Choosing the best AI decisioning platforms for 2026 (across industries)

Published on February 12, 2026/Last edited on February 25, 2026/17 min read

Team Braze

Contents

- What is an AI decisioning platform?

- Choosing the best AI decisioning platforms for marketing and customer engagement

- Choosing the best AI decisioning platforms for fraud detection and risk management

- Choosing the best AI decisioning platforms for general business operations

- Choosing the best AI decisioning platforms for compliance and regulation

- Choosing the best AI decisioning platforms for patient care

- How to choose the right AI decisioning platform

- Extra criteria for marketing and customer engagement

- Final thoughts on some of the best AI decisioning platforms

- Frequently Asked Questions

AI decisioning platforms give teams a way to personalize decisions at scale, using reinforcement learning to pick the best combination of message, channel, timing, and offer for each individual. Instead of relying only on fixed segments or static rules, these systems test different options in the background and adapt based on what actually optimizes the goal you care about.

While marketing and customer engagement are common entry points, decisioning systems can also be used to support fraud and credit risk, patient care, compliance, and wider operational use cases. That includes everything from triage and underwriting to claims routing and transaction screening, often under tight regulatory and performance constraints.

This guide highlights leading AI decisioning platforms across key categories—marketing and customer engagement, fraud detection and risk management, general business operations and compliance, and patient care—so you can see, with AI decisioning use cases, how different vendors approach similar decisioning problems.

What is an AI decisioning platform?

An AI decisioning platform is software that uses customer data, business rules, and reinforcement learning to make 1:1, personalized decisions across every aspect of a lifecycle campaign—what to offer, when to engage, which channel to use, and how often to reach out.

It replaces broad segmentation with individual decisions based on all available data for each person.

