3 min read

Wealthsimple Drives Acquisition and Long-Term Value With Their Customer Engagement Strategy

Wealthsimple, one of Canada’s fastest-growing and most trusted money management platforms, wanted to deepen client activation, monetization, and retention but lacked a customer engagement platform capability of creating the personalized, automated campaigns they needed.

After switching to Braze, they were able to action on their wealth of data to address every aspect of the customer journey. For example, they launched a promotional campaign that encouraged both new and existing clients to move their financial assets to Wealthsimple, helping to achieve the goal of becoming clients’ primary financial relationship.

The campaign resulted in a record month for net deposits, with 20% of clients who received the campaign registering for the promotion. Additionally, 25% of all participants were new clients, making it both an effective acquisition and loyalty play.

INDUSTRY

PRODUCTS USED

BY THE METRICS

40%

Increase in team quarterly net deposits, including a record-breaking month

20%

Of clients who received the campaign registered to qualify for the mobile device

25%

Of all participation came from new clients

Wealthsimple, a Canadian money management platform, has been working to revolutionize the financial landscape since its start in 2014. Serving over 3 million Canadians and managing over $30 billion in assets, Wealthsimple offers a full suite of financial products across managed investing, cryptocurrency, tax filing, and more. At its core, Wealthsimple is dedicated to providing simple yet sophisticated financial solutions for everyone to help them achieve financial freedom.

As Wealthsimple has expanded over the last decade, nurturing and strengthening customer relationships has remained paramount. Their ambition extends beyond offering just financial services; they aim to be the go-to financial partner for their clients. However, they needed help scaling personalized customer experiences. Faced with this challenge, Wealthsimple sought a scalable, user-friendly solution to increase the effectiveness of their customer engagement strategy. That’s when they turned to Braze.

Rethinking Customer Engagement in Campaigns

Striving to be their clients’ primary financial relationship, Wealthsimple was looking to better activate, monetize, and retain users across the entire lifecycle. They turned to Braze for its ability to create and scale automated, dynamic campaigns across a wide variety of in-product and out-of-product channels.

After switching to Braze, they began to address every aspect of the customer journey with personalized, relevant content that helped increase engagement and loyalty almost immediately. With Braze, they have been able to scale and deliver rich experiences for their millions of clients.

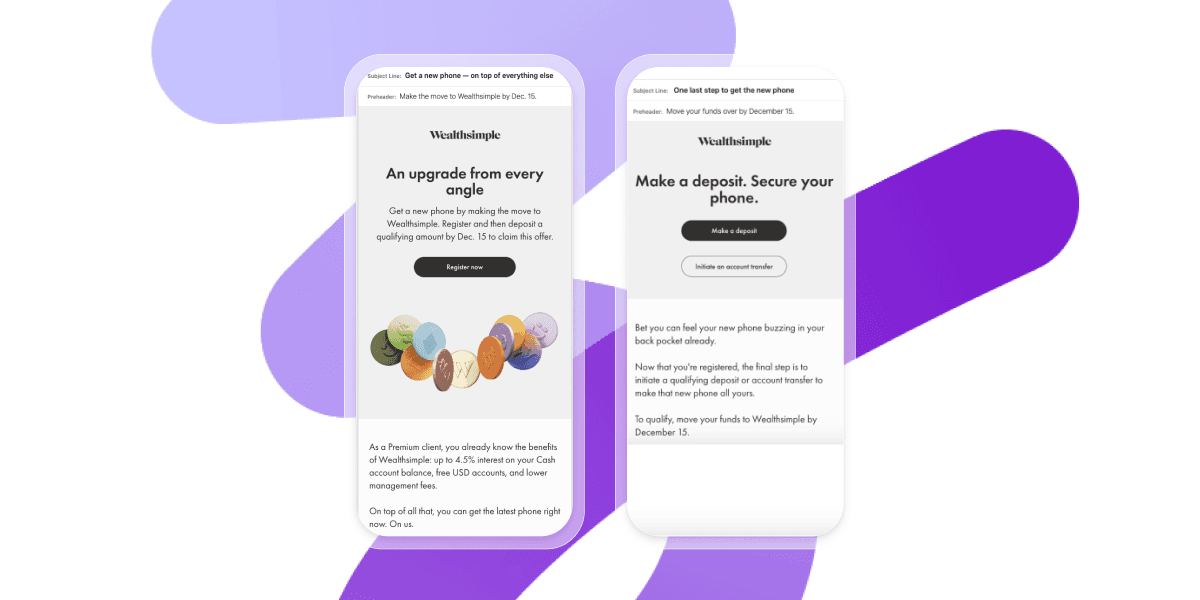

Recently, they were looking to create a campaign to strengthen new and existing client relationships by encouraging those who might be hesitant to move their assets over to take that leap. This campaign—a departure from the often complex promotions offered by traditional banks—delivered a straightforward and exciting incentive: A cell phone for clients transferring a certain amount of assets into their Wealthsimple accounts.

Using a series of emails, in-app messages, and Braze Content Cards, they seamlessly collected registrations and sent confirmation messages with detailed next steps to qualify for the reward. They also leveraged Braze Data Transformation, which enables custom integrations from existing software, to pass client registrations from an external source and add custom attributes to each user profile when registration is completed. This streamlined approach reduced costs, effectively targeted a group of engaged users, and simplified the client process—all which serve to strengthen their relationship to Wealthsimple.

Additionally, what set Wealthsimple's campaign apart was its focus on transparency and excitement, diverging from the typical bank promotion tactics. Using Braze for registration and cross-channel communication showcased Wealthsimple's commitment to innovative financial solutions. It ensured the campaign's communications were carefully timed and tailored, providing a consistent and compelling client experience.

Braze has enabled us to completely step-change our relationship with our clients. The range and variety of communication we now have with our clients at every stage of their journey with our financial products has improved exponentially—and I’m excited about how we will continue to grow together in the years ahead.

Jessica Owen

Director of Lifecycle Marketing, Wealthsimple

The Power of Progressive Marketing

Wealthsimple's strategic marketing move aimed at growing customer relationships and boosting asset transfers achieved outstanding results, driving significant business growth and stronger client connections. This innovative approach led to a record month in net deposits, with 20% of clients who received the campaign registering for the mobile phone. Additionally, 25% of all campaign participants were new clients, proving this to be both an effective acquisition and monetization strategy.

Key Takeaways

- Your tech stack needs to make things easier: Wealthsimple's transition to Braze underscores the importance of easy-to-use tools for effective customer engagement. Now, the team can do more with less, all while driving business goals.

- Know your differentiators, and message around them: To encourage clients trust in Wealthsimple, they used messaging to demonstrate that they live up to their values with a campaign as straightforward as their platform.