Mold your messaging: How top-performing marketers across the world drive emotional connection

Published on May 28, 2025/Last edited on May 28, 2025/7 min read

Team Braze

BrazeMeaningful customer engagement is about more than just perfecting your messaging. It’s about choosing the right channels, content, timing, and tools to build an emotional connection with your customers.

Our research with 2,300 marketing leaders across 18 countries shows that high-performing brands don’t treat content and technology as separate levers. They’re using them in tandem to create and automate personalized connections at scale. While the global picture almost universally points to the growing importance of messaging apps and personalization, there are key regional differences, representing differing levels of marketing maturity, platform diversity, and infrastructure.

So, where does your business fit globally and regionally? Are your tactics tip-top or trailing the pack? Let’s start by looking at the preferred channels for marketers in 2025.

Messaging apps are the new email for most marketers

For years, email has been unchallenged as the champion of marketing channels, offering rich content and lots of real estate. However, its dominance has levelled out in the past decade, widening the channel playing field for especially younger demographics.

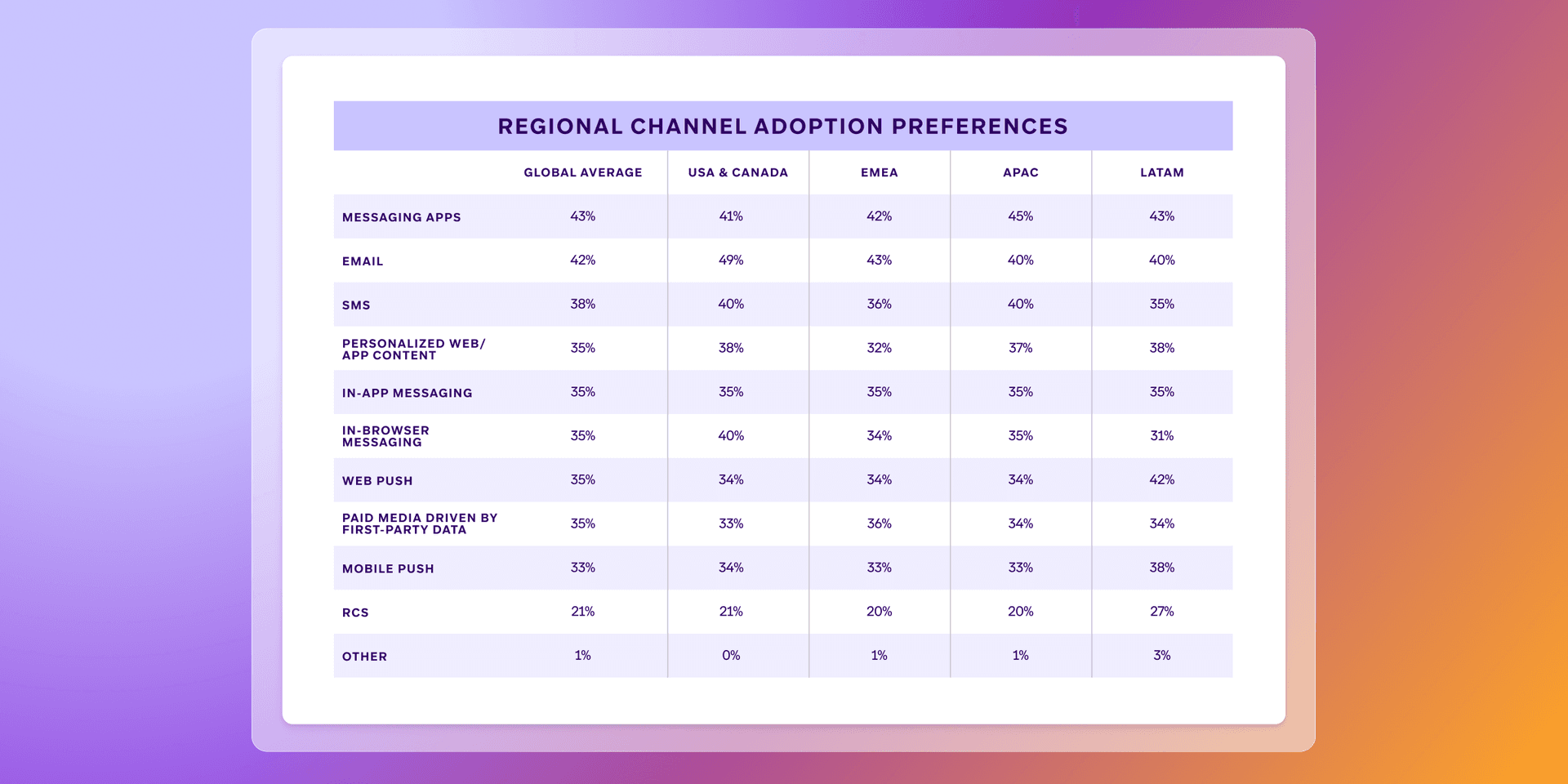

Messaging apps like WhatsApp, LINE, and KakaoTalk are the most popular marketing channels in 2025, with 43% of global marketers intending to use them in the next twelve months compared to 42% for email. It is a small shift that we can expect to see grow in the coming years, as the market moves towards more direct, mobile-first communication.

