Understanding “Growth”—and What It Means for Retailers

Published on October 17, 2019/Last edited on October 17, 2019/11 min read

Warrick Godfrey

VP, Industry Solutions at BrazeThe term “growth” gets thrown around a lot these days, in part because so many businesses are evolving and finding themselves forced to embrace new approaches and new technologies to thrive in a fast-changing landscape. But trying to achieve sustainable growth without really understanding what the term means is a fool’s errand.

With that in mind, let’s explore what growth is, what factors influence it, and how brands—especially in the retail space—can master the strategies that make growth possible.

The Basics of Growth

So, what is growth, really? Growth is a result or output from any part of your company that meaningfully expands the scope of your brand’s business. This can apply to any part of the business, from product features, market expansion, customer activation/engagement or finding ways to improve your business efficiencies.

But the challenge that all of us face is that businesses simply do not grow by themselves. While people sometimes treat growth as a series of tips, hacks, and tricks, that’s not how companies grow. Real growth, as defined by the leading practitioners, follows from a systematic way of approaching and thinking about business risks and opportunities. Teams that have a growth focus tend to become more aware of the sustainability and efficiency of their business inputs, which is an important step for any team, as it drives a bias for action instead of a focus on surface outputs.

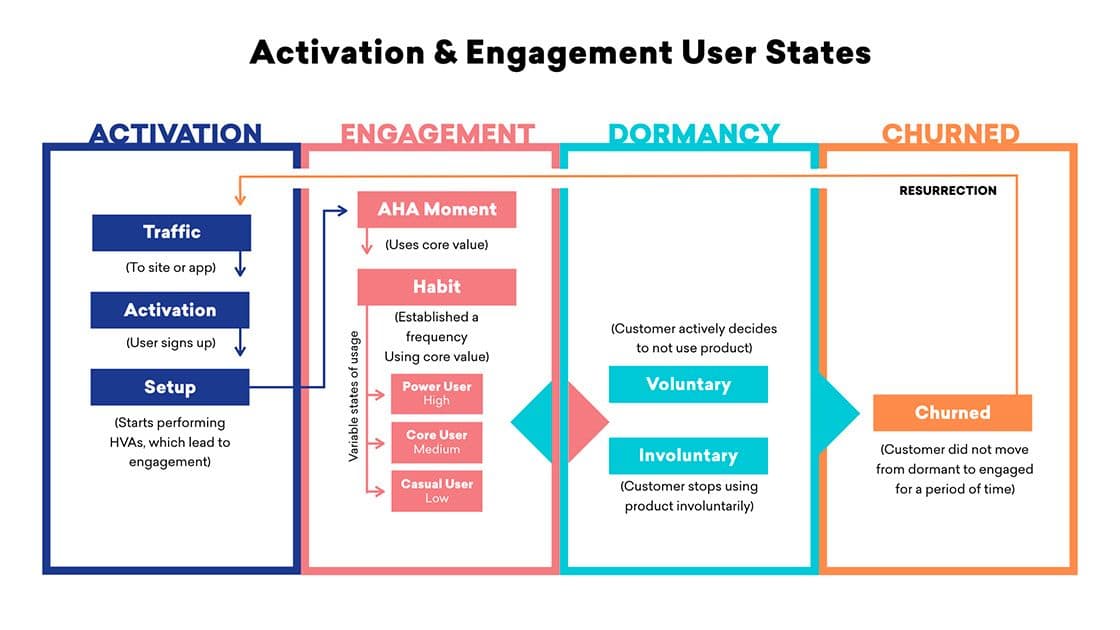

For example, when you’re looking at a surface metrics, your growth efforts will be best served if you dig a little deeper. Take monthly active users (MAU)—instead of just looking at your MAU numbers in the aggregate, make sure you understand your net MAU; that is, (new customers) ➖ (churned customers) ➕ (resurrected customers). When you know how your MAU for each segment is trending, you can nurture each one differently. If you look after the inputs, the outputs will take care of themselves.

One issue that high-growth and early stage businesses inevitably need to face is that fast growth tends to fade with scale and time. This DNA shift to being growth focused is equally relevant for more traditional, lower growth companies. Business leaders need to prepare by looking ahead years in the future and thinking through how they’ll continue to scale. It’s not an easy exercise, but we’ve seen it done successfully again and again by truly strategic brands:

- eBay evolved from a focus on real-time bidding to offering some items at a fixed price, then grew their business through international expansion and by moving into payments.

- Amazon systematically fueled their flywheel approach to growth with new business models, leveraged their scale to provide consumers with greater selection, moved continually into new marketplaces, and executed on pricing vs. margin strategy supported by uncompromising customer obsession.

When you see an exponential growth curve, it’s often driven by a combination of accelerating pieces, rather than by a single growth lever. Online retailers often run headlong into the consequences of driving growth through a single approach—namely that “OMG” moment when the growth slows down.

Here, more than ever, it’s important to be able to assess a combination of different business inputs in concert to accurately see where there are growth opportunities. The truth is, when you operate solely based on surface aggregate metrics like gross merchandise volume (GMV) or monthly active users (MAU), you often can’t see the forest for the trees. What you need to do is dig deeper to discern the inputs—like new users over time, or orders/unique buyers stickiness. This level of detail allows you to create specific strategies that drive meaningful impact on your business.

Growth and Efficiency

The growth vs. efficiency conundrum is often among the most heated debates between finance and marketing teams. In a lot of situations, scale and efficiency will tend to move in opposite directions—for instance, spending more on marketing can mean that efficiency declines, while reducing your acquisition spend means that your efficiencies generally improve, but at the cost of scale!

To solve this, retailers need to change how they look at the issue. First, by assessing product-market fit and ensuring that they understand how much of their customer acquisition is organic vs. paid. That means examining metrics like customer acquisition cost (CAC) and lifetime value (LTV) by acquisition channel. For digital retail and ecommerce, LTV is typically measured over a trailing 12 month (T12M) period however this time frame can make it difficult to discern cause and effect in the short term. For this reason, a healthy metric to focus on is next month retention rate (NMRR) which is the percentage of customers that transact in the month following their first transaction. Focusing on the second purchase via your customer engagement channels within the next 30 days will have a significant impact on the retention tail of your overall customer cohort.

In particular, it’s important to ensure that your overall LTV is profitable after all direct costs are accounted for and to understand your per-channel CAC vs. your blended (organic + paid) CAC. Why? Because blended CAC tends to obscure the business inputs that are driving the numbers you’re seeing, making it a dangerous one for marketers to obsess over. With scale, LTV to CAC decays over time, making it essential for brands to continue to invest in viral and organic channels while also leveraging their product and customer engagement technologies to improve customer activation and reduce overall CAC.

There are three main successful scenarios for companies looking to drive growth through efficiencies:

- Scenario #1: Driving incremental profit contribution coming in from a user at the normal CAC

- Scenario #2: Driving normal profit contribution coming in from a user at the lower CAC

- Scenario #3: Driving incremental profit contribution coming in from a user at a lower CAC

If all scenarios assume the same spend, then Scenario #3 would do the most to drive growth through efficiency, since it would allow the brand in question to see the highest profits with the lowest cost.

Looking for ways to kick off your flywheel? Paid channel marketing can be an effective tool. After all, the larger your network, the better it can scale. However, it’s usually quite difficult to become profitable when your company is entirely reliant on paid channels—and keep in mind that even paid channels can decay. Even worse, this approach can leave retailers exposed to increased competition, since anyone with deeper pockets can outspend them and squeeze their market share.

It’s wiser to focus on your growth loop opportunities; if you produce a lot of content, for instance, prioritize creating content loops where engagement and sharing can generate more customers for your business. Or keep an eye on emerging technologies, such as virtual assistants or connected homes, that could represent a new platform for acquiring or engaging customers.

Engagement and Retention

It's remarkable how many businesses apply the majority of their growth focus at the top of the funnel—and forget to focus on what happens after a new customer is acquired. Your average marketing team today is weighted heavily toward acquisition channel marketing, while retention and lifecycle teams are only now starting to get more attention.

Brands generally end up approaching marketing very differently over time. Early on, it’s all about getting new users, but eventually, you have to pay attention to engagement or you’ll watch your new customers slowly drift away. By keeping a close eye on the new customers who are joining each day/week/month, the channels you’re using to acquire each one, and the different segments they fall into, you can effectively compare how they’re behaving over time and take action when it makes sense.

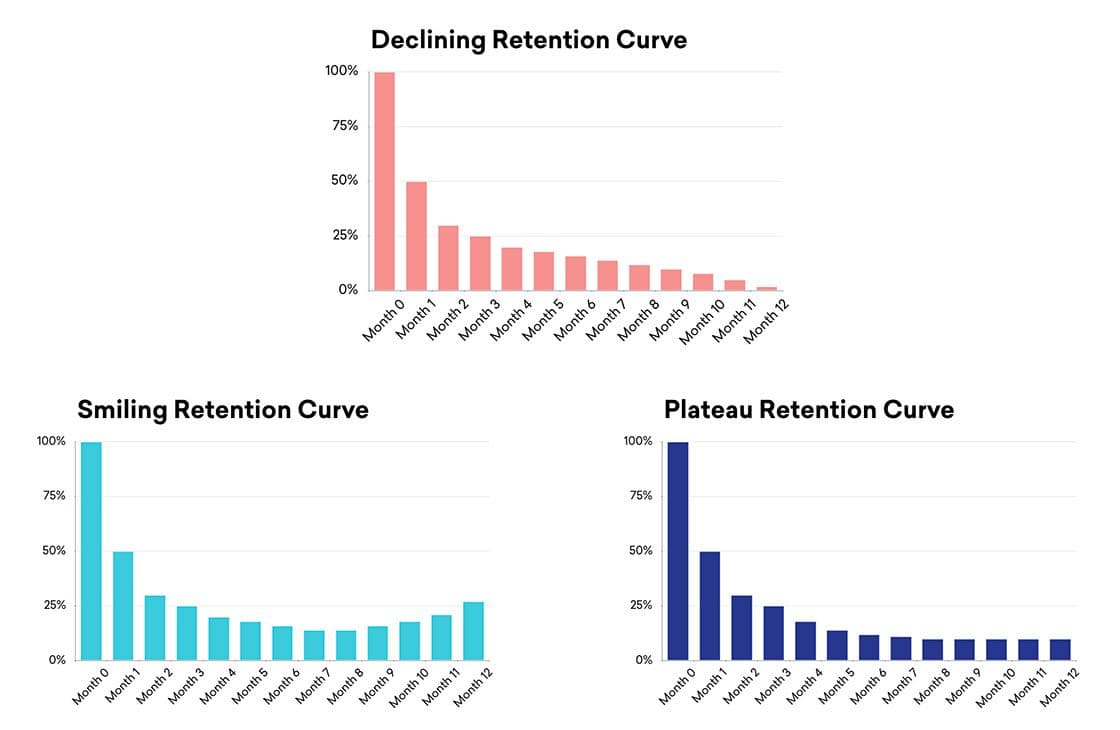

- Declining Retention Curve: Acquired customers are eventually all churned at the end of the cohort window. Businesses with declining retention curves are almost entirely reliant on acquiring new customers.

- Plateau Retention Curve: The consistent (plateaued) tail of the retention cohort means that you can still grow over time by constantly adding new customers.

- Smiling Retention Curve: Retention curves start to “smile” when businesses focus on initiatives that encourage dormant buyers to return more often.

Look at the relationship between recency versus frequency once new users have signed up and pay attention to how active your audience is. Analyze those retention curves—good retention curves flatten out, but great retention curves smile. If you’re in a situation where your new user cohorts are in a continual decline, it’s time to face the fact that you’re filling a leaky bucket and are in for some trouble ahead if you don’t course correct.

Cohorts can also be segmented by geography, time, business size, etc., and if you can understand these cohort behaviors, you can more easily determine the retention curve by segment and increase the chances that each one is a smile, rather than an endless decline. To get there, your customer onboarding and ongoing messaging experience need to effectively drive high-value actions (HVA) which will result in better engagement. That way, your new customers will be nudged to become engaged customers (in what we call an “aha moment”), and your engaged customers with low frequency will be encouraged to increase their frequency.

What does that look like in real life? Well, accounting software brand Intuit QuickBooks Self-Employed (QBSE) uses an in-house propensity model that can predict whether a new user will subscribe based on their first few use days of engagement in concert with the Braze customer engagement platform to power cross-channel campaigns nudging lagging users to up their engagement and increase the chances that they purchase a subscription. Similarly, global freelance services marketplace Fiverr leveraged the Braze Canvas visual customer journey tool to identify a messaging approach targeting new users that led to an 8.8% increase in the number of purchases made in a three-day window and bolstered associated revenue by 20.9%.

Having access to actionable data and the right technology isn’t a silver bullet, but it does make identifying and acting on data to encourage HVAs much easier.

High-Value Actions and Negative Value Actions

HVAs are typically a set of actions that you can predict will set up customers to be valuable to your business in the long term. But there’s a darker flipside as well—negative value actions (NVAs), which are negative signals that highlight low-value conditions in your audience over the long haul. You need to be mindful of both to maximize growth.

Start by segmenting users into engagement maps, then work out how to move these customer groups through their lifecycle using incentives, content, and customer education. In general, engagement metrics like frequency of orders by total customers (that is, the number of orders ➗ number of unique customers) ratio can give you a good sense for how your customers are engaged. That said, keep in mind that there’s a natural cadence that can influence what success looks like—after all, a florist will probably always have higher numbers for this metric than a mattress company will—and make sure the metrics you’re measuring against are right for your strategy.

When you look at the acquisition loop, growth is all powered by engagement. But it’s too easy to game things for a while by bombarding your new users with email and push notifications. Doing that indiscriminately can boost your MAU in the short term but drive down your daily active users (DAU) and increase the chances that your audience disengages. Instead, focus on the HVAs that your metrics say matter for your business and use messaging thoughtfully to encourage your users to take steps that will deepen their engagement and increase the odds that they stick around. Each HVA you encourage (and each NVA you avoid) will have a positive incremental effect—known as a downstream impact (DSI)—on your customer LTV and have a positive influence on your brand’s overall growth.

Final Thoughts

We live in interesting times when it comes to growth. These days, brands that are looking to grow their business on mobile are finding themselves needing to effectively take minutes of engagement from other brands’ apps in order to grow. That means every retailer—and every company, for that matter—is competing against all comers (think Tinder, YouTube, Netflix, podcasts, email, games) for consumers’ attention and their precious moments of focus.

In order to survive and thrive today, retail brands must approach growth from the inside out. That means starting with your existing core customer base and identifying the behaviors and characteristics associated with the highest returns. Brands who know how to detect, measure and drive these high value actions throughout the customer lifecycle can create the powerful, sustainable growth engine their business needs.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

View the Blog

How behavioral marketing turns data into personalized experiences

Team Braze

The new inbox reality: How iOS changes are reshaping email marketing

Aparna Prasad

Experience optimization: Turning data insights into better journeys