The State of Customer Engagement in LATAM in 2024

Published on April 15, 2024/Last edited on April 15, 2024/6 min read

Team Braze

The 2024 Global Customer Engagement Review is here. This study reveals three major trends that are shaping how brands and customers interact across the world. As part of our analysis, we also explored what’s happening at the regional level in Latin America (LATAM), Asia-Pacific (APAC), and Europe, the Middle East, and Africa (EMEA).

Here we’ll share an updated view on the state of customer engagement in LATAM, based on our analysis of two countries in the region: Brazil and Mexico.

The State of Customer Engagement in LATAM in 2024: 3 Key Takeaways

LATAM brands are innovating with AI, with artificial intelligence for customer engagement achieving full adoption in the region. While most Latin American companies had a successful year in 2023, the outlook for marketing budgets isn’t as bright as in other parts of the globe. And as brands look to prioritize in 2024, we see two key areas where LATAM marketers are struggling—namely, having insufficient technology to execute on their creative ideas and having to spend too much time executing routine tasks, cutting into other opportunities.

1. Using AI for marketing is the norm in LATAM

All of the marketers we surveyed in the region (100%) say they are using or plan to use AI for marketing and the vast majority (82%) say they favor AI “because it can help automate routine tasks and free up more time for creative thinking.”

Some of the main use cases for LATAM marketers include leveraging AI to generate creative ideas (51%), unlock predictive insights (49%), and automate repetitive tasks (48%).

2. Most Latin American businesses exceeded their revenue goals, but their marketing budgets are less certain than in other regions

