The State of Customer Engagement in the UK in 2023

Published on May 01, 2023/Last edited on May 01, 2023/8 min read

Team Braze

Forward-looking brands have long understood the positive impact that customer engagement can have on their businesses—and now new data is reinforcing that dynamic. The 2023 Global Customer Engagement Review leverages a survey of 1,500 VP+ marketing decision-makers across 14 global markets, among other data, to reveal key opportunities for brands and their marketing and customer engagement efforts. And to provide targeted guidance, we’re focusing on UK companies and what these emerging customer engagement trends mean for them.

Conducted by Wakefield Research, on behalf of Braze, the survey found 62% of UK brands exceeded their revenue goals in the past twelve months, with brands investing almost equally across acquisition and retention to reach those goals. However, when it came to customer engagement, the results indicated that there were opportunities for UK brands to leverage technology, cross-team ownership, and collaboration more effectively.

Today, we’ll delve further into our analysis of the state of customer engagement in the UK and explore how brands can advance their customer engagement strategies for the highest impact.

Key Takeaways

1. UK brands are striking a balance between attracting and retaining customers in a bid to feed the funnel from both ends during the downturn

When it comes to the question of where you should focus your marketing efforts—on attracting new customers or retaining existing ones—the answer should always be “both.” However, the exact percentage split will often depend on individual brands, their priorities, and the business goals they’re looking to achieve.

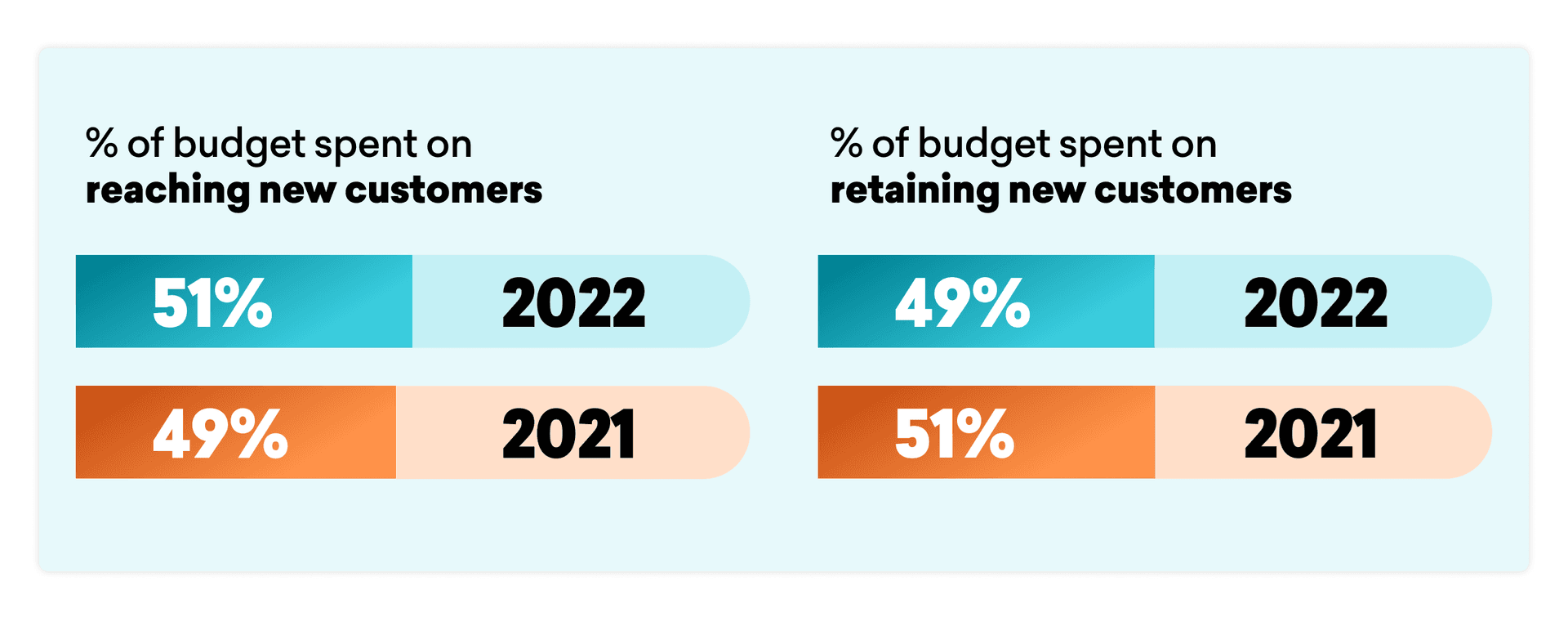

During an economic downturn like the UK is currently experiencing, achieving the perfect balance is ever more pertinent. This year, on average, 51% of UK respondents’ marketing budget was spent on reaching new customers and 49% on retaining existing ones. That outcome is exactly the reverse of last year’s when brands in the country spent 51% to reach new customers and 49% to retain existing ones.

This flip is likely due to the challenging economic climate, which can lead brands to try and secure dependable recurring revenue from their existing customers, recognising the business value that this segment represents. Put simply, existing customers are the life and blood of any business, with retention efforts boosting the bottom line in ways such as increased CLV (customer lifetime value) or AOV (average order value).