Choosing the best AI decisioning platforms for marketing and customer engagement

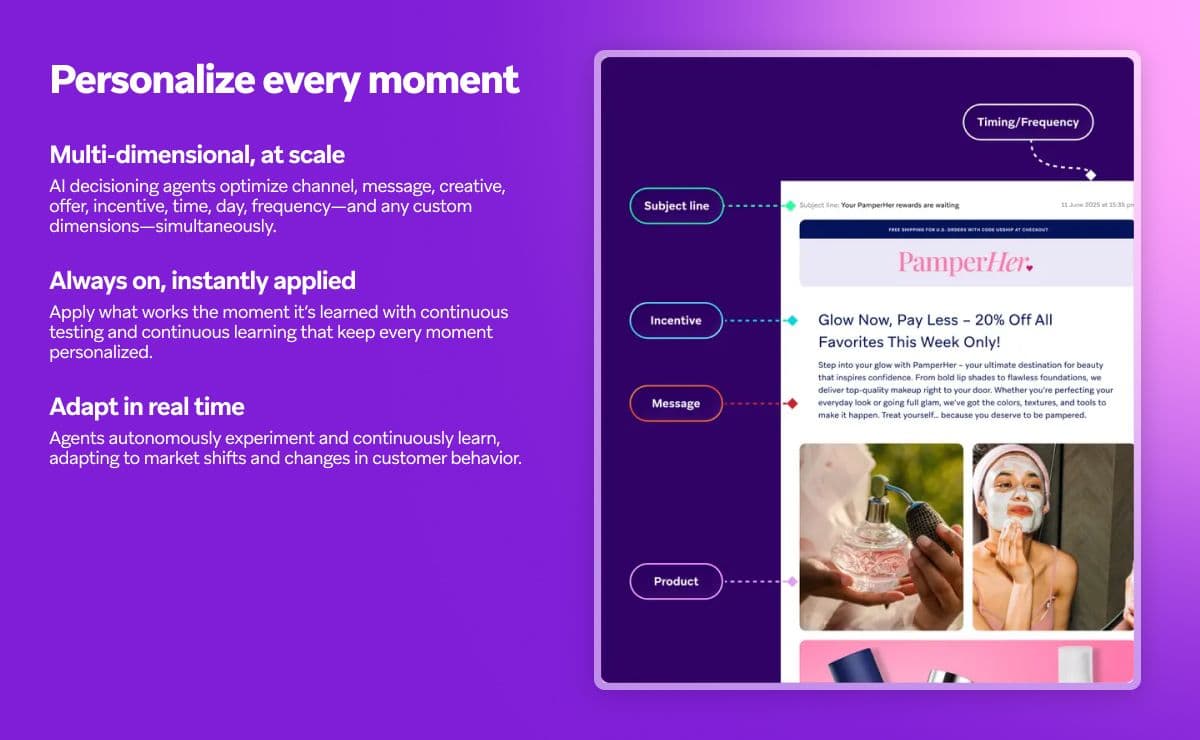

In marketing and customer engagement, AI decisioning platforms help teams make 1:1 choices across many levers at once—channel, message, timing, frequency, product or offer, and more. Instead of relying only on static segments and rules, these systems autonomously experiment and continuously learn from real behavior, updating decisions as goals, audiences, and context change.

Vendors approach the decisioning layer from different directions. Some embed AI decisioning directly into a customer engagement platform, while others extend existing personalization, promotion, or data products so they can decide “who sees what” in real time. The summaries below focus on those decisioning capabilities for marketing and lifecycle teams. Here are some examples AI decisioning platforms.

BrazeAI Decisioning Studio™(formerly known as OfferFit)

BrazeAI Decisioning Studio™ is an AI decisioning layer for 1:1 personalization integrated with the Braze Engagement Platform.

It uses reinforcement learning agents to find the optimal combination of channel, message, offer, timing, and frequency for each individual, based on first-party data and defined business goals. BrazeAI Decisioning Studio also works as a standalone product that can be integrated into existing CDPs.

Key capabilities for AI decisioning in marketing

- BrazeAI Decisioning Studio, previously OfferFit, helped define the category and has more than five years of experience personalizing enterprise-level lifecycle campaigns.

- Reinforcement learning agents that optimize multiple levers at once for every customer, rather than just testing single variables.

- Use of rich first-party data from Braze profiles, events, catalogs, and warehouse/CDP connections to replace broad segments with 1:1 decisions.

- Native decision activation in Canvas and campaigns across email, push, in-app, SMS, and other channels.

- Always-on experimentation and lift measurement against KPIs like revenue, conversions, and retention.

- Analytics that surface why an agent chose a specific option for a given customer.

- Built-in control groups and lift reporting to track incremental impact against KPIs like revenue, conversions, and retention.

- Brands have access to white glove, forward deployed data scientists that customize based on your KPIs, monitor performance and help troubleshoot where necessary.

Example use cases: repurchase and loyalty journeys, upgrade and cross-sell programs, activation and referral flows, arrears recovery and retention journeys, cart abandonment and win-back campaigns, plus dynamic pricing and contract optimization.

Salesforce Einstein Decisions

Einstein Decisions is part of Salesforce’s Einstein AI capabilities and acts as a decisioning engine within Marketing Cloud Personalization.

It looks at each customer’s profile and behavior, then chooses the next-best offer, promotion, or experience from a defined set, so teams don’t have to hard-code “who sees what” into every journey.

Key capabilities for marketing decisioning

- Decisioning engine that evaluates multiple promotions or actions and selects the most relevant one for each customer based on business goals like clicks or conversions.

- Requires contextual and behavioral data from Marketing Cloud Personalization and connected Salesforce sources to inform decisions.

- APIs and templates that let web, app, and CRM touchpoints request and render Einstein Decisions as part of existing experiences.

- Continuous model training that learns from engagement outcomes and updates decision policies without manual rule changes.

Example use cases: product and order recommendations, next-best offer and promotion selection, send-time and journey optimization, campaign audience refinement, and service journeys that adapt based on case history and context.

Adobe Target Auto-Target and Automated Personalization

Adobe Target’s Auto-Target and Automated Personalization features use machine learning to decide which experience or offer combination to show each visitor.

Auto-Target chooses among marketer-defined experiences, while Automated Personalization combines offers and matches them to visitors based on profile, context, and behavior.

