5 min read

Stash drives long-term investing habits with sophisticated, personalized user onboarding

As a personal finance app focused on helping everyday Americans invest and build wealth, Stash needed to optimize their onboarding funnel to reduce drop-offs and increase user activation. The brand sought to create personalized communications to guide users through complex onboarding steps while building confidence and trust.

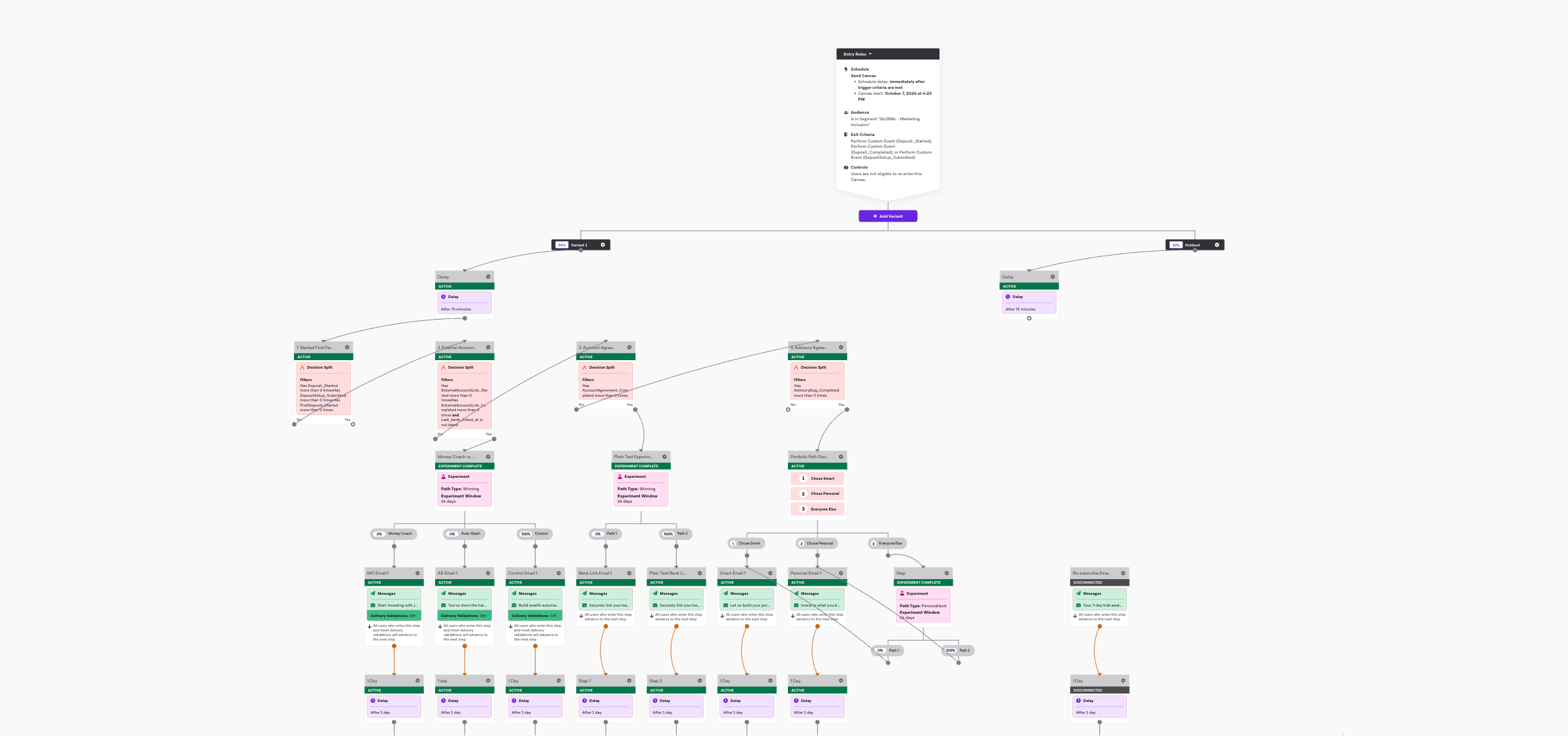

Stash implemented a sophisticated, multi-Canvas onboarding campaign that dynamically personalizes messaging based on where a given user drops off in their journey. Using real-time segmentation and behavioral triggers, the campaign delivers targeted communications across multiple channels, highlighting specific benefits and features relevant to each user's next step in the onboarding process.

The personalized onboarding campaign delivered strong results across conversion events and email engagement, which included a 64% increase in email click-through rate and 72% increase in email open rates. Importantly, this led to a 20.34% “FirstDeposit_Started” conversion rate—truly helping users get started on their financial journey.