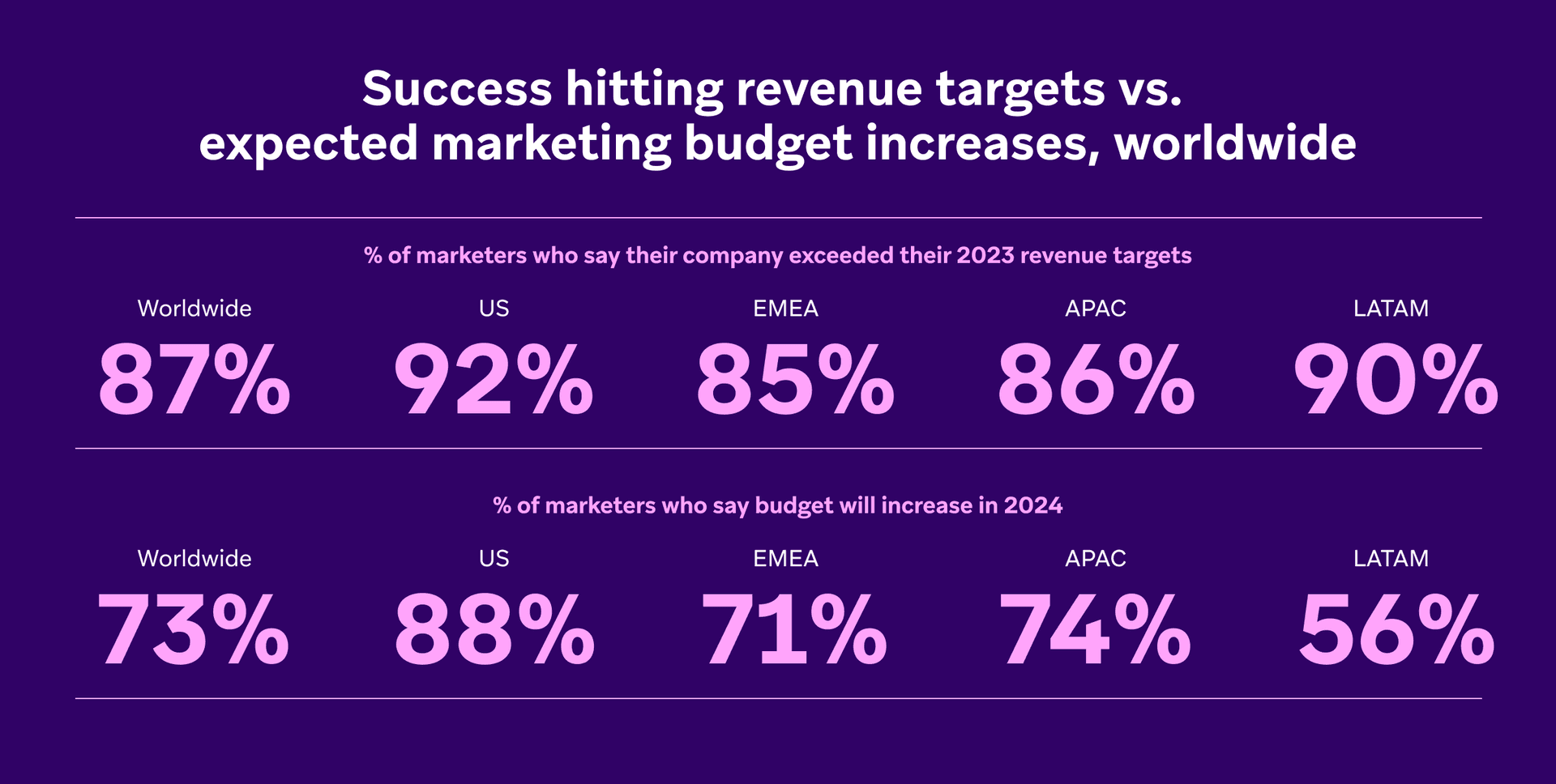

An impressive 90% of LATAM marketers say their companies exceeded their revenue goals over the past 12 months. That’s higher than the global average (87%) and second only to the US (92%).

Still, there’s less optimism in the region when it comes to marketing budgets. Only 57% of marketers believe their team’s funds will increase in 2024. Meanwhile 73% of our worldwide survey participants expect their financial resources to grow in size this year, a difference of nearly twenty points.

3. Compared to marketers in other regions, LATAM teams lack the technology to execute their creative ideas and are spending too much time on business-as-usual tasks

Latin American marketing teams say their biggest creativity and strategic blockers are not having the technology necessary for deploying their creative ideas (47%) and having to spend too much time on routine tasks and execution (45%). With nearly half of professionals in the region struggling with these issues, the finding highlights the widespread nature of these concerns and their broad potential impact on strategy and creativity in customer engagement.

Areas Where LATAM Brands Excel—and Areas for Improvement

In 2021, we introduced The Braze Customer Engagement Index, offering brands across the globe a shared framework for measuring customer engagement performance. The Index includes a ranking system with three levels of maturity based on how companies, industries, countries, or regions score across 12 key factors, including channels used for customer engagement, metrics for evaluating success, experimentation approaches, overall strategy, and more.

- Activate: brands are those just getting started in customer engagement.

- Accelerate: companies are notable for collaborating, experimenting, and employing data-driven strategies.

- Ace: organizations are at the top of their field for utilizing streaming data to power full-fledged lifecycle-driven customer engagement approaches.

