2024 Media and Entertainment Marketing Trends to Watch

Published on May 31, 2024/Last edited on May 31, 2024/8 min read

Team Braze

We’ve wrapped up our annual worldwide analysis on the state of customer engagement, and the findings are now available in the fourth edition of the Global Customer Engagement Review (CER).

This comprehensive report includes an overview of three emerging trends we uncovered from our survey of 1,900 VP+ marketing decision-makers across 14 countries in three global regions; our analysis of Braze proprietary data, which includes 9 billion global users and nearly 1,000 Braze customers in 50+ countries; and in-depth interviews with marketing leaders from best-in-class brands across five industries.

While conducting this research, we also discovered additional important learnings relevant to specific business sectors and regions of the world. Ahead, we’ll share what’s unfolding in the customer engagement landscape for media and entertainment brands—including the top 2024 media and entertainment marketing trends to watch.

Creativity, AI, and cross-Channel engagement are key trends for media and entertainment marketers

Today's media and entertainment industry is a dynamic one, marked by market consolidation, cross-industry partnerships, and disruption at every turn. However, as new product tiers and expanded content become table stakes, we're seeing more brands in the space shifting their focus to profitability, leading to growing scrutiny around customer engagement and the role it plays in supporting overall customer health.

Our analysis identified three areas of focus related to customer engagement and marketing that could impact media and entertainment brands. Let’s dive in.

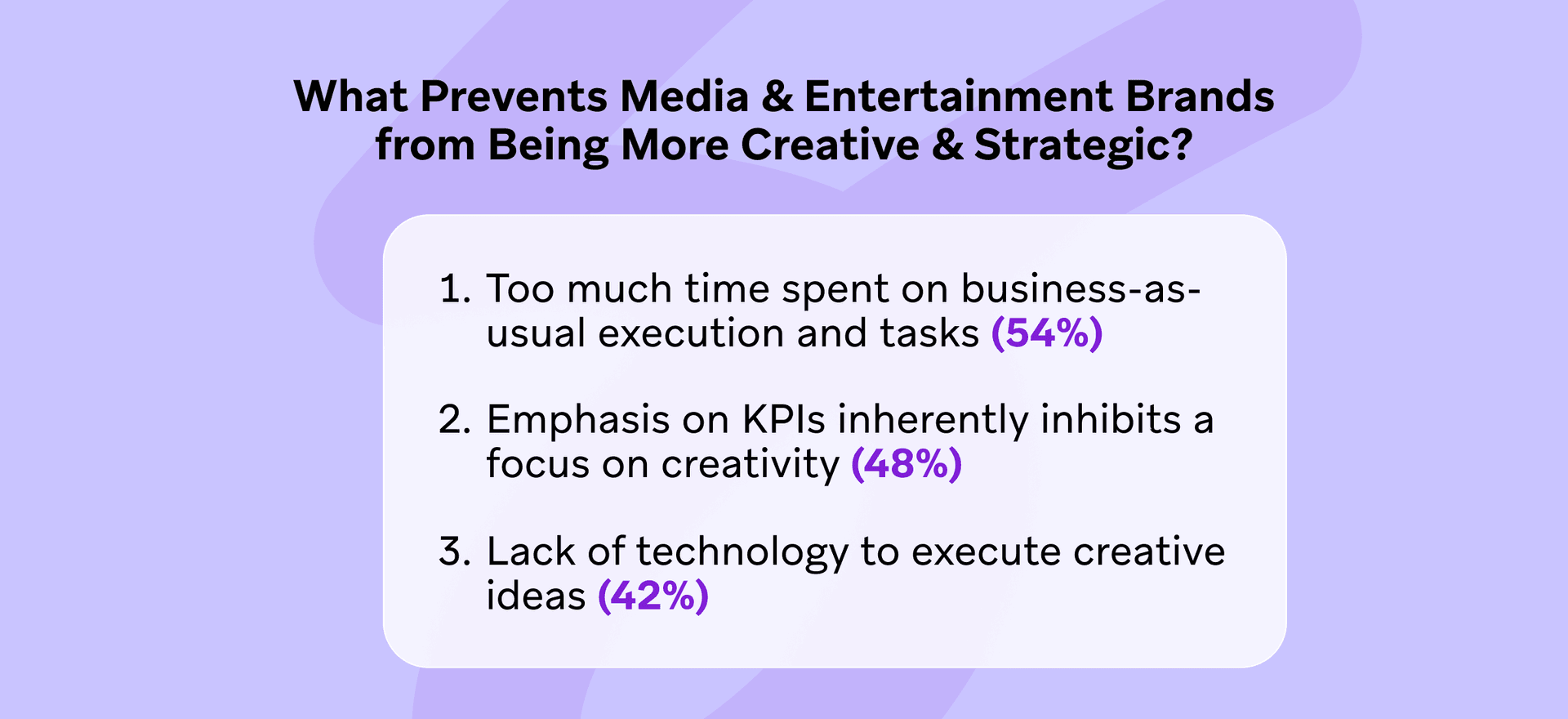

1. Having to spend too much time on business-as-usual tasks is getting in the way of media and entertainment marketing teams’ creativity

More than half of surveyed markers in the industry (54%) say daily responsibilities are one of their main obstacles to being more creative and strategic. Nearly half (48%) believe the focus on driving KPIs inhibit their ability to be creative.

Given the high competition between media and entertainment companies, brands in the space need to focus on building brand loyalty to drive stronger business results. One thing that can help? Prioritizing creativity to create memorable and emotional connections with consumers.

2. Marketers in the industry generally have positive views of AI and are using it to automate repetitive tasks and generate creative ideas

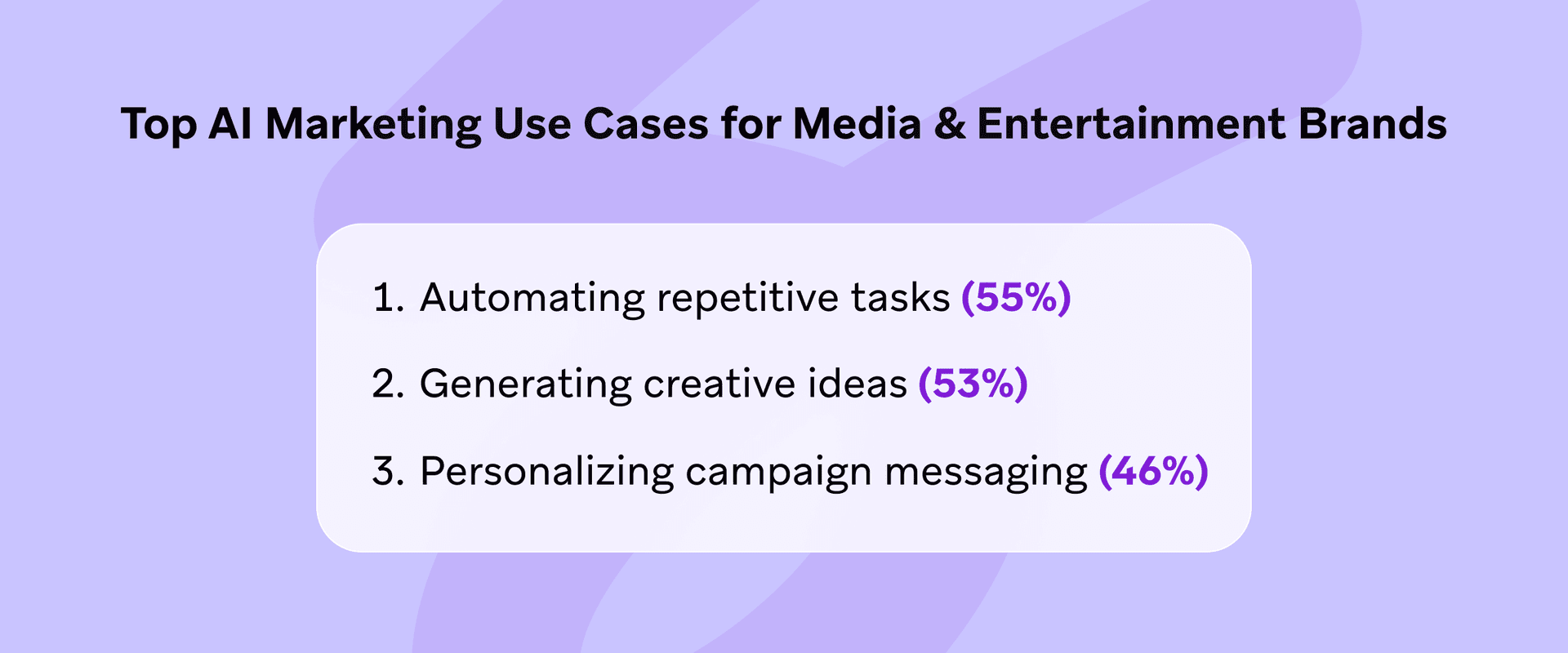

Perhaps in response to the big challenge at hand—namely, not having enough time to focus on creativity and being strategic—marketing teams are adapting and addressing the issue with AI.

Most surveyed media and entertainment marketers (80%) say they favor AI because it can help automate routine tasks and free up more time for creative thinking, and that’s how teams in the industry are using (or plan to use) AI.

More than other industries, more than half of all surveyed marketers in this field (55%) say they already are leveraging—or intend to—leverage AI for automating repetitive tasks. A similar share, 53% are thinking about or are taking advantage of AI for generating creative ideas; that’s a greater share of participating marketers than in most other industries.

AI can be used to develop multiple variants of copy, to create images for experimentation, and determine winning campaigns and journeys faster in testing.

3. Cross-channel customer engagement is a powerful tool for media and entertainment marketers to improve both customer activation and retention

Our analysis of Braze data finds that surveyed brands in this industry that send email marketing campaigns see a:

- 11.1X uplift in 365-day retention, compared to customers who receive no messaging campaigns at all

- 93% uplift in 365-day retention, compared to customers who receive other types of messages but no email marketing campaigns.

Plus, a cross-channel messaging strategy that includes Content Cards, email, in-app messages, and mobile push can boost 365-day retention by 20.4X, compared to customers who receive no messaging campaigns. To be clear, cross-channel messaging doesn't mean engaging customers with the same message on multiple channels, but focusing on connecting the experience across relevant channels so they all work together effectively.

For driving session engagement, Content Cards and cross-channel coordination make an impact. Braze data reveals that:

- Content Cards improve session engagement among recipients by 36.8X, compared to customers who receive no messaging campaigns at all, and by 4.1X compared to customers who receive other types of messages but no Content Cards. Content Cards enable easy web and mobile personalization to broaden the reach of marketing and help guide customers to actions once in the product.

- Using Content Cards, email campaigns, in-app messaging, mobile push, and webhooks can boost session engagement by 61.4X, compared to customers who receive no messaging campaigns at all

Areas Where Media and Entertainment Brands Excel—and Areas for Improvement

In 2021, we introduced the Braze Customer Engagement Index, offering brands across the globe a shared framework for measuring customer engagement. The Index includes a ranking system with three levels of maturity.

- Activate brands are those just getting started in customer engagement.

- Accelerate companies are notable for collaborating, experimenting, and employing data-driven strategies.

- Ace organizations are at the top of their field for utilizing streaming data to power full-fledged lifecycle-driven customer engagement approaches.

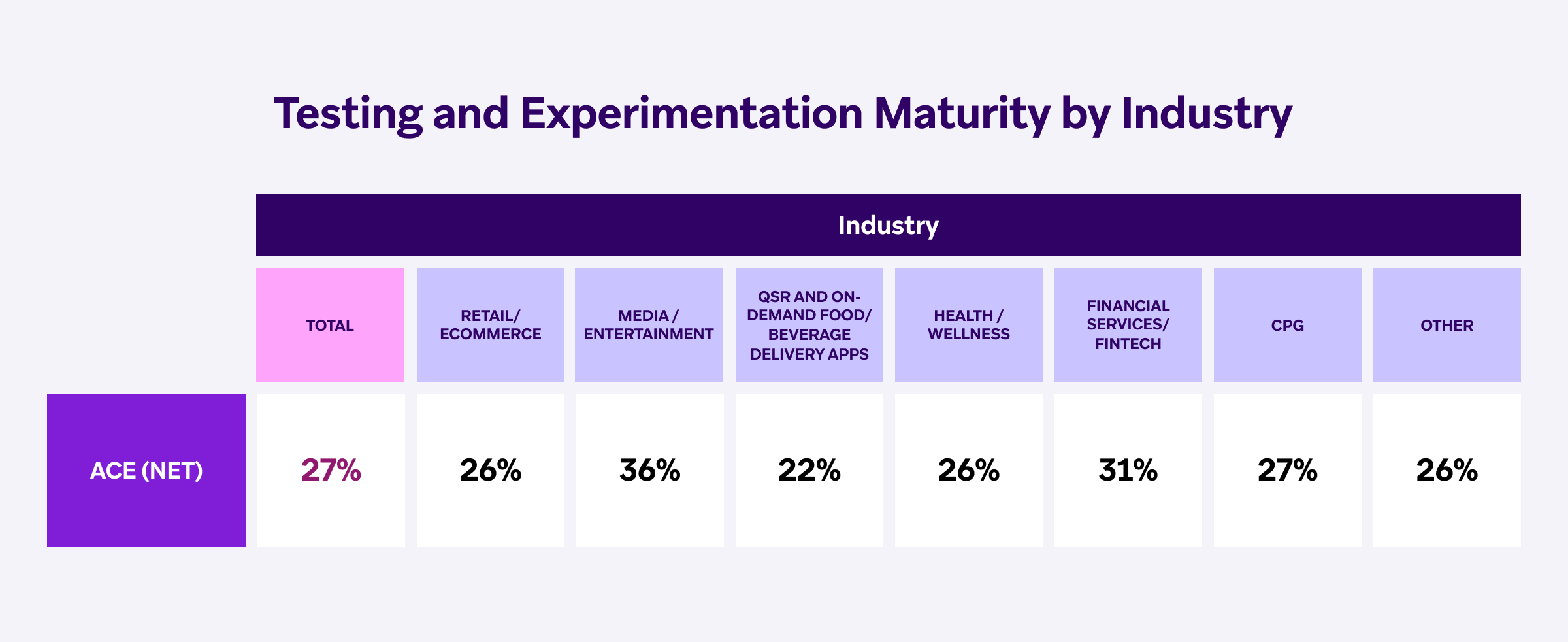

Media and Entertainment brands excel at experimentation and measuring performance

Our research shows that media and entertainment companies are ahead of the curve on testing and experimentation. Many of these brands have mastered trial-to-subscription, win-back, and new content campaigns. They’re more likely than companies in other industries to:

- Continuously experiment by design with several tests running at once and

- Use advanced analytics to provide in-depth insights

They’re also among the most likely of businesses across sectors to:

- Regularly partner with business intelligence to plan tests to ensure statistical significance

Surveyed media and entertainment marketers excel most at optimizing the timing and cadence of messaging, allowing them to stand out in today’s noisy marketing landscape. Optimal messaging timing is different for every company, and this industry’s success is a result of their continuous testing and experimentation.

They also have the edge when it comes to measuring customer engagement success, paying close attention to down-the-funnel KPIs like revenue per campaign, customer satisfaction scores, and customer lifetime value, as well as top-of-the-funnel metrics like message engagement and app engagement and usage.

Lastly, it’s important to have a strong experimentation culture—which is matched by a strong measurement culture. With constant testing and experimentation, you also need to be measuring impact to understand what's working and not working and adjust your strategy.

Brands can improve success by aligning on objectives and increasing collaboration

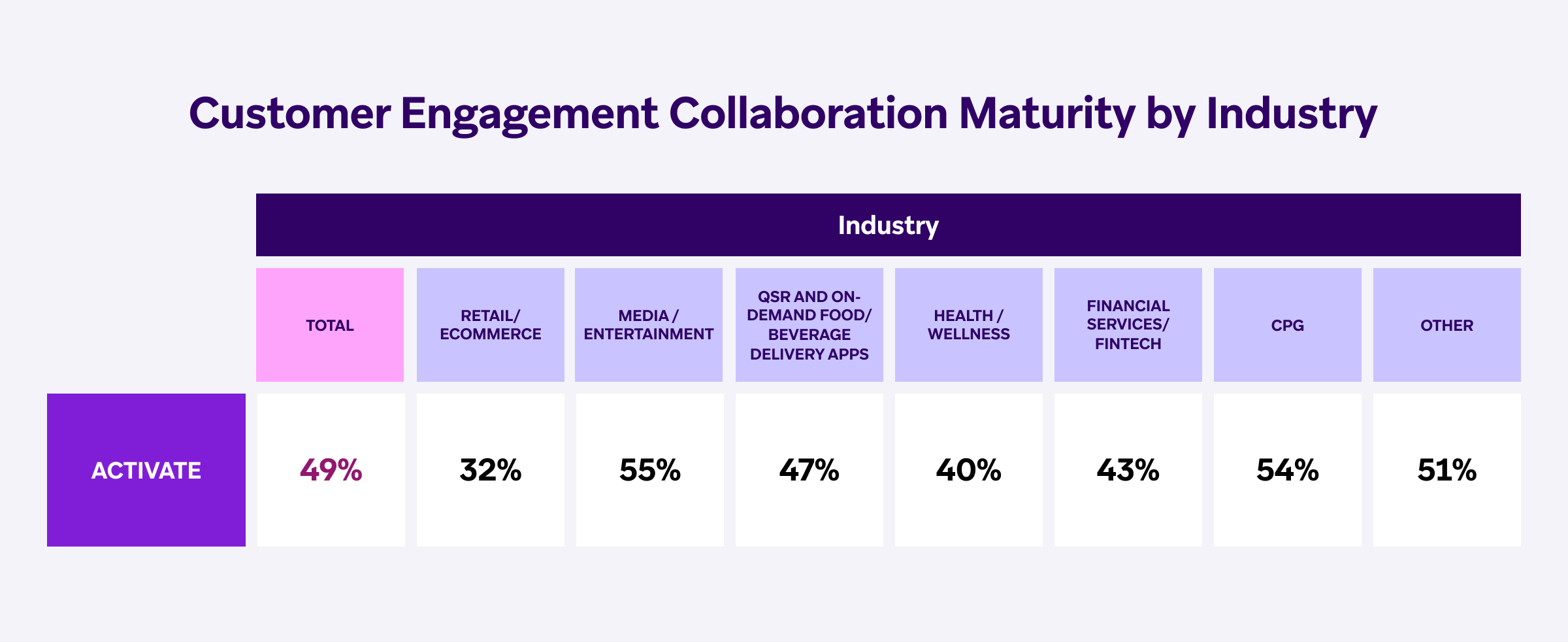

Respondent executives in the industry report difficulty taking action on data. With over 30% of surveyed media and entertainment brands reporting they have channel-specific customer engagement solutions, unifying customer engagement through the use of a single, coordinated platform could enable better and faster data activation.

Taking a closer look at the tech and team competencies within the Index, the real challenge for brands in the space may be an absence of shared success criteria across teams. This lack can hinder progress on larger initiatives like introducing new channels or loyalty programs.

This is further reinforced by our finding that over 50% of companies are collaborating with relevant teams once a month or less. Overall, surveyed media and entertainment marketers operating at less advanced levels when it comes to customer engagement collaboration, compared to other industries.

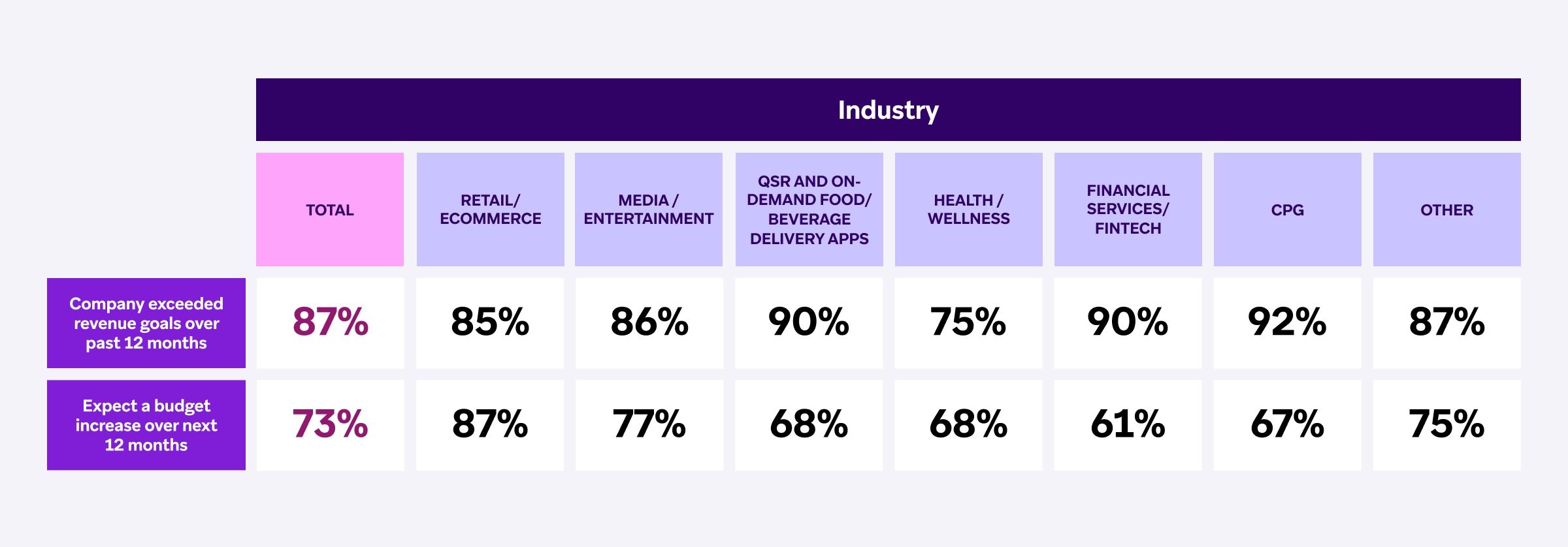

In terms of meeting revenue goals in the last twelve months, media and entertainment brands in our survey scored a near-average rank, compared to other industries. To double down on hitting and exceeding revenue targets, these teams need to continue to invest heavily in customer retention. Currently, 43% of respondents allocate over half their marketing budget to retention.

Final Thoughts

As media and entertainment brands focus their energies on developing better content and experiences to drive profitability throughout the year ahead, they also need to prioritize connected and creative customer engagement. By focusing on unifying their customer engagement efforts, finding the right channel mix for their campaigns, and prioritizing collaboration, these brands have an opportunity to boost performance and strengthen customer relationships.

About the Study

These findings are part of our broader fourth-annual Global Customer Engagement Review, which draws on the following sources:

- Market research featuring 1,900 VP+ marketing decision-makers across 14 countries in three global regions.

- An analysis of Braze proprietary data, including 9 billion global users and nearly 1,000 Braze customers in 50+ countries, via our leading customer engagement platform.

- In-depth interviews with marketing leaders from best-in-class brands in five industries across three regions.

Find Out Even More 2024 Marketing Trends

Learn about the worldwide state of customer engagement in the 2024 Global Customer Engagement Review, which reveals three global marketing trends as well as important customer engagement developments by industry.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

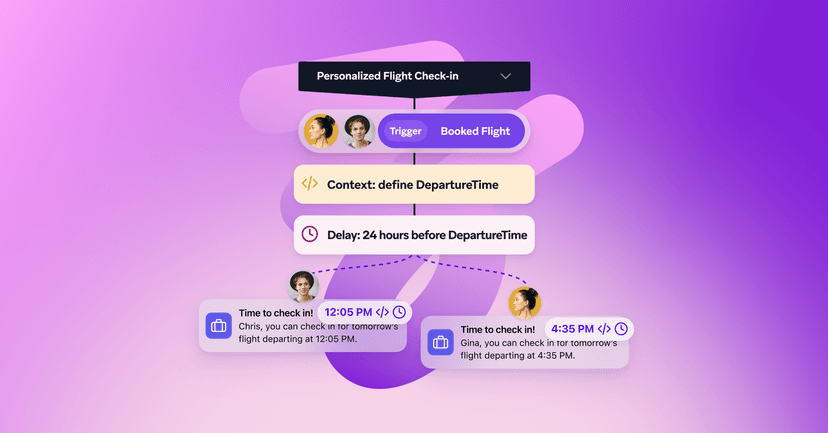

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026