INDUSTRY

PRODUCTS USED

BY THE METRICS

20.34%

FirstDeposit_Started conversion rate

18.71%

DepositSetup_Submitted conversion rate

19.75%

Deposit_Completed conversion rate

Stash is a personal finance app that helps Americans invest and build long-term wealth, beginning in small increments—$5 at a time, as the brand says. The goal is to make investing easy and affordable for millions of everyday people, whether it’s managing a budget or stock rewards, building a savings account, or saving for retirement.

Stash knows that customer engagement directly impacts user retention, lifetime value, and the success of their mission to help make investing easy and affordable. The brand works to build confidence and trust through personalized content and education that promotes long-term habitual investing behavior. Part of this effort means ensuring that customers—known as Stashers—are active within the app, and adopting and using the features available, which helps to increase their customer lifetime value (LTV).

Meeting Stashers at the start of their financial journey

Stash's core focus centers on growth. As part of that, activation and onboarding are critical growth levers because they sit at the intersection of customer acquisition and long-term retention. In a highly regulated, trust-dependent, and competitive industry, the quality of a customer’s initial experience often determines whether they become a loyal user or quietly churn—and the team knows that they only get one chance to make a great first impression.

Stash wanted to create a system that could dynamically respond to user behavior and provide the right message at the right time to help improve funnel conversions and reduce drop-offs. In order to achieve that goal, they wanted to build a comprehensive, multi-Canvas onboarding campaign in Braze that personalizes communications based on specific user drop-off points and behaviors.