Key capabilities for marketing decisioning

- Experience-level decisioning that selects the best variation for each visitor from a set of defined options.

- Automated Personalization to assemble and match different offer combinations using advanced machine-learning models.

- Auto-Allocate capabilities that shift more traffic toward higher-performing experiences as results come in.

- Visual Experience Composer so marketers can configure and manage web experiences without heavy engineering effort.

Example use cases: web and app experience testing, personalized hero banners and navigation, tailored offers and promotions, cart and journey abandonment flows, and content variations that adapt to customer behavior in real time.

Pega Customer Decision Hub

Pega Customer Decision Hub is an enterprise decisioning engine widely used in sectors like financial services and telecom.

It focuses on real-time decisioning and centrally managed strategies, often framed as next-best-action, across marketing, sales, service, and collections.

Key capabilities for marketing decisioning

- Always-on decisioning that generates recommendations in real time across inbound and outbound channels.

- Centralized decision strategies spanning acquisition, cross-sell, retention, and service use cases.

- Integration with web, mobile, and contact center systems to surface offers and treatments based on live interaction context.

- Strategy management and analytics tools for tuning models, rules, and eligibility constraints across complex deployments.

Example use cases: real-time next-best-action recommendations, cross-sell and upsell offers, retention and win-back journeys, service-case suggestions during customer interactions, and centralized decisioning for inbound and outbound campaigns.

Hightouch AI Decisioning

Hightouch AI Decisioning builds on the company’s cloud data warehouse, adding AI agents that drive 1:1 personalization across email, SMS, push, and web.

It reads from the cloud data warehouse, uses agents to optimize for goals like retention or conversion, and sends decisions into existing engagement and ad tools.

Key capabilities for marketing decisioning

- AI decisioning agents that learn which content, channels, timings, and frequencies move target outcomes for each customer.

- Direct connection to the data warehouse so decisions use a complete, up-to-date view of customer history and behavior.

- Orchestration of personalized experiences requires integration with a downstream ESPs, engagement platforms, and ad networks.

- Insights and lift reporting that highlight which strategies and creatives are working for different audiences.

Example use cases: real-time web and app personalization, personalized coupons and offers, journey and message optimization based on warehouse data, churn and retention-focused outreach, and cross-channel experiences that react to customer behavior in the same session.

Choosing the best AI decisioning platforms for fraud detection and risk management

In fraud, credit, and risk, AI decisioning platforms sit behind decisions like who to approve, what to challenge, which cases to review, and how to manage exposure. Common use cases include credit decisioning, risk scoring, fraud detection, underwriting, and collections strategies.

FICO

FICO provides decisioning tools used for credit risk, fraud control, and other high-volume financial decisions. Its platform combines analytics and business rules so risk teams can automate decisions while keeping policies under control.

Key capabilities for fraud and risk decisioning

- Centralized strategies across credit risk, fraud prevention, underwriting, and pricing.

- Real-time transaction fraud scoring for cards and digital payments.

- Advanced models and monitoring to test, deploy, and refine decision strategies.

Example use cases: credit application approvals, real-time card fraud scoring, and portfolio-level risk strategy.

Provenir

Provenir offers an AI decisioning platform built for credit risk, fraud, identity, and compliance. It focuses on orchestrating data and decisions across the full lifecycle, from onboarding to collections.

Key capabilities for fraud and risk decisioning

- End-to-end decisioning for credit, fraud, and identity checks.

- Data marketplace that connects to multiple credit, fraud, and identity sources.

- Real-time approvals and case management when human review is needed.

Example use cases: application decisioning, fraud and identity screening, and collections strategies informed by risk signals.

Experian

Experian provides data, scores, and decisioning software that help organizations manage credit risk and fraud. Its platforms combine rich data assets with automated decision logic for lending and risk workflows.

Key capabilities for fraud and risk decisioning

- Credit scoring and decisioning to support approvals and pricing.

- Fraud and compliance checks on identities, devices, and transactions.

- Decisioning tools that operationalize data and rules across the customer lifecycle.

Example use cases: automated credit approvals, combined credit and fraud decisioning at onboarding, and ongoing portfolio risk monitoring.