Areas Where LATAM Brands Excel

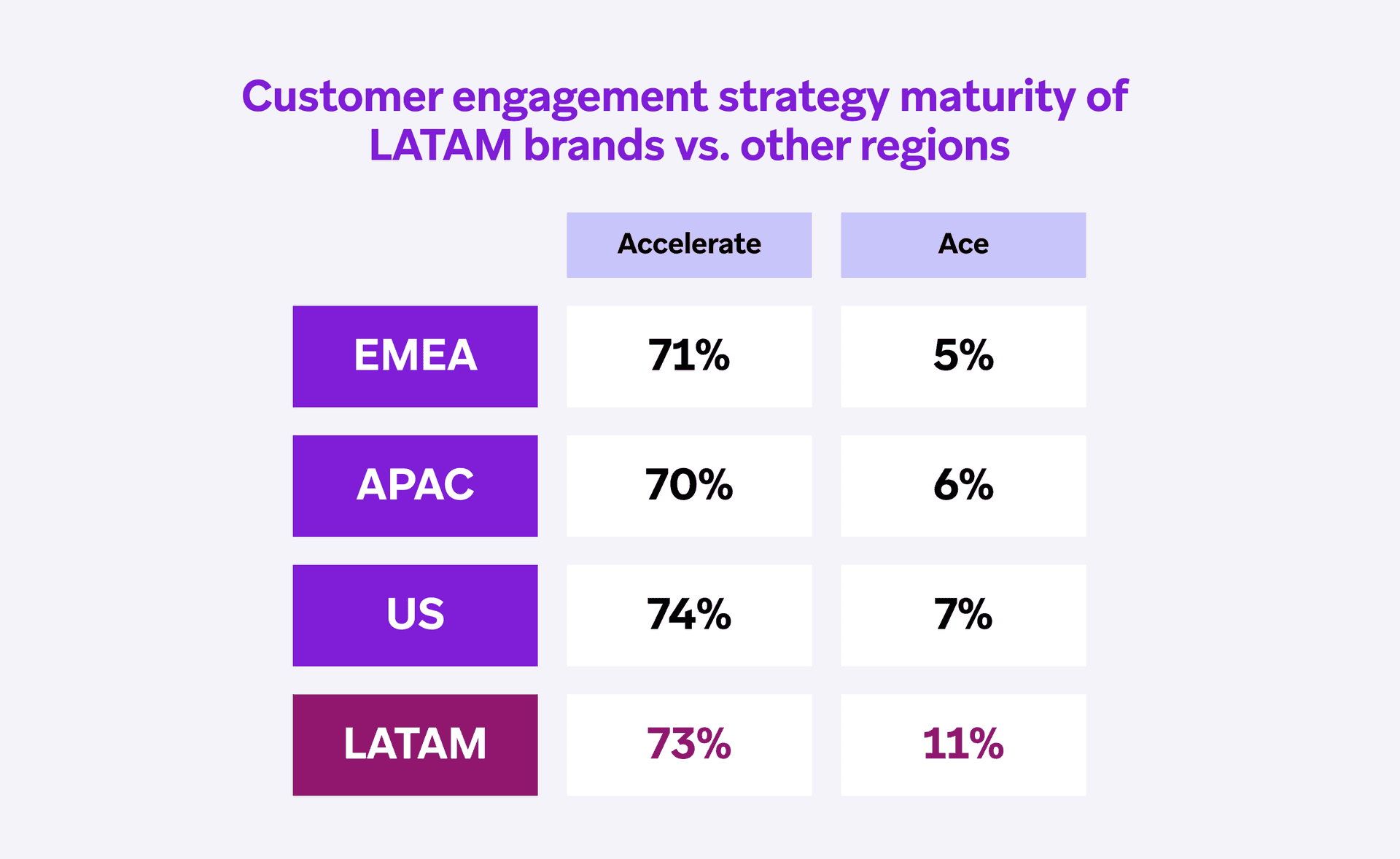

Latin American companies lead the rest of the globe with their advanced customer engagement strategies. A sizable 11% of brands in the region have achieved the highest levels of maturity, reporting that they focus on both customer engagement and downstream metrics and map their customer behavior and sentiment to their product, brand, and creative strategy. To put this into context, only 6% of brands across the world are taking these steps.

