braze customer success manager (CSM) to plan and execute much more dynamic campaigns, drawing on the customer success team’s technical and strategic expertise.

In the past, Azimo created different versions of each email they sent for each customer language they offered outreach in, a process that was tedious and time-consuming. With the Braze platform’s Connected Content dynamic personalization feature, Azimo is now able to automate the translation process and, at the same time, send real-time exchange rates for different currencies. These changes have helped the company improve open rates by 14%, click-through rates by 24%, and the rate of registered users completing their first transfer by four points.

Keep reading to see How Azimo Is Cashing in on Better Customer Engagement With the Help of Braze Customer Success.

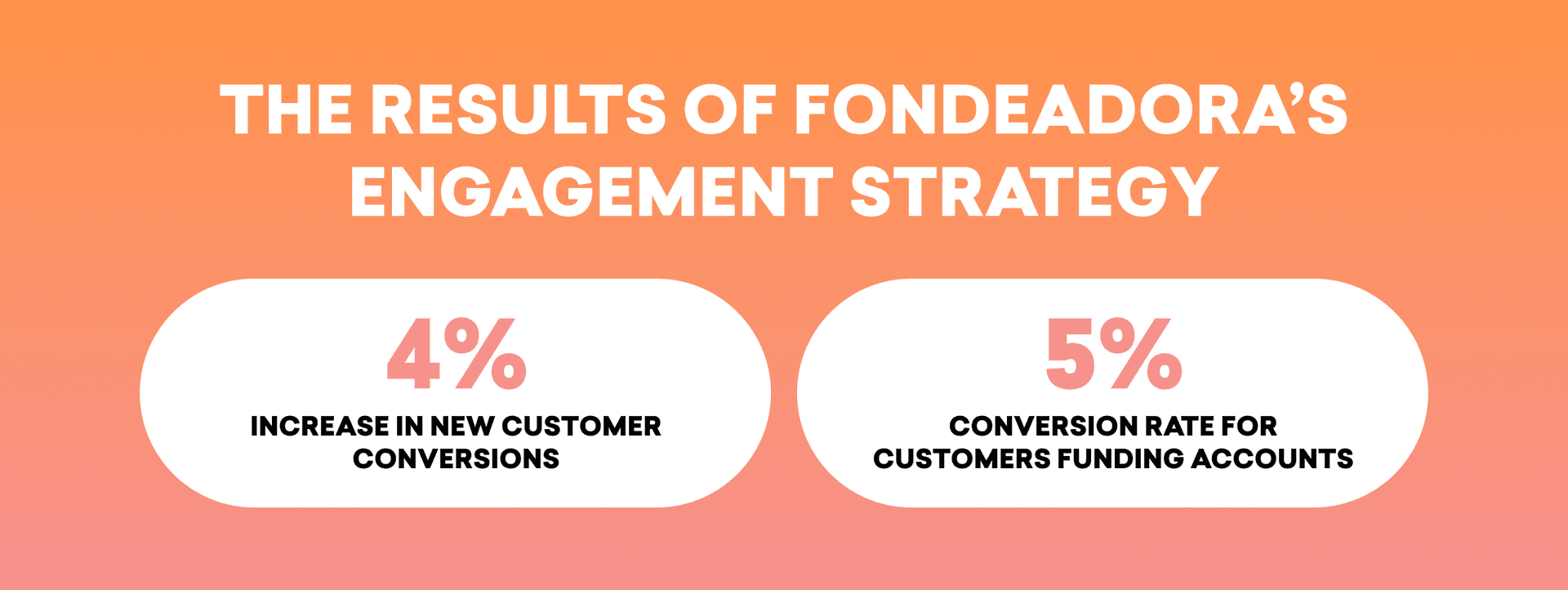

4. Mexico City-based Latin American FinTech Fondeadora has grown enrollments by 4% and account funding by 5% since teaming up with Braze

Offering free reloadable debit cards and an integrated banking app, Fondeadora, an 100% digital banking business, relies on data-driven customer engagement to fuel the company’s growth. That’s why the FinTech brand chose to work with Braze—for the Braze platform’s native mobile functionality, cross-channel support for SMS and email campaigns, testing capabilities, custom attributes, and easy integrations with other key technologies across their MarTech stack. Since enhancing Fondeadora’s re-engagement efforts with unenrolled leads and customers who have yet to fund their accounts, the brand has driven conversions in both initial enrollment (up 4%) and account funding (up 5%).

