The State of Customer Engagement in EMEA in 2023

Published on May 02, 2023/Last edited on May 02, 2023/7 min read

Team Braze

Each year, Braze produces the Global Customer Engagement Review (CER), an in-depth report on the state of customer engagement across a spectrum of industries and regions. The CER showcases a comprehensive picture of customer engagement around the globe using a robust combination of sources, including:

- Market research featuring 1,500 VP+ marketing decision-makers across 14 global markets

- Analysis of the interactions between 8.5 billion global customers and 775+ brands via our leading customer engagement platform

- In-depth interviews with best-in-class brand leaders such as HBO Max, KFC, and Hugosave

Equipped with these insights, our analysis:

- Uncovers the latest best practices for building relationships with customers

- Reveals what successful marketers are getting right when it comes to customer engagement

- Offers guidance on how to elevate your strategy in today’s challenging market

Today, we’re going to take a look at key takeaways from our analysis of the state of customer engagement in Europe, the Middle East, and Africa (EMEA) in 2023. We’ll walk through how brands can advance their customer engagement strategy to drive activation, engagement, and monetization when it comes to EMEA customers.

The State of Customer Engagement in EMEA in 2022: 3 Key Takeaways

Our survey identified three key areas of focus when it came to customer engagement for EMEA brands: Customer retention, data challenges, and silos. Let’s explore them further below.

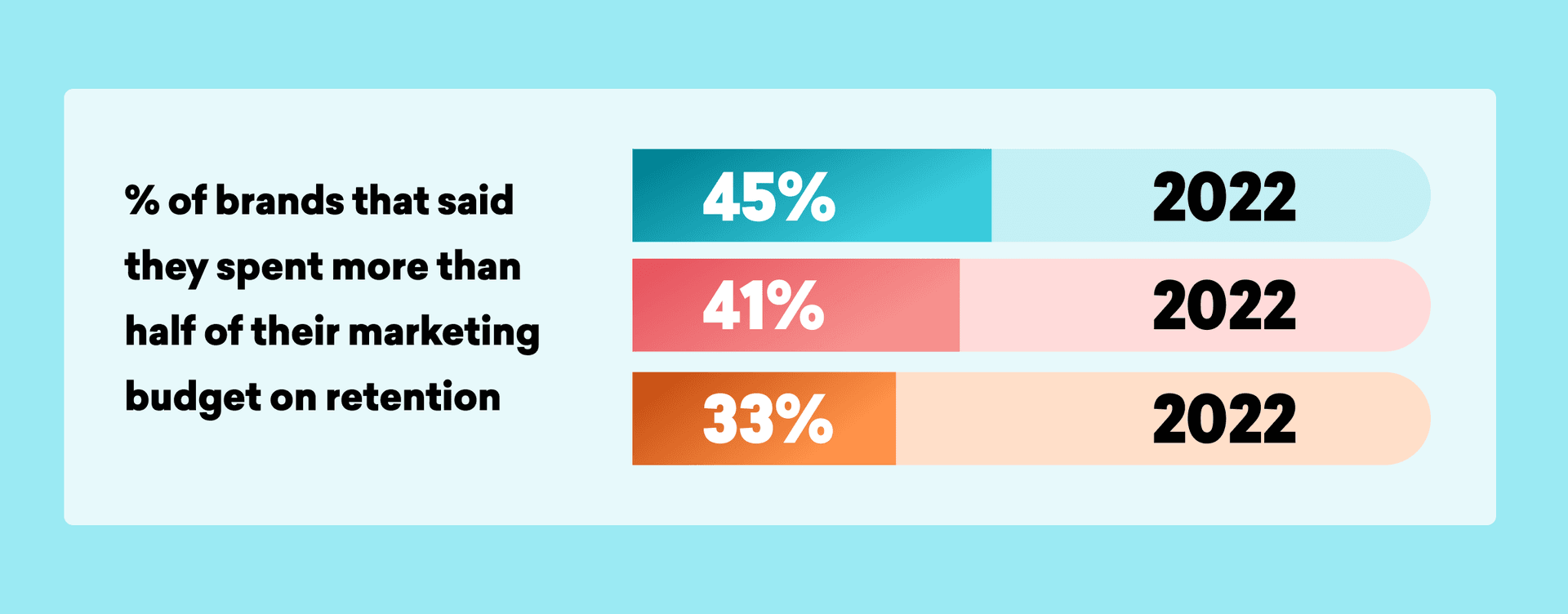

1. Brands are increasing their focus on retention

In the face of economic instability, brands are investing more of their marketing budget year over year in connection with retaining existing customers versus reaching new ones. Increasing customer acquisition costs and challenging macroeconomic conditions have made customer retention a more attractive strategy and research done by Frederick Reichheld of Bain & Company (the inventor of the net promoter score) shows increasing customer retention rates by 5% can increase profits by more than 25%.