Choosing the best AI decisioning platforms for general business operations

Outside of marketing and fraud teams, AI decisioning also supports everyday operational choices—how to route work, handle claims, apply rules, and automate repetitive decisions at scale. Common use cases include routing and workload management, claims decisions, rules-based fraud checks, and other process-level decisions across industries like insurance, banking, and utilities.

SAS

SAS offers decisioning capabilities that combine analytics, machine learning, and business rules to support operational decisions in areas like claims, fraud, and case routing.

Its tools are used by operations and risk teams that need real-time scoring and routing across large volumes of transactions and events.

Key capabilities for operations decisioning

- Real-time fraud and claims scoring to flag high-risk items early in processes.

- Case routing and prioritization based on risk, value, and workload.

- Use of analytics and machine learning models to detect anomalies and patterns at scale.

Example use cases: routing and scoring of insurance claims, operational fraud checks on payments and account activity, and prioritization of cases for investigation.

InRule

InRule provides an AI decisioning and decision automation platform that lets business users design, test, and deploy decision logic without heavy coding.

It is used across operations functions that need transparent, rule- and model-driven decisions embedded in existing applications and workflows.

Key capabilities for operations decisioning

- No-code authoring and testing of decision logic so analysts can maintain rules directly.

- Combination of business rules, machine learning, and process automation to drive complex decisions.

- Integration with operational systems (such as CRM and line-of-business apps) to apply decisions in real time.

Example use cases: routing and approval decisions in service processes, rules-based fraud and compliance checks, and automated decisions for claims, loans, or account changes.

Sapiens Decision

Sapiens Decision is a decision management platform that externalizes business logic from core systems, with a strong focus on insurance and other financial services operations.

It helps organizations model and manage decision logic for processes like underwriting, claims, and product changes, then apply that logic consistently across systems.

Key capabilities for operations decisioning

- Centralized decision logic that can be updated without changing core policy, billing, or claims systems.

- Automation of underwriting, claims handling, and other rule-heavy processes.

- Tools for business analysts to author and test decision rules, reducing reliance on IT.

Example use cases: underwriting decisions, automated claims handling rules, and routing or eligibility logic in insurance and lending operations.

Choosing the best AI decisioning platforms for compliance and regulation

In compliance and regulatory contexts, AI decisioning platforms help teams apply complex rules consistently, document how decisions are made, and adapt quickly when regulations change.

Common use cases include policy enforcement, know your customer (KYC) and anti-money laundering (AML) checks, eligibility decisions, sanctions and screening workflows, and audit-ready rule management.

CRIF

CRIF provides data, analytics, and decisioning solutions used by financial institutions, insurers, and other regulated organizations.

Its decision management platforms, such as StrategyOne, are designed to help business users implement and govern policies across areas like credit, risk, fraud, and regulatory compliance.

Key capabilities for compliance-focused decisioning

- Centralized policy and decision management across credit, fraud, ESG, and regulatory workflows.

- No-code tools for business teams to design, test, and update decision strategies with full audit trails.

- Support for risk, pricing, underwriting, and early-warning strategies that must align with regulatory requirements.

Example use cases: regulatory-compliant credit and pricing strategies, insurance risk and claims decisioning, fraud and ESG compliance checks.

FlexRule

FlexRule offers an open decision intelligence platform focused on managing and automating decisions end to end. It brings together business rules, data, orchestration, and analytics so organizations can design, automate, and monitor decisions that must meet compliance and policy standards.

Key capabilities for compliance-focused decisioning

- Decision-centric approach that models and governs business decisions, rules, and policies.

- End-to-end decision automation that combines business rules, data integration, and workflows for consistent execution.

- Support for risk and compliance scenarios where transparency, explainability, and traceability are essential.

Example use cases: policy enforcement across processes, automated checks for regulatory compliance, and documented decision flows for audit and governance.

ACTICO

ACTICO provides a decision management platform used in regulated industries such as banking and insurance for credit risk, compliance, and fraud prevention. The platform combines business rules and AI to automate mission-critical decisions with full traceability across systems and workflows.