Building trust through personalized onboarding flows

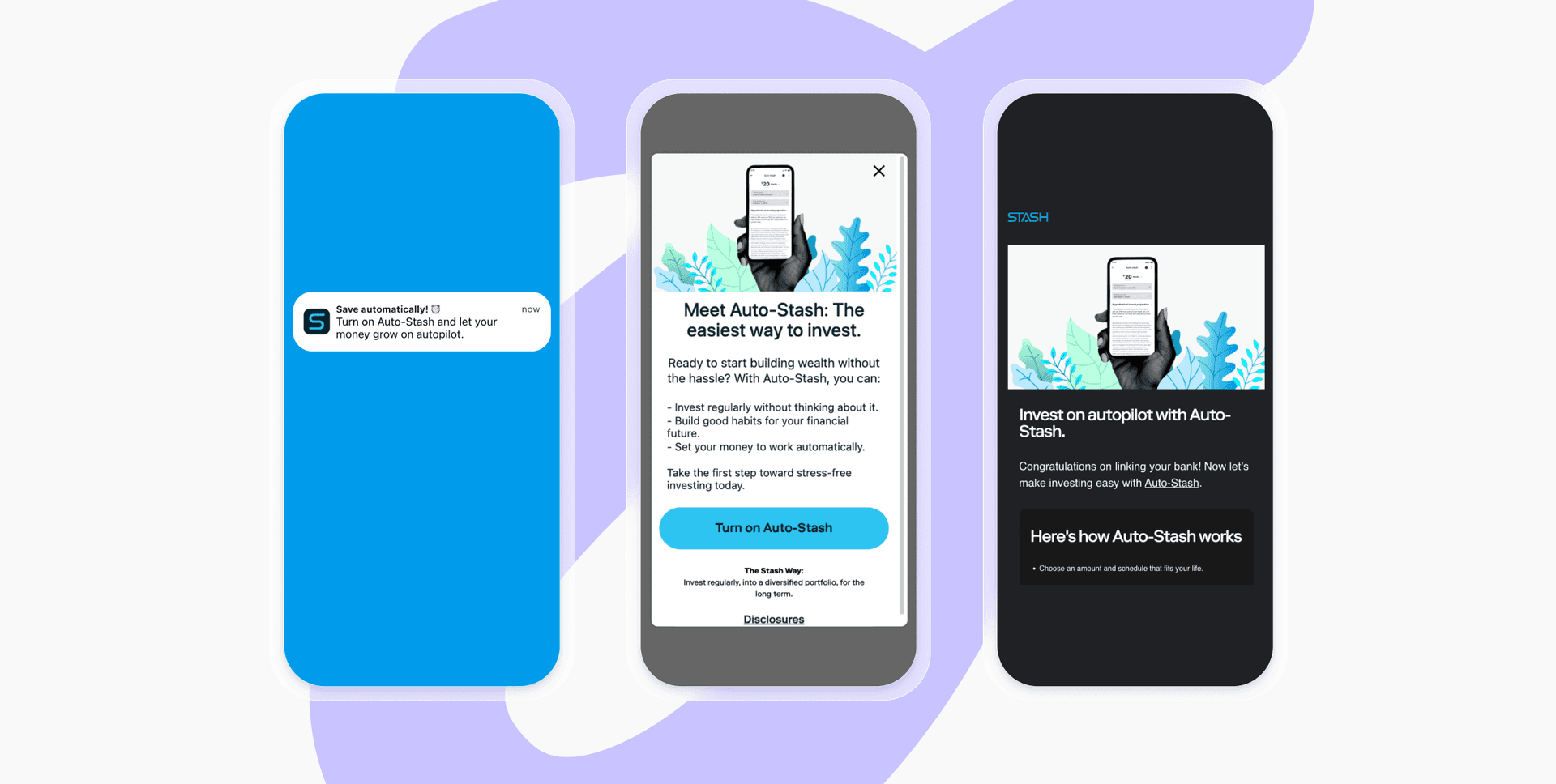

The Stash team moved quickly and set up the campaign in just three weeks—from ideation to launch. The first step was to determine key drop-off points where personalized communications would be valuable. Then, they built messaging flows that triggered after a defined delay, and carefully curated content across four channels: Email, push notifications, in-app messages, and SMS.

Before launching, Stash implemented Experiment Paths to test content variants. They also ensured that message content highlighted the benefits and features that were best aligned to the next step in each user’s process.

Here’s a closer look at the two primary Canvas flows:

Canvas 1: Post-advisory e-signature onboarding

This canvas triggers when a user completes their Social Security Number (SSN) verification and routes them down personalized paths based on their subsequent actions:

- Users who haven't started a deposit, linked an account, or signed the agreements receive targeted communications based on whether they chose "Smart" or "Personal" portfolio options, with messaging highlighting specific benefits and features tied to each option.

- Users who signed the account agreements, but haven't deposited or linked their accounts receive communications emphasizing how simple and secure linking a bank account is.

- Users who linked their accounts, but haven't made any deposits receive messaging highlighting Stash's Auto-Stash feature, which allows users to "set it and forget it" for consistent investing and wealth growth.

Canvas 2: Pre-advisory e-signature flow

This canvas triggers immediately when a user completes sign up and evaluates the first key drop-off point—SSN verification:

- Users who haven't successfully verified their SSN receive communications focused on Stash's safety and security, addressing potential concerns about information security.

- Users who verified their SSN but haven't completed the advisory e-signature enter an A/B test comparing two approaches: promoting the 7-day free trial versus highlighting their AI Money Coach feature to provide advice during the trial period.

Stash's technical approach enables sophisticated personalization at scale. User data flows into Braze via an integration with leading customer data platform (CDP) Segment, allowing for real-time behavioral segmentation. Currents connector exports data back to Segment, which distributes to analytics platform Mixpanel for product and marketing analysis, and AWS S3 for data science work in Looker. Additional integrations include Facebook and Google connections to filter users from affiliate promotions, and Trustpilot integration to gather feedback from new users after their first deposit, helping to build a positive reputation and attract future users.

Within Braze, our Connected Content dynamic personalization feature connects to Stash servers for real-time data that doesn't fit into standard eventing, and webhooks enable promotional offers to be automatically sent to qualified users.

"With Braze, we've been able to meet our customers where they are in their onboarding journey, personalizing their experience in real time based on their next best action. This level of dynamic engagement has been critical to building confidence early and empowering long-term investing habits."

Corinne Clough

Director, Lifecycle Marketing, StashResults: A surge in the number of Stashers now saving

Stash experiences a boost in engagement as a result of these new personalized onboarding campaigns. Timely and relevant messaging served as a helpful prompt to continue the user journey. In terms of email engagement, the team saw a 72% increase in email open rate and a 64% increase in email click-through rate.

Importantly, Stash achieved a boost in conversion for the following events:

- FirstDeposit_Started: 20.34% increase

- DepositSetup_Submitted: 18.71% increase

- Deposit_Completed: 19.75% increase

These results represent nearly 60,000 new users beginning their path toward building long-term wealth, demonstrating the power of meeting users with dynamic, personalized messaging that addresses their needs and concerns at each stage of the onboarding process—and specifically in moments of hesitation.

Key takeaways

- Behavioral segmentation drives results: By identifying specific drop-off points and creating targeted messaging for each scenario, Stash saw improvements in both conversion rates and engagement metrics.

- Multi-channel orchestration enhances impact: Using email, push, in-app messages, and SMS in coordinated flows ensures users receive the right message through their preferred channel at the optimal time.

- Real-time personalization builds trust: In financial services, the ability to dynamically adjust messaging based on user behavior and concerns is critical for building the confidence needed for long-term engagement.

- Speed to market enables optimization: The 3-week implementation timeline allowed Stash to quickly test, learn, and iterate on their approach, maximizing the impact of their onboarding improvements.