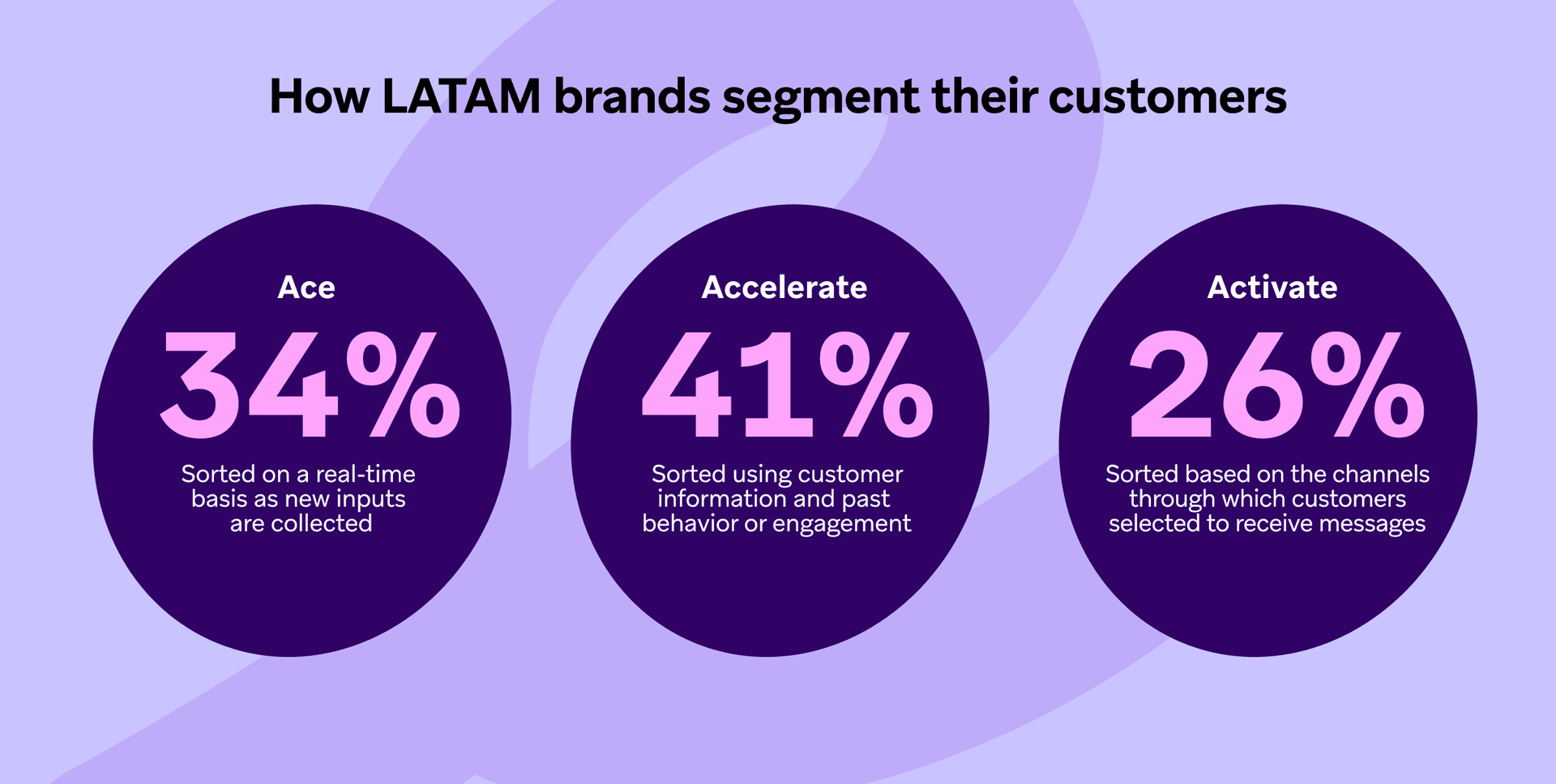

Brands in Latin America are also more likely to be using mid-level to sophisticated segmentation strategies compared to marketers in other countries—75% report doing so, compared to only 66% in EMEA, 68% in APAC, and 71% in the US.

Opportunities for Improvement for LATAM Brands

Currently, companies in Latin America are underperforming compared to their peers in other regions across four key factors that determine customer engagement maturity. These include:

