Beyond Paid Acquisition: Driving Growth for Digital Payments in APAC

Published on January 26, 2021/Last edited on January 26, 2021/6 min read

Yi En Chye

Senior Strategic Business Consultant, Industry Solutions, BrazeDigital payment adoption in Asia is unparalleled, with digital wallets surpassing cash at point-of-sale and accounting for 58% of ecommerce transactions in the region. And despite this market penetration, there’s no sign that this space is slowing down—in fact, capital invested in the payments technology sector hit a new record in 2019, and five of the top-funded startups are either paytech brands or active in the payments sector.

For many APAC consumer mobile payments startups, this highly-competitive landscape has led them to embrace pay-to-play solutions with the goal of aggressively acquiring customers in order to quickly capture market share. But while acquisition is essential to growth, we’re increasingly seeing that brands who leverage stand-alone efforts to “buy the customer” in consumer digital payments are struggling to gain true sustainable usage.

To better understand the challenges and opportunities for today’s payments brands, let’s take a look at the larger APAC digital payments space and how these companies can set themselves up for success over the long haul.

Where Things Stand for Digital Payments in APAC

The rise of financial technology (FinTech) brands in APAC has led to a surge in the number of apps in the region that are offering payments capabilities or other financial-related features, further intensifying the race to acquire new customers. Installs for finance apps in APAC have decreased 18% year over year (YoY) and these installs tend to be driven by non-organic campaigns: In fact, the average share of non-organic installs for a finance app in APAC increased to 65% in 2019. The upshot is that more marketing dollars are being poured into driving visibility in an increasingly crowded market. Worse, fraud is serving to further compound acquisition costs, with the average finance app install fraud rate ranging from 40% to 80% in 2019, leading to significant waste in many FinTech marketing budgets.

Acquisition costs are also being driven up by incentivisation, often in the form of price cuts or other aggressive promotional offers. While this approach may be necessary to kickstart users to form usage habits, an overreliance on these incentives can lead to a decline if business yields if overused and eventually become unsustainable. That, in turn, can mean that more work is needed to retain customers and minimize churn, and can lead to added pressure on marketers to convince customers to increase usage frequency and the size of purchases.

The key to escaping this cycle? The most successful APAC digital wallets today typically have at least one function that can entrench habitual usage by consumers—whether that’s chat or ride-sharing or something similarly sticky. These “super apps” tend to use multiple partnerships to build on their core competency and meet as many daily behaviors as possible, from delivery services and online groceries to utility bill payments and even credit scoring for financial services. Competing with these highly-engaging, multifaceted platforms can be a challenge for smaller brands, but it’s also possible to learn an important lesson from their example—namely, the importance of encouraging ongoing engagement in order to drive stronger retention and long-term value.

How APAC FinTech Brands Can Succeed in a Challenging Landscape

While increasing your marketing budget to quickly build a user base is a tried and true way to grow your business, the fact is that the point of diminishing returns with this strategy often happens earlier than you expect. To overcome this challenge, it’s important to build an acquisition ecosystem where consumers are at the heart of your strategy and to develop ways to invite or organically attract new users into your world.

What does that look like in practice? Be present where your consumers are in their daily lives. Identify the moments that are relevant to your specific product or service within their day and use those insights to create contextually relevant messages for each communication channel you’re leveraging. By ensuring that you’re targeting users based on their actual behavior and preferences and doing so in the platforms or channels they’re active on allow for more effective relationship-building than conventional targeting and prevents one-size-fits-all messaging.

