The State of Customer Engagement in APAC in 2022

Published on February 09, 2022/Last edited on February 09, 2022/5 min read

Mary Kearl

WriterEach year, the Braze Global Customer Engagement Review (CER) offers insights into the latest developments in the customer engagement landscape, providing brands with a fuller picture of what marketing success looks like and guidance on how to achieve it. In the 2022 edition, we’ve identified three major trends we expect to see unfold over the next 12 months, and explore how brands can meet the moment with approaches designed to address continuously evolving consumer needs.

Based on this analysis, let’s take a look at the most important learnings we uncovered about the state of customer engagement in the Asia-Pacific (APAC) region in 2022, and how brands can advance their customer engagement strategy to drive loyalty and retention specifically with APAC customers.

The State of Customer Engagement in APAC in 2022: Key Takeaways

The past year has seen massive digital growth in the APAC region. Since the start of the COVID-19 pandemic, 60 million new individuals have become first-time internet users in Southeast Asia alone, with 20 million doing so in the first half of 2021.

For brands, this presents a huge opportunity to attract, acquire, and nurture the next generation of mobile-first consumers in the area. Building these new relationships and guiding customers from first-time users to brand loyalists will play a critical role in driving long-term, sustainable business success in this new era. That’s especially true given the rise of high acquisition costs and high competition in the region, powered by lots of brands with money to spend on advertising.

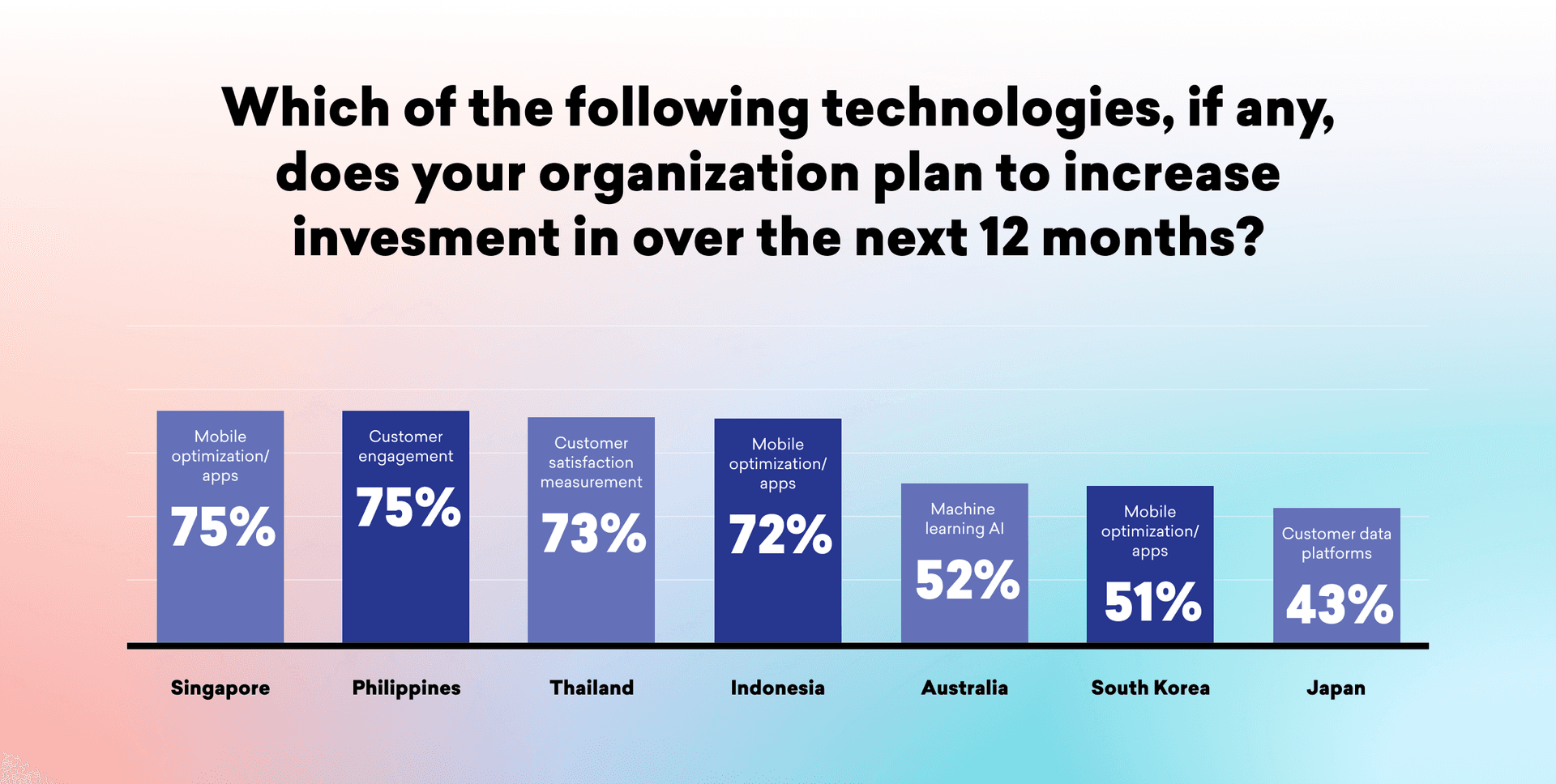

It’s not surprising to see that many APAC brands have started to recognize the importance of an effective customer engagement program when it comes to their bottom line. Accordingly, our research found that many brands in the region are planning to double down on customer engagement, mobile engagement, and data management in the year to come.

At the same time, we found that APAC brands on average tend to have the most mature customer engagement programs of any region. As part of our research, we asked marketing decision makers in APAC to self-review their customer engagement strategy and, based on their responses, sorted each respondent based on their customer engagement maturity. The top category, “Ace,” reflects a top-performing brand with a lifecycle-centric customer engagement strategy managed by a cross-functional team and powered by streaming data.

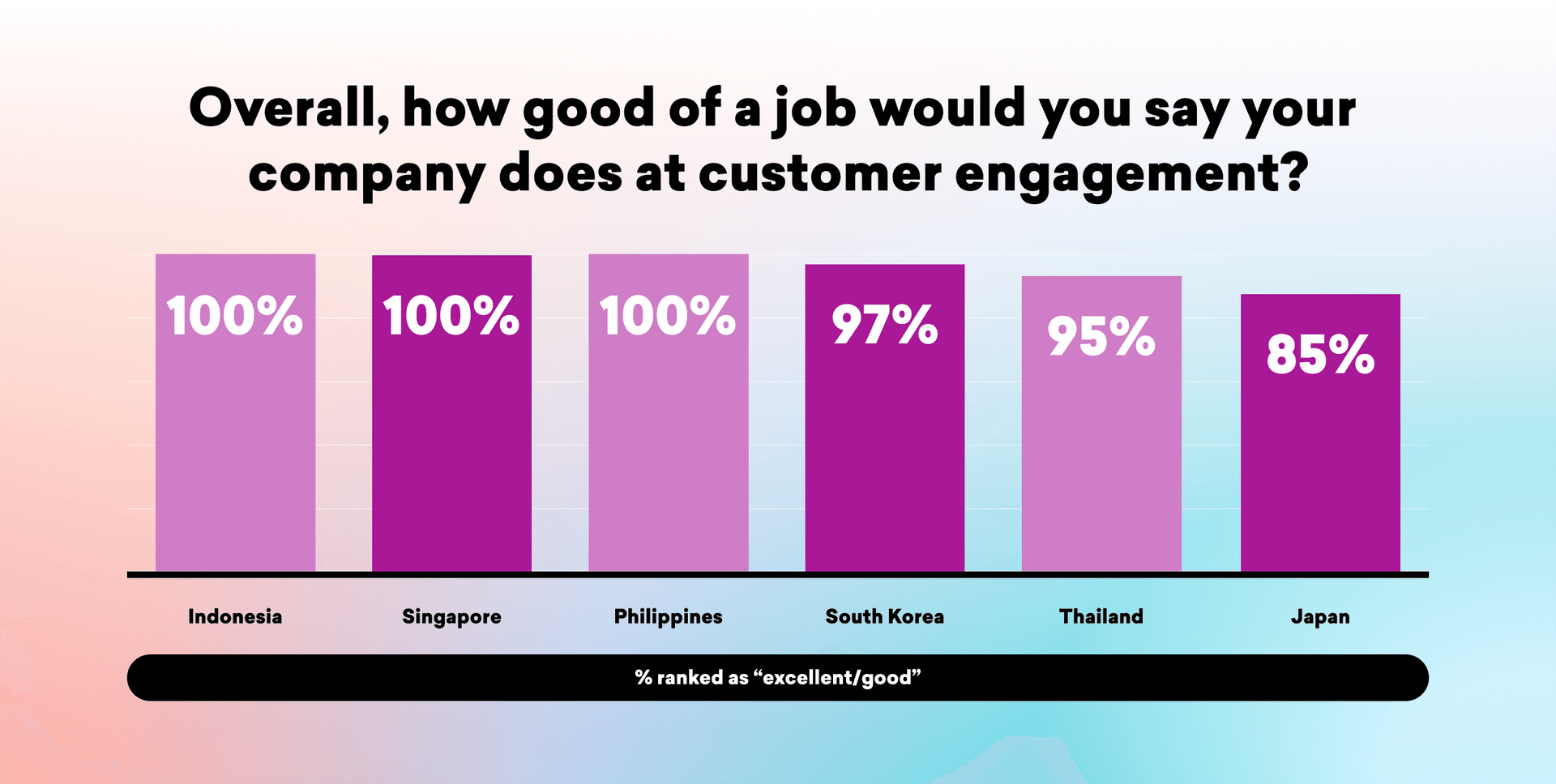

At the same time, we asked these decision makers to self-assess how well their company is currently handling their customer engagement program. We found that the vast majority of respondents in the region were very positive about their company’s customer engagement efforts, with the majority ranking themselves as doing a “good” or “excellent” job.

APAC and Customer Engagement: Areas for Improvement

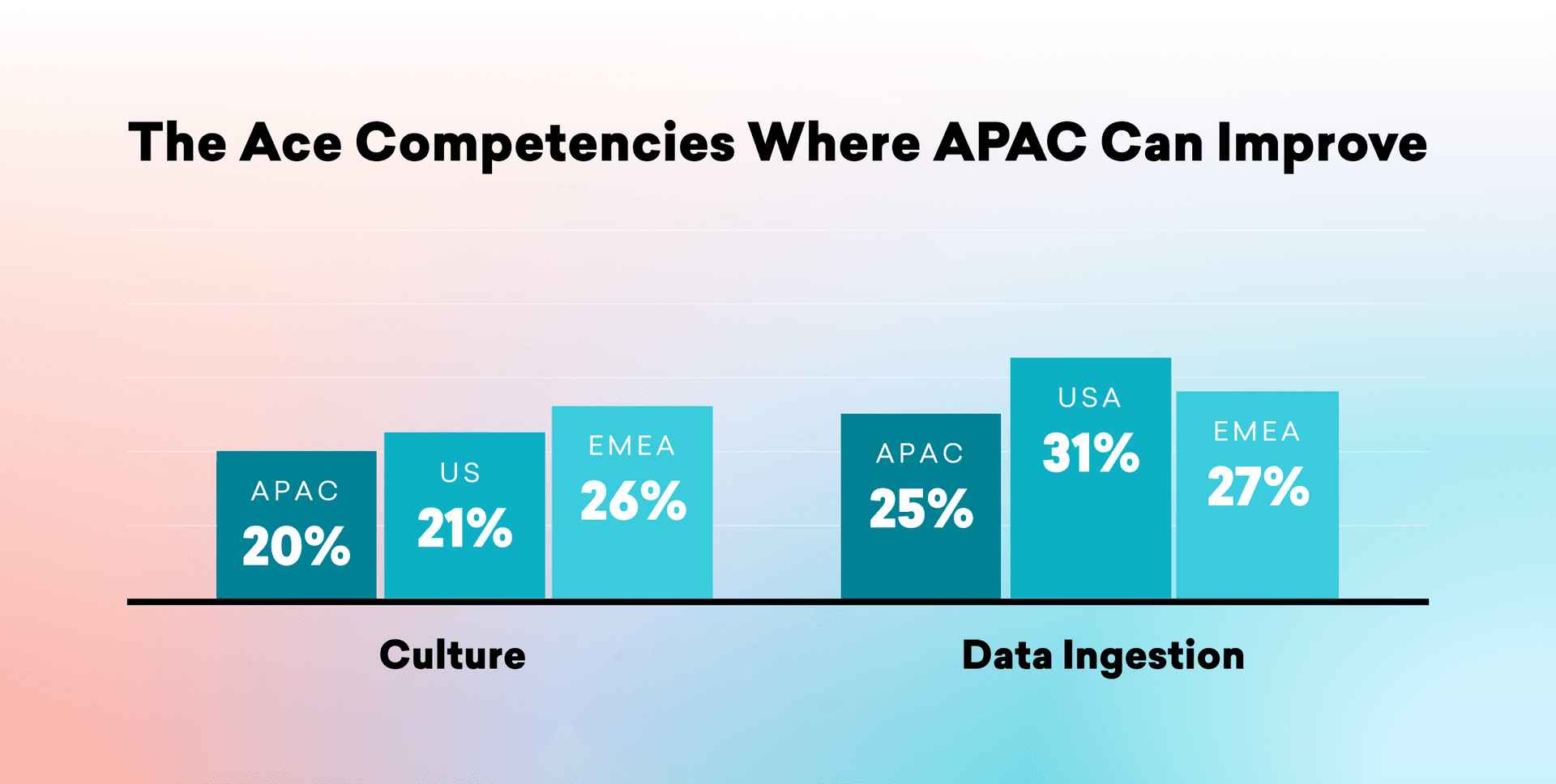

While there’s a lot to celebrate when it comes to the way that APAC brands are approaching customer engagement, that doesn’t mean that there are no areas of concern. On a high level, our research found that there was room for improvement in the region when it comes to the ingestion and management of data and in connection with cross-team collaboration.

APAC brands showed strength compared to companies in other regions when it came to implementing a strong experimentation and measurement culture, setting them up to successfully optimize their marketing programs over time. But our research found that the region lagged behind the US and especially EMEA when it came to taking full advantage of cross-team collaboration to reduce silos, with a higher than average number of companies seeing infrequent partnership between marketing and other consumer-facing teams. Brands in the region should consider syncing with other teams that touch the customer experience (e.g. product, engineering, growth) to see if there are ways to work more closely together and avoid data and process silos.

On the technology side, APAC generally saw strong results, but could stand to double down on data ingestion and management. In particular, emphasizing the importance of ensuring that you have the tech and processes needed to combine data from multiple sources into a single, real-time customer profile should be made a priority, since that makes it possible for brands to access the elusive single, 360-degree view of their customers.

The State of Customer Engagement in APAC in 2022: 4 Winning Strategies for Driving Customer Engagement in APAC

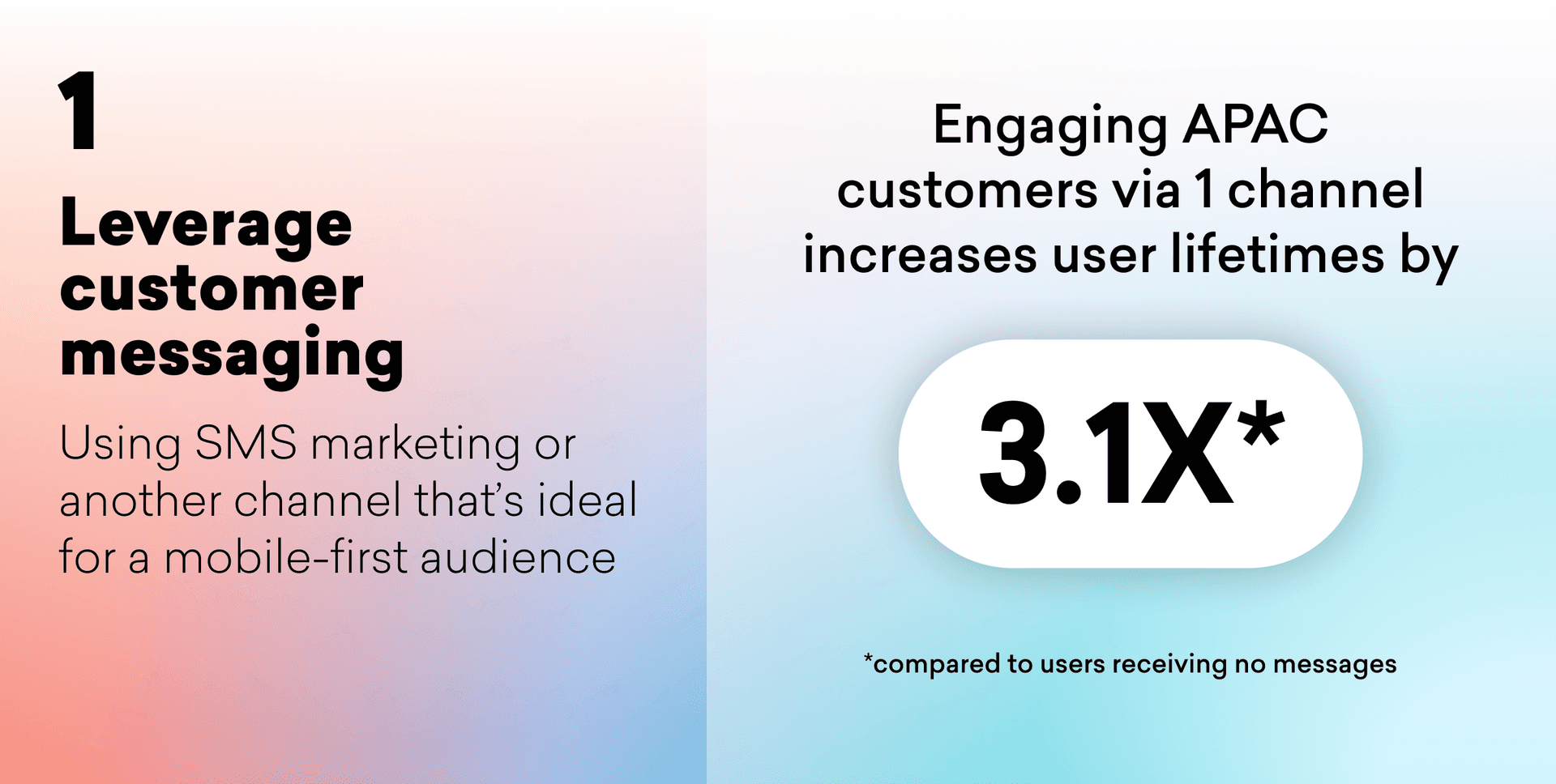

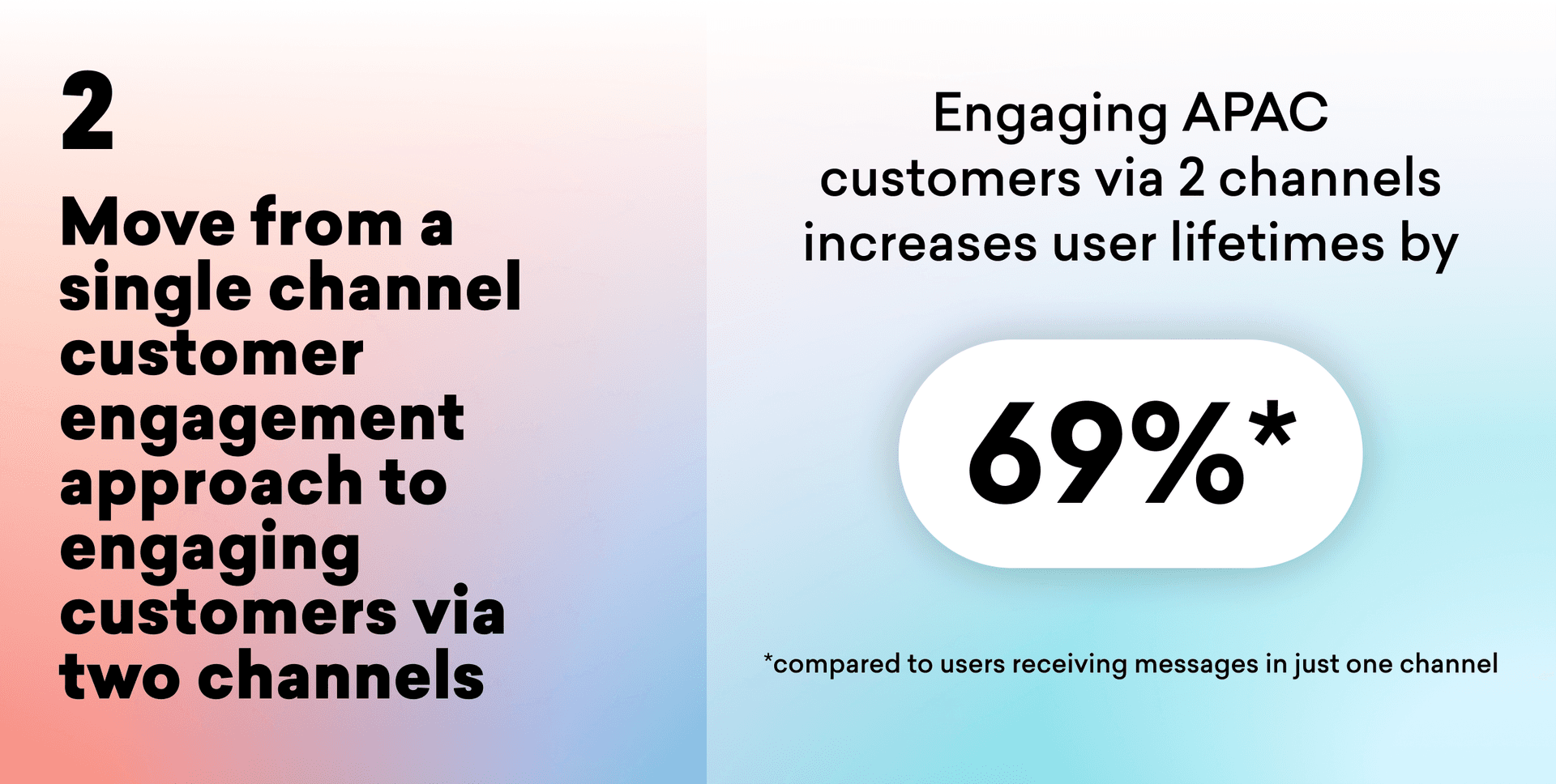

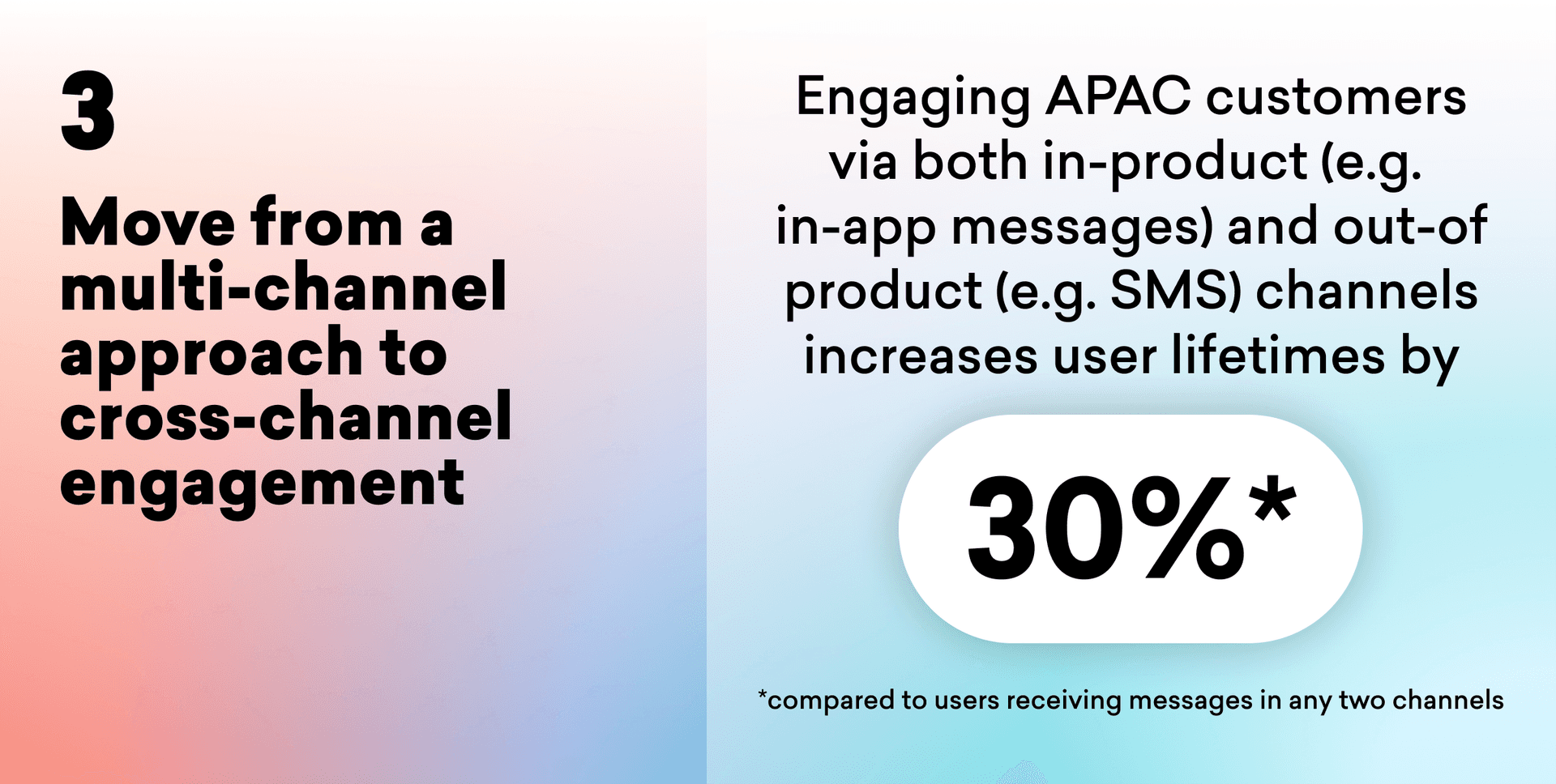

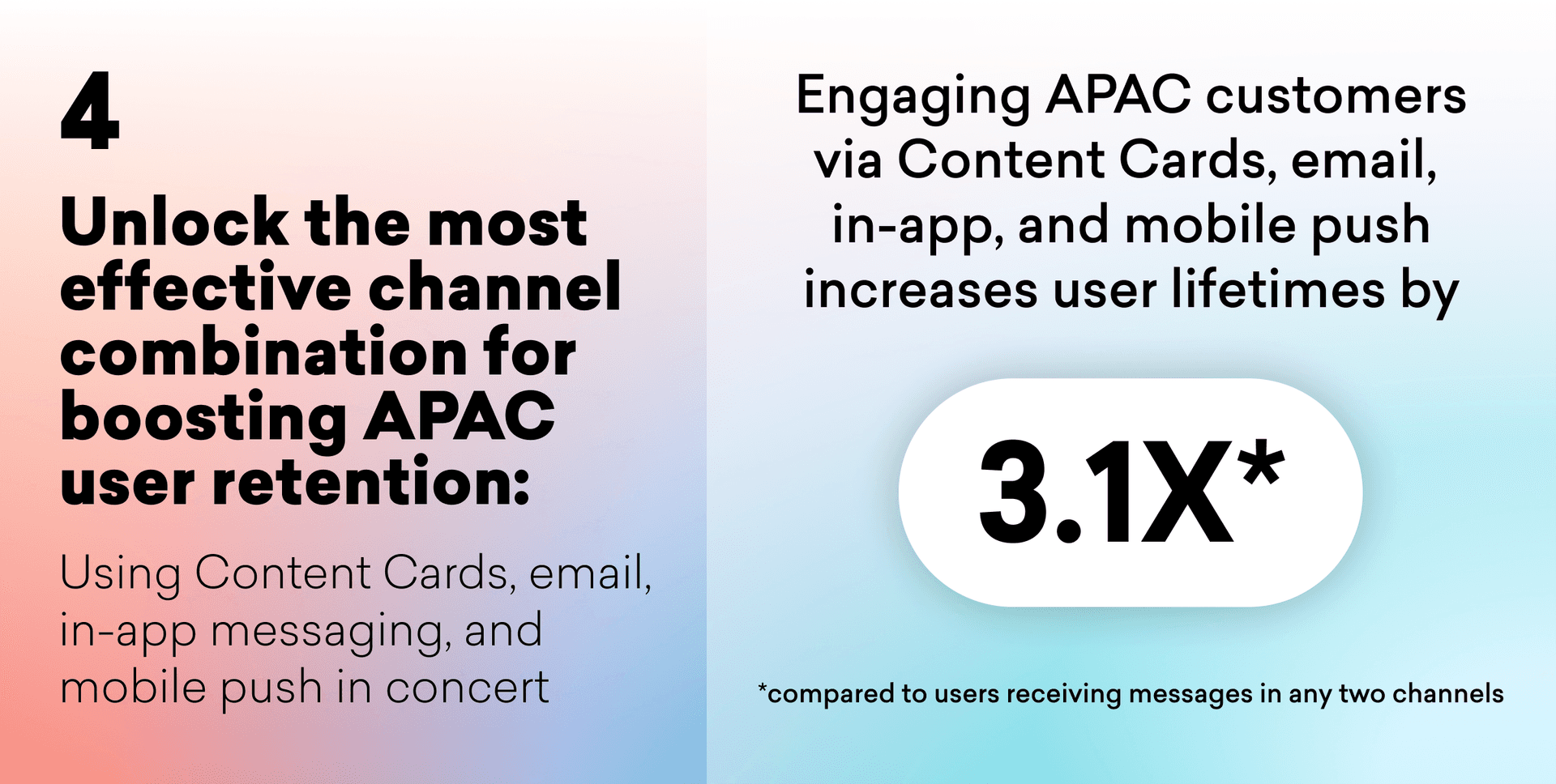

When we took a look at the most effective ways to engage and retain APAC customers, we were able to identify four customer engagement strategies that brands can put in place to keep their customers around longer.

About the Study and the APAC Countries Represented

These findings are part of our broader second-annual Global Customer Engagement Review, which draws on the following data sources:

- Marketing decision-maker market research commissioned by Braze and conducted by Wakefield Research: We gathered insights from 1,500 marketing executives (all vice presidents or higher) from B2C companies with an annual revenue of $10M across 14 global markets; Australia, Indonesia, Japan, the Philippines, Singapore, South Korea, and Thailand represented the APAC region.

- Braze customer data: Our research includes data aggregated from over 5.4 billion global users from our leading customer engagement platform that powers experiences between consumers and 1,000+ brands in 50+ countries.

- Braze customer interviews: For in-depth learnings, we spoke with top brands in five industries across three regions (including APAC).

Final Thoughts

For additional insights on the state of customer engagement in APAC in 2022 and how trends in this region compare to the rest of the world, download our comprehensive 2022 Global Customer Engagement Review.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.