- The use of experimentation and testing

- Customer engagement execution

- Personalization

- Measurement of performance

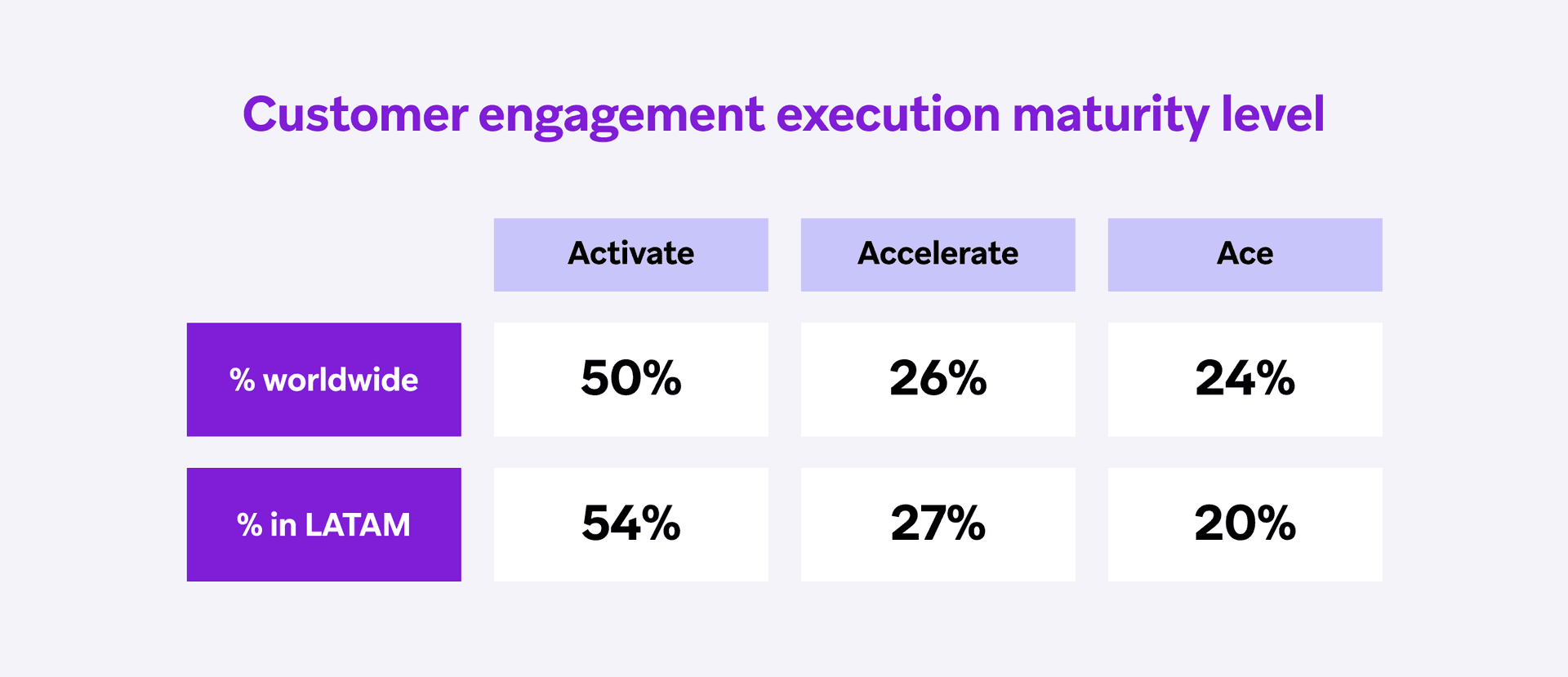

For experimentation, LATAM brands are more likely to say they don’t have a specific framework for testing and less likely to run continuous experimentation and A/B with multivariate testing than brands in other regions. As it relates to customer engagement execution, companies in Latin America are more likely to use channel-specific solutions and less likely to cohesively orchestrate efforts across campaigns, lifecycles, and channels.

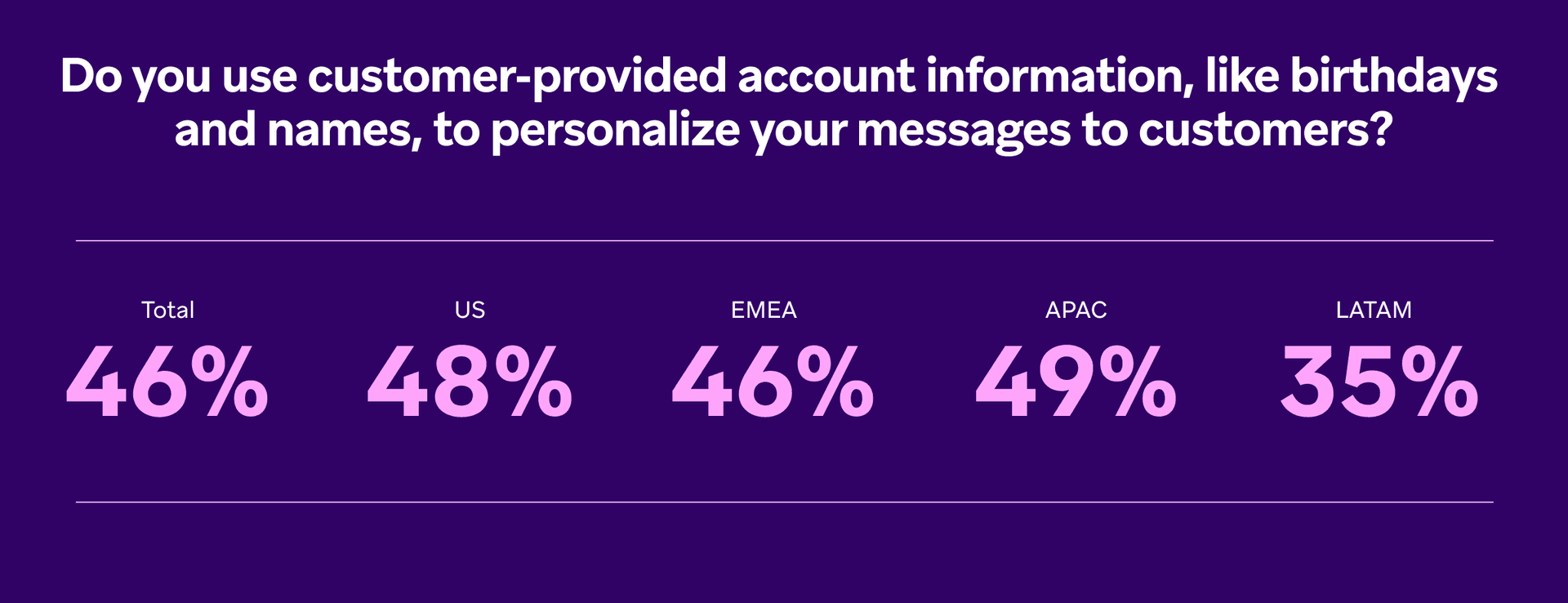

In terms of personalization tactics, marketers in this region are more likely to be at the beginner’s level and some low-hanging fruit for those who aren’t already doing so is to start with the basics. LATAM brands are less likely to use name-based personalization and leverage customer-provided account information, such as birthdays.