2. Data management remains a big challenge.

Data tops the challenges that EMEA brands face when it comes to implementing their customer engagement strategy. Asked to select their top challenges—from a list including data, collaboration, internal skills and more—41% of EMEA brands listed “collecting, integrating, managing, and accessing marketing data,” compared to the global average of 36%. When brands lack a thoughtful data management strategy, they often find they cannot gather or act on real-time insights and then struggle to turn them into revenue-driving consumer experiences.

When asked specifically about data challenges, the following emerged as EMEA brands’ top challenges:

- Working with internal data scientists/business intelligence teams who don’t understand marketing priorities - 46%

- Data quality - 40%

- Skepticism from leadership or employees on the value of data - 39%

3. Siloed teams are a barrier to progress

Customer engagement today is an interdisciplinary sport and those who make a point of thoughtfully combining marketing know-how with technical expertise will be better positioned to succeed. However, against a backdrop of evolving team roles and a maturing digital landscape, EMEA brands still need to break down silos and collaborate more effectively if they are to deliver consistent customer experiences that significantly boost revenue.

Areas Where EMEA Brands Excel—and Areas for Improvement

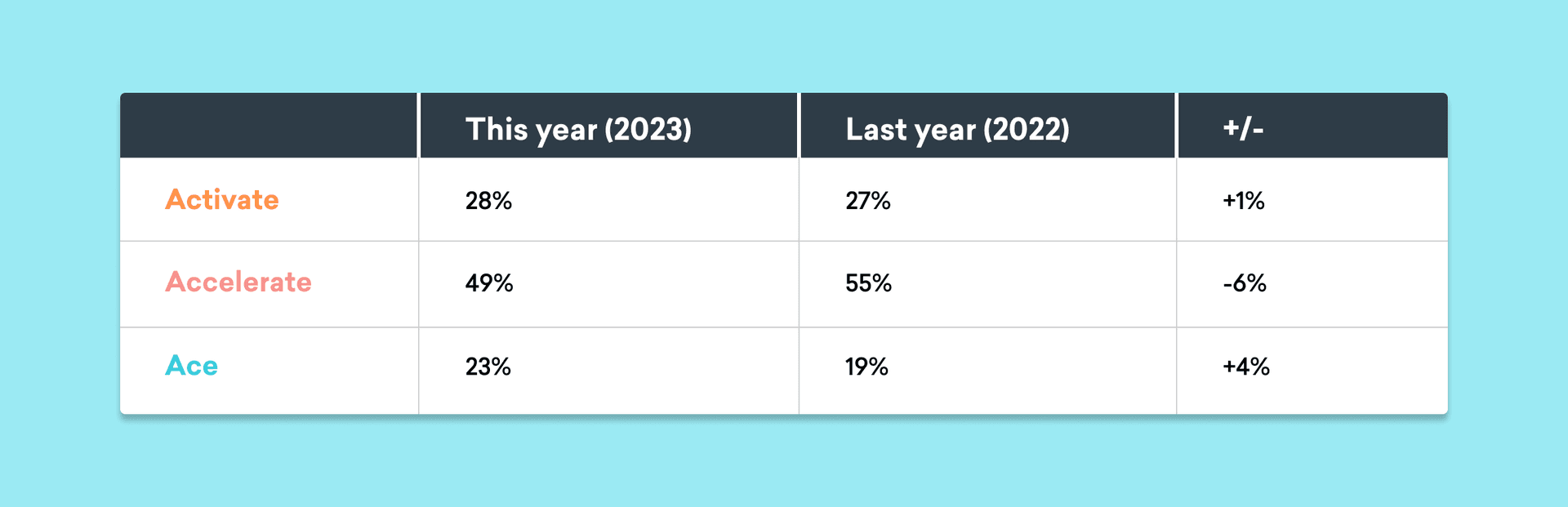

In 2021, we introduced The Braze Customer Engagement Index, offering brands across the globe a shared framework for measuring customer engagement. The Index includes a ranking system with three levels of maturity.

- Activate brands are those just getting started in customer engagement.

