The State of Customer Engagement for Health and Wellness Brands in 2023

Published on April 19, 2023/Last edited on April 19, 2023/7 min read

Team Braze

At Braze, each year we make a point of taking a deep dive into the current state of marketing in order to shed light on how today’s brands can stand out in the evolving customer engagement landscape. Here are the highlights from data reviewed in connection with our 2023 Global Customer Engagement Review that (i) reveal the state of customer engagement for health and wellness brands in 2023, and (ii) some of the top strategies companies in the industry can use to boost activation, monetization, and retention.

Digital-First Experiences Are Here to Stay, So Now It’s All About Providing Premium Experiences

At the outset of the COVID-19 pandemic, health and wellness brands that managed to pivot to offering digital products and services achieved huge wins. Now, however, the number of digital healthcare and wellness offerings has exploded. Digital-first experiences are no longer a trend—they’re a fundamental customer expectation. As a result, businesses have to do more than simply have an app and website to be able to stand out from the crowd and maximize long-term user retention.

To continue adapting, companies in this space will need to meet each health and wellness user where they are on their respective journey by providing the kind of responsive, high-touch, personalized engagement customers experience during in-person interactions. That will require them to lean into cross-channel campaigns to do so effectively.

Top Strategies for Improving Customer Engagement for Health and Wellness Brands in 2023

Want to increase customer activation (sessions per user), monetization (purchases per user), and retention for your health and wellness brand? Here are some of the most effective approaches that set top-performers in the industry apart from the rest.

#1: Leveraging cross-channel customer engagement and hybrid messaging

Getting customers to come back to your website or app and make repeat purchases—and engage in both of these activities over longer periods of time—is no easy feat. But cross-channel customer engagement and hybrid messaging are crucial for delivering results.

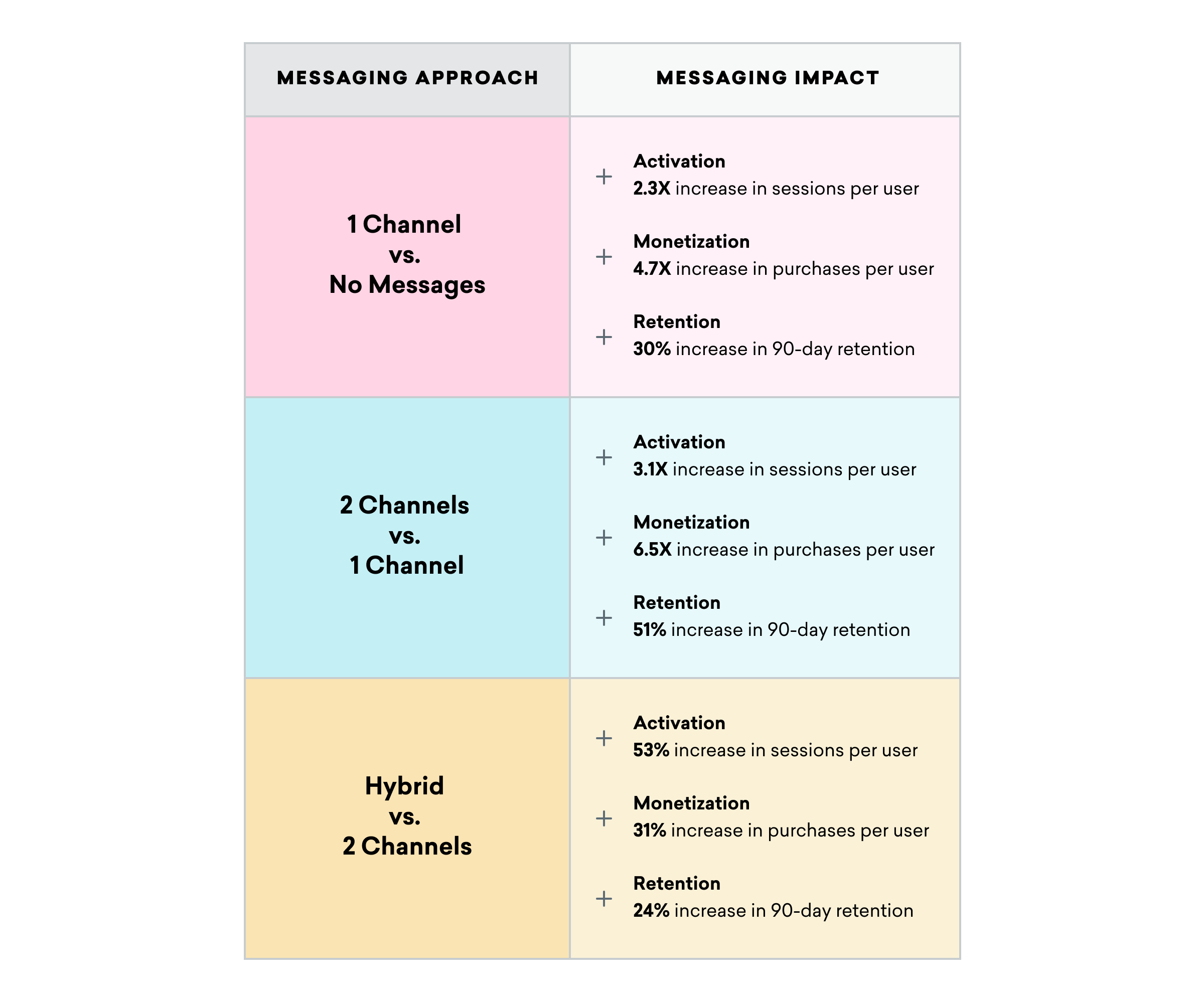

Health and wellness brands that start by messaging customers using just one channel, whether that’s email, SMS, push, or another popular channel, can improve activation rates by 2.3X, monetization by 4.7X, and 90-day retention by 30%.