Key capabilities for compliance-focused decisioning

- Centralized rule and decision modeling with audit-proof execution logs and statistics.

- Support for regulatory compliance use cases like KYC/AML, transaction monitoring, and sanctions screening.

- Tools to test, simulate, and monitor decision services so teams can adjust to new regulations quickly.

Example use cases: regulatory compliance decisioning, anti-money laundering and sanctions checks, and transparent rule management in credit and fraud processes.

Choosing the best AI decisioning platforms for patient care

In clinical and patient support settings, AI decisioning helps teams identify at-risk patients, select appropriate interventions, and guide next steps in care.

Common use cases include triage, care-gap identification, treatment pathway support, adherence outreach, and population-level risk stratification.

Merative

Merative provides healthcare data, analytics, and clinical decision support tools designed to help clinicians and care teams make evidence-based decisions at the point of care and across populations.

Its portfolio includes Micromedex for drug and disease decision support, imaging solutions, and analytics platforms that help pinpoint which patients need which intervention and when.

Key capabilities for patient-care decisioning

- Evidence-based clinical decision support for drugs, dosing, interactions, and disease management at the bedside or in the EHR.

- Population health analytics to identify high-risk members and match them with targeted interventions at the right time.

- Tools to compare treatment costs and outcomes, supporting value-based care and benefits decisions.

Example use cases: surfacing evidence-based guidance during prescribing, flagging high-cost/high-risk members for outreach, and supporting plan and care-path decisions with real-world analytics.

IQVIA

IQVIA offers Healthcare-grade AI®, data, and real-world evidence solutions that support patient identification, treatment optimization, and clinical decision support.

Its applications help life sciences organizations and healthcare providers find eligible patients, understand disease journeys, and close care gaps with targeted interventions and content.

Key capabilities for patient-care decisioning

- AI-driven patient and disease insights to identify hard-to-find patient cohorts and map real-world treatment pathways.

- Clinical decision support tools that flag care gaps such as delayed diagnosis, under-treatment, and nonadherence.

- Healthcare-grade AI models and reasoning engines designed specifically for regulated healthcare and life sciences use.

Example use cases: identifying patients eligible for specific therapies, supporting clinicians with care-gap alerts, and guiding outreach programs that improve adherence and treatment outcomes.

How to choose the right AI decisioning platform

Choosing an AI decisioning platform starts with the decisions you want it to make and the outcomes you need to move. From there, it comes down to how each vendor handles data, experimentation, governance, and activation in your real environment.

Cross-industry criteria to weigh

These points apply whatever industry you’re focused on:

Use cases and outcomes

- Is the platform built to handle your highest-value decisions (for example, credit approvals, fraud checks, retention, repurchase), not just simple content swaps?

- Does it optimize against the metrics that matter to you—profitability, retention, CLV, risk—rather than only surface-level engagement?

- Can you run holdouts and lift tests so you can prove incremental impact, not just raw performance?

Data, signals, and feedback loops

- What data can it use (events, attributes, products/offers, risk scores, external feeds), and how fresh is that data at decision time?

- How quickly do outcomes feed back into the system—near real time, daily, weekly?

- Can it learn from a wide range of signals, not just a narrow set of fields?

Decisioning approach and levers

- Does it personalize across multiple levers at once—channel, message, offer, timing, frequency—at the individual level?

- Can you configure goals, constraints, and guardrails (budgets, eligibility, compliance rules) in a transparent way?

Governance, explainability, and risk

- Are there clear logs and explanations for decisions at the customer or case level?

- How are policies and approvals managed across teams like risk, legal, and marketing?

- Are there tools for testing, monitoring, and alerting when model performance or data quality drifts?

Implementation, integrations, and services

- How does the platform connect to your existing data sources, engagement tools, and operational systems?

- What implementation support is available—self-serve only, or software plus expert services?

- Is there a structured process to validate use cases, check readiness, and de-risk rollout before you commit heavily?

Scalability and cost model

- How does pricing scale with more use cases, audiences, and decision volume?

