Send Frequency 2021: Exploring Messaging’s Impact on Engagement and Conversions, Industry by Industry

Published on April 21, 2021/Last edited on April 21, 2021/10 min read

Brendan O'Connor

Customer Insights Analyst, BrazeDuring 2020, Braze sent more than a trillion messages on behalf of customers, giving us a unique window into how send frequency can impact results. In that spirit, we offer these analyses as a starting point for your brand's own frequency testing and optimization work, rather than as a one-size-fits-all optimal benchmark that all brands should match. Remember that many factors can influence frequency, including the use of behavioral and transactional triggers, the segments a given user belongs to (for instance, more engaged customers may be open to more messages), the way a given audience is split within an industry, and the specific messaging strategies a particular brand is using.

When it comes to send frequency, there’s usually a sweet spot—the point at which you’re sending your customer neither too many nor too few messages in a given time period. But accurately assessing when you’ve hit that point depends on having a clear goal in mind. And if you don’t know what you’re trying to achieve with your messaging, it’s hard to know if you’ve achieved it.

Back in 2019 we took a look at the ideal send frequency for push notifications, emails, and cross-channel messages overall. This year, we decided to dig a little deeper, exploring the impact of send frequency first on purchases (see that article here) and then on the app usage of message recipients (article here). And because everyone knows that the third part is always the best one in any trilogy, we’re back with a look at how send frequency impacts engagement and conversions.

A few caveats before we get under way. In our analysis, we didn’t drill down into specific conversion types, preferring to focus on the overall impact that message frequency has on conversions and message engagement rates. For the sake of simplicity and readability, we’ve rolled up our message engagement rates into a single metric, with the weighting of individual channel engagement rates coming from their volume within that industry. And remember that this piece—and the previous articles in the series—are intended to be a jumping off point for your own experimentation. There are always a variety of metrics that aren’t factored into analyses of this kind, so it’s most useful as a window into the frequencies that might be helpful to examine in this specific context. Finally, we focused our examination on brands where conversions and engagement are central to their business model. With that in mind, we’ll be digging into send frequency for the following industries:

- Listings & Marketplaces

- Booking Services

- Payments

- Financial Planning and Investment

- Banks

- Insurance (Non-Health)

- Productivity

- Tools & Utilities

1. Marketplaces

Over the past two decades, marketplaces have become an integral part of the digital economy. Consider this: When was the last time you bought a product or purchased a service online without checking the prices on a marketplace or booking aggregator first? (Or maybe I’m just particularly thrifty…) In addition to providing valuable price comparison and deal-hunting tools, marketplace and booking aggregators have also flourished in niche industries; we’ve come a long way from this industry’s historical focus on classified ads, with non-fungible tokens (NFTs), used clothing, and specialty grocery items among the hot new entrants into this industry.