2. Cookiepocalypse is becoming a reality and there is a significant shift in UK brands planning to reduce their reliance on third-party cookies in the next 12 months

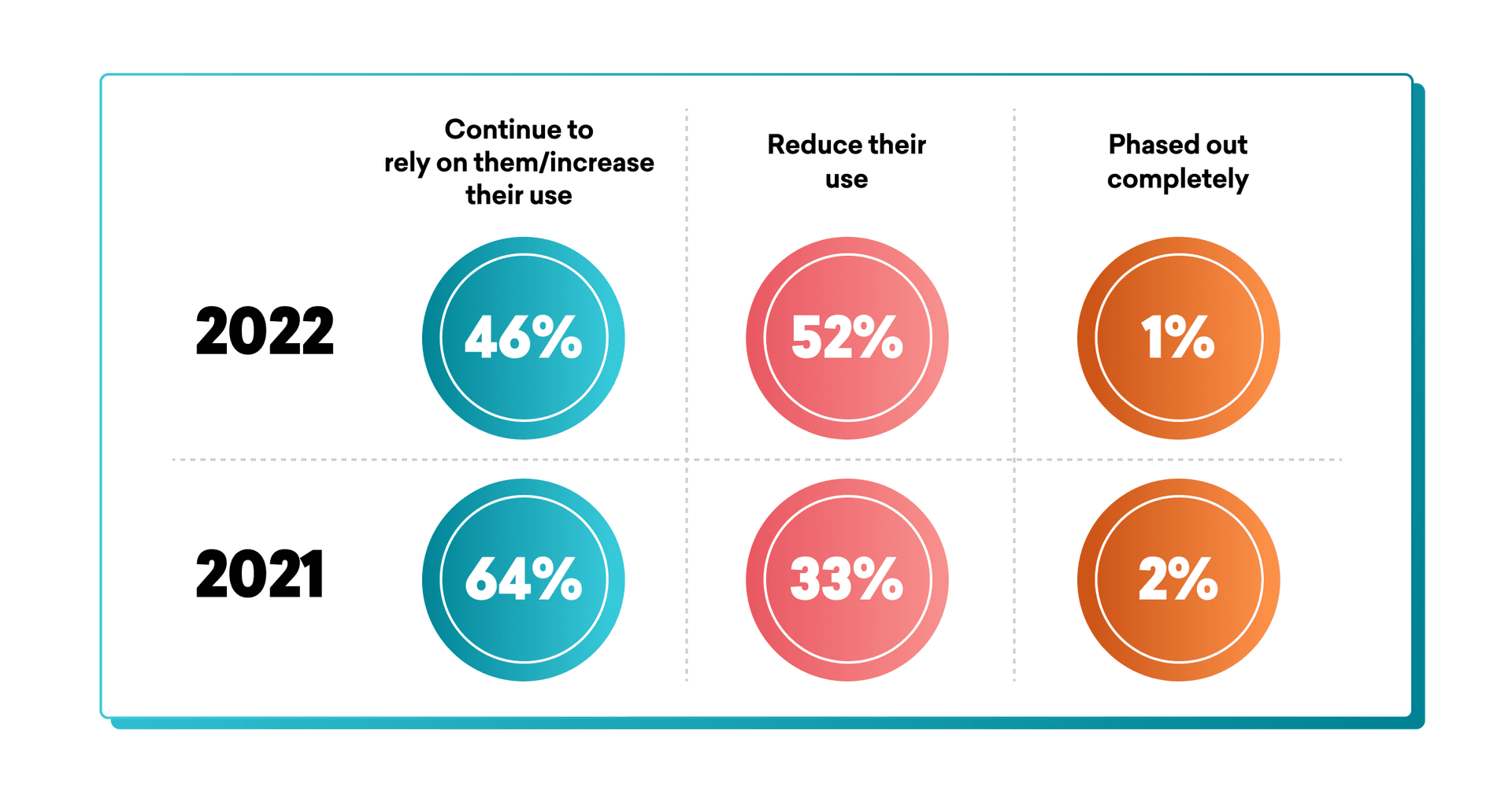

Amid growing privacy concerns and Google’s plan to deprecate third-party cookies from Chrome browsers by 2024, UK brands are being pushed to pursue alternative data sources before it’s too late. This year 46% will continue to rely on third-party data or even increase their use, while 52% will reduce their use of third-party data, and 1% have already phased it out completely. And while these numbers may seem high in terms of continued third-party data usage, there’s evidence that the tide is turning year on year—with last year’s results showing 64% of respondents planned to rely on third-party data or increase their use, only 33% intended to reduce their usage of third-party data, and 2% had already phased them out completely.

A savvy alternative to third-party cookies can be found in zero- and first-party data. That’s transactional data collected during users’ interactions with your site or app or messages (first-party data) and information volunteered by the user, for example, when filling out an in-app survey (zero-party data). Brands that collect and leverage this information have their own source of compliant customer data they can use to personalize and target campaigns.

However, it is no good collecting data if you can’t use it effectively and many brands surveyed are struggling to do just that: In fact, 78% of UK brands surveyed said they’re collecting more data than they can use effectively. With this in mind, collecting actionable data will be critical, reducing the burden of storing data that serves no purpose and allowing for refined focus on the data that does.

3. UK brands are struggling to connect the dots with cross-team collaboration and require a mindset shift to achieve their full potential

Effective customer engagement strategies are rarely created in silos. As with most strategies, when the wider business is invested, informed, and collaborated with, the success rate increases exponentially. In this vein, we asked UK brands how often the various teams and departments involved in customer engagement programs sync up—on the basis that more frequent generally equals better.