As companies add more channels to the mix and use both push and pull messaging—that is, out-of-product (push, email, SMS, etc.) and in-product messages (in-app and in-browser messages and Content Cards), also known as hybrid messaging—they can see even more gains across activation, monetization, and retention.

#2: Utilizing the right combination of channels

According to the research conducted in connection with the 2023 Customer Engagement Review, the following combinations of messaging channels help health and wellness brands maximize campaign results.

- +76% retention: By sending email and in-app messaging campaigns, in addition to mobile push, health and wellness brands can see an average 76% increase in 30-day retention, compared to a single channel approach

- 2X higher sessions per user: Companies who employed a hybrid messaging strategy saw an increase of more than 2X in sessions per user when compared to either exclusively in-product or out-of product messaging strategies.

- 4X higher retention: Messaging users via a combination of Content Cards, email, in-app messaging, and mobile push helps health and wellness companies increase six-month retention by 4X compared to sending no messages to customers at all

#3: Incorporating mobile messaging as part of a broader customer engagement strategy

Top-performing health and wellness brands (also known as “Ace” brands) are 47% more likely to send SMS campaigns than organizations with less mature customer engagement programs. That’s according to our 2023 Customer Engagement Review analysis conducted using the Braze Customer Engagement Index, a proprietary framework Braze developed in 2021 to evaluate brands against key customer engagement factors.

The index encompasses “Activate” brands that are just beginning to integrate customer engagement into their business, “Accelerate” brands with more established customer engagement programs that have yet to yield a comprehensive customer view, and “Ace” brands that are customer engagement leaders with lifecycle-centric customer engagement programs owned by cross-functional teams, built on streaming data. From our findings, advanced Ace brands are positioned to deliver stronger results. For instance, compared to non-Ace companies, Ace health and wellness brands have a:

- +172% higher buyer rate

- +47% higher average user lifetime

#4: Using real-time data to power segmentation, targeting, and analytics

Ace brands are 64% more likely to use Braze Currents, the Braze platform’s real-time data streaming capabilities, to power segmentation, targeting, and analytics, compared to non-Ace brands in the health and wellness industry.

#5: Testing customer engagement campaigns

Compared to other industries, a greater share of top-performing health and wellness brands use campaign testing to drive greater results.

#6: Adopting cross-functional approaches to managing customer engagement

Disconnected teams often lead to disconnected customer experiences, which is why cross-functional customer engagement is a competitive advantage. That’s an area where health and wellness brands stand out. This industry has the highest share of Ace brands with respect to cross-team collaboration around customer engagement.

#7: Taking advantage of marketing personalization technologies

Ace brands are 7% more likely to use the open-source templating language Liquid to incorporate customers’ personal contextual information into campaigns to make messaging more relevant.

Discover the Complete State of Customer Engagement in 2023

Get exclusive access to this year’s top three worldwide trends in customer engagement by claiming your copy of the 2023 Global Customer Engagement Review.

Methodology

For this analysis, Braze pulled anonymized and aggregated behavioral data from 775+ Braze customers across our US, APAC, and EU clusters to analyze app activity, message engagement, and purchasing trends by industry. These statistics span January 1, 2022 to December 31, 2022 and include data from over 8.5 billion user profiles and 53 sub-industries. Of this data, over 80 Braze customers, over 200 million users and 5 sub-industries were deemed Financial Services Brands for purposes of the discussion included herein. The raw data has been cleaned using volume and company count checks so that no one brand or group of brands is over-represented. For all purchase- and messaging-related stats, only brands tracking the relevant information have been included so as not to skew the analysis. All uplift figures greater than 100% are rounded to the nearest decimal point, and all uplift figures below 100% are rounded to the nearest whole percent. When comparing two rounded numbers, percent change metrics are calculated as the difference between the two numbers after rounding.

The Braze Ace Technology, Teams, and Business Impact metrics were measured by selecting the top 50th percentile of Braze customers compared to the full data set (and within a given industry in the report’s industry-specific sections) in terms of likelihood of a user making a purchase, likelihood of a buyer making a repeat purchase, average sessions per user, average

user lifetime, and message engagement for the period of January 1, 2022 to December 31, 2022. All industries had message engagement used as a criteria to select Ace brands. For industries where purchase behavior is less often used as a key performance indicator (financial services, media and entertainment, and health and wellness), purchasing metrics were not included in Ace brand selection process.

The Braze Ace Technology, Teams, and Business Impact metrics for Health and Wellness Brands were measured by selecting the top 50th percentile of Braze customers compared to the full data set of Health and Wellness Brands based on sessions per user, average user lifetime, and message engagement for the period of January 1, 2022 to December 31, 2022.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.