“Braze is without a doubt the right customer engagement partner to help us build our vision and become a global leader in the FinTech landscape,” says Ana Paula Sánchez, Engagement Lead at Fondeadora.

Keep reading How Fondeadora Boosts Key Conversion Metrics With Braze-Powered Messaging.

5. The award-winning money management app Snoop has added new messaging channels and driven logins and interactions with revenue-generating categories since partnering with Braze

The platform that lets consumers visualize all their financial accounts in one place to drive savings, Snoop, has achieved over a half a million downloads and 400,000 logins per month.

“We’ve grown huge amounts in 18 months….and Braze has been critical in that,” says Cara Norton, Head of Operations and Cofounder at Snoop.

Norton says she and her team selected Braze for the platform’s functional capabilities, cost, integrations, configuration options, data privacy and security advantages, ease of use, and for the team members working at Braze. That’s a decision that’s enabled the company to build out a true cross-channel strategy leveraging push notifications, emails, web notifications, and in-app messages.

“With so many different product categories in the app, our team needed the ability to build experiences around each of them, and try and bring them together as cohesive experiences for customers,” says Norton. “Braze empowers our team to get messaging out to customers in the way we want. If we were dependent on development resources, we would never have been able to drive engagement with our revenue-generating categories to the level we have. As a result, our engagement rates have increased: We find customers logging in more and interacting more with the services we offer.”

Keep reading How Snoop Leverages Their Tech Stack to Jumpstart Growth, Build Consumer Trust, and Optimize Messaging.

6. The platform that lets families easily set up modern investment portfolios for their kids, EarlyBird, is using Braze to convert consumers into lifetime users and drive engagement across the lifecycle

Chicago-based EarlyBird leverages Braze capabilities for a variety of compelling use cases, from converting web leads into app installs to creating an eight-part educational email series all about crypto with a staggering 85% open rate. One of the biggest challenges the team has been able to tackle using Braze has been addressing the steep dropoff that occurs during the EarlyBird account signup process, using Braze Canvases to encourage people to continue their journey at the exact step in the flow where they’ve dropped off.

“Without Braze, I couldn't imagine communicating to so many users at one time,” says Customer Success Manager Ciara Grierson. “How would I even go about that and be even able to segment users out as specifically as I can within Braze?"

“I can't imagine a world in which you’re running a successful business and you aren't able to easily deploy customized, beautiful, personalized messaging and communications to drive awareness, adoption, and engagement with users who've never before interacted with features like all of what EarlyBird offers,” adds COO Caleb Frankel. “Within our first year, we've been able to fully communicate to tens of thousands of families in really unique and powerful ways using Braze.”

Keep reading How EarlyBird Leverages Braze to Optimize Messaging and Convert Users for Life.

Step Up Your FinTech Customer Engagement Using These Campaign Templates

Looking for more on industry trends, consumer expectations, and opportunities for growth in the FinTech space? Check outBanking on the Customer Journey: 2022 Financial Services Insights.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

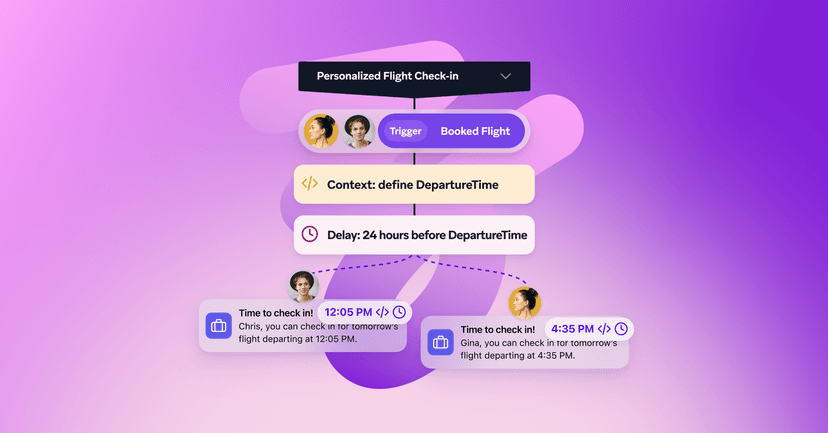

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026