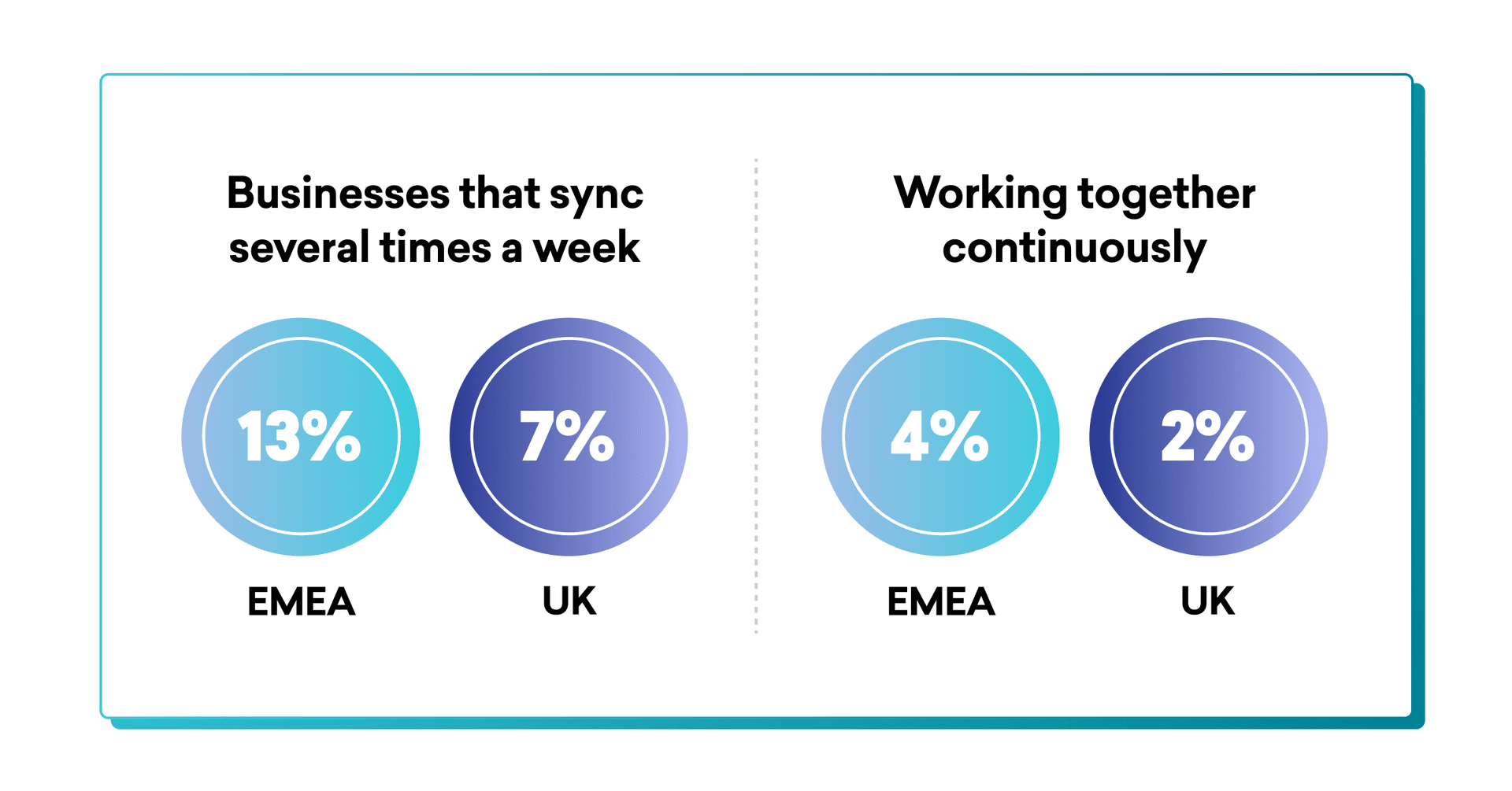

Most UK respondents said they synced weekly (33%) or monthly (30%). Looking at averages across EMEA as a whole, the UK outperformed EMEA by 10 percentage points for weekly syncs, which could be seen as a positive. However, the key point of differences are the two highest frequencies for syncs, with 13% of EMEA businesses sync several times a week, and 4% are working together continuously—in the UK, that slumps to just 7% and 2%, respectively.

Whilst it’s great to see brands are actively looking to break team silos and communicate more, it still isn’t happening frequently enough to let them make the most of their customer engagement efforts. The data suggests that UK brands favor a more structured approach to their cross-team collaboration, with cadences that are specific and repeatable (i.e. weekly and monthly). The next step is to move to an ongoing mode of collaboration outside of those set cadences, making them less of a formality and instead an adopted way of working.

Top Areas Where UK Brands Excel (and Areas for Improvement)

100% of UK brands plan to adapt their messaging to reflect consumer concerns, demonstrating deep empathy and understanding

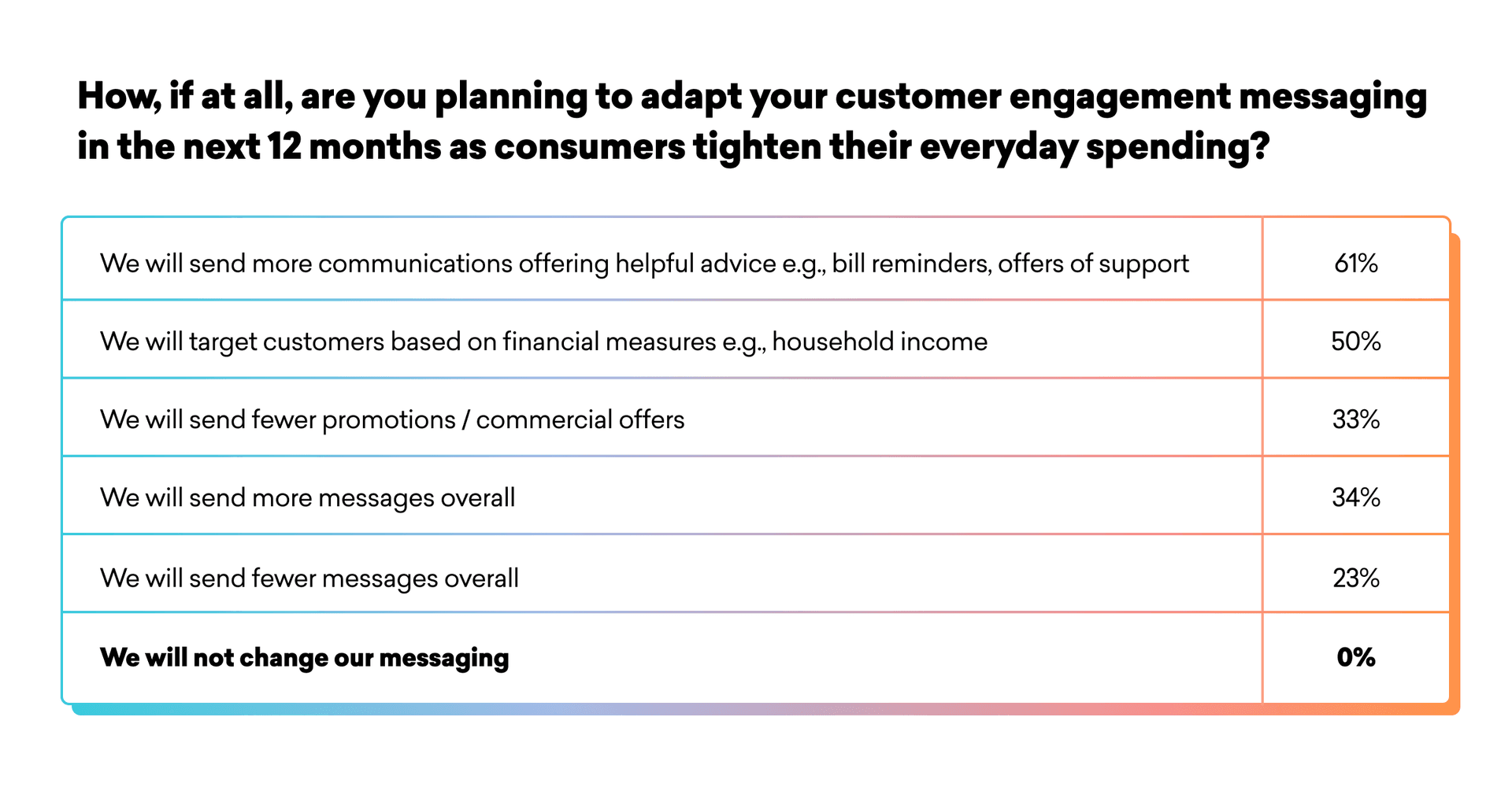

All respondents in our survey said their brand would adapt its messaging as consumers tighten their everyday spending. 61% of UK brands said they would offer helpful advice versus the EMEA average of 53%; in addition, 33% of UK brands said they will send fewer promotional/commercial messages. Even without a commercial goal, keeping in touch with customers is a great way to stay front-of-mind and build brand affinity—especially if those messages help customers live their best life despite the challenging circumstances.

This deep understanding and empathy of consumers should come as no surprise, especially when you look at how customer engagement success is being measured for UK brands. The most popular KPIs or metrics are customer satisfaction (37%) and customer lifetime value (36%) respectively, indicating that UK brands are prioritizing building emotional connections and long-term relationships with their customers, rather than chasing short-term revenue gains.

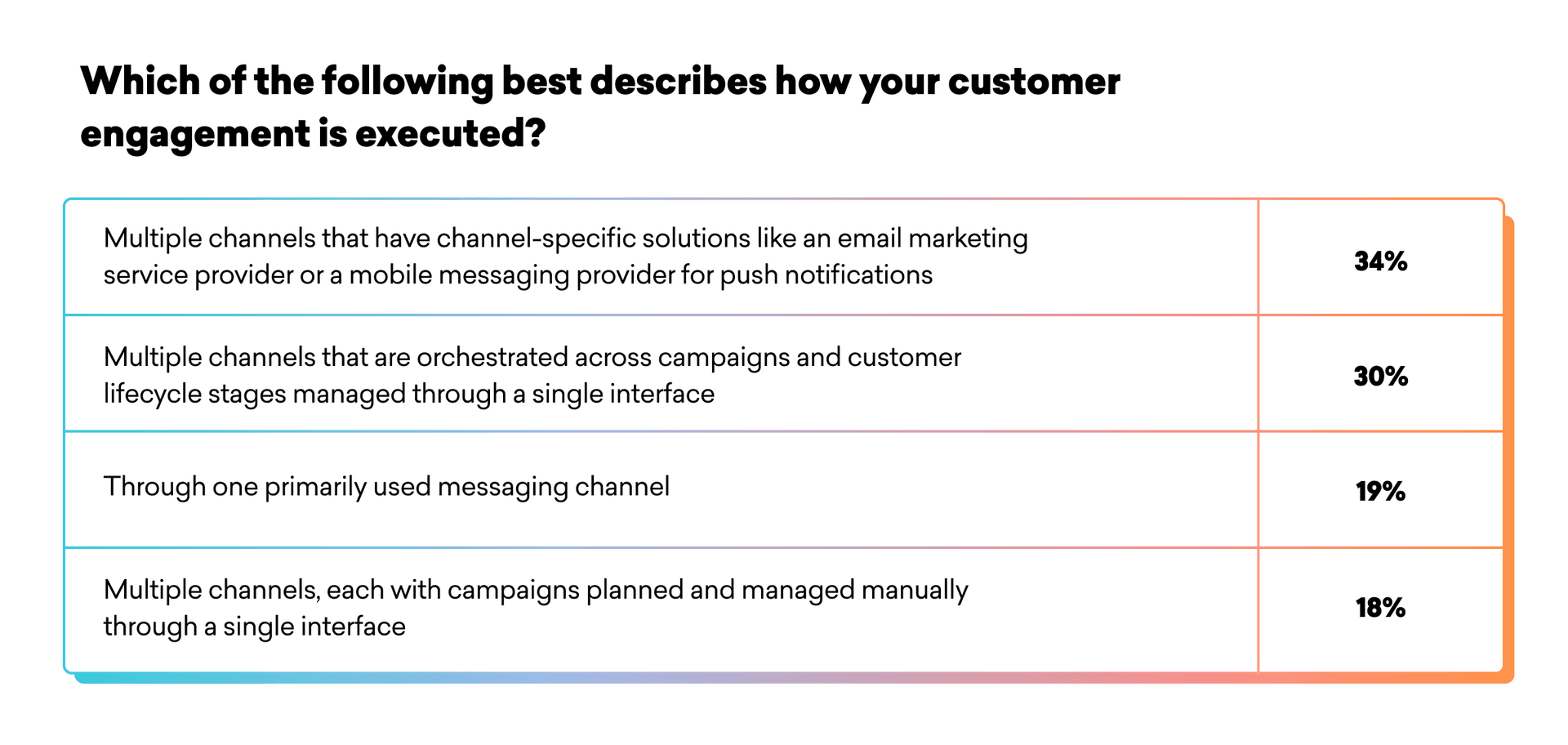

Two-thirds of UK brands are currently under-leveraging customer engagement technologies, which could be hindering their ability to scale campaigns effectively

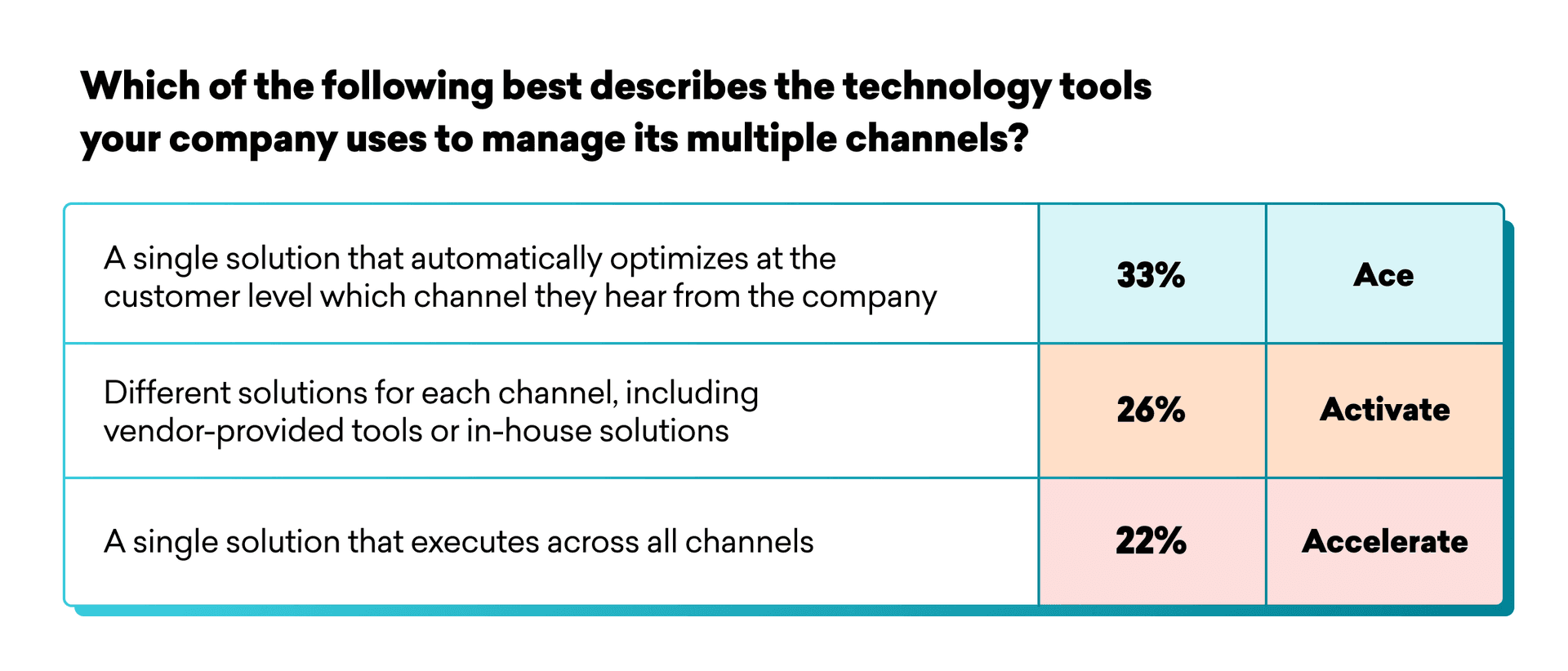

When we asked respondents about the technology they use to manage multiple communication channels, we discovered that only a third of brands are equipped with the tools needed to make the most of their customer engagement.

22% of respondents use a single solution that executes across all channels. That means the brand uses a centralized tool to orchestrate customer campaigns across every channel (in-app messages, email, etc.), rather than multiple disconnected tools. We coded this as “Accelerate” behavior because it’s a strong foundation for consistent, contextual, cross-channel communication.

33% of respondents similarly use a single solution—but one that automatically optimizes which channel customers hear from the company on. We coded that “Ace” behavior because it represents highly sophisticated optimization of the user journey. Automatically selecting the right channel at the right time for the individual customer is top-tier execution.

26% of respondents use multiple different tools to manage their communication with customers. We coded that as “Activate” behavior because there’s significant room for improvement. Using multiple tools is time-consuming and can result in disconnected, less effective campaigns.

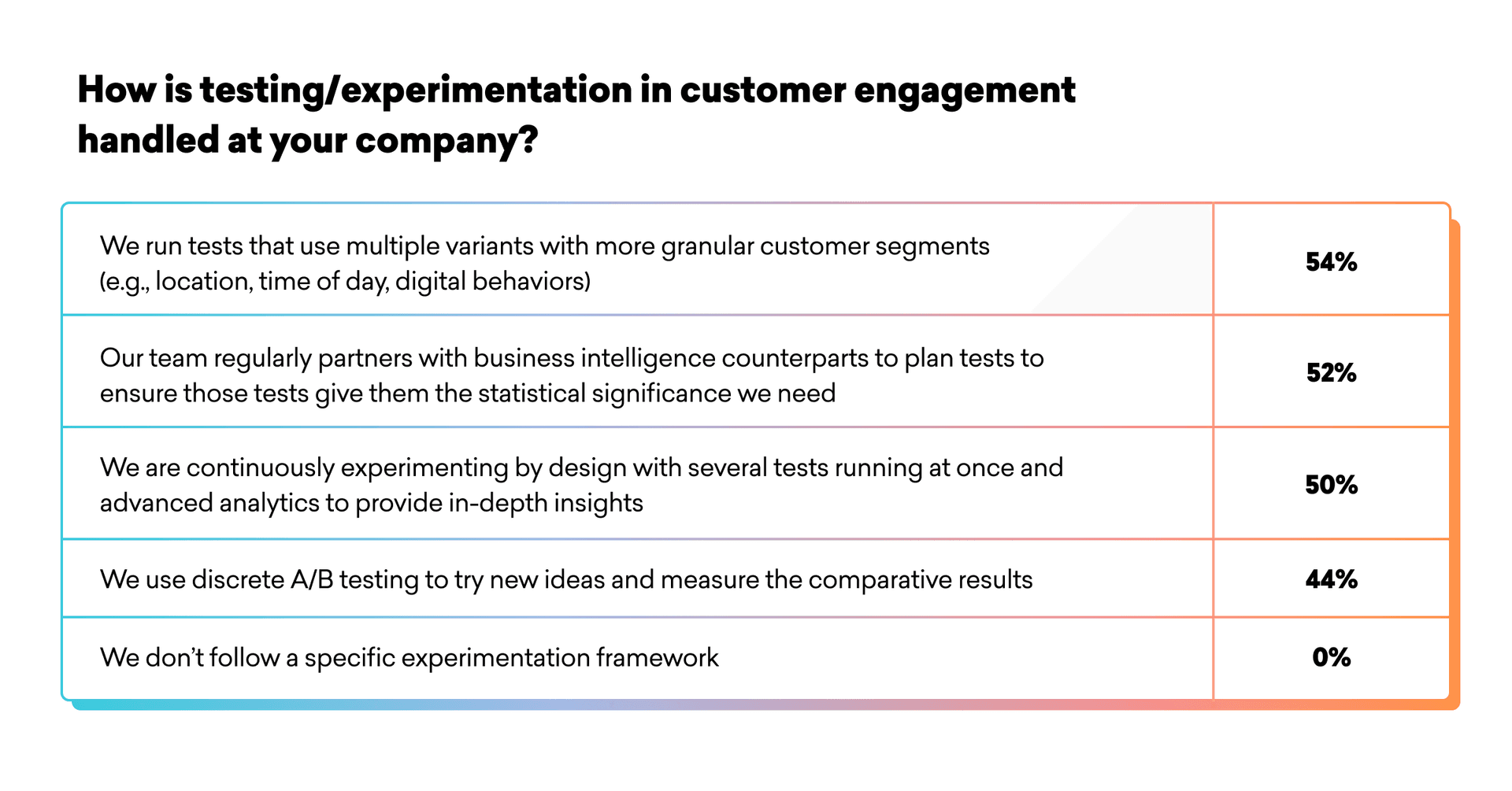

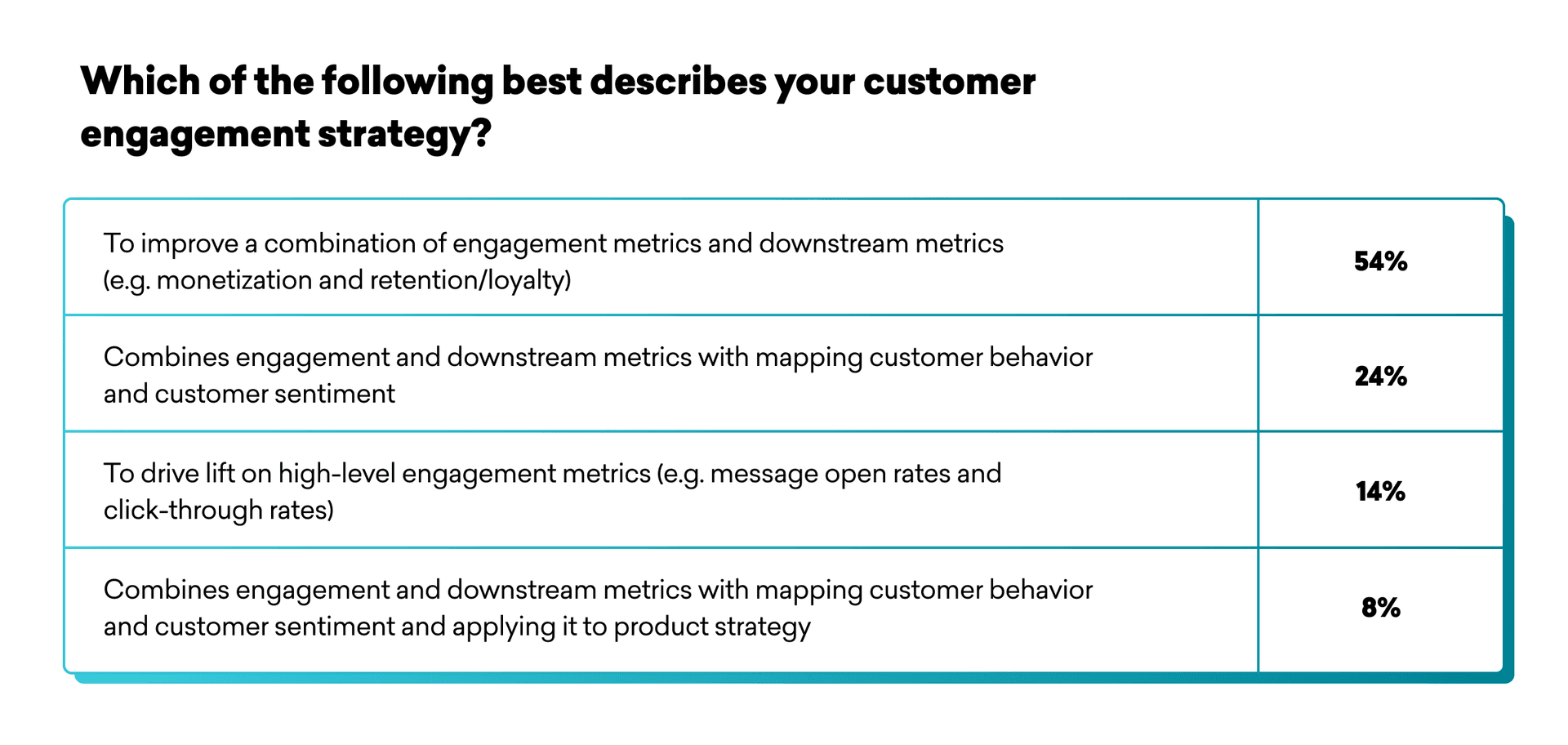

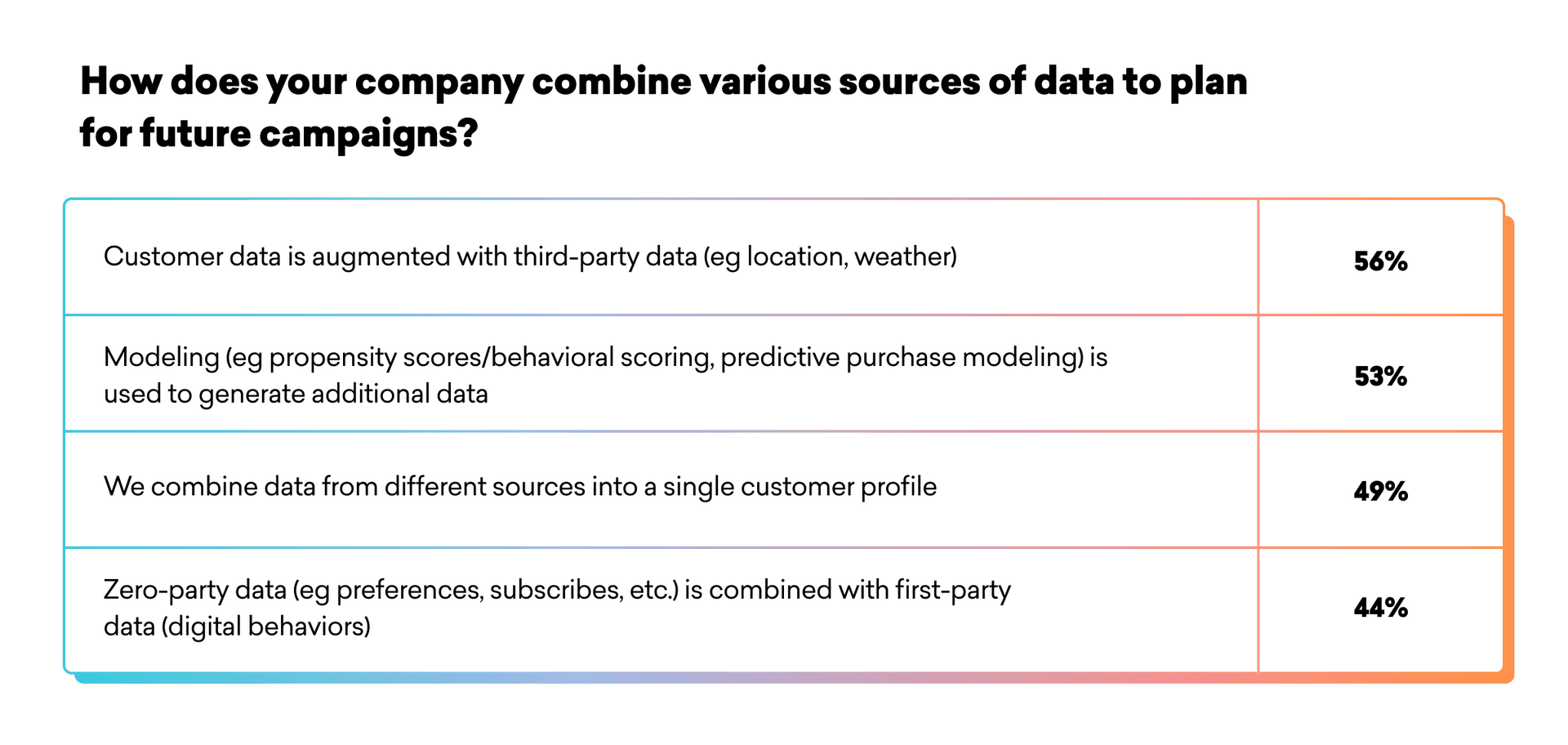

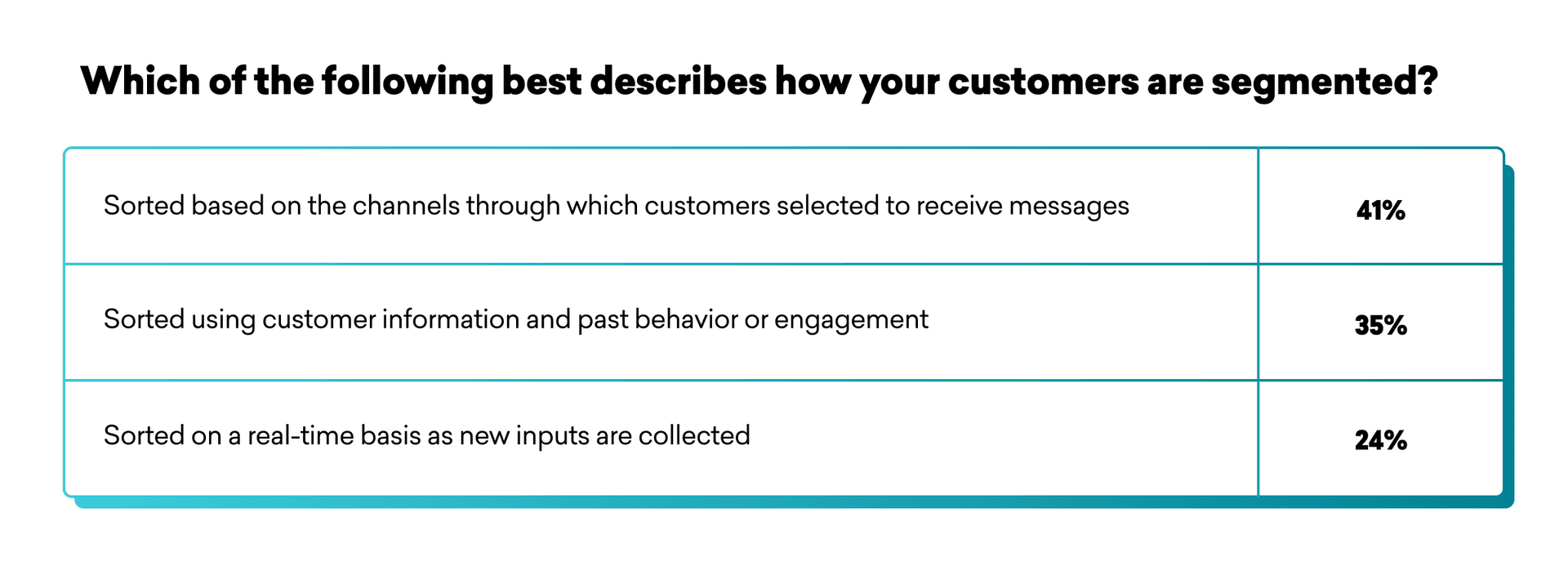

Customer Engagement Benchmarks for UK Brands

Check your customer engagement strategy and execution against other UK-based businesses. How do you measure up? Do the challenges match your own? What could you learn from your competitors?

Final Thoughts

Overall, UK brands are performing well in an increasingly sophisticated customer engagement landscape. Taken on their own, these stats show promising signs that UK businesses are committing to customer engagement as a significant source of competitive advantage. However, compared to some counterparts in the EMEA region, they are still behind the curve in key areas of strategy and execution.

Assigning ownership of customer engagement to the right cross-functional team, improving collaboration, and using customer engagement technology more effectively will be crucial to helping UK brands close the gap.

For additional insights on the state of customer engagement in 2023 and how trends in this region compared to the rest of the world, get your copy of the complete 2023 Global Customer Engagement Review.

About the Study and UK Representation

The findings covered here are the result of our broader third-annual Global Customer Engagement Review, an analysis that draws insights from the following key data sources:

- Marketing decision-maker market research commissioned by Braze and conducted by Wakefield Research: We gathered insights from 1,500 marketing executives (all vice presidents or higher) from B2C companies across 14 global markets.

- Braze customer data: Our research includes data aggregated from over 8.5 billion global users from our leading customer engagement platform that powers experiences between consumers and 1,700+ brands in 60+ countries.

- Braze customer interviews: For in-depth learnings, we spoke with top brands in five industries across three regions.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.