The State of Customer Engagement in EMEA in 2022

Published on March 21, 2022/Last edited on March 21, 2022/4 min read

Team Braze

Each year, Braze produces the Global Customer Engagement Review (CER), a comprehensive report on the state of customer engagement across industries and regions. Based on a combination of market research, analysis of the interactions between 5.4 billion global customers and 1,000+ brands from our leading customer engagement platform, and in-depth interviews with best-in-class brand leaders, we uncover the latest best practices for building relationships with customers, reveal what successful marketers get right, and offer guidance on how to elevate your strategy.

In this year's second-annual edition of our CER, we unveiled three major global customer engagement trends for 2022, as well as critical regional insights for the APAC, EMEA, and North American markets. Today, we’re going take a look at key takeaways from our analysis on the state of customer engagement in the Europe, Middle East, and Africa (EMEA) region in 2022, and walk through how brands can advance their customer engagement strategy to drive activation, engagement, and monetization when it comes to EMEA customers.

The State of Customer Engagement in EMEA in 2022: 2 Key Takeaways

#1: More consumers are engaging on digital channels

Historically, EMEA users may have been less digitally engaged compared to their APAC and US peers; however, that's changed since the start of the pandemic. Take shopping online for clothes—two years ago only one in five UK adults shopped for clothes online, while today that share has jumped to one in three. Similarly, about one in three German smartphone users engage in mobile shopping on a weekly basis and digital purchases have soared by 14% in the Middle East. Bottom line: More consumers are engaging with digital channels, which further underscores the need for brands in the region to ensure that they have a holistic cross-channel engagement strategy.

#2: Consumers expect their data to be protected

With privacy and data a growing concern and GDPR in place, it’s not surprising that 73% of EMEA consumers use services that offer data protection. When developing digital strategies, brands need to put their customers at the center of everything they do—especially when it comes to their data wants and needs.

The State of Customer Engagement in EMEA in 2022: 4 Strategies for Driving Customer Engagement