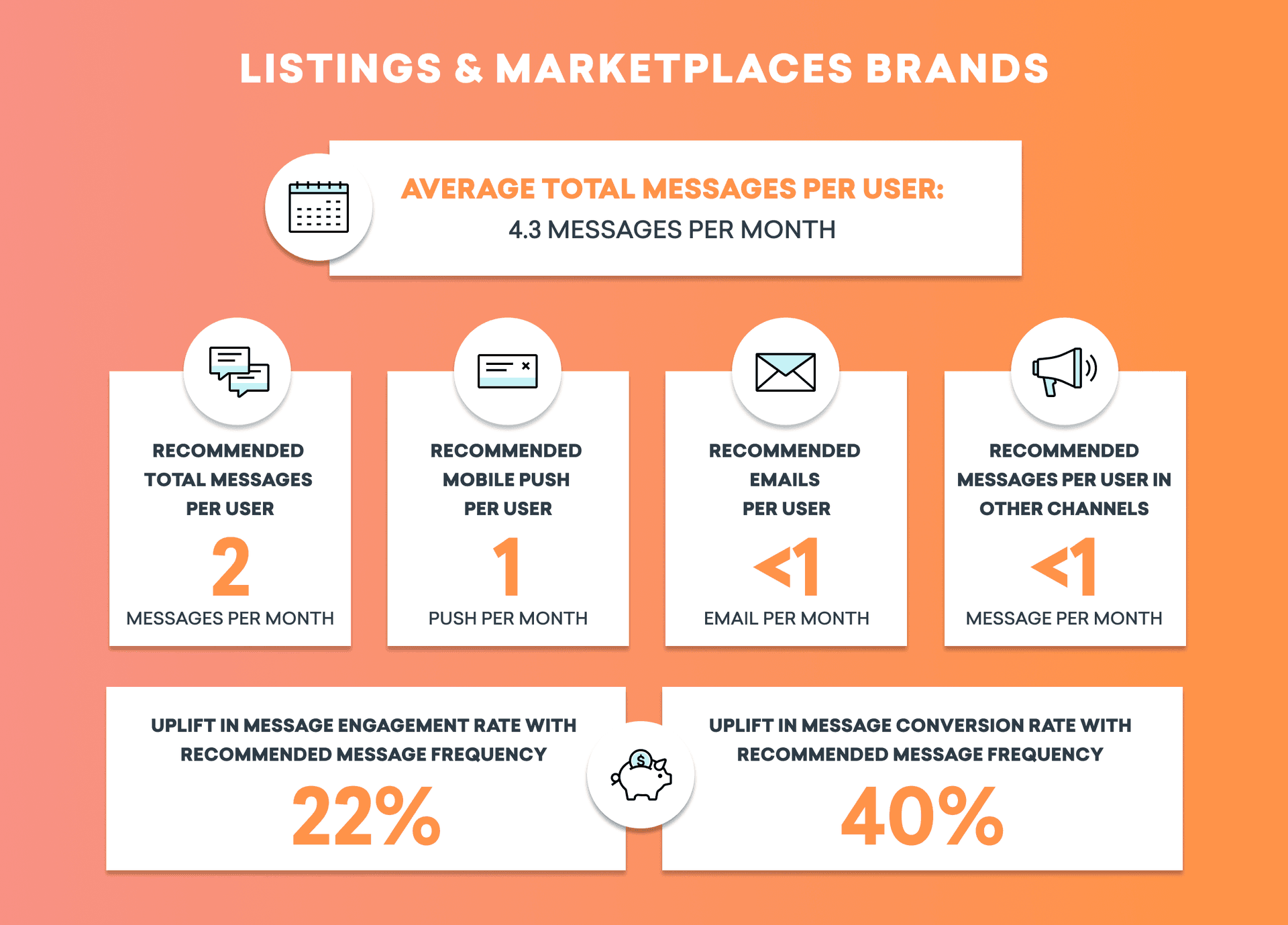

Listing & Marketplace Brands: Messaging Is a Hot Item—But Maybe a Little TOO Hot

During the COVID-19 pandemic, marketing brands have become an increasingly essential part of the global economy. From general-use classified ads to specialized services focused on reselling the latest kicks, these days there’s a marketplace for practically any product or service you might need.

Our analysis found that marketplace brands that sent two messages per month saw a 22% increase in message engagement and a 40% rise in message conversion rates. However, this frequency was less than 50% of the monthly industry average of 4.3 messages per user. If you’re looking to downshift your send frequency, it can be wise to take a hard look at who you’re messaging and why. Narrowing your focus and messaging customers who have completed high-value actions (HVAs) is a great way to achieve greater efficiency when it comes to the outreach you send!

