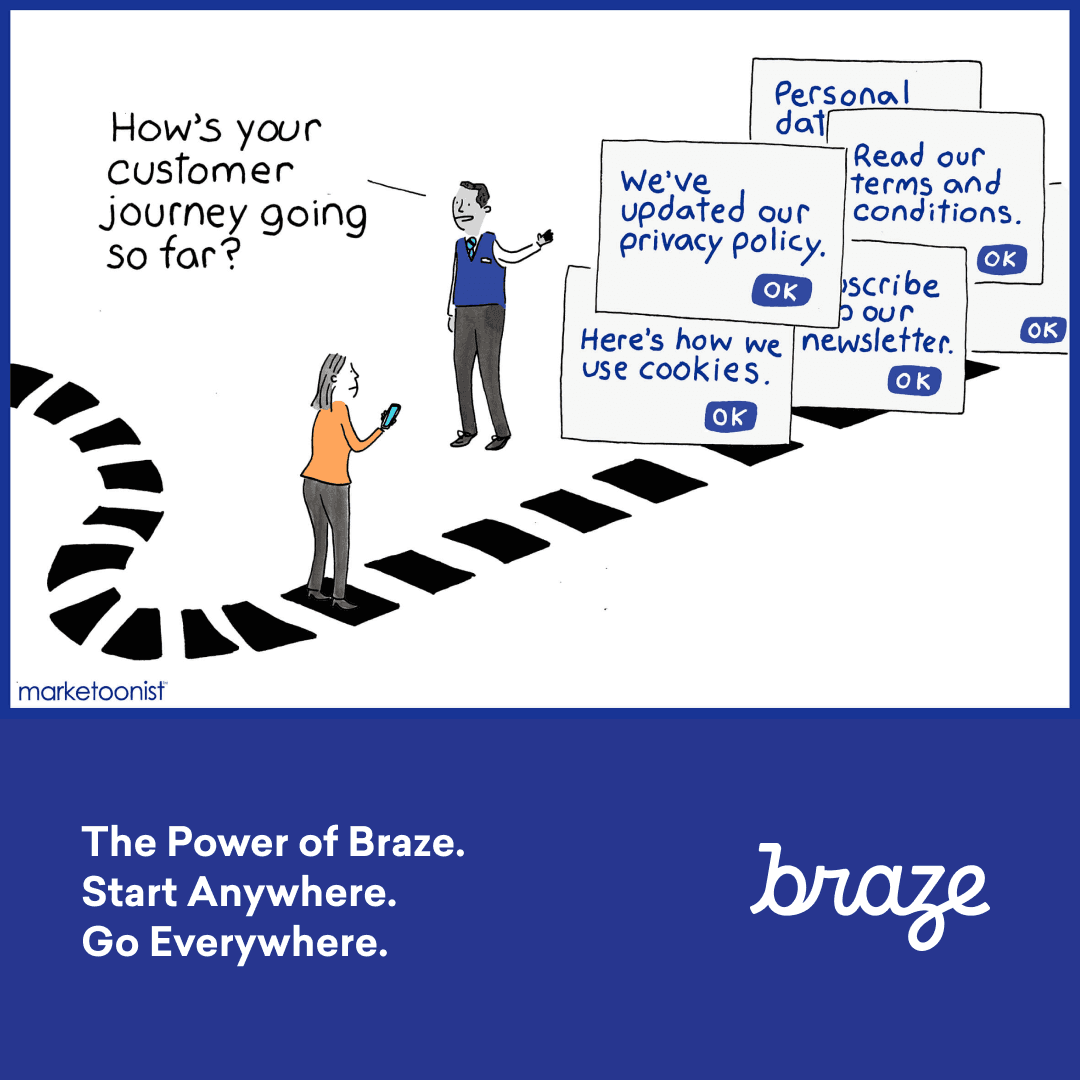

The Customer Journey Has Become One Bad Trip

Published on August 04, 2021/Last edited on August 04, 2021/3 min read

Sara Spivey

Chief Marketing Officer (CMO), BrazeSeveral years ago, I tried to open one of these newfangled online banking accounts. Seemed so simple. STOP. Seemed so logical. STOP. Seemed so straightforward. STOP. Despite my best efforts as a reasonably tech-savvy person (not as good as my husband or my 23-year-old, but pretty good), I abandoned ship after about the seventh step, and I was nowhere near getting an online account. I appreciate the need for information (especially for a bank account) and the various legal disclaimers that are required, but the claim of a “1-2-3” process here was false advertising at its most extreme.

Today’s consumers have short attention spans and expect positive reinforcement and gratification. They don’t like friction, particularly when it is crystal clear that the benefit of that friction goes to the company and not the consumer. They have short memories and little loyalty. Tough sledding for companies trying to compete in this environment.

But it can be done! Consider these tips as you craft your customer’s journey:

- Begin with the end goal in mind. Ask yourself, “What is the easiest path for the customer to get there?”

- Use progressive profiling. Ask for the minimum amount of information in early interactions, then build a more complete profile over time and across multiple touch points.

- Once they have decided to engage with you, put together an onboarding flow that invites the customer into a deeper connection, and allows you to dig a little further to understand their preferences.

- Get your data act together. Make sure you aren’t asking for the same information that someone in customer service did 10 minutes ago, nor are you sending them suggestions or recommendations for things they’ve never shown an interest in. Data silos in organizations are deathstars. Make sure you don’t have them.

- Lastly, make sure you think about all communication from the perspective of what the customer needs from you, not what you need from the customer.

Epilogue to the online banking experience, four years later: I signed up for an account with one of these newfangled “banking disruptors.” Took me 30 seconds to set it up—name, email and phone. Then I got a follow-on message telling me if and when I wanted to actually use the account (which seemed like a good idea), to go back in and add a little more info, which I did. Took 45 seconds or so. First transaction, I had to add a little more info, maybe another 30 seconds. It was clear why they were asking for this information and what purpose it served at each step of the journey. It was built around what I wanted from the bank, not what the bank wanted from me.

Brilliant customer journeys are possible; I see them every day. The one thing they all have in common is that they put me in control of the journey. And that’s a great trip.

A longer version of this piece originally appeared in Business2Community.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article12 min read

Article12 min readLeaders in marketing: Celebrating the women redefining customer engagement on International Women’s Day

March 09, 2026 Article4 min read

Article4 min readClosing the retail experience divide

March 09, 2026 Article5 min read

Article5 min readRamadan revelations: Mastering customer engagement in MENAT with AI

March 06, 2026