- Can multiple teams share the same platform without fragmenting data or logic?

- What happens to performance and cost as you add more offers, creatives, and channels into the decision space?

- Will there be hidden costs, such as additional compute on our cloud data warehouse?

Extra criteria for marketing and customer engagement

For lifecycle, CRM, and growth teams, a few additional filters make a big difference:

Fit for next-best-everything engagement

- Can the platform decide, per person, what to send, when, how often, in which channel, and with which incentive or creative?

- Does it work alongside your existing predictive models (churn risk, propensity to buy) as inputs, rather than trying to replace them?

1:1 decisions vs. segment-based rules

- Does it explicitly move from segment-level treatments to 1:1 decisions based on all available first-party data?

- Can it adapt within a segment as behavior changes, instead of being locked to a static rule set?

Activation across channels

- Is the decisioning engine embedded in, or tightly integrated with, your customer engagement platform so decisions can trigger journeys in real time?

- Can it activate across email, push, in-app, SMS, and web without custom builds for each campaign?

Experimentation and learning

- How does it balance exploration and exploitation—trying new options vs. leaning into known winners?

- Are holdouts, control groups, and lift measurement built into the workflow so marketers can see genuine incremental gains?

Guardrails, brand controls, and creative workflow

- Can you define guardrails around frequency caps, eligibility, budget limits, and content rules?

- Does it plug into your catalogs, templates, and brand system so agents only choose from compliant, on-brand options?

Use case design and ongoing support

- Will the vendor help you prioritize starter use cases based on impact, data quality, number of levers, and feedback speed?

- Is there ongoing support to tune agents, interpret results, and identify the next wave of marketing and customer engagement use cases once the first ones are live?

Final thoughts on some of the best AI decisioning platforms

AI decisioning platforms are becoming a shared layer across functions. Marketing teams use them to optimize journeys, fraud and risk teams use them to score transactions and applications, and healthcare teams use them to surface the right intervention at the right moment. The common thread is reinforcement learning and continuous experimentation, turning every interaction into feedback that improves the next decision.

The right choice depends less on generic AI features and more on the decisions you need to make, the data you can bring to the table, and the guardrails your teams require. Starting with a handful of high-impact use cases, then expanding as you prove lift and build trust, tends to create better outcomes than trying to switch everything on at once.

Connect with Braze to map your first AI decisioning use cases and understand where BrazeAI Decisioning Studio™ can boost your brand.

Frequently Asked Questions

What is an AI decisioning platform?

An AI decisioning platform is software that uses data, business rules, and techniques like reinforcement learning to decide the “next best everything” for each person—what to offer, when to engage, which channel to use, and how often to reach out.

How do AI decisioning platforms work?

AI decisioning platforms work by ingesting data, applying policies and constraints, and using agents to test and select the best option for each individual, then learning from outcomes to improve future decisions.

What features matter most in decisioning tools?

The features that matter most in AI decisioning tools include support for your core use cases, access to high-quality data, multi-lever 1:1 decisioning (channel, message, timing, offer), clear governance and explainability, and strong integration with your existing systems.

What are the best AI decisioning platforms for marketing?

The best AI decisioning platforms for marketing are those that can optimize journeys at the individual level across channels, such as BrazeAI Decisioning Studio™, Salesforce Einstein Decisions, Adobe Target’s decisioning features, Pega Customer Decision Hub, and Hightouch AI Decisioning.

How is Braze used for AI decisioning?

Braze is used for AI decisioning through BrazeAI Decisioning Studio™, which applies reinforcement learning to choose the best combination of channel, message, timing, offer, and frequency for each customer and activates those decisions directly in cross-channel journeys.

How do I choose the right decisioning platform?

To choose the right AI decisioning platform, match vendors against your priority use cases, data readiness, governance needs, and required channels, then look for tools that offer measurable lift, explainable decisions, and a clear path from pilot use cases to broader rollout. Brands should also consider AI decisioning that comes with AI success and forward deployed data scientists to customize, monitor, and report on their AI decisioning campaigns.

Be Absolutely Engaging.™

Sign up for regular updates from Braze.