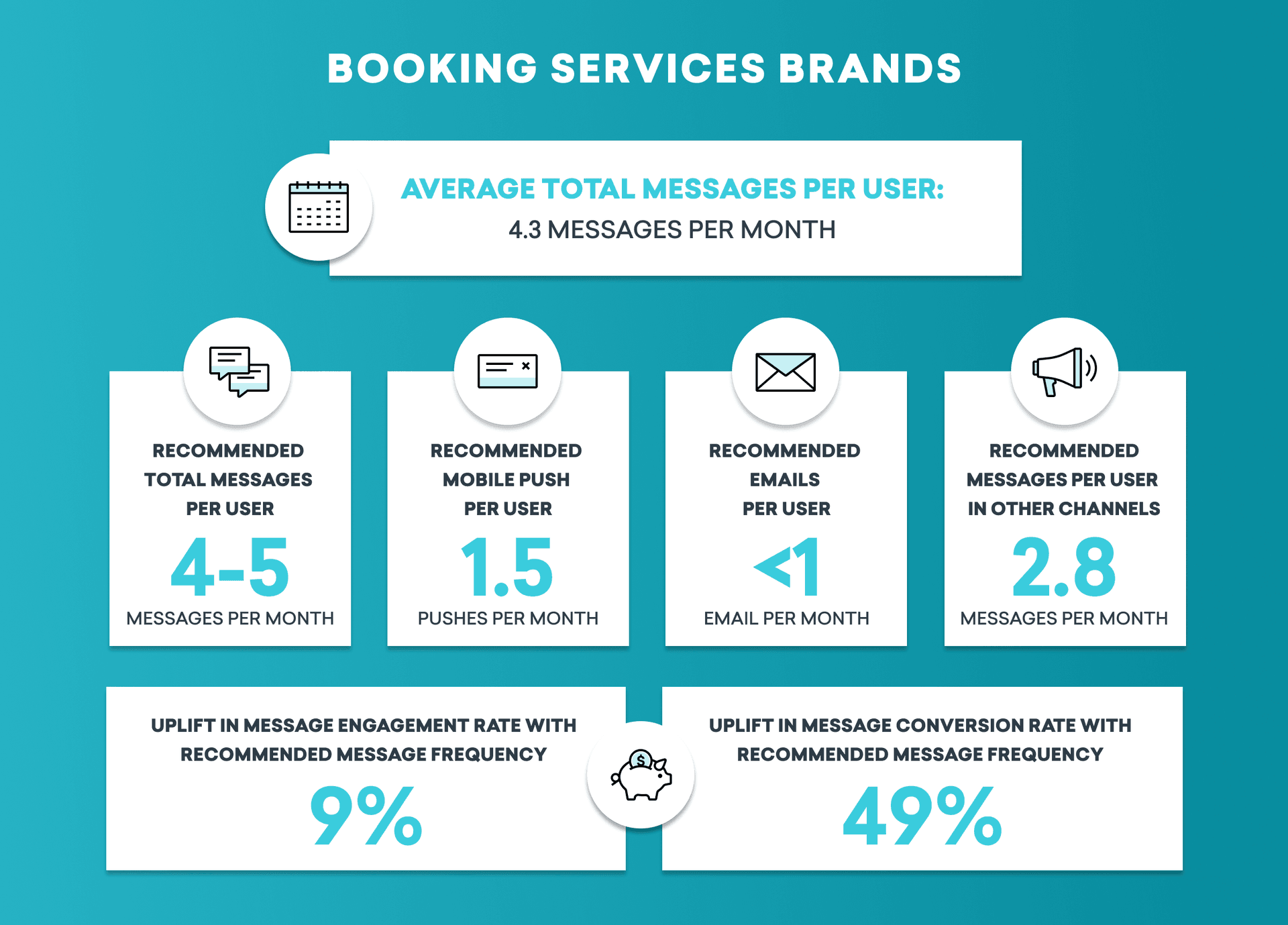

Booking Service Brands: Just Right, Right Now

We’re beginning to see travel start to heat up again in some countries as COVID vaccination rates increase. And that’s good news for booking service brands, who are well-positioned to capitalize on the return of travel.

As people begin to hunt for vacation destinations and deals, they’re more open to frequent notifications to help them book what is for many, a much needed vacation. Our research found that booking service brands average about 4.3 messages per month, which is right in the middle of our recommended monthly send frequency of 4-5 messages per user. Brands that fell into this high-performing tier saw an increase in message engagement of about 9% and a 49% jump in message conversions.

2. Finance

Digital finance is one of the most exciting spaces in today’s economy. Between cryptocurrencies, neobanks, mobile stock trading, robo-advisors, and automated budgeting apps,consumer finance has been completely revolutionized over the past decade. In many cases, financial products and services that were once only available to the very wealthy have become widely available, andhe cost of sending money directly to family members and friends has dropped dramatically over the same time period.

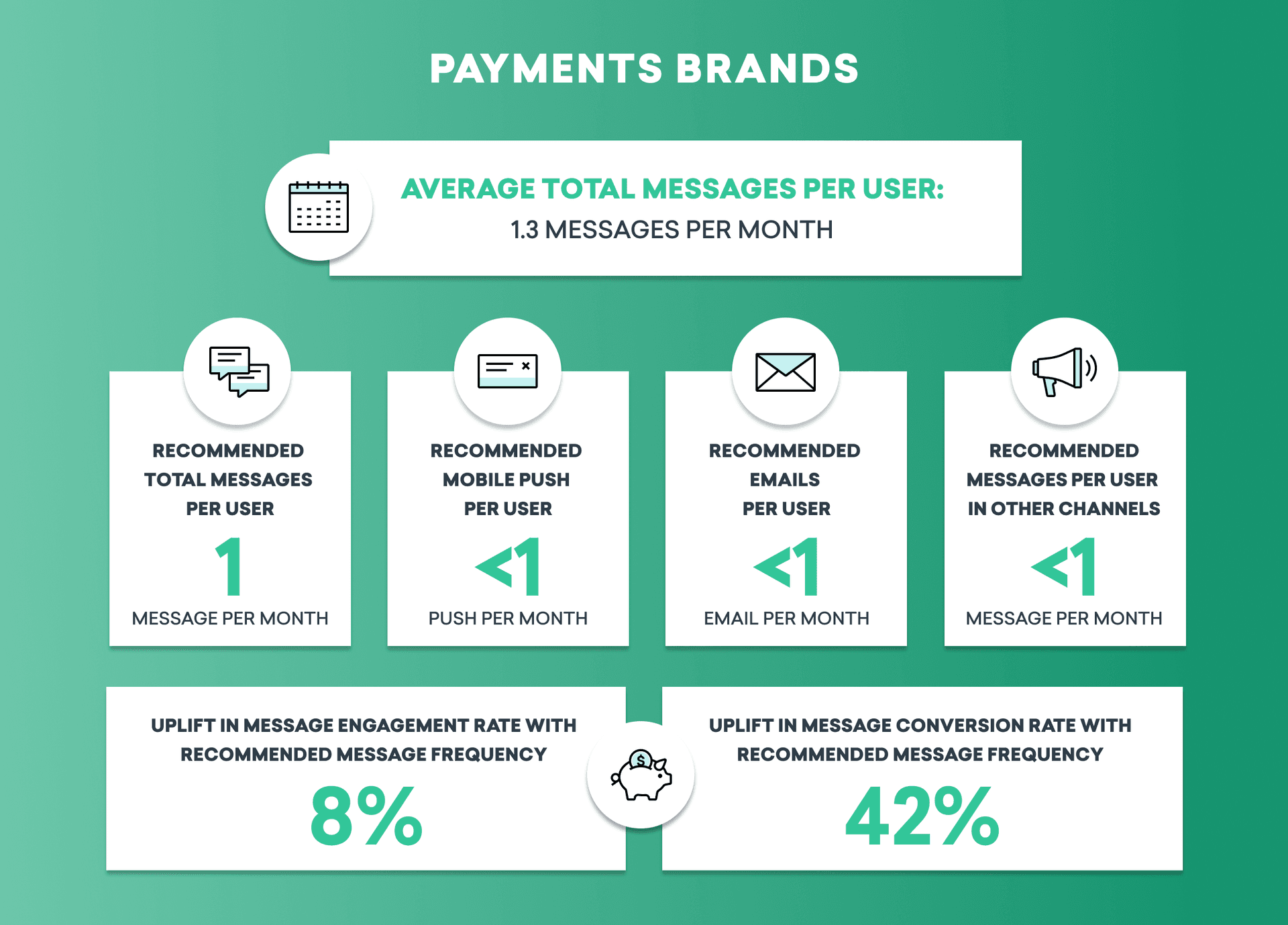

Payment Brands: Messaging Pays Off

These days, payment apps have become an integral part of life. Whether it’s reimbursing a friend for your share of dinner, accessing a payment plan, or sending money to family members abroad, payment apps have made sending money from point A to point B much easier and more convenient.

