Why Customer Messaging Matters for Financial Services

Published on July 21, 2020/Last edited on March 21, 2025/6 min read

Erin Bankaitis

Director, Strategic Consulting for Financial ServicesBanking products and services, once housed in pantheon-like buildings evoking trust and security, have a new look and feel today. But while the physical spaces have changed—with the center of business activity moving away from bank branches to apps, chat windows on websites, and knowledge bases for individual research—the importance of trust and security has not.

Privacy and responsible data handling are even more front and center today. Customers across generations are banking on the go and engaging across multiple devices, and they expect financial institutions to safeguard their most sensitive information while also delivering a great experience across touchpoints. It’s up to financial services brands to drive stronger, enduring customer relationships using different channels and approaches. Here’s what these brands should keep in mind when it comes to using messaging to build trust across every interaction.

1. Know your customer—for real, in real time

“Know Your Customer,” also known as “KYC,” is a common term in the financial services space. But knowing your customer is just the start, especially given the speed of rising customer expectations. Financial brands already have rich data at their fingertips based on customer transactions: ATM withdrawals, recurring payments, retirement account distributions, annual tax filings, and more. By today’s standards, that information is just the start.

Financial services customers are inherently segmented already—the cohort that is “de-cumulating wealth” by tapping retirement savings and downsizing their homes, for example, is a very different audience than recent college graduates learning the value of starting young with a 401(k). When done right, banks and other financial brands can use life stage information and individual user data to better understand the subsets in their audiences, better segment that audience for each campaign, and shift messages based on how each customer responds to a given message.

For example, a bank could trigger a promotional in-app message targeted at users with a specific credit card who have spent X amount of time browsing new cards; the message could then be personalized based on what card the user spent the most time viewing. Really knowing your customers also requires brands to be honest with themselves about what isn’t working. If I ignore a credit card upsell email, a bank should use this information to determine the next best interaction. Hint: It’s not sending the same email one week later.

Banks need the right data infrastructure and a thoughtful data collection strategy in place in order to listen to customers’ preferences, understand and anticipate their needs, and act accordingly. Financial brands know that they have to step up to this challenge—but too often they end up settling for the insufficient status quo. That could mean ignoring departmental or data silos, continuing to rely on legacy marketing technologies that can’t support real-time streaming data, or continuing to build marketing strategies around hunches instead of true data insights.

2. Personalization drives trust—and all financial services companies can do more

Personalization isn’t just about a first-name greeting in an email subject line (anymore). It’s about demonstrating that you’re “listening” to that customer’s intent and preference—acting upon digital body language, as we outline throughout in our 2025 Customer Engagement Review. Fintech companies have disrupted the industry and done a better job in this area, but all financial services companies can be doing far more with the customer data they have. Traditional banks can step up their digital game by modernizing their tech stack with in-app message capabilities and behavior-based upsells, while up-and-coming fintech players can hit the right, sober tones when communicating on any channel about customers’ money and financial futures. The impact of targeted, personalized cross-channel campaigns is significant across verticals. For financial services brands, a head of household looking for an auto-loan might respond best to an email emphasizing safety, while a younger buyer might be more likely to engage with a push notification that highlights cars that feature better sound systems. If you send a generic, one-size-fits-all campaign via a single channel, you’re bound to alienate at least one of those groups.

Instead, banks and other financial brands should message their customers with relevant content and prompts based on what their behaviors and preferences suggest they care about, from financial tools and tips to education about how to holistically manage their finances. Rather than compulsively offering the “next best product” to consumers who may not be interested, these brands should offer the next best resource—even if that resource isn’t a product. Financial services customers often conduct research on their own, fiddling with retirement calculators and reading articles before taking any conversion actions. When done correctly, this type of messaging strategy earns customer trust and loyalty.

3. Prioritize message testing to change perceptions and drive value

You don’t know what you don’t know. The 2025 Braze Customer Engagement Review found that 32% of surveyed leaders skip testing their customer engagement efforts due to resource constraints—that finding was even more pronounced in financial services, where 41% of those leaders skip this step. This is especially risky in the highly personal, high-stakes world of personal finance.

Gamifying a savings account, for example, might sound silly to some. But if a customer is meaningfully engaged with the product, the approach is working—and there’s only one way to find out. Rewarding customers with badges for never missing a monthly deposit or sending celebratory in-app messages about increased interest rates promotes happy feelings but, most importantly, demonstrates the brand “listens” to customers and helps them reach their financial goals. If that’s not trust, I don’t know what is.

Conclusion

The modern financial services customer is complex, and legacy banks and fintechs alike must deliver a trustworthy, cross-channel digital experience to meet or exceed expectations. Trust is the operative word, and those serious, columned buildings aren’t the only way to start earning it from customers of all generations. A careful customer engagement strategy that demonstrates active listening and understanding when messaging customers is key.

For more insights on connecting with customers in financial services, download the Braze State of Customer Engagement in Financial Services report.

Forward-looking statements

This blog post contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding the performance of and expected benefits from Braze and its products. These forward-looking statements are based on the current assumptions, expectations and beliefs of Braze, and are subject to substantial risks, uncertainties and changes in circumstances that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Further information on potential factors that could affect Braze results are included in the Braze Quarterly Report on Form 10-Q for the fiscal quarter ended October 31, 2024, filed with the U.S. Securities and Exchange Commission on December 10, 2024, and the other public filings of Braze with the U.S. Securities and Exchange Commission. The forward-looking statements included in this blog post represent the views of Braze only as of the date of this blog post, and Braze assumes no obligation, and does not intend to update these forward-looking statements, except as required by law.

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

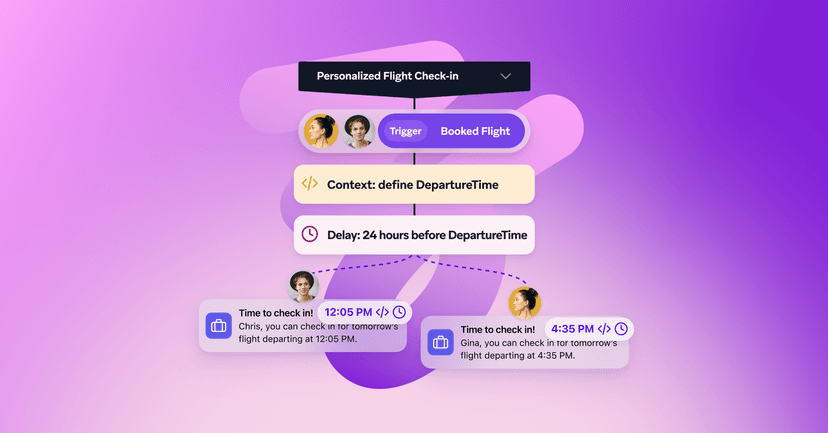

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026