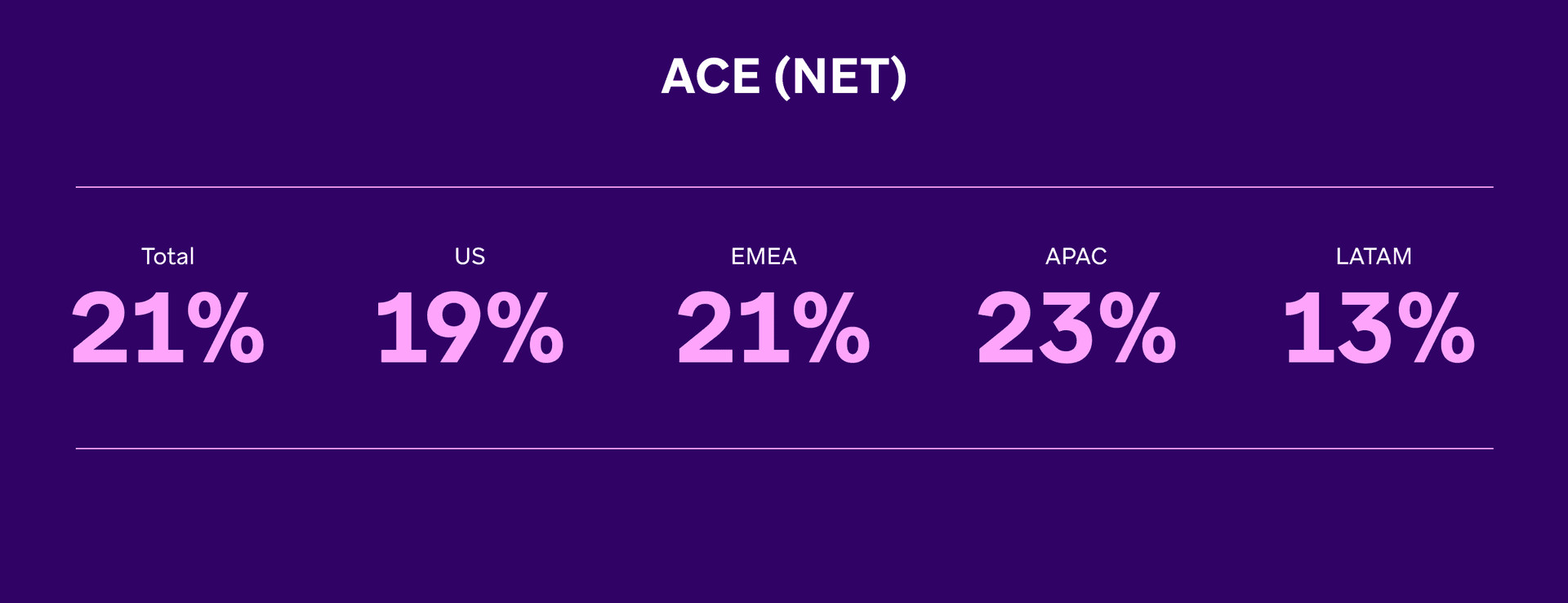

One area where marketers in the region have the greatest room for growth is in using advanced measurement practices. More than one in five brands globally have reached the “Ace” level for this factor, but in comparison, only 13% of Latin American companies report utilizing these more complex measurement approaches.

About the Study and the LATAM Countries Represented

These findings are part of our broader fourth-annual Global Customer Engagement Review, which draws on the following sources:

- Market research featuring 1,900 VP+ marketing decision-makers across 14 global countries in three global regions; Brazil and Mexico represented the LATAM region.

- An analysis of Braze’s proprietary data, including 9 billion global customers and 2,000+ brands in 50+ countries, via our leading customer engagement platform.

- In-depth interviews with marketing leaders from best-in-class brands in five industries across three regions.

Get the 2024 Global Customer Engagement Review

To learn more about the state of customer engagement across the world, get your copy of the complete 2024 Global Customer Engagement Review. Inside, you’ll get insights about the customer engagement programs and strategies of top-performing brands.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.