Given the careful eye that most people already keep on their finances, it’s unsurprising to see that the most effective message frequency for this space is only one message per user each month. Thankfully, the industry average is already pretty close to this ideal, clocking in at 1.3 monthly messages per user.

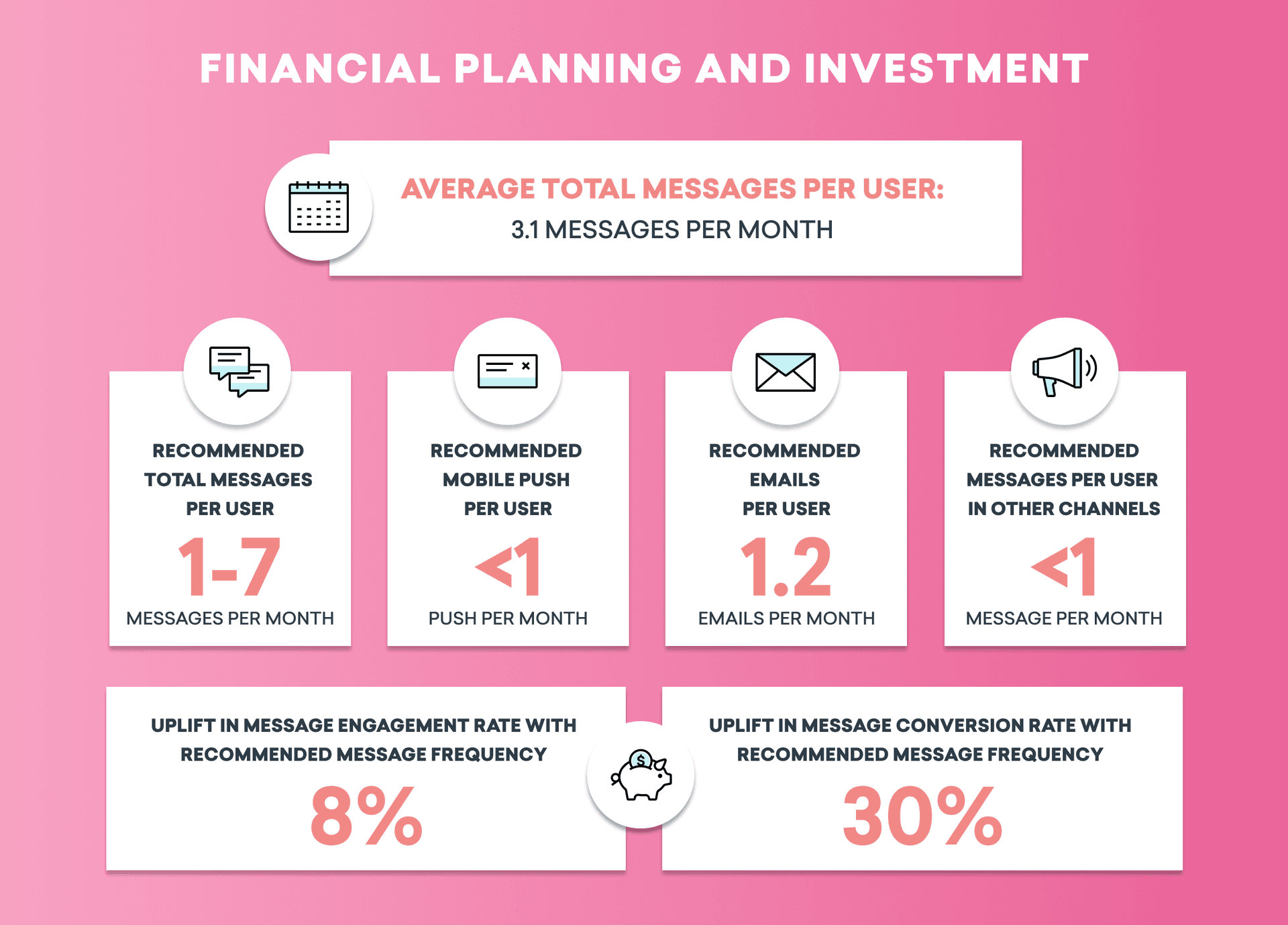

Financial Planning and Investment Brands: On Target, But With Room to Grow

For anyone who didn’t go to the moon on GME, there are many financial planning apps out there to help you manage your money. Automated budgeting, trading, and lending apps have seen rapid adoption on mobile, unlocking access to a wide range of financial services.

