Data and the Financial Services Space: Where We Are and What It Means for Customer Engagement

Published on September 24, 2020/Last edited on September 24, 2020/8 min read

Erin Bankaitis

Director, Strategic Consulting for Financial ServicesIn modern customer engagement, real-time data is at the center of everything. Over the past decade, the rise of mobile has given marketers access to more customer data than ever before—but it’s also led to higher customer expectations when it comes to the user experiences that brands are serving up. This shift is creating a world of new opportunities for financial services companies when it comes to delivering meaningful customer experiences, but many of these companies are reluctant to fully commit to modern customer engagement strategies because of concerns about data privacy risk and potential compliance barriers when it comes to communicating with their customers.

It may be a challenge for brands in highly-regulated spaces, but making this change is both possible and essential. To get there, marketers need to ensure that they strike the right balance between data privacy/security and innovation. Let’s dig into what that journey looks like and how financial services brands can make it as smooth and secure as possible.

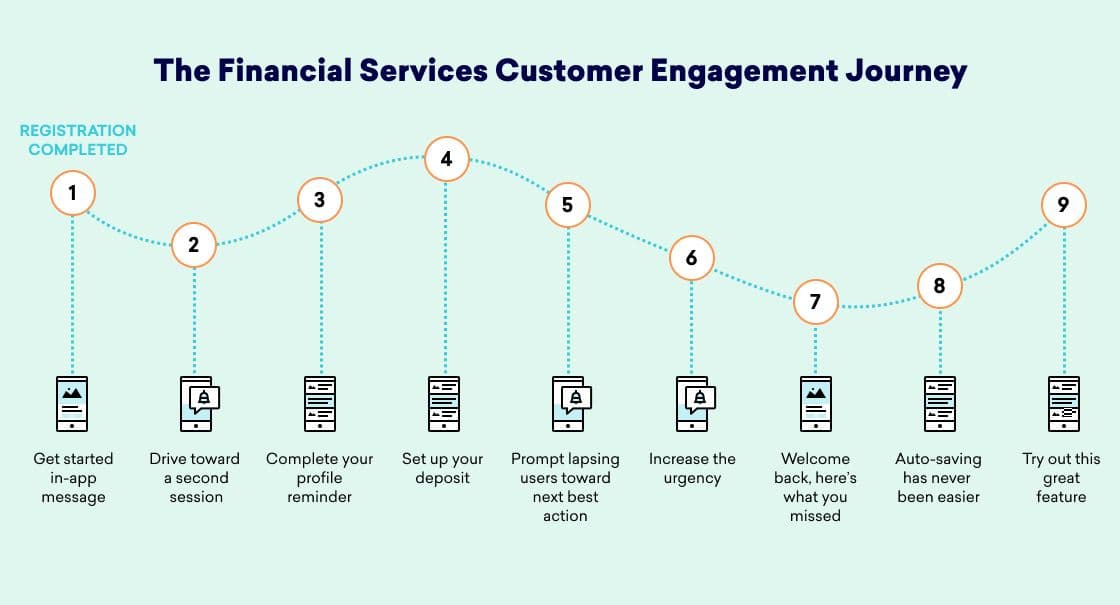

The Financial Services Customer Engagement Journey

While every industry—and every company, for that matter—is different, building out an effective customer journey is an essential part of the long-term success of any brand in today’s increasingly in-the-moment, mobile-first world. For financial services brands, implementing this kind of data-driven customer engagement program requires two key elements:

- Taking steps to make sure data privacy concerns are addressed

- Ensuring compliance when it comes to in-the-moment customer messaging

1. Ensuring Data Privacy

Traditional banks are well aware of the challenges associated with data privacy, because they’ve had to adhere to some of the world’s most stringent data privacy standards for many years. As such, they tend to pride themselves on their data privacy practices and have generally managed to avoid the nightmarish, headline-worthy data privacy breaches we’ve seen in other industries.

To keep data private, financial services companies have to constantly monitor and understand where data is coming from, something that’s only getting more difficult as the amount of data and the number of systems processing it keeps expanding with no signs of slowing down. With the ever-growing number of touchpoints that exist between mobile devices, websites, social accounts, in-person branch visits, and more, maintaining data privacy going forward is going to require fundamental changes that legacy technologies, operations, and siloed organizations simply aren’t built to handle.

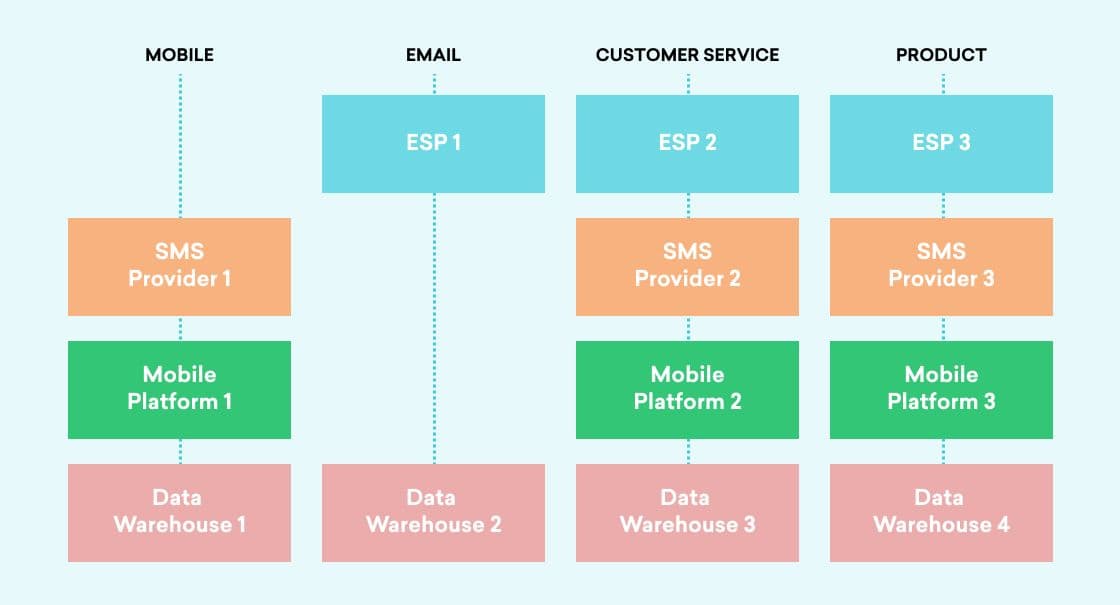

Historically, the marketing departments at traditional financial institutions have primarily been product and/or channel-focused, rather than holistic in nature. This may not seem like a data privacy issue on the surface, but siloed organizations tend to suffer from saturated and disjointed marketing technology stacks, resulting in a chaotic distribution of data that can expose organization to data privacy risks over time.

To avoid this outcome, financial services brands need to ensure that their marketing technology stack can support true data agility, providing teams with a holistic view of the data at their disposal and making it easier to carry out effective data management and privacy practices. When data is managed collectively at a customer-by-customer level, rather than based on the channel or the team that’s associated with a particular action or campaign, it’s possible for financial services brands to act more effectively on the information at their disposal while also reducing the risks associated with a series of disconnected technologies.

2. Maintaining Compliance When Communicating with Customers

For financial services firms, compliance requirements are a major concern when it comes to communicating with the customers. While there are many intricacies that emerge when you dig into issues of compliance around user messaging, the central principle is pretty clear: Brands must ensure that the messages that are sent to their customers are in fact the right messages, containing the right content, and do not contain information that is required to be kept confidential.

Many banks and other financial institutions leverage batch static data processing across a variety of systems that eventually feed in information that will later be sent to customers. One of the major risks associated with standard data processing is that it can be hard to ensure that the information that results from it is accurate—because the information processed and transferred in near real time. For example, imagine that a bank’s marketing team has been asked to help boost the volume of international money exchanges at the institution's local branches. To make this happen, they decide to send a promotional email highlighting a new two-week low in exchange rates to a group of US-based customers who recently purchased a ticket to Mexico through a credit card rewards program, encouraging them to visit their local branch versus a third-party currency exchange provider.

While this is a great idea for a campaign, the team will only see results if the information informing it is up to date—after all, exchange rates can change quickly, so if the bank uses batch data processing (rather than in-the-moment streaming data), they run the risk of including out of data or otherwise inaccurate information in their customer communications, potentially putting them out of compliance. Of course, the marketing team could address this risk by just refraining from sending these sorts of communications at all. But then they run a different risk, namely losing these customers to companies that can provide them with these sorts of value-add, time-sensitive communications—such as challenger banks.

While this sort of real-time messaging campaign may seem complex at first glance, it’s actually pretty simple if you have the right strategy and the right technology. With a dynamic content feature like Braze Connected Content, you can customize campaigns across multiple different channels with personalized information from your company's own internal servers and third-party APIs—allowing the marketing team in our example to simply pull the exchange rate information at send-time, so there’s no risk that the information is out of date. Even better, the data being leveraged via Connected Content is encrypted at rest and in transit and isn’t ever stored on the Braze platform, making it easy to safeguard the information.

The long and short of it? While compliance can often feel like a burden, it’s also a sacred responsibility for brands. Your customers deserve accurate, relevant campaigns that don’t waste their time or put their information at risk—and if you live up to that standard, it can go a long way to establish humanized, honest conversations with your customers.

Why Financial Services Companies Choose Braze

To find that balance between data privacy/security compliance and the real-time, value-add experiences today’s consumers crave, brands need a customer engagement platform that is architected to support both these essential needs. With a technology like Braze, there’s no need to choose between privacy and personalization; instead, marketers at financial services brands can build out nuanced, timely campaigns that speak to their customers’ individual needs and wants while still staying in compliance.

Braze and First-Party Data

Customer data is essential to today’s best marketing programs—but if that data isn’t being provided directly by consumers who have explicitly opted in to share it, a lot of the benefits can be lost. That’s why Braze is built to help marketers request this kind of first-party data in clear, transparent ways and then act on it to put customer value at the forefront.

What does that look like? With Braze, brands can leverage in-app messages and other custom prompts to walk their customers’ through the benefits of sharing data and make it more likely that they choose to opt in. And once their data is in hand, Braze is architected to allow marketers to easily leverage that information to inform live-updating customer profiles that can power dynamic audience segmentation, nuanced message personalization, real-time data inclusion via Connected Content, and more. All from a single dashboard; all supported by information that your customers willingly share.

Braze: A Trusted, Creditable Partner

Brands in the financial services space face some of the strongest regulatory scrutiny of any industry. For that reason, it’s essential that these companies leverage technologies that are capable of handling the critical (and often complicated) regulatory requirements that they must operate under.

The Braze platform was built on the concept of “security by design,” which means that we’ve built security and privacy controls into the core of our product and have made it a key focus from day one. At Braze, we take pride in maintaining the highest standards of compliance with data protection regulations and security standards including: Conducting third-party penetration tests, undergoing SOC II and ISO 27001 compliance audits, and ensuring that our system is ready when new privacy regulations are implemented. Braze has a longstanding commitment to helping our customers comply with relevant data protection laws and regulations and we continue to do what it takes to ensure that our technology makes effective, compliant brand experiences possible.

Final Thoughts

Data privacy and compliance are often major growth blockers for financial services brands looking to improve their customer engagement strategy—but it doesn’t need to be this way. At Braze, we view data and security best practices as foundational elements in establishing and retaining trust. Leading firms are building relevant, value-driven experiences that include transparent, secure data privacy practices and communications. For highly-regulated spaces, the journey is a daunting, but essential step in building true customer loyalty.

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

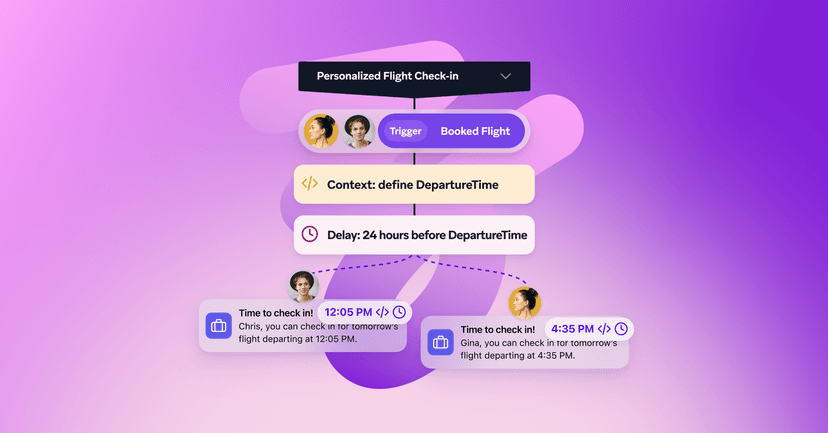

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026