The State of Customer Engagement for Retail and eCommerce Brands in 2023

Published on May 03, 2023/Last edited on May 03, 2023/6 min read

Team Braze

Now in its third year, the 2023 Global Customer Engagement Review showcases the latest insights regarding how marketers are evolving their customer engagement strategies to adapt to the current economic climate, top areas of concern for brands in the year ahead, and the strategies that savvy organizations are using to drive customer engagement, monetization, and retention. Here are the key takeaways from this year’s analysis specifically for retail and eCommerce brands.

Amid Economic Uncertainty, Consumer Behavior Continues to Evolve and Marketers Are Under Pressure to Deliver ROI

In today’s climate, consumers are cutting back on extras and buying journeys are growing even more complex as shoppers look for savings. That's a complication for retail and eCommerce marketers as they face resource constraints and increasing expectations to drive results. However, marketing teams are making headway by prioritizing retention and loyalty and leveraging customer engagement strategies to cut through the noise.

Top Strategies for Improving Customer Engagement for Retail and eCommerce Brands in 2023

Braze researchers studied Braze customer engagement data for billions of consumer profiles associated with 775+ businesses based in the US, APAC, and EMEA, digging into factors that drive app activity, message engagement, and purchasing behavior. Based on this analysis, here are five tactics we found that help retail and eCommerce brands deliver gains in terms of customer engagement, monetization, and retention.

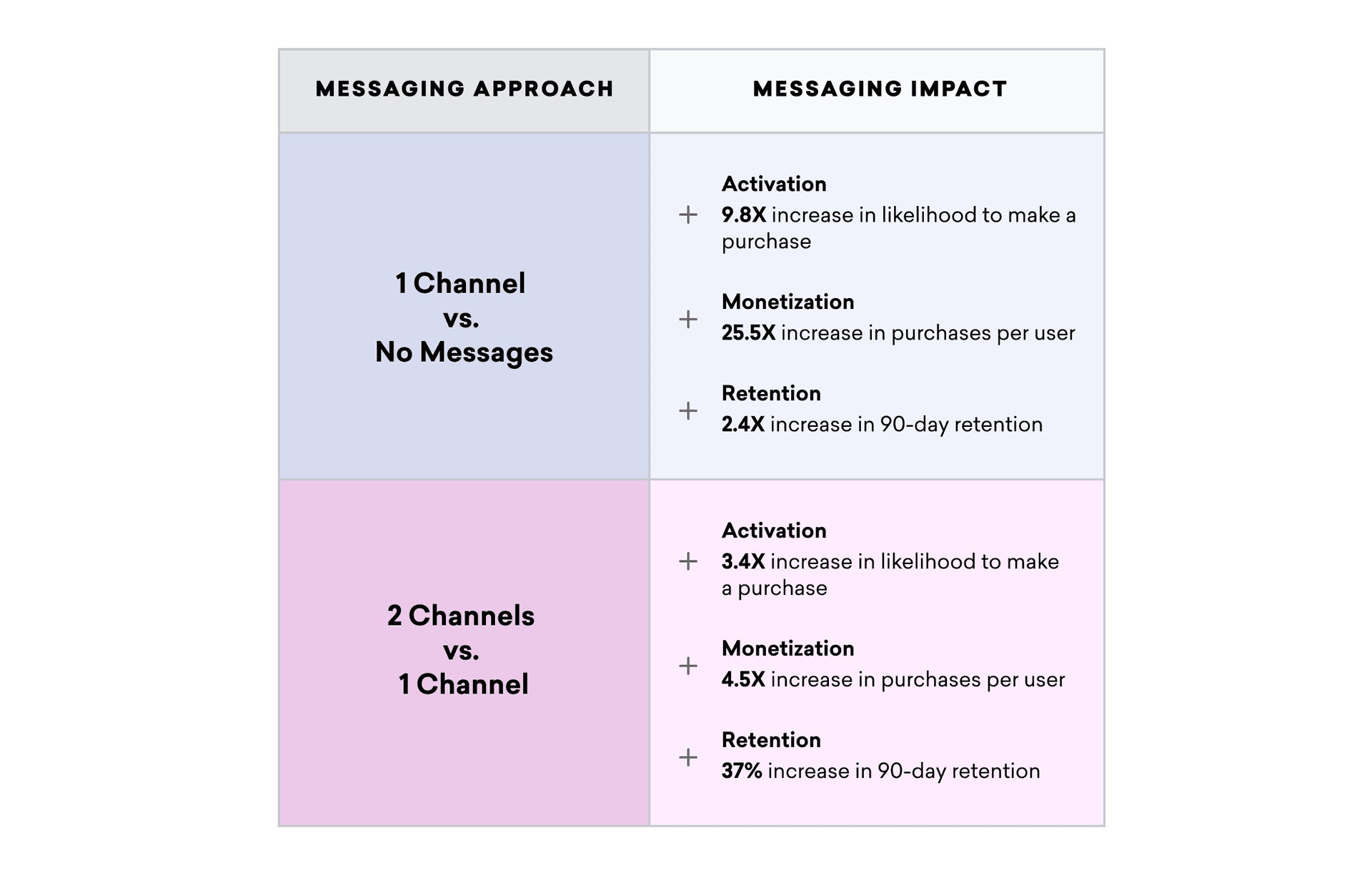

#1: Leveraging cross-channel customer engagement

Using just one channel (e.g.in-app messaging, email marketing) to keep in touch with shoppers between purchases can help brands increase purchase likelihood, purchases per user, and retention. For even more impact, adding in a second channel enables marketers to achieve 3.4X gains in purchase likelihood, 4.5X gains in purchases per user, and a 37% uplift in 90-day retention.

#2: Utilizing the right channels

According to the 2023 Customer Engagement Review, retail and eCommerce brands deliver maximum results when:

- Sending email marketing campaigns, which can boost likelihood to purchase by 38X, vs. sending no messages at all

- Sending email and in-app messaging campaigns in tandem, which can boost likelihood to purchase by 3.1X vs. sending messages via just one channel

#3: Using real-time data to power segmentation, targeting, and analytics

Top-performing retail and eCommerce brands (which we refer to as “Ace” brands) are 6% more likely to use a real-time data streaming solution like Braze Currents to support effective segmentation, targeting, and analytics. This approach helps them generate greater marketing results compared to non-Ace retail and eCommerce brands, according to the 2023 Customer Engagement Review.

We conducted this study using The Braze Customer Engagement Index, a proprietary framework designed to evaluate customer engagement maturity based on the use of core customer engagement competencies.

While “Activate” brands are just beginning to integrate customer engagement practices into their business and “Accelerate” brands have more established customer engagement programs but aren’t yet achieving a comprehensive customer view, “Ace” are customer engagement leaders.

Based on our findings, Ace retail and eCommerce have a:

- +21% higher buyer rate than non-Ace brands

- +27% higher repeat buyer rate than non-Ace brands

#4: Automating campaign optimization leveraging data-based insights

Ace brands are 59% more likely to leverage technologies like the Braze Intelligence Suite to automate campaign optimization with data-based insights. Retail and eCommerce brands are more likely to use send-time optimization to deploy marketing messages to individual users at the time each customer is most likely to engage, compared with other industries.

#5: Pulling in customer data to personalize marketing campaigns

Ace brands are 9% more likely to use the marketing personalization tactic of pulling in information from customers’ user profiles to tailor marketing campaigns at the individual level. Retail and eCommerce have the highest Ace ranking of any industry (18% vs. 13% on average for all other sectors) when it comes to the usage of data to personalize messages.

Critical Priorities for Customer Engagement for Retail and eCommerce Brands in 2023

As part of a Braze-commissioned Wakefield Research survey of 1,500 VP+ marketing decision-makers across 14 global markets, we asked retail and eCommerce brand leaders about their outlook on customer engagement for the year ahead and here’s what they told us.

#1: The most important measures of customer engagement success are customer lifetime value (#1 choice among survey takers); enrollment, subscriptions, and message opt-ins (#2 choice); and customer retention (#3 choice).

#2: Brands in the industry are struggling with orchestrating cross-channel marketing campaigns. While 30% of companies report sending messaging campaigns via multiple channels, most are managed through channel-specific solutions instead of utilizing a true cross-channel customer engagement platform. That approach can make it more difficult to swiftly and effectively deliver cohesive experiences across channels.

The Top Three Customer Engagement Trends for 2023

This year, three major customer engagement trends are at play, shaping brands’ marketing approaches across industries as well as across the world. To find out what these critical driving forces are, get your copy of the complete 2023 Global Customer Engagement Review.

Methodology

For the analysis included in the 2023 Customer Engagement Review, Braze pulled anonymized and aggregated behavioral data from 775+ Braze customers across our US, APAC, and EU clusters to analyze app activity, message engagement, and purchasing trends by industry. These statistics span January 1, 2022 to December 31, 2022 and include data from over 200 brands, 2+ billion users and 8 sub-industries. Of this data, over 200 Braze customers, over 2 billion users and 8 sub-industries were deemed Retail and eCommerce Brands for purposes of the discussion included herein. The raw data has been cleaned using volume and company count checks so that no one brand or group of brands is over-represented. For all purchase- and messaging-related stats, only brands tracking the relevant information have been included so as not to skew the analysis. All uplift figures greater than 100% are rounded to the nearest decimal point, and all uplift figures below 100% are rounded to the nearest whole percent. When comparing two rounded numbers, percent change metrics are calculated as the difference between the two numbers after rounding.

The Braze Ace Technology, Teams, and Business Impact metrics were measured by selecting the top 50th percentile of Braze customers compared to the full data set (and within a given industry in the report’s industry-specific sections) in terms of likelihood of a user making a purchase, likelihood of a buyer making a repeat purchase, average sessions per user, average

user lifetime, and message engagement for the period of January 1, 2022 to December 31, 2022.

The Braze Ace Technology, Teams, and Business Impact metrics for Retail and eCommerce Brands were measured by selecting the top 50th percentile of Braze customers compared to the full data set of Retail and eCommerce Brands based on buyer rate, repeat buyer rate, and message engagement rate for the period of January 1, 2022 to December 31, 2022.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

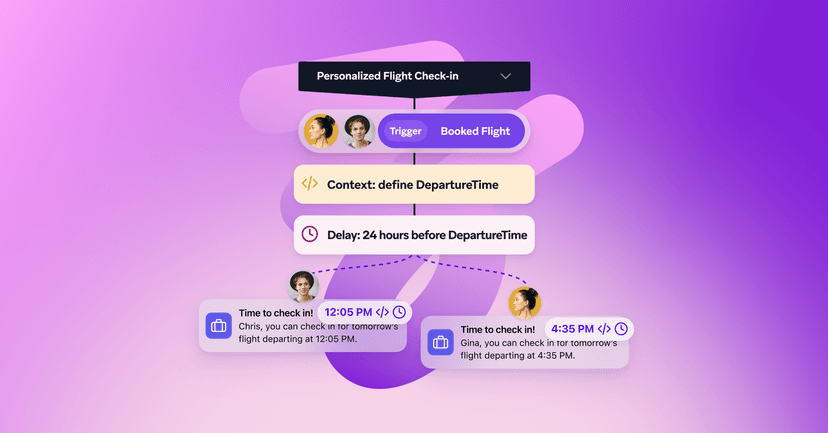

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026