When it comes to this industry’s recommended message frequency, there’s some interesting nuance here. The recommended frequency identified by our analysis is quite broad—between one and seven messages per user each month. We found that users who received more than seven messages had significantly lower message engagement and conversion rates, while brands who stick within the suggested range saw an 8% increase in message engagement and a 30% rise in conversion rates.

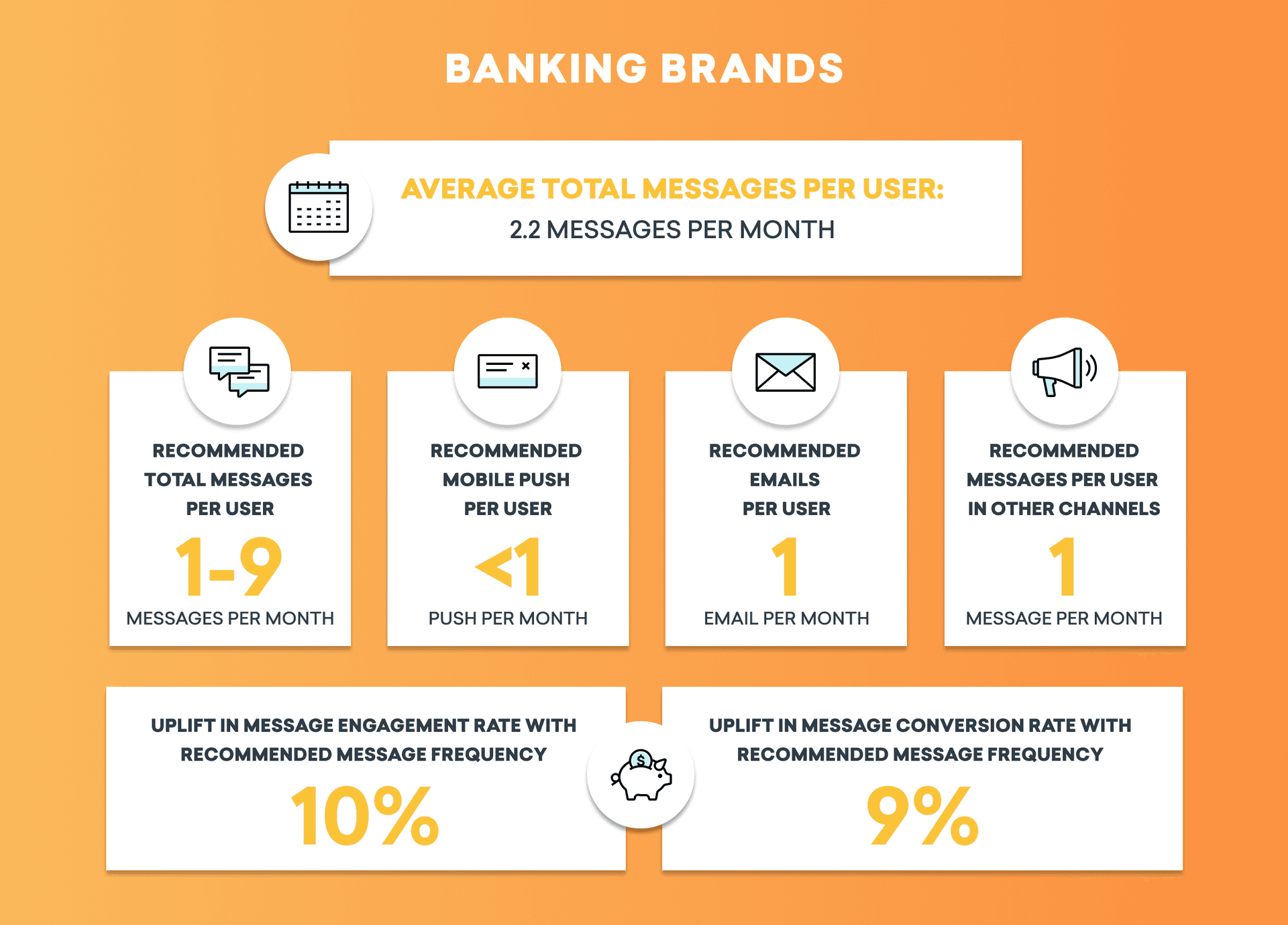

Banking Brands: On Track, With Plenty of Flexibility

Banking apps have seen rapid growth over the past decade in ways that are reminiscent of the financial services space. It’s now commonplace for consumers to access their banking accounts, send money, or deposit checks via their mobile devices, which is a major shift from the traditional brick and mortar focus of the banking industry.

And just like with financial services brands, we found that banking apps have an unusually wide recommended range when it comes to monthly send frequency and a notable drop in result when that range is exceeded. For banking apps, that sweet spot is between one and nine monthly messages per user and brands that fell within this range saw 10% higher message engagement and a 9% jump in conversion rates.

