The State of Customer Engagement in APAC in 2024

Published on March 27, 2024/Last edited on March 27, 2024/5 min read

Team Braze

Each year, Braze publishes the Global Customer Engagement Review (CER