- Accelerate companies are notable for collaborating, experimenting, and employing data-driven strategies.

- Ace organizations are at the top of their field for utilizing streaming data to power full-fledged lifecycle-driven customer engagement approaches.

Since last year, the proportion of EMEA businesses at each level has shifted, with more brands achieving Ace level than in 2022.

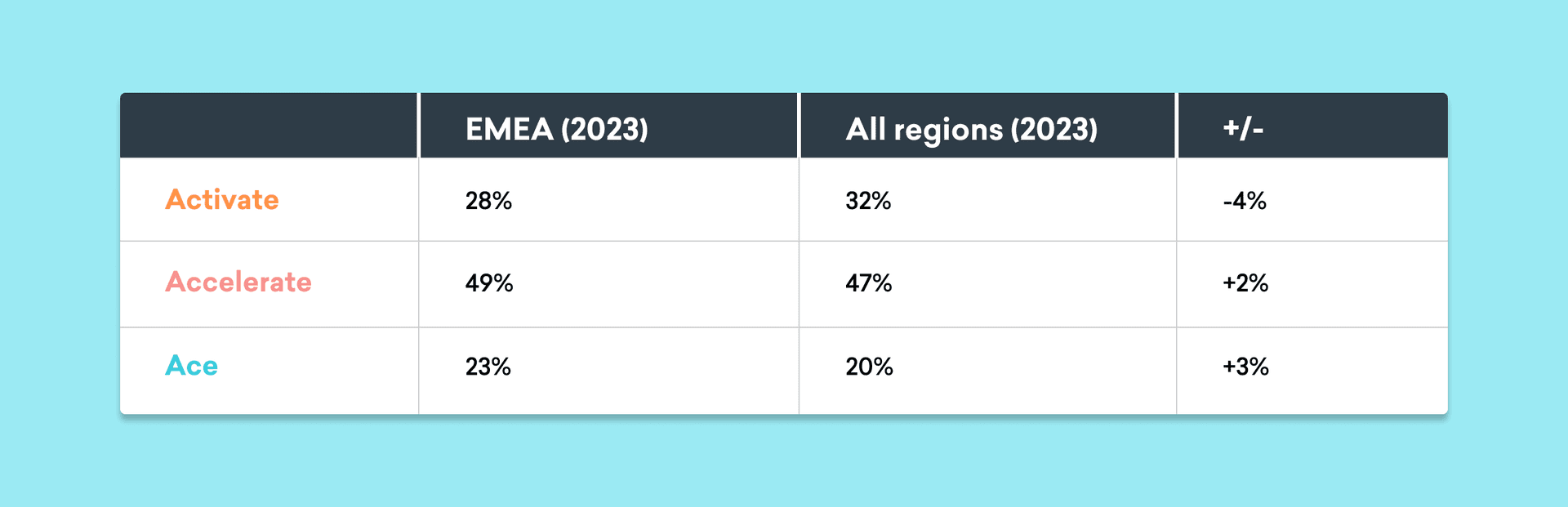

These figures show positive progress from EMEA brands over the last twelve months. They also position the EMEA favorably compared to other regions surveyed, with more brands appearing in the top two levels (Ace and Accelerate) when compared to the global average for all regions.