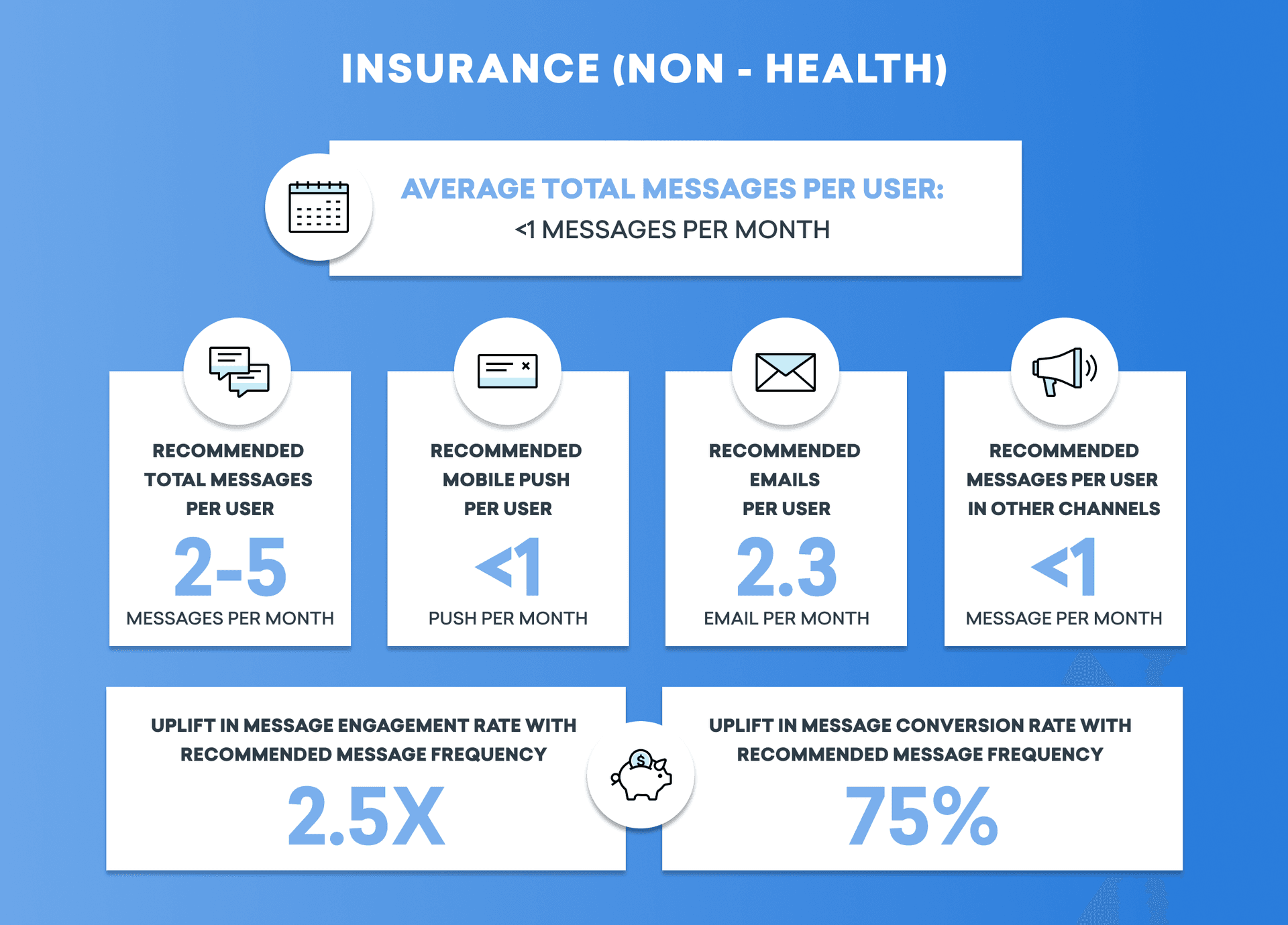

Insurance (Non-Health) Brands: Time to Raise Those (Message) Rates?

While insurance is an essential part of modern life, it isn’t something that the average consumer is necessarily that focused on, unless they have a claim in progress. And that more occasional approach to engagement shows up in insurance brands’ send frequencies—on average, most insurance brands send less than one monthly message per user.

However, our research found that insurance brands that send between two and five messages per month saw a 2.5X increase in message engagement, and a 75% increase in conversion rates. It’s possible that this dynamic reflects some selection bias, with people who are dealing with a claim being more likely to engage with a given message and potentially overrepresented in this group. However, it may still make sense for brands in this segment to leverage testing tools like the Braze platform’s Intelligent Selection feature to help new customers connect with different benefits they might not be aware of, since it will set the stage for future engagement and ensure a smoother process when users do need to make a claim.

3. Productivity and Tools

If—like me—you’re currently wearing ratty sweatpants, ask yourself this: When was the last time you felt the rays of the sun on your skin? These days, the average knowledge worker likely spends the majority of the work hours inside, leveraging one productivity solution or another. Without these technologies, the swift change to working from home in the early days of the pandemic would have been impossible to achieve, highlighting their significant and growing role in today’s digital landscape.

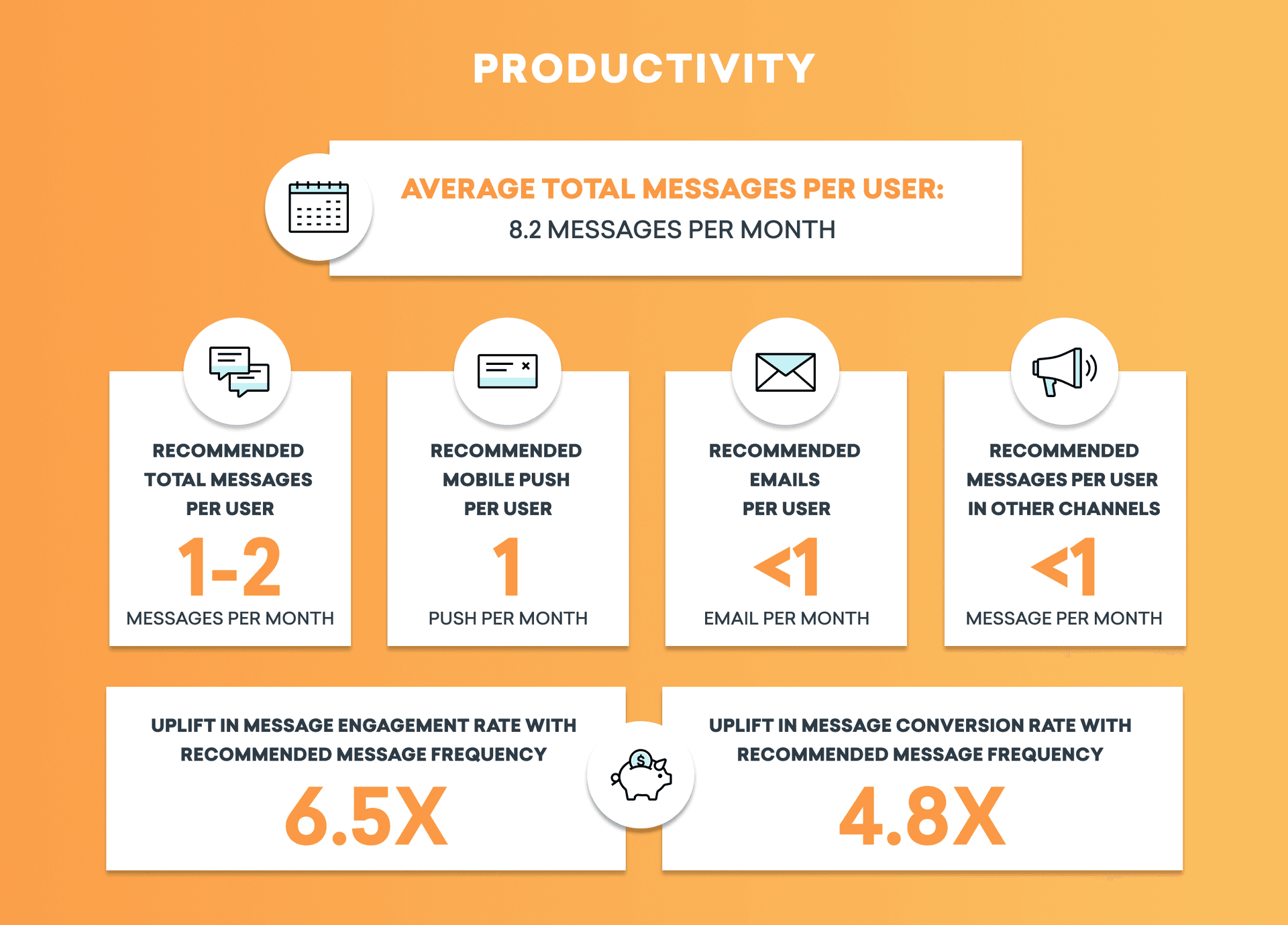

Productivity Brands: Frequency-Wise, There’s Such a Thing as TOO Productive

With many people shifting to a work from home approach over the past year, productivity apps have become further ingrained in the modern workplace. Most of us spend all day in them, including yours truly. Many of these brands are pushing out new features all the time, and sending messages at a fairly high clip to their users—in fact, our research found that the average frequency is a staggering 8.2 messages per month!

However, we found that sending at this cadence may not be the most effective way to engage users. Brands that send only about one to two messages per user each month see much stronger results, with a 6.5X increase in message engagement and a 4.8X rise in conversion rates. If you’re on the higher end when it comes to cadence, it may be time to consider consolidating your messages so that users can process changes in a more condensed manner, and get back to work!

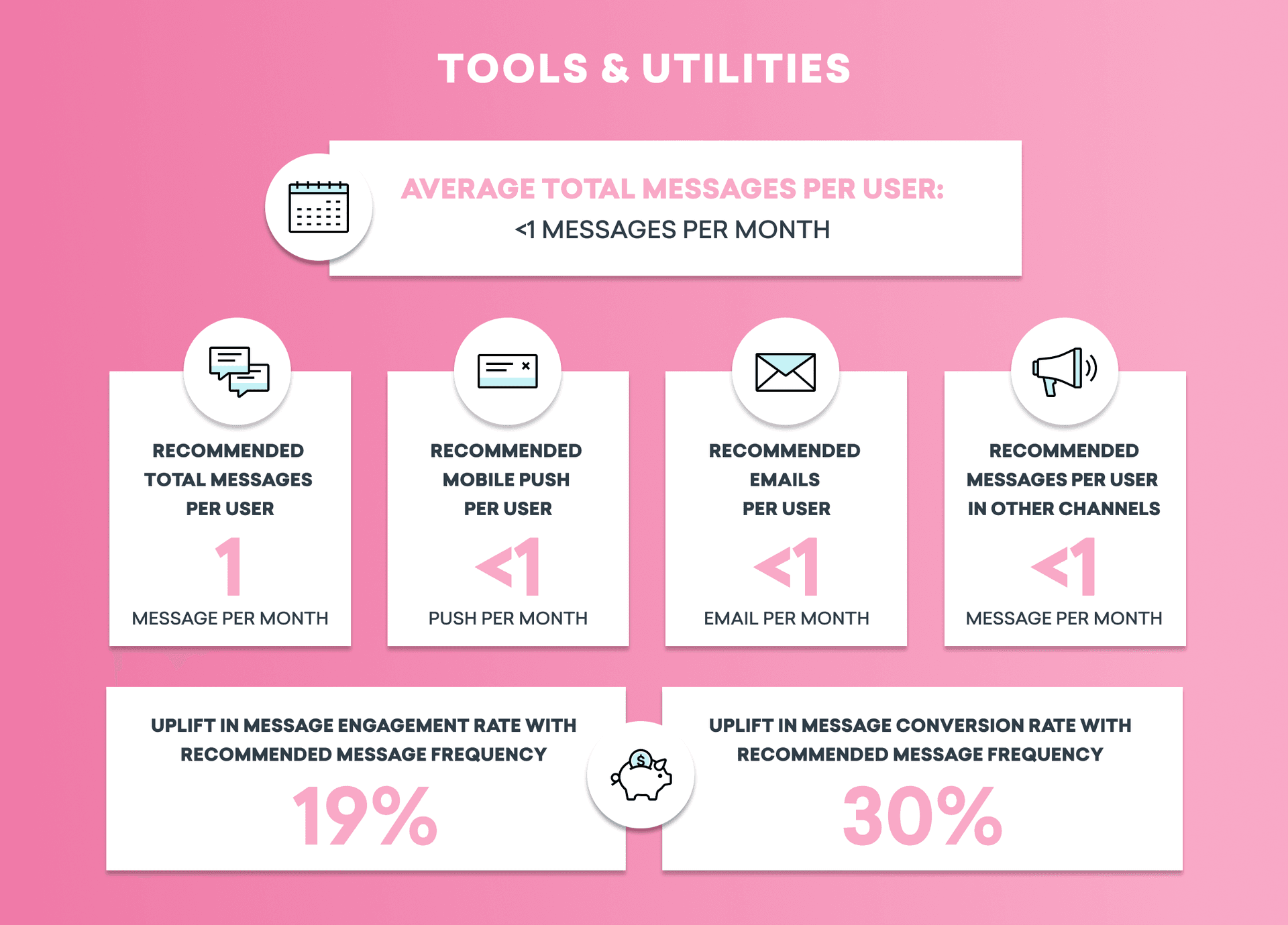

Tool and Utility Brands: Keep It Low (But Maybe Not This Low…)

As consumers’ digital footprints continue to grow, we’ve seen a growing number of tools emerging to help people manage access to devices and platforms, limit screen time, protect passwords, or provide increased security. While brands in this segment are already keeping their messaging light, with an average of less than one monthly message per user, they could actually stand to benefit from a slight increase in frequency.

Our research found that brands who send one monthly message per user saw a 19% increase in message engagement and a 30% rise in conversion rates. So if you’ve got a new product release in the pipeline, consider using targeted segmentation based on customer attributes to make sure that you’re driving awareness to people who would find them to be helpful!

Final Thoughts

That’s it—we’ve come to the end of our send frequency journey. We’ve covered some serious ground over the course of these three articles; hopefully, you’ve found them helpful when assessing how you can adjust message frequency cadence to meet your company’s specific needs. Just keep in mind that these findings are intended as a starting point, and that your customers might prefer a cadence that’s different from what you see here. Given that, it’s smart to carry out message testing and optimization to find your ideal frequency.

Interested in learning more about average message performance? Check out our interactive Braze Benchmarks feature to dig deeper into key engagement metrics.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

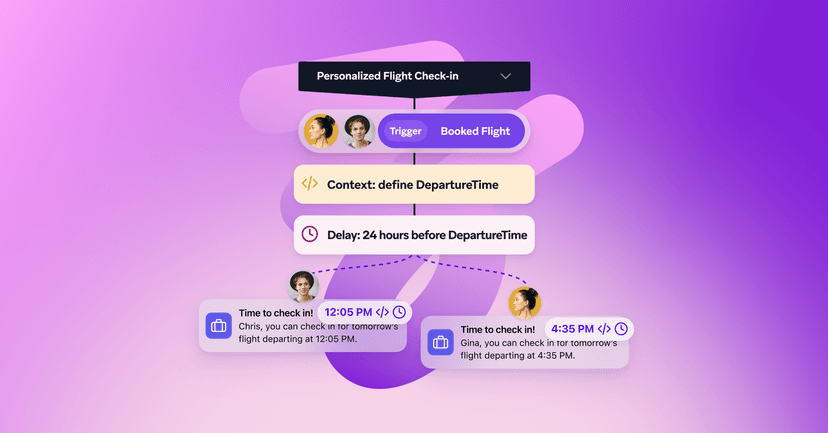

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026