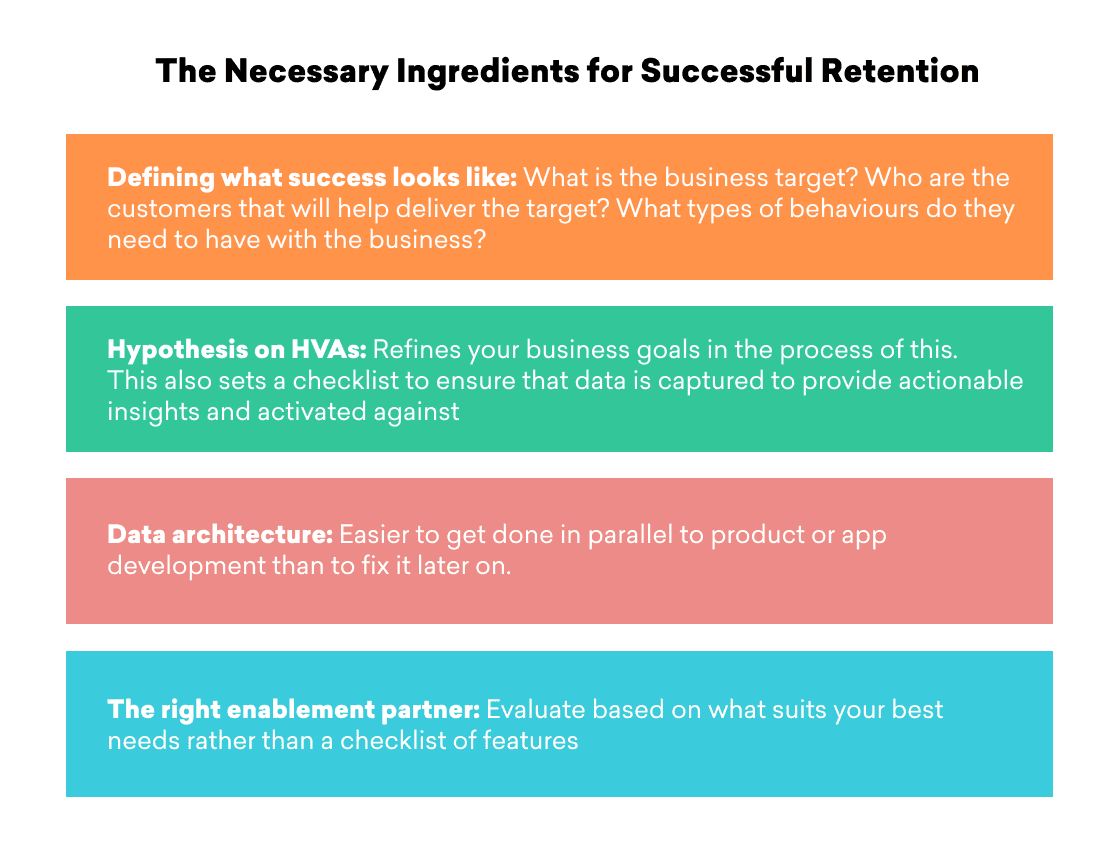

Another fallacy to avoid is the belief that your customer retention efforts can wait until you’ve reached a critical mass of users. In fact, prioritizing effective retention marketing strategies up front can make it easier to build a sustainable audience by allowing you to hold a larger and larger share of the users you acquire. Ideally, you should be cultivating customer behaviors associated with retention in parallel with your acquisition strategy, allowing experimentation with lower risk and establishing a good runway for future success.

Embracing the Acquisition Loop Approach to Customer Engagement

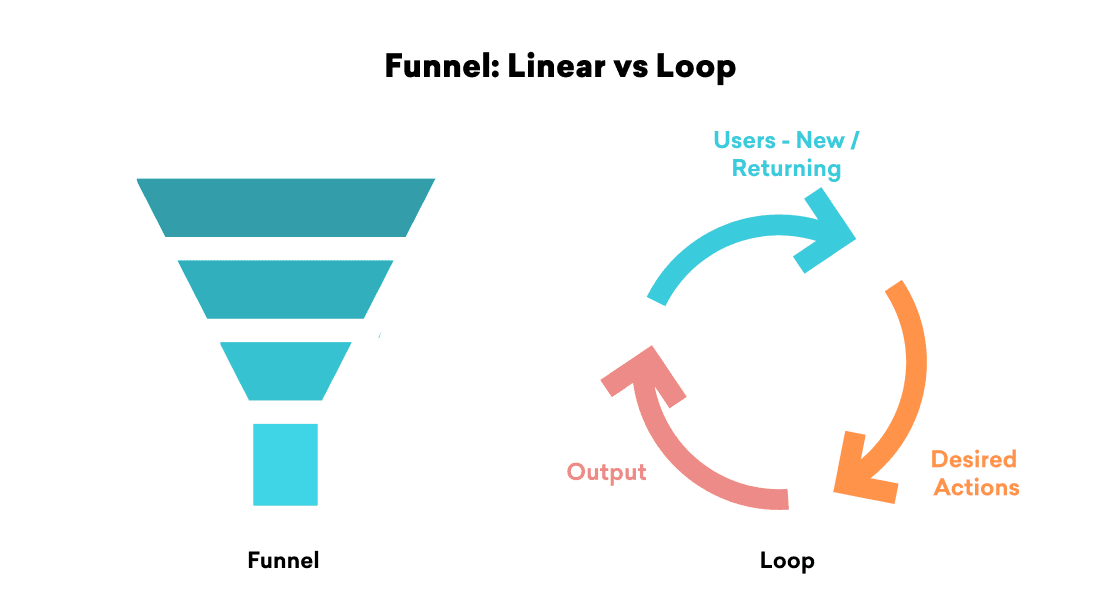

If your only way to acquire new customers is through costly pay-for-play strategies, the scale of your growth is tightly constrained by the budget at your band’s disposal. In APAC’s highly competitive digital payments space, that can put your company at the mercy of larger, better-capitalized competitors and make it difficult to achieve long-term success. But while paid acquisition will likely always be part of your marketing efforts, it isn’t the only way to grow your customer base.

Consider acquisition loops. An acquisition loop is a system where new users’ actions in connection with your brand’s product serve to bring in additional waves of users. Think of the refer-a-friend discount strategy widely used in the ride-sharing space or the way that many social networks automatically nudge new users to invite their friends to join them.

With an acquisition loop approach, your marketing isn’t a standalone funnel, but rather something that can operate within or alongside the product itself, removing functional silos and streamlining the process of encouraging customers to evangelize your brand. Done right, an acquisition loop can drive sustainability and efficiency by ensuring that your marketing costs don’t grow at the same exponential rate as your business targets. Plus, these loops are usually far harder for your competition to copy—since they’re highly integrated into your product experience—while individual campaigns and tactics may be more easily replicated by rival brands, reducing their impact on your efforts over time.

Final Thoughts

Prioritizing acquisition loops and ongoing retention marketing programs can be a challenge for marketers, but, when done right, it’s also a major opportunity. By focusing on building a cohesive user experience at every step of the customer journey, APAC FinTech brands can stand out in a crowded market place and set themselves up for sustainable, long-term success.

To more effectively understand how your customer engagement efforts are faring and how you can uncover opportunities to improve your marketing outcomes, check out the Braze Measurement Guide.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

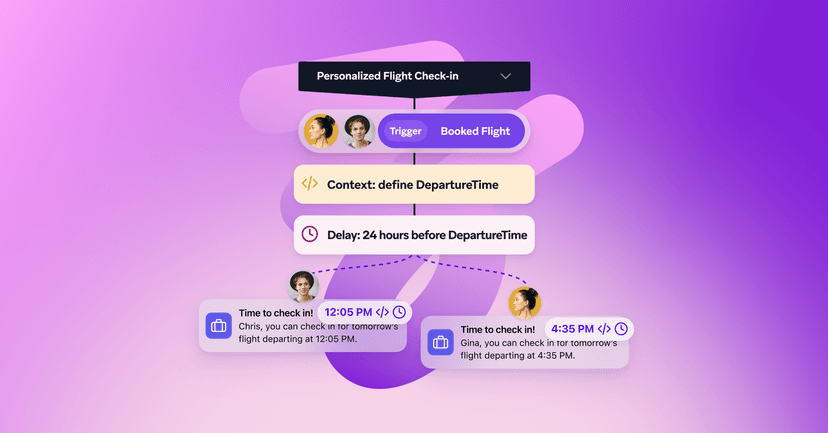

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026