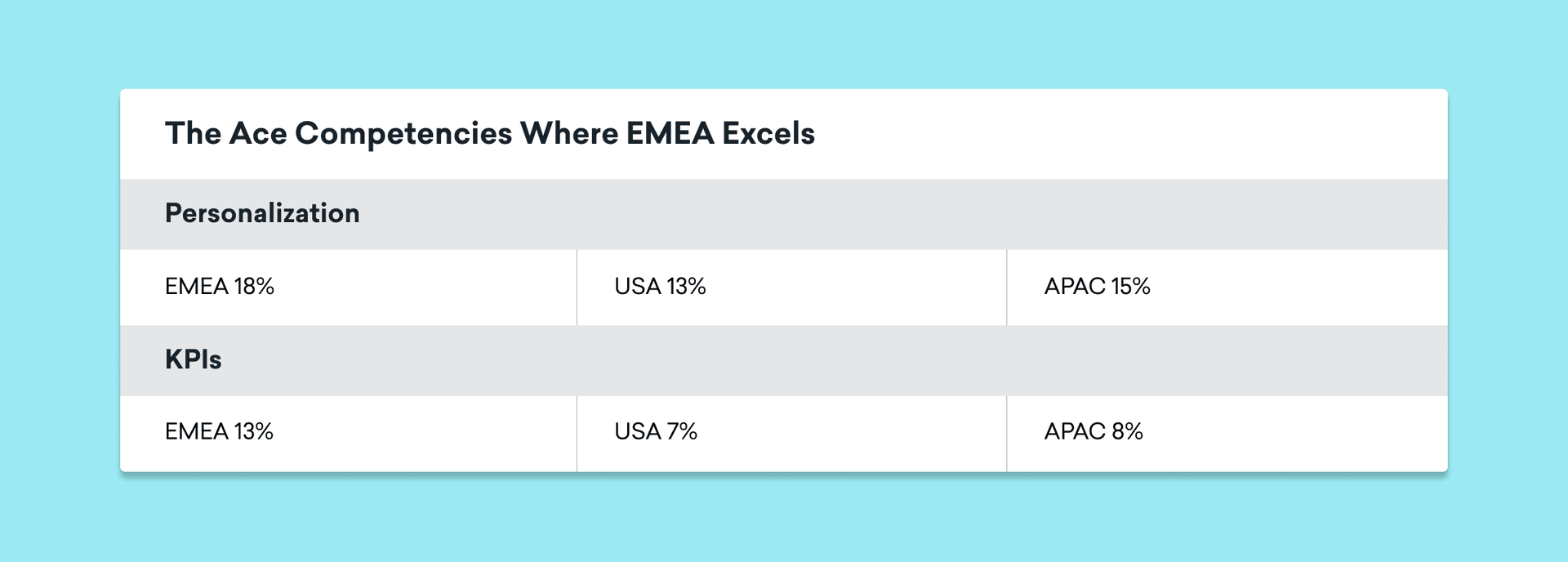

Areas Where EMEA Brands Excel

Personalization

EMEA brands are more likely to use real-time engagement—like browsing behavior, clicks, and views—to personalize interactions with customers (48% in EMEA, compared to the global average of 45%). They’re also more likely to deploy send-time optimization that determines the best time and cadence to send messages (46%, compared to the global average of 41%).

It’s encouraging to see EMEA brands’ progress when it comes to personalization, since this focus area was flagged in last year’s CER report as an area for improvement. Using live data and optimizing send time allows EMEA brands to engage customers in a timely way when they’re known to be most responsive, making conversion more likely.

Measurement/KPIs

Businesses in the EMEA region also outperform the global average for customer engagement measurement. EMEA brands use a wide range of KPIs to measure their success, with more EMEA brands measuring customer retention and customer lifetime value (LTV) than global averages—two key indicators of successful engagement and strong foundations for sustainable revenue growth.

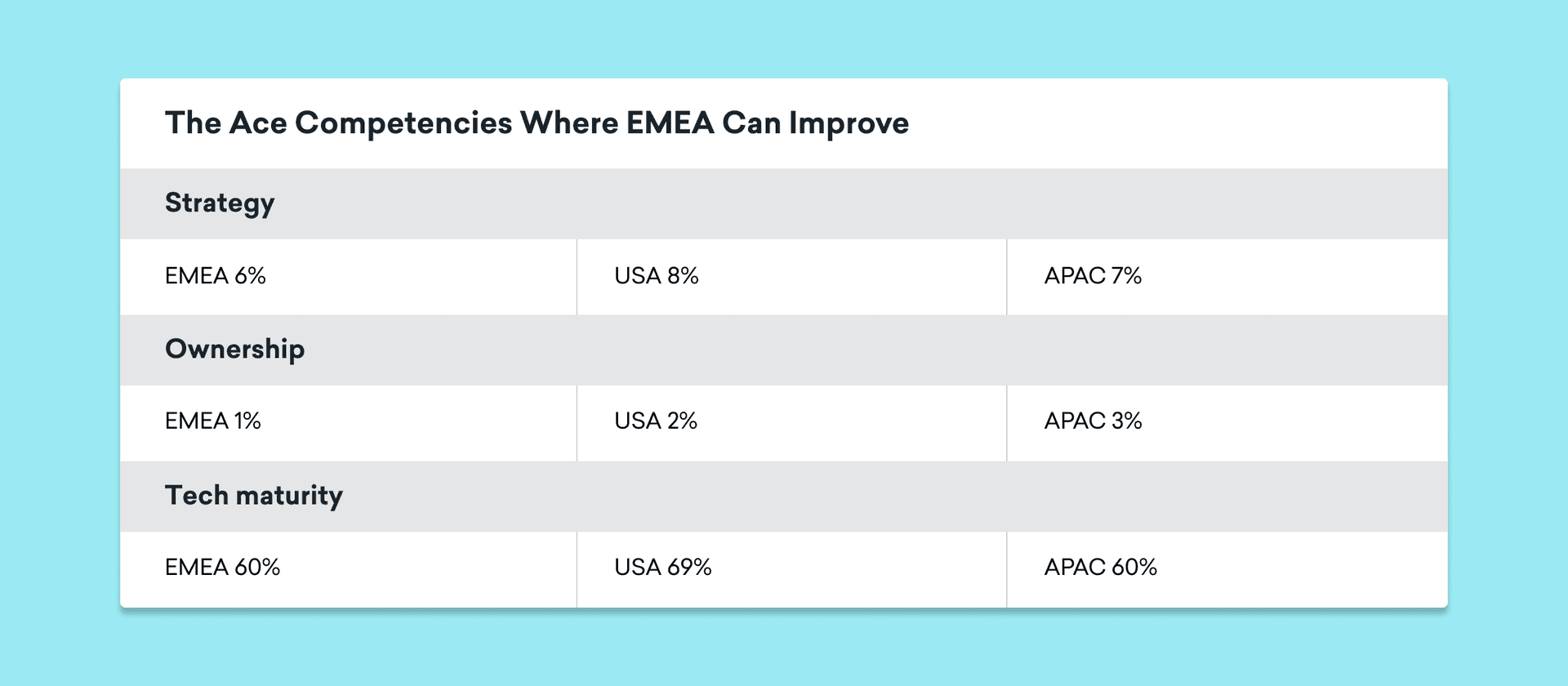

Opportunities for Improvement for EMEA Brands

EMEA brands mirror global trends in terms of strategy and ownership, where every region has room for improvement when it comes to “Ace” behaviors.

Strategy

Globally, around a quarter of brands are at the “Activate” level for strategy, aiming to drive lift on high-level engagement metrics like message open rates and click-through rates.

The majority are at the “Accelerate” level, combining engagement metrics with downstream metrics such as monetization and retention/loyalty.

But few achieve the “Ace” level, which requires these metrics, as well as customer behavior and sentiment mapping, to be applied to product strategy.

Ownership

Ownership also has room for improvement globally, but particularly in the EMEA region, and the best practice is for customer engagement to be owned by a cross-functional team. That’s because bringing together different customer-facing teams and internal expertise (such as marketing and data analysis) is the optimal way to deliver innovative, effective engagement across every touchpoint. However, customer engagement is still mostly owned by the marketing team in the majority of EMEA businesses, requiring them to increase their internal stakeholder engagement if they are to reap the full benefits associated with cross-functionality.

Technology

There is also room for EMEA brands to improve their use of technology to support customer engagement activities. In fact, both EMEA and US regions lag behind the APAC when it comes to overall tech maturity.

32% of EMEA brands achieve our “Ace” level for technology. This means using a single solution that automatically optimizes engagement at a customer level, rather than different solutions for each channel.

About the Study and the EMEA Countries Represented

The findings covered here are the result of our broader third annual Global Customer Engagement Review, an analysis that draws insights from the following key data sources.

Decision-Maker Survey

Conducted by Wakefield Research on behalf of Braze, this survey gathered insights from 1,500 VP+ marketing decision-makers across 14 global markets to uncover year-over-year changes, new trends, and the impact of customer engagement on revenue.

Markets covered: Australia, France, Germany, Indonesia, Japan, the Philippines, Singapore, Spain, South Korea, Sweden, Thailand, UAE/Dubai, the UK, and the USA.

Braze Customer Data

As a leading customer engagement platform that powers experiences between consumers and 775+ of our customers in 60+ countries, Braze has unique insight into the marketing and technology landscape.

Our research included data aggregated from over 8.5 billion global users to provide analysis for activation, monetization, retention, and purchasing trends, as well as to identify the common characteristics of brands that excel at customer engagement.

Customer Stories

To demonstrate the tangible success of best-in-class customer engagement strategies, we spoke with leading brands in five industries and across three regions, including the EMEA.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article4 min read

Article4 min readBuilding spaces for connection: Inside our Bucharest office

March 05, 2026 Article7 min read

Article7 min readData agility at a massive scale: How the Braze Data Platform supports customer engagement

March 04, 2026 Article13 min read

Article13 min readAI customer retention: Strategies, tactics, and mistakes to avoid

March 04, 2026