Only North America bucks the trend, with 49% of marketers intending to utilize email. This is notably higher than the global average of 42%, as is the region’s use of in-browser messaging and personalized web and app content. This could be a reflection of the region’s mature digital landscape, characterized by cross-device usage and a well-established culture of inbox-based marketing. Messaging app adoption lags slightly in this region, while SMS rides a little higher than average, due to differences in consumer preferences by region between the likes of WhatsApp and pre-installed messaging apps (Apple and Google Messages).

The EMEA region maps closely to global averages, showing a slight preference for messaging apps above email in the next 12 months. A slightly lower use of personalized web or app content in this diverse region could suggest several things. In more mature areas, privacy concerns could curb marketers’ personalization goals (supported by the EMEA’s higher-than-average concern with user data consent, which stands at 45% to the global 43%). While less mature areas may currently lack the technology to execute personalized campaigns.

The Asia-Pacific region stands out for high messaging app usage and lower reliance on email, which aligns with mobile-first consumer behavior, as does Brazil and Mexico. However, the LATAM region shows much higher adoption of RCS (Rich Communication Services) than the global average (27% to 21%), which is largely because they’re familiar with the rich benefits.

RCS is essentially the evolution of SMS and MMS, offering the ubiquity of SMS combined with highly engaging, interactive messaging similar to WhatsApp. Marketers no longer need to choose between reach and richness; RCS supports messages enhanced with videos and interactive elements from any mobile device. Now supported on both Android and iOS, RCS is set to become the default messaging protocol on mobile. This makes it an attractive option for marketers looking for the immediacy of direct messaging without the fragmentation of using multiple different proprietary apps.

True cross-channel messaging thrives in a unified platform

Of course, these channels aren’t typically used in isolation. Only 18% of surveyed global marketers said they relied on a single customer communication channel. Cross-channel marketing is the norm for most businesses, with top-performing brands 16% more likely to use 3+ channels. This cross-channel approach means that message delivery is only part of the equation. The tech and tools marketers use to create and orchestrate their customer journeys are equally important.

You’d think more sophisticated frontend strategies would mean smarter tech choices behind the scenes. But, counterintuitively, as cross-channel marketing approaches mature, brands have increased their reliance on multiple point solutions to cover individual channel needs.

The use of disconnected point solutions to manage separate channels individually has grown in the past five years, from 26% to 32% of marketers. This is a retrograde step, as 39% of brands that missed their revenue goals last year used this systemically siloed approach. However, 50% of marketers are using a unified cross-channel engagement platform.

As cross-channel adoption increases, more brands need to rethink their approach by consolidating and unifying their channels on a single platform in order to drive more cohesive customer experiences while increasing revenue and alignment.

Marketing leaders worry their messaging misses the mark

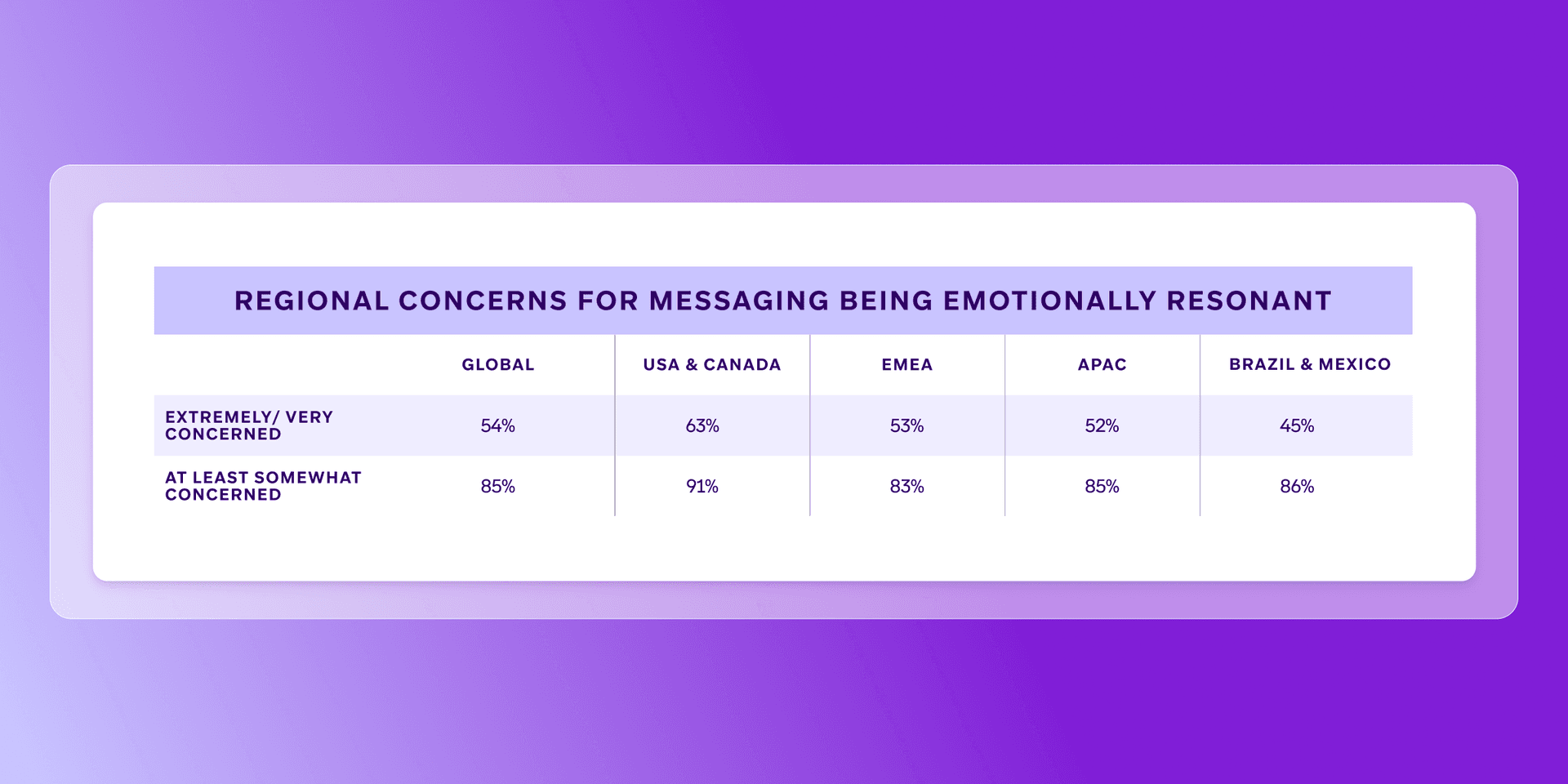

Our research found that 54% of marketers and 20% of top executives are ‘extremely or very concerned’ about the emotional resonance of their customer messaging. But that’s not a bad thing.

60% of brands and leaders that exceeded their revenue goals were also very concerned about emotional connection. This suggests that emotional resonance delivers better messaging, higher engagement, and stronger returns. This knowledge can drive strategy and tactics for brands that trail the global average.

North America is the most concerned with emotional resonance, with 63% of marketers extremely or very concerned. At the other end of the scale, LATAM is least concerned at 45%. This could suggest different marketing maturity stages, with more advanced brands optimizing existing strategies to increase connection, while less mature brands implement more foundational tactics such as price or product-based strategies.

EMEA and APAC track closely to the global average at 53% and 52%, respectively, which may suggest a balanced approach to emotional resonance and other levers, or simply different maturity levels within these diverse regions.

High-performers build better connections through content and tech

To optimize their relationship with customers, top-performing brands use a mix of technology and content-driven strategies to increase relevance and resonance, as evidenced by this year-end campaign from Dutch Bros.

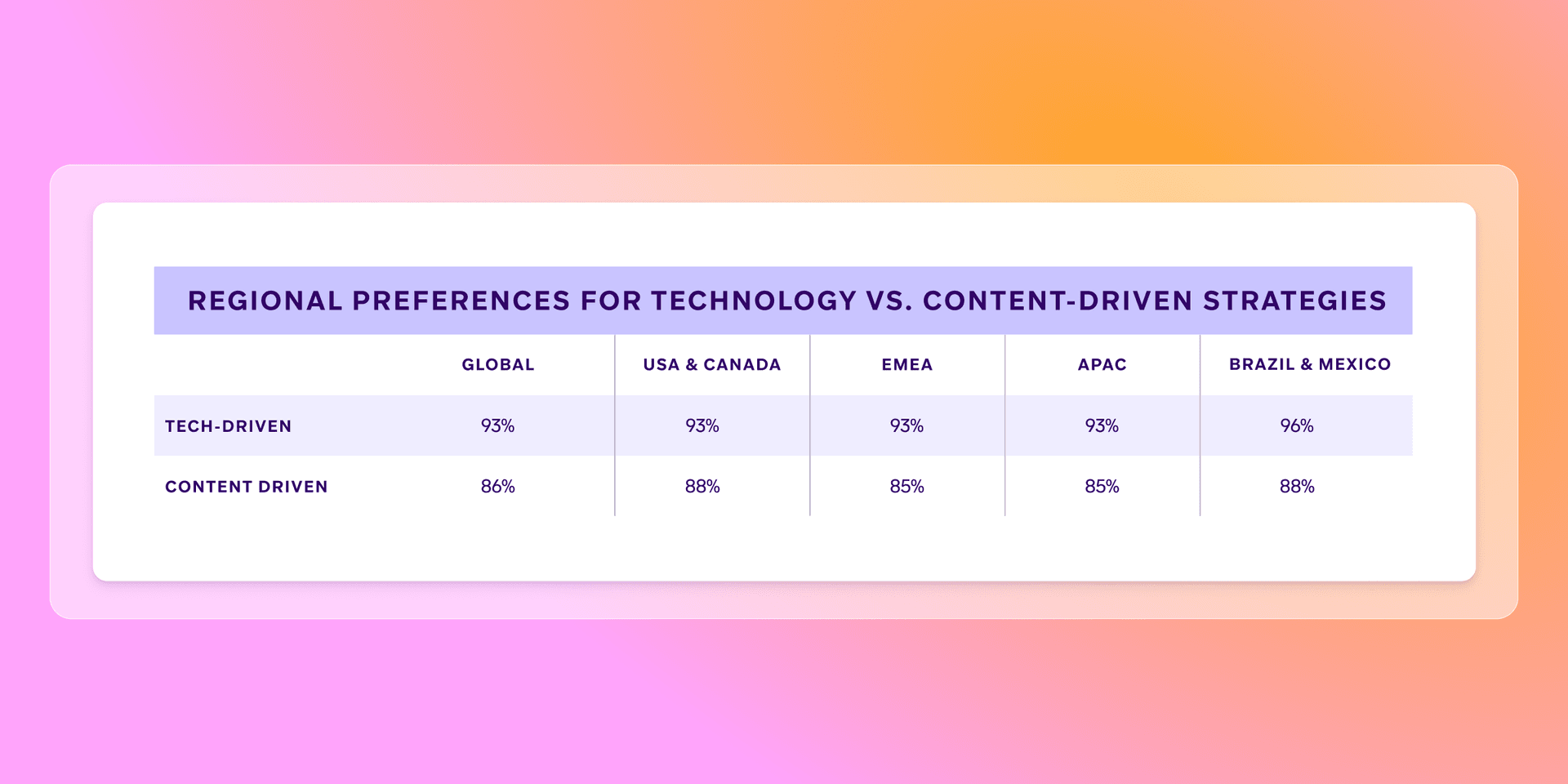

Worldwide, the balance is slightly in favor of tech, with 93% of brands using advances like AI and automation to boost engagement, compared to 86% using content. Regionally, LATAM brands lead the way, leveraging both approaches more often than global comparators.

While there’s not much variation between the overarching approach to increasing the relevance and emotional resonance of their messages, there are regional differences in the tactics used.

For example, along with pop culture references, LATAM is considerably more concerned with capitalizing on time-sensitivity, such as countdown timers and send-time optimization. This is also reflected in their use of more outbound, disruptive channels like push notifications. However, North America lags in this area, leading instead with social proof and community-focused messaging.

Preferred tactics in EMEA include using humor and cultural references, and celebrating customer milestones, to connect emotionally. Whereas APAC leans more heavily into tech-drivers such as personalizing messages based on customer data and using AI tone adjustments, as well as visual content and a community focus.

Final thoughts

Reflecting on our regional data, it’s clear that most marketers are leaning into new technologies to increase engagement and emotional resonance—whether that’s LATAM brands leading the way with RCS, or APAC leveraging customer data to personalize messaging. However, behind the scenes, legacy and siloed tools pose a threat to marketers’ cross-channel goals.

Our highest performing brands show that when content and technology work together, they can unlock unrivalled engagement and revenue. In an ever-challenging but always-ambitious landscape, brands that embrace tech enablers and phase out tech inhibitors will thrive.

Download the Braze 2025 Global Customer Engagement Review for more insights and inspiration.

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article5 min read

Article5 min readRamadan revelations: Mastering customer engagement in the GCC with AI

March 06, 2026 Article4 min read

Article4 min readBuilding spaces for connection: Inside our Bucharest office

March 05, 2026 Article7 min read

Article7 min readData agility at a massive scale: How the Braze Data Platform supports customer engagement

March 04, 2026