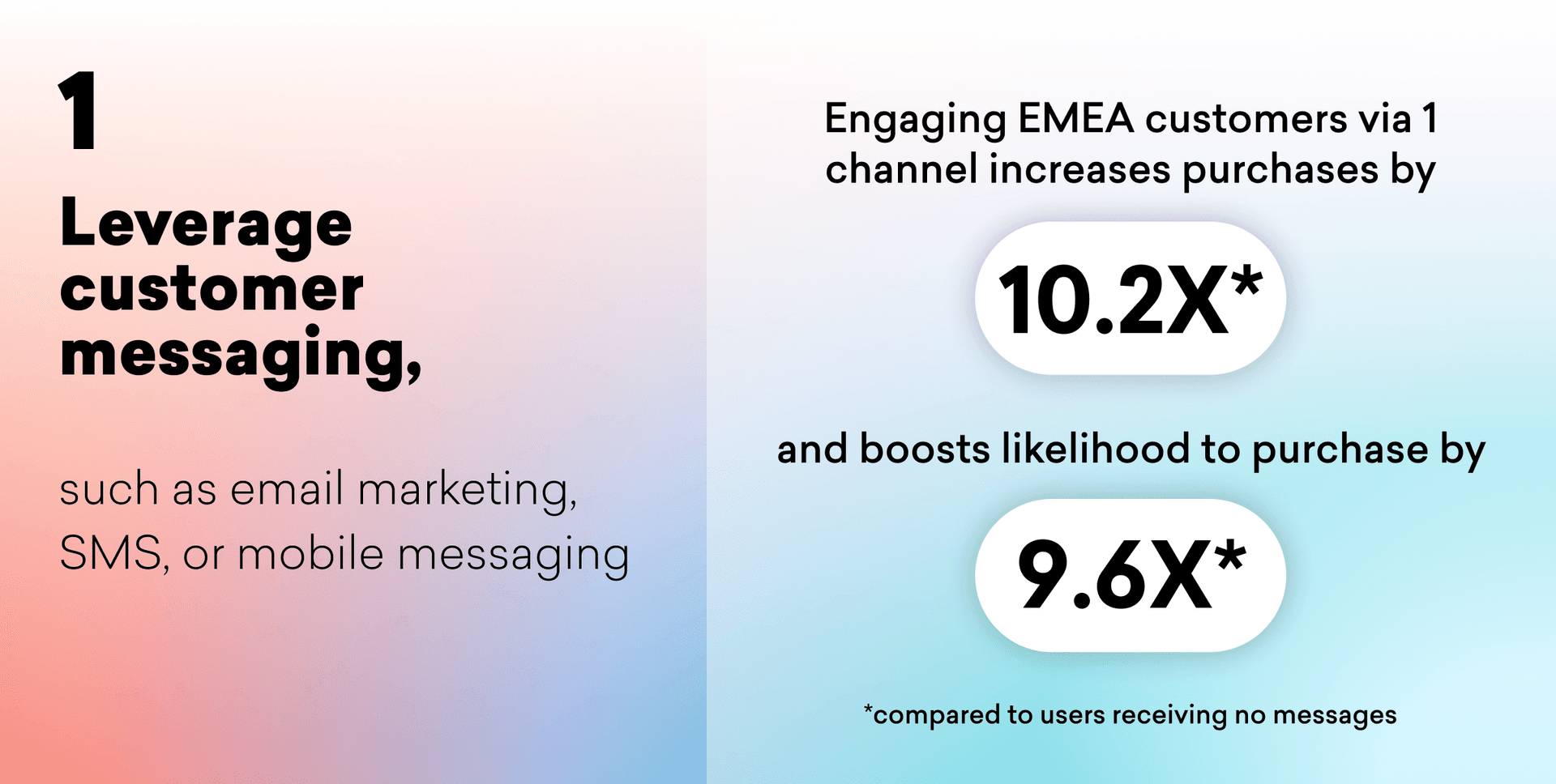

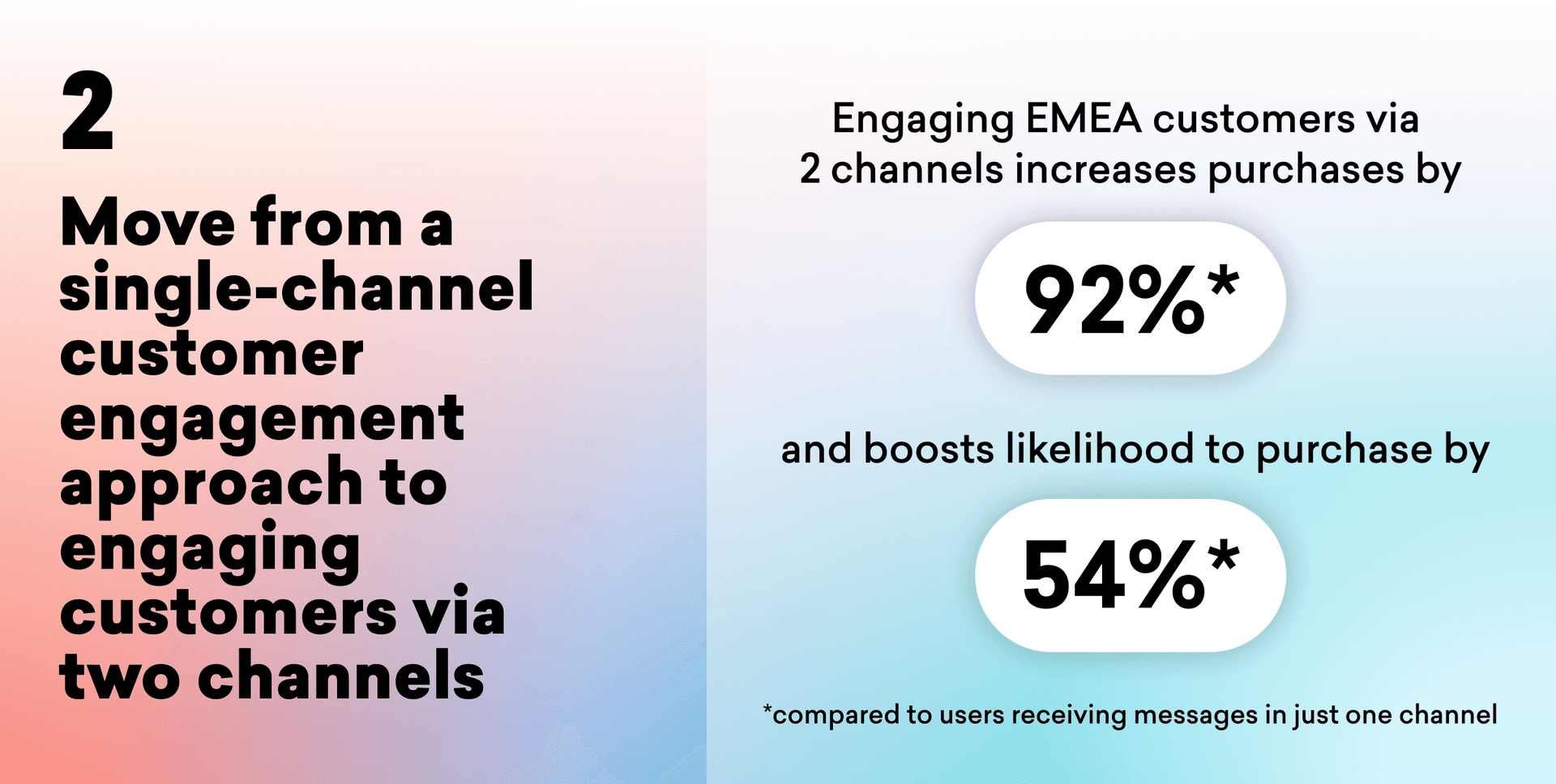

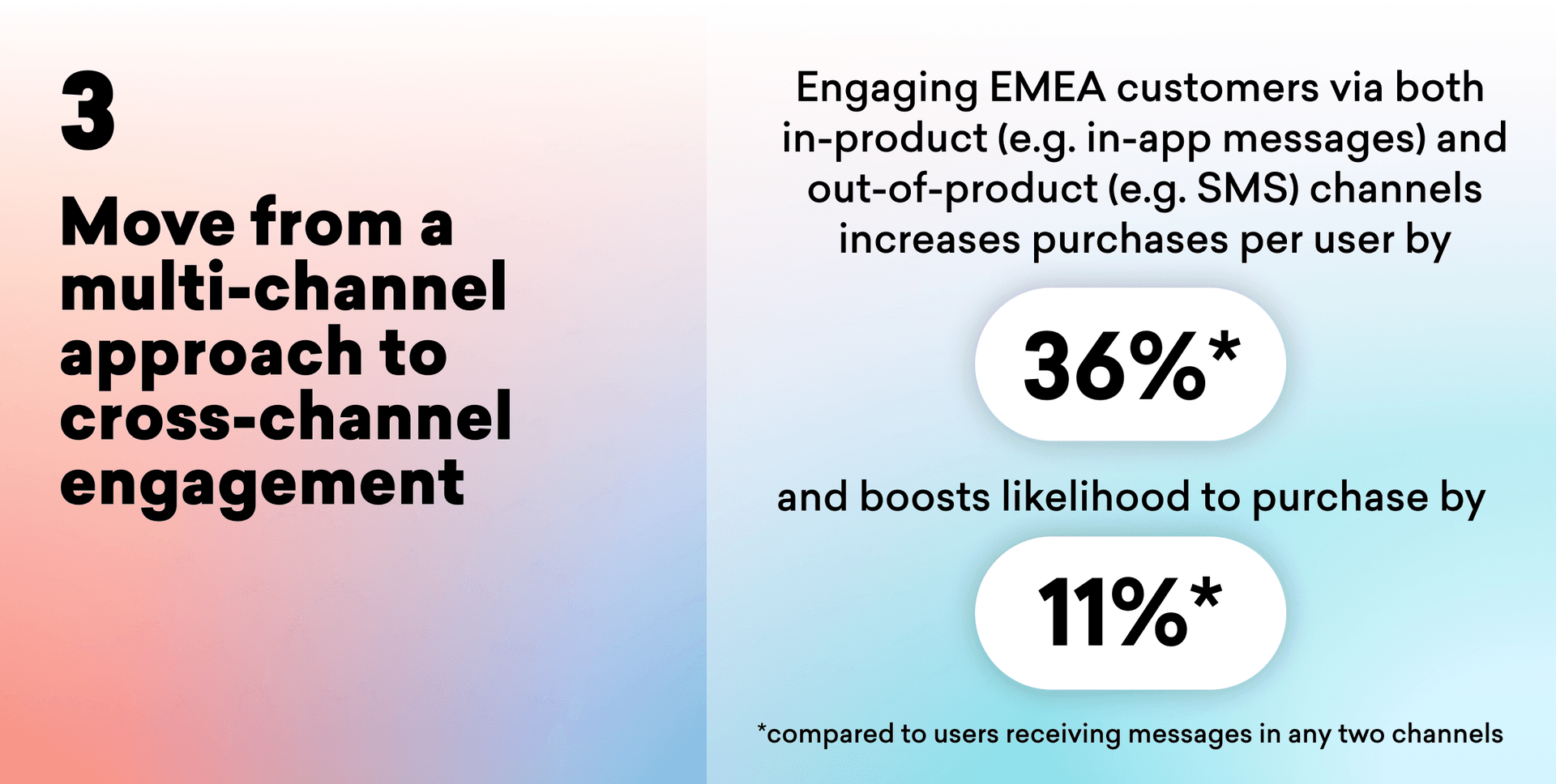

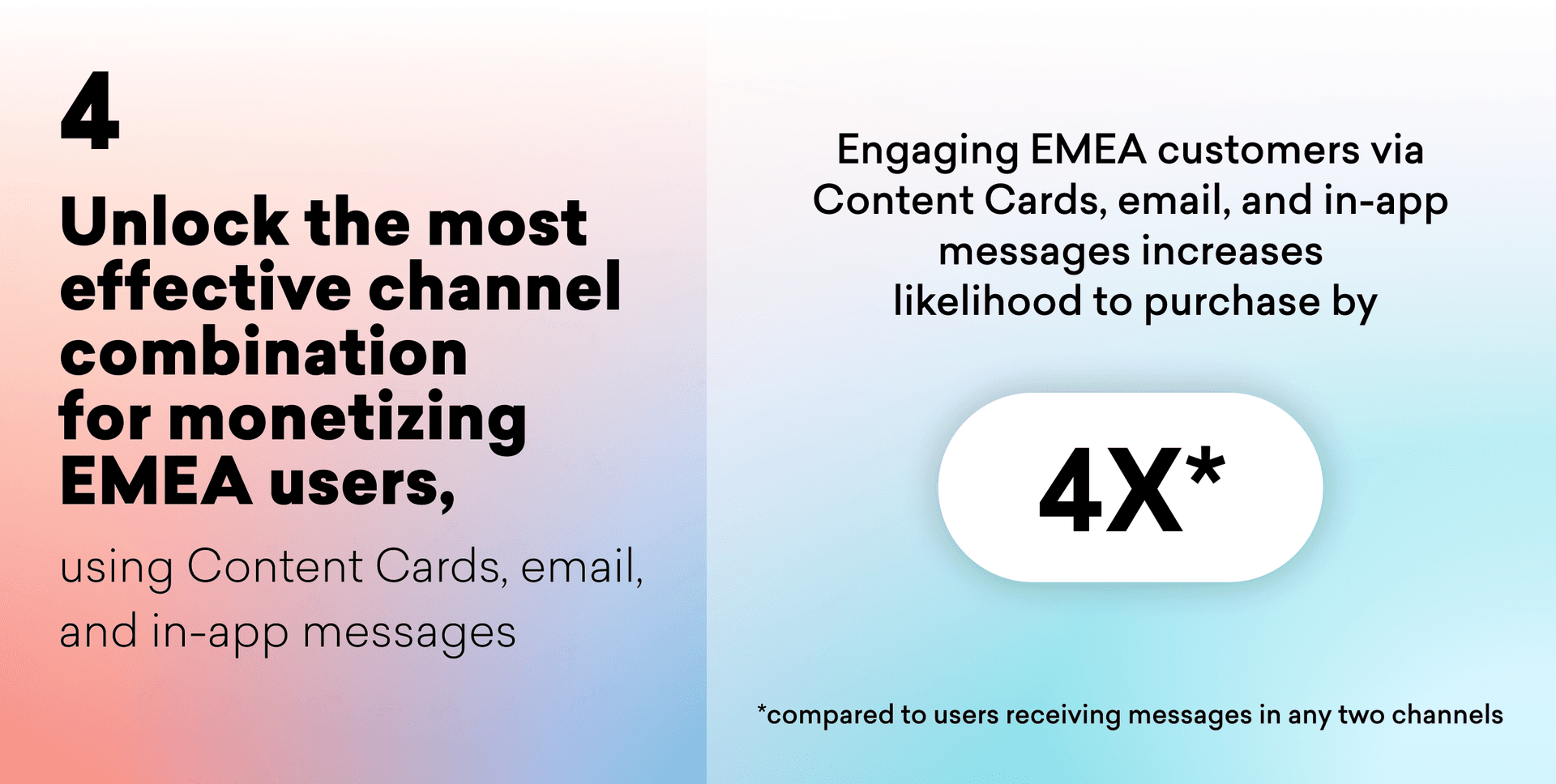

As part of our analysis, we took a look at the most effective ways to engage and retain EMEA customers, and identified these four customer engagement strategies that brands can put in place to encourage their customers to stick around longer.

EMEA and Customer Engagement Index Scores: Areas Where EMEA Brands Excel and Areas for Improvement

In 2021, we introduced The Braze Customer Engagement Index, offering brands across the globe a shared framework for measuring customer engagement. The Index includes a ranking system with three levels of maturity: Activate brands are those just getting started in customer engagement; Accelerate companies have notable for collaborating, experimenting, and employing data-driven strategies; and Ace organizations are at the top of their field for utilizing streaming data to power full-fledged lifecycle-driven customer engagement approaches.

While some EMEA companies rose to the level of Ace (19%), most fell within Accelerate (55%), and a good portion remained at the entry level Activate stage (27%).

