2024 QSR Marketing Trends to Watch

Published on May 24, 2024/Last edited on May 24, 2024/7 min read

Team Braze

The findings from this year’s Global Customer Engagement Review (CER) are in. This annual update on the state of customer engagement across industries and regions is a must-read for marketers. Our 2024 report draws insights from a survey of 1,900 VP+ marketing decision-makers across 14 countries in three global regions; an analysis of proprietary Braze data, which includes 9 billion global user and nearly 1,000 Braze customers in 50+ countries; and in-depth interviews with marketing leaders from best-in-class brands across five industries.

We’ve identified the most important insights marketers across the globe need to know about and presented them in the fourth edition of the CER. We’ve also broken out region- and industry-specific learnings. Keep reading to find out the top 2024 marketing trends to watch for quick service restaurants (QSRs) and delivery brands.

The Top 3 Key Takeaways for QSR and On-Demand Food and Beverage (ODFB) Marketers

Our analysis identified three areas of focus related to customer engagement and marketing for QSR and on-demand food and beverage brands. Let’s dive in.

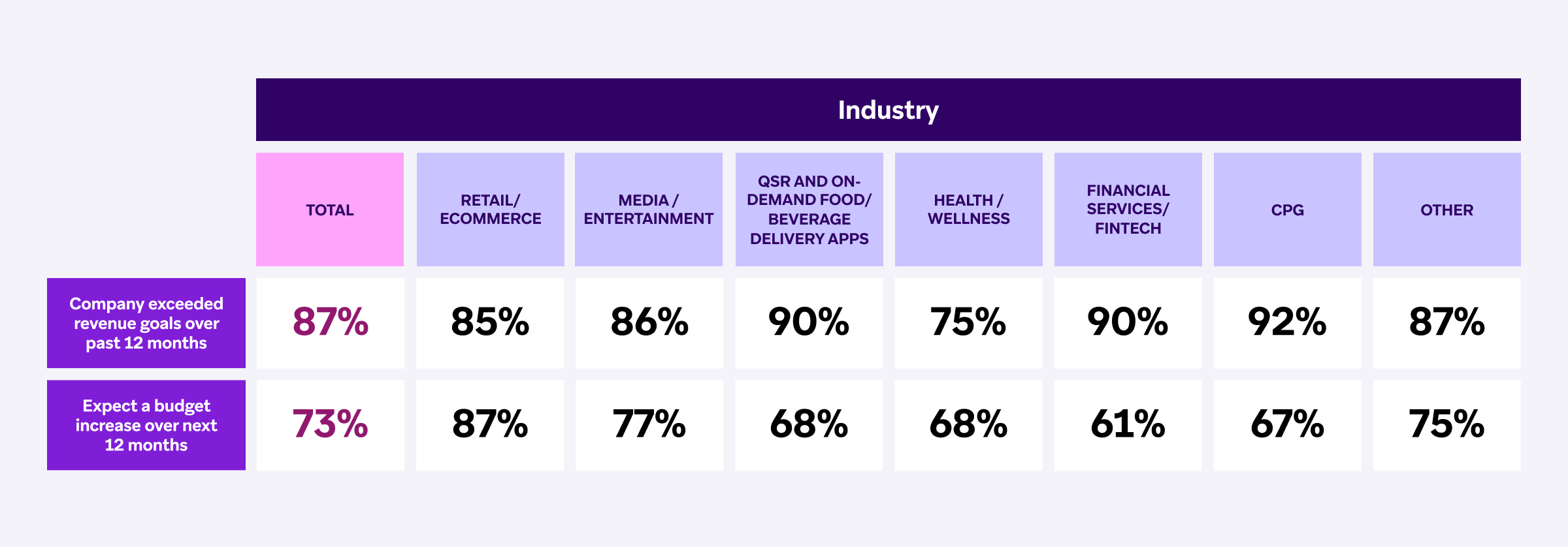

1. Doing More with Less: Brands in this industry are among the most likely to have exceeded their revenue goals in 2023, but among the least likely to be optimistic about budget increases for 2024

QSR brands have embraced apps, kiosks, and QR codes to reduce their costs and increase convenience for their customers, and it appears to be paying off: The brands are among the most likely to have reported exceeding their revenue goals over the past year.

While they’re ahead of all other industries, except consumer packaged goods, these results don’t appear to have helped with optimism around budget growth in 2024. Only 68% of these marketers see increases coming this year, compared with 87% of retail and eCommerce teams and 77% of media and entertainment teams.

With budgets more or less staying flat, QSR and on-demand food and delivery brands will have to be more efficient with time and resources. This could look like A/B testing, more effective use of data, and better AI adoption.

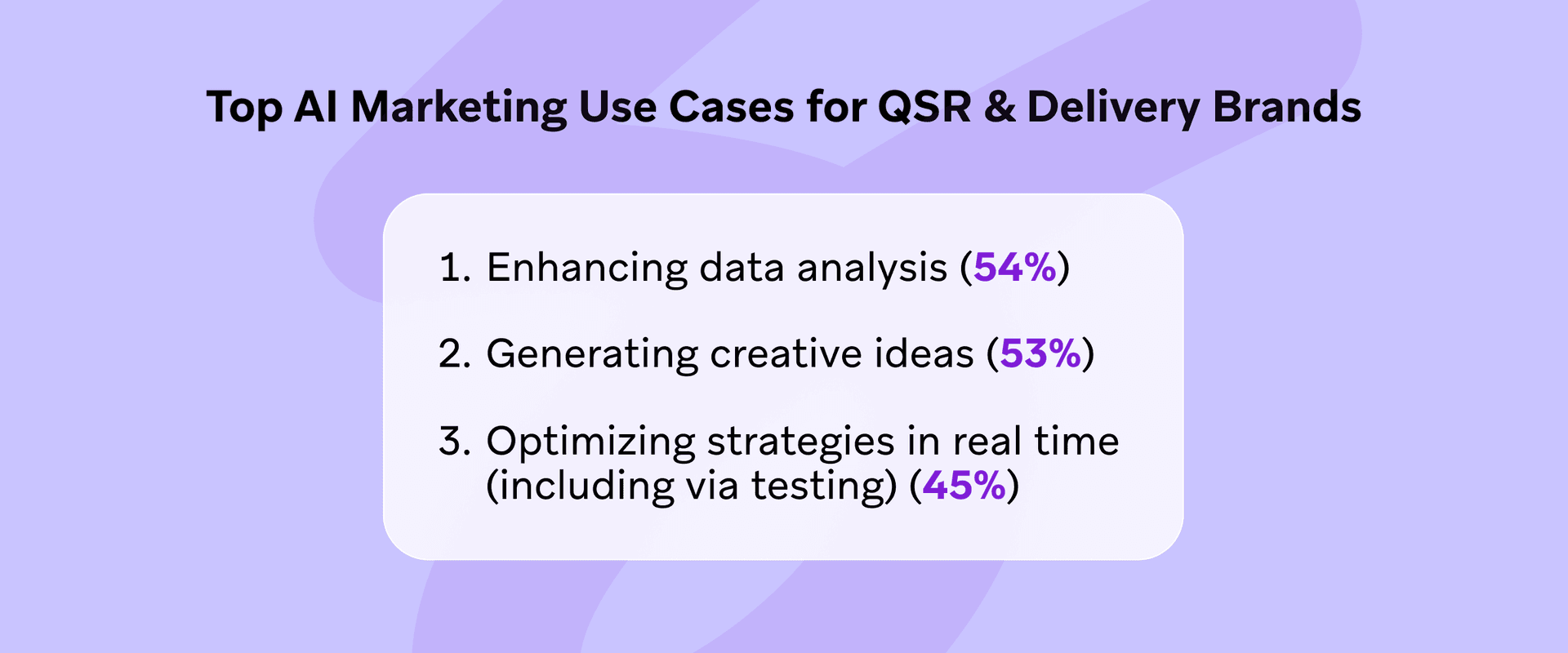

2. Embracing AI: QSR marketers have some of the most positive views of AI and are using it to enhance data analysis and generate creative ideas

The vast majority (83%) of QSR and on-demand food and delivery brands say they favor AI because it can help automate routine tasks and free up more time for creative thinking. This rate of favorability is second only to 85% of retail and eCommerce brands reporting they favor AI for marketing.

For QSR and delivery companies, the three biggest reported AI marketing use cases include enhancing data analysis, generating creative ideas, and optimizing strategies in real time.

With a slowed budget outlook in 2024, QSR and ODFB marketers should continue to use AI as a tool to do more with less. This could look like automating routine tasks, using recommendation engines to automatically serve up the most relevant product or service, or intelligent personalization that dynamically tailors experiences for each customer.

3. Cross-channel customer engagement has the power to help QSR and delivery marketers drive retention and repeat purchases

Out-of-product messaging powerhouse, SMS marketing, has been shown to boost the retention of quick service restaurant and on-demand app customers considerably. Our analysis of Braze data finds that brands that leverage SMS for engagement achieve a:

- 24X uplift in 365-day retention, compared to customers who receive no messaging campaigns at all

- +34% uplift in 365-day retention, compared to customers who receive other types of messages not including SMS messages

For driving repeat purchases, mobile push is a winner. Analyzing Braze data reveals that companies in this industry that send mobile push campaigns see a:

- 2.1X uplift in repeat purchase rates, compared to customers who receive no messages

- +16% uplift in repeat purchase rates, compared to customers who receive no mobile push notifications

For a powerful combination of channels, leveraging Content Cards, email marketing, in-app messages, and mobile push increases:

- Purchases per user by 210X, compared to customers who receive no messages

- Buyer rates by 21X, compared to customers who receive no messages

- Repeat buyer rates by 2.4X, compared to customers who receive no messages

Areas Where QSR Brands Excel—and Areas for Improvement

In 2021, we introduced The Braze Customer Engagement Index, offering brands across the globe a shared framework for measuring customer engagement. The Index includes a ranking system with three levels of maturity.

- Activate brands are those just getting started in customer engagement.

- Accelerate companies are notable for collaborating, experimenting, and employing data-driven strategies.

- Ace organizations are at the top of their field for utilizing streaming data to power full-fledged lifecycle-driven customer engagement approaches.

Areas Where QSR Brands Excel

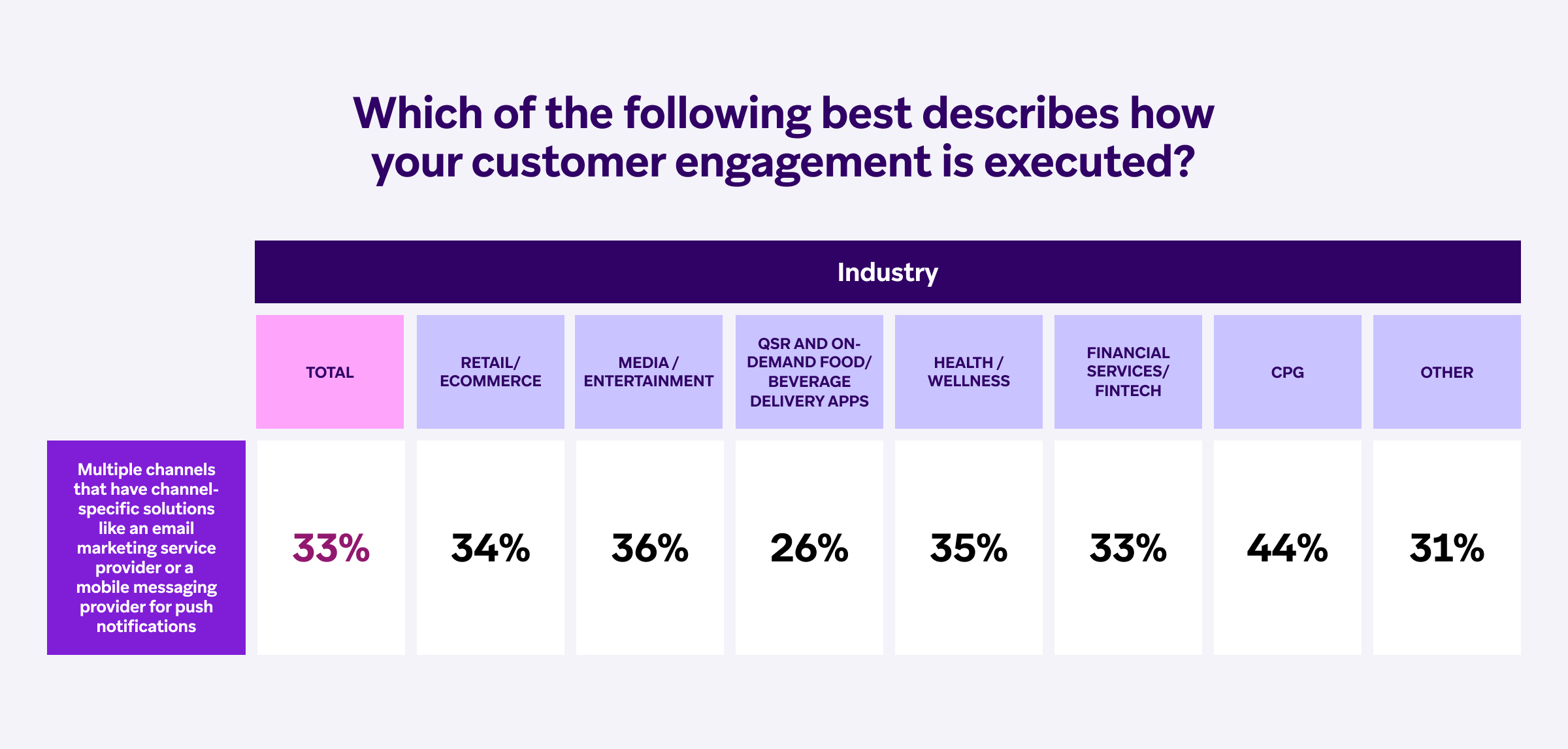

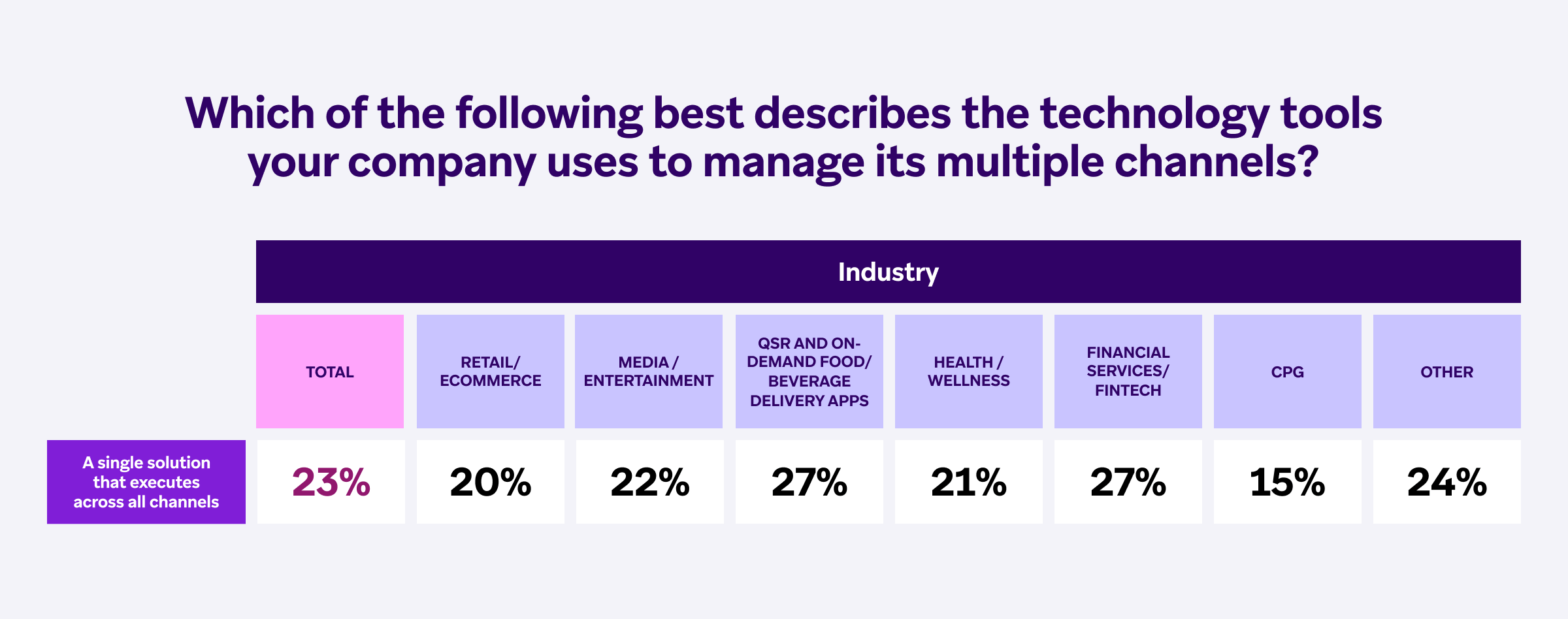

QSR and delivery brands lead other industries when it comes to ditching dated, less effective channel-specific solutions like a standalone email marketing service provider or a mobile messaging provider for push notifications. Only about one-fourth of marketers in this industry say they’re using these kinds of solutions, compared to one-third of teams in other verticals.

More than half (52%) of QSR and delivery marketers are executing their customer engagement efforts at the Accelerate and Ace levels, compared with only 50% of all other marketers.

Similarly, QSR and delivery brands are more likely than most other types of companies to report using a single customer engagement platform that executes across all channels. More than half (56%) of marketers in this industry are using Accelerate- and Ace-level technology and tools to manage customer engagement across multiple channels, compared with only 53% of all other marketers.

QSR and delivery brands are first in line when it comes to using—or intending to use—targeted, personalized web or app content to engage with audiences. Nearly half of marketers at these companies (47%) are doing this (or plan to), compared with only 41% of all other types of brands.

QSR marketers recognize that personalization should permeate the entire customer experience, with a higher likelihood than other industries to assign product teams to collaborate on customer engagement. This is an advantage as cross-team ownership of customer engagement is what drives results.

Opportunities for Improvement for QSR Brands

QSR and delivery marketers struggle with fragmented data, which hampers the delivery of a unified digital experience across mobile and in-store platforms. While brands in this industry have gotten better at personalizing digital messaging, they recognize and report the need for greater consistency across platforms.

Restaurants are adequately bridging the gap between online and offline, but they must stay diligent about how they act on customer data to be more consistent and creative in engaging customers. Customers know what data they are sharing with restaurants and expect it to improve their experience in more creative and conversational ways.

The next phase of personalization is interactive, and this is an area where QSR and delivery businesses lag behind other industries in utilizing first-party data. Successful brands are leveraging technology to make loyalty programs more engaging and to incentivize customers to share data via surveys and events.

QSR and delivery teams are renowned for developing innovative brand campaigns, yet they often lack encouragement for strategic creativity in customer engagement, and report this as an issue more than any other industry. Ace brands are crafting unique experiences and rewards for their communities, emphasizing that personalization should extend beyond mere order recommendations.

Find Out Even More 2024 Marketing Trends

Learn about the worldwide state of customer engagement in the 2024 Global Customer Engagement Review, which reveals three global marketing trends as well as important customer engagement developments by industry.

About the Study

These findings are part of our broader fourth-annual Global Customer Engagement Review, which draws on the following sources:

- Market research featuring 1,900 VP+ marketing decision-makers across 14 countries in three global regions.

- An analysis of Braze’s proprietary data, including 9 billion global users and nearly 1,000 Braze customers in 50+ countries, via our leading customer engagement platform.

- In-depth interviews with marketing leaders from best-in-class brands in five industries across three regions.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

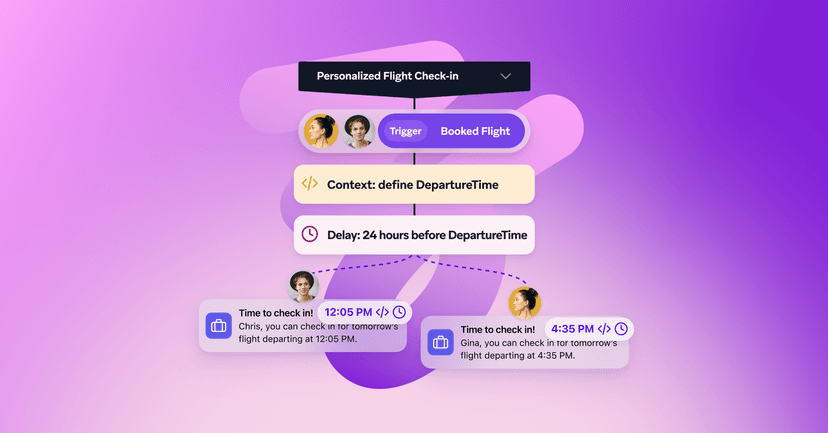

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026