How to Compete in the Evolving Financial Services Landscape

Published on June 23, 2020/Last edited on June 23, 2020/9 min read

Erin Bankaitis

Director, Strategic Consulting for Financial ServicesOver the past decade, consumers have gotten used to disruption. While the rise of mobile helped businesses understand, reach, and retain their customers, it also weakened the long-time competitive advantages held by established incumbents by making it possible for other brands to speak directly to their customers and offer more responsive and relevant experiences.

These disruptors were usually small, nimble startups and other forward-looking competitors, brands that understood the potential that technology had to transform their businesses. And by leveraging the tools and tactics that mobile made possible—from dynamic message personalization and highly segmented outreach to automated message testing and location-based marketing—they were able to outflank traditional industry leaders and grow global audiences at a pace that’s never been seen before.

But while we’ve seen this trend around the world and in a wide range of industries, it’s taken longer to manifest in heavily regulated industries like financial services. But in recent years, we’ve begun seeing a meaningful shift in the financial services industry, one that has the potential to reshape the space for years to come.

Where We Were: The Unbundling of a Bank

While consumers are at the core of any successful business, some verticals—financial services among them—have been able to remain profitable and build sustainable success over the years while offering up slow, confusing, or frustrating experiences to the customers they serve. In the financial services space, incumbent brands have long profited from the essential services they provide (e.g. savings accounts, mortgages, CDs, etc.), reducing the perceived urgency around conforming to consumer expectations or responding to the changing technology and business landscape.

But, as we all know quite well from recent events, there’s no change agent quite like a crisis. The 2007-2008 mortgage crisis seriously damaged consumer trust in the banking establishment, creating an opportunity for financial technology (FinTech) brands. Fintech companies are digital-first, financial technology brands that have built their value proposition around providing consumers with brilliant, seamless—and, mostly importantly, customer-centric—experiences across nearly the entire banking value chain. The birth of FinTech sent waves across Wall Street, finally forcing incumbents in the financial services space to revisit their digital transformation plans in order to ensure they could stay competitive.

While incumbent financial service brands’ newfound focus on customer-first banking experiences are a positive step in the right direction, their work is far from done. The rise of FinTech and ongoing advancements in the technology space have unlocked market forces that call for further action from big banks and other incumbents in order to stay competitive.

Where We Are: Financial Services’ Technology Arms Race

What do those market forces look like—and how are today’s financial services brands dealing with them?

At its core, the outcome of the mobile revolution has been a renewed focus on their consumer and their preferences and behaviors. It’s easier than ever before for brands to use data to understand how each individual customer is engaging with their digital properties and to use those insights to provide a better brand experience—but only if those brands have their data collection strategies and technology stacks fully built out.

In financial services, the growing number of FinTech startups and incumbents’ late-to-the-game focus on technology has led to some of the fiercest competition of any industry, Banks have woken up and are throwing multi-billion-dollar technology budgets into digital transformation initiatives. Fintech brands, on the other hand, are racing to build out more products and features in order to scale and stay ahead of their entrenched competitors.

Right now, FinTechs still have key strategic advantages over financial services incumbents. For one thing, they generally have the ability to spin up new experiences at a much faster speed, thanks to modern technology stacks and more nimble team structures. That said, many FinTechs lack the brand reputation and customer base needed to compete effectively with the giants, which continue to dominate market share despite the disruption. When facing off against the big banks, FinTechs have to lean into their strengths—especially their ability to use data to power the responsive, personalized experiences that customers crave—in order to boost their customer retention as they scale.

Where We’re Headed: The Biggest Opportunities for Financial Services Brands

It’s clear that technology-driven customer experiences are of central importance for both established financial services brands and and FinTech insurgents—but where are the biggest opportunities for each to use tech to drive stronger customer relationships and business outcomes? Let’s dig into three key areas of focus:

1. Differentiated Loyalty and Rewards

While loyalty is often associated with the retail/ecommerce and food/beverage verticals, the truth is that loyalty is the lifeblood of every industry. In banking, loyalty is becoming a key focus for innovation as the slim margins associated with customer rewards programs continue to drive friction between banks, card issuers, and merchants. And with increased competition putting the pressure on card net interchange, banks have an opportunity to revamp their existing loyalty programs to make them more responsive and personalized, reflecting consumers’ individual lifestyle needs.

The question becomes: What do you need to carry out a great loyalty program? Credit cards have historically been the main source for cashback rewards in the financial services space, but we’re starting to see a lot of activity around FinTech debit card offerings in the hopes of stimulating growth and revenue opportunities around loyalty. Customer adoption has been significant, as FinTech-issued debit cards can offer customers unique benefits like instant cash back that their credit card issuers often don’t. Winners in the financial services industry will not only provide the best rewards, they’ll also couple those rewards with experiences that are frictionless and personalized for each individual customer.

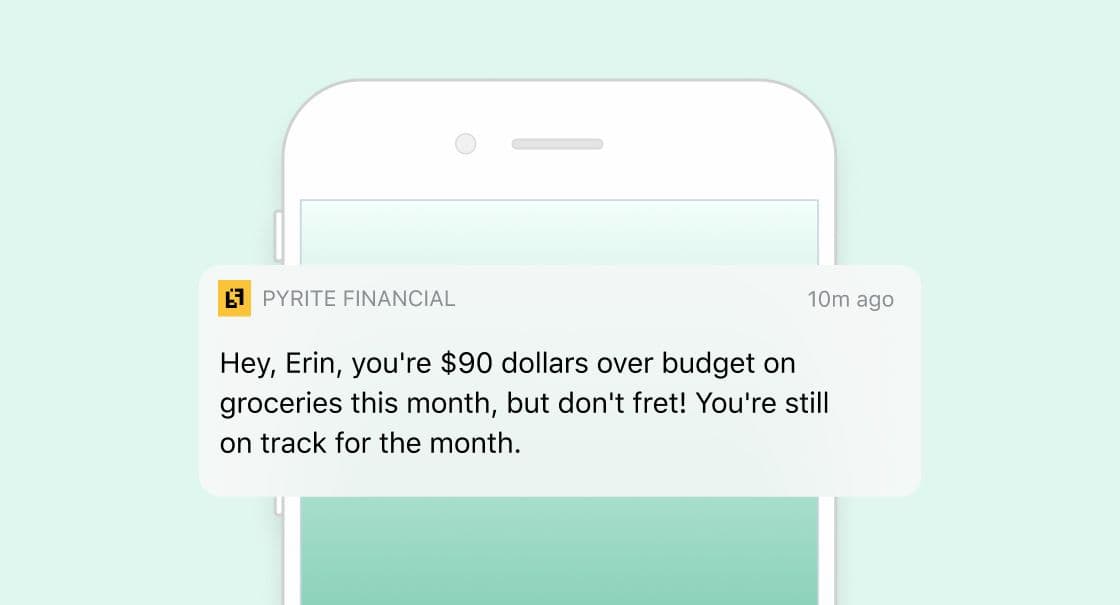

What does that look like? Imagine receiving a notification from your banking provider that automatically suggests the card that offers the best rewards/savings at the time of purchase. That’s the thing, it’s not just about what rewards are offered—after all, a rewards arms race can get expensive—but rather how those rewards are communicated to customers.

2. Communication and Education

Both FinTech brands and traditional banks are working hard to create ancillary value, but there’s still a significant opportunity when it comes to how they’re using messaging tools to better educate customers on an ongoing basis. Today’s consumers are looking for branding providers that not only arm them with the tools they need, they use communications and resources to help them make better financial decisions. Take savings products, for example—many banking customers have a plethora of options today (from traditional savings accounts, CDs, high-yield savings accounts, etc.), but can feel overwhelmed by choice paralysis when it comes time to select the product that best fits their unique needs. By leveraging data in concert with educational resources and messaging, brands can better serve their customers and also increase the chances that they do actually open a new account or expand the number of offerings they’re using.

How can banks and FinTech brands make that happen? Start by asking. 61% of customers are willing to share personal information to enable highly personalized experiences, but those experiences aren’t possible if you don’t educate customers about why they should share that data and how you’re going to use it to help them. By incorporating those asks and personalized follow-ups into an effective, continuous onboarding flow, you can learn more about each customer and provide them with more value, creating a virtuous cycle that just keeps giving.

3. Demonstrate Value Beyond the Transaction

As the financial services ecosystem continues to expand, personalized user experiences are becoming a prime competitive differentiator. Great user experiences in this space designed around human needs—and those needs don’t start or and with a given transaction. For example, payments providers can connect with customers both before and after purchases by offering expense management services that arm their users to more effectively control their personal spending. By implementing easy to use, automated features enabling consumers better manage their financial life, these brands can empower them with transparency and control while also bolstering the customer/brand relationship.

In addition, as financial services companies seek to better understand their customers, they’ll be in a better position to optimize those customers’ experiences. Imagine that a consumer gets an alert to pay a cell phone bill while they’re at the mall and they decide to pay a nearby store run by their telecom of choice, rather than their usual web-based bill paying. A smart payments system would be able to speak to that location’s point-of-sale system, allowing it to stop additional alerts and to use updated consumer information to provide guidance for future actions. The financial services brands that focus their attention on removing friction across their unique journeys will be in the best position to take advantage of this fast-growing area.

Final Thoughts

While there are major opportunities when it comes to using customer data and personalization tools to provide better experiences for financial services customers, it’s important to remember seeing the full value of these initiatives takes more than just data and technology. The financial services space is built on a foundation of consumer trust, and brands that fail to gain or maintain their customers’ trust are going to be hard-pressed to win them over in other ways.

We’re seeing ever greater accessibility when it comes to customer data, fueled by open banking, APIs and changing customer attitudes—and that accessibility is allowing payments companies and others to more easily personalize and tailor experiences to fit individual customer needs. But this change requires even more responsibility from financial services brands. Leaders in the space will need to responsibly manage this resource through tightened security and increased customer transparency initiatives. For banks and nonbanks alike, success will hinge on reshaping the banking experience to put the consumer first, powered by a robust marketing strategy and supported by a foundation of hard-earned consumer trust.

To learn more about how brands can leverage personalization to provide exceptional customer experiences, check out the Braze personalization guide.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

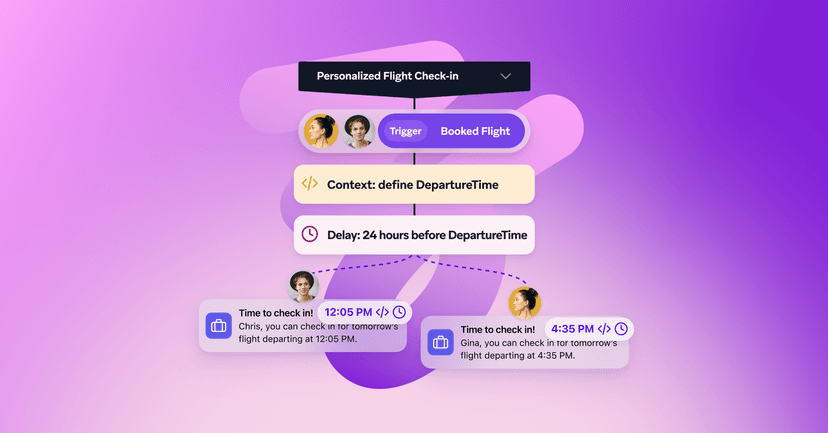

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026