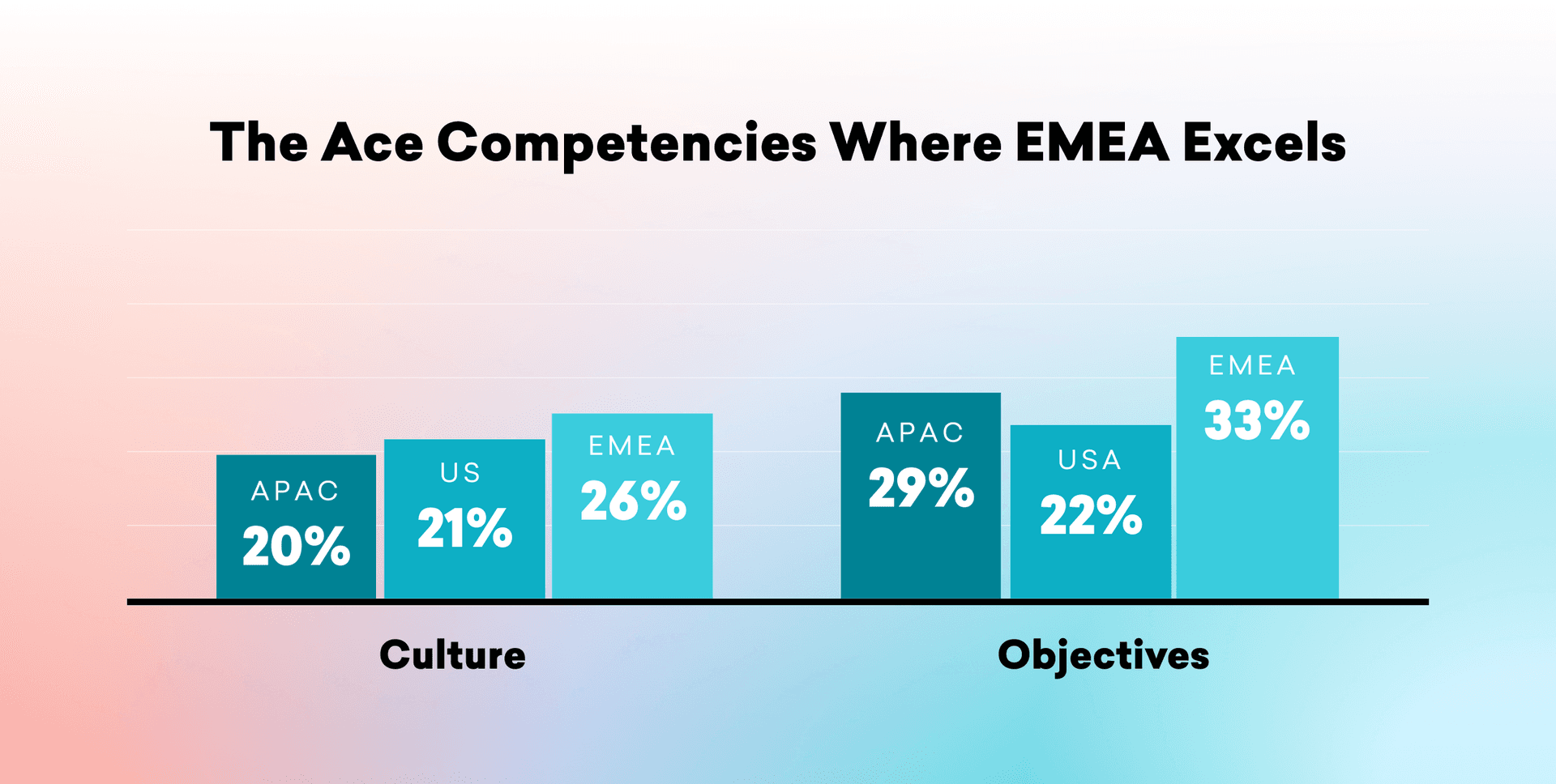

EMEA brands outperform US and APAC brands when it comes to having both a team culture and team objectives that foster customer engagement.

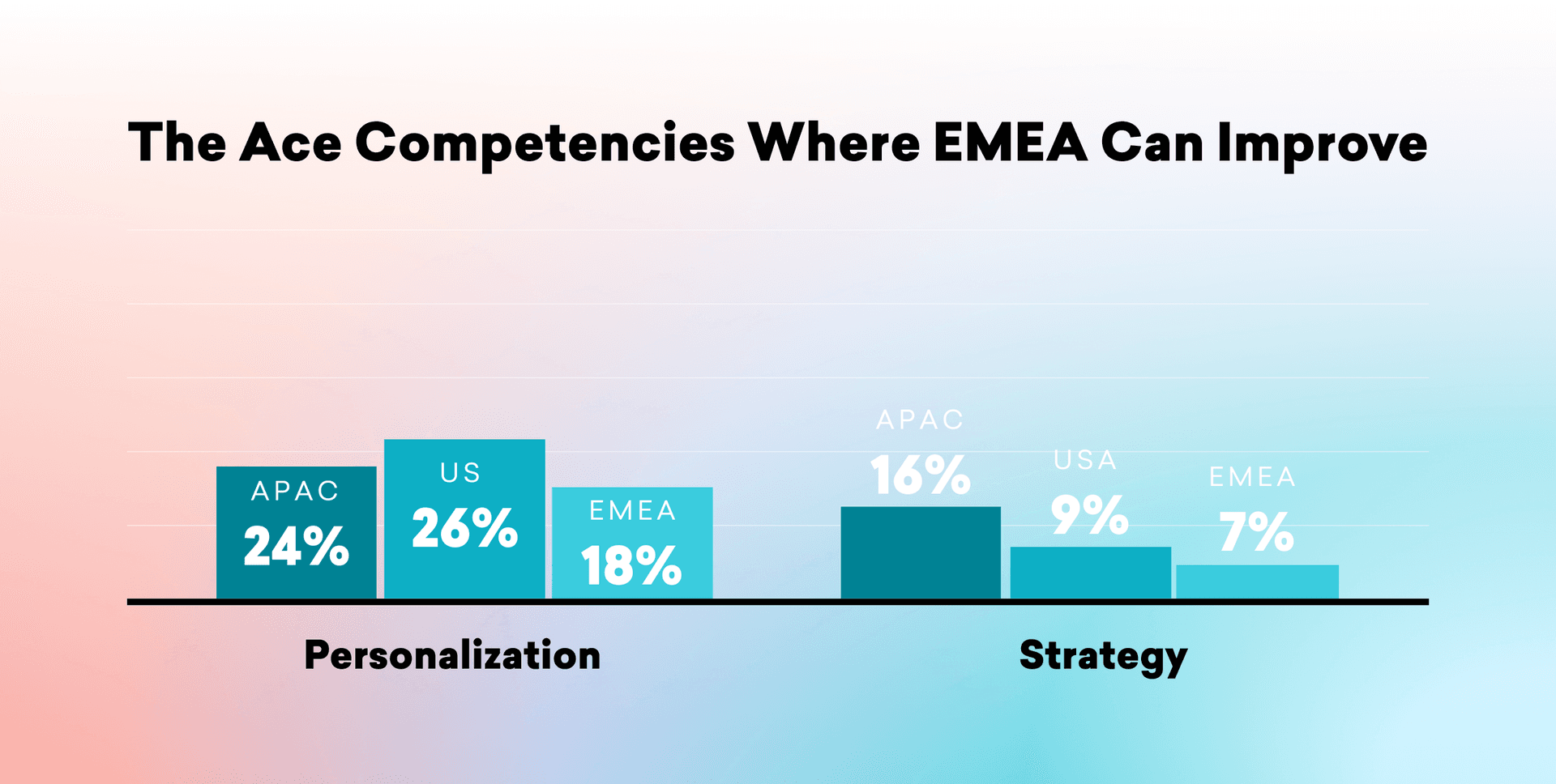

EMEA brands trail US and APAC brands when it comes to having the technology in place to enable personalization powered by real-time data. They also fall short when it comes to having strategies that ladder up to specific customer engagement goals and align with border product and company strategies.

About the Study and the EMEA Countries Represented

The findings covered here are the result of our broader second-annual Global Customer Engagement Review, an analysis that draws insights from the following key data sources:

- Marketing decision-maker market research commissioned by Braze and conducted by Wakefield Research: We gathered insights from 1,500 marketing executives (all vice presidents or higher) from B2C companies with an annual revenue of $10M across 14 global markets.

- Braze customer data: Our research includes data aggregated from over 5.4 billion global users from our leading customer engagement platform that powers experiences between consumers and 1,000+ brands in 50+ countries.

- Braze customer interviews: For in-depth learnings, we spoke with top brands in five industries across three regions (including in EMEA).

Final Thoughts

For additional insights on the state of customer engagement in EMEA in 2022 and how trends in this region compare to the rest of the world, get your copy of the complete 2022 Global Customer Engagement Review.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

View the Blog

How behavioral marketing turns data into personalized experiences

Team Braze

What are contextual bandits? The AI behind smarter, real-time personalization

Team Braze

What is a multi-armed bandit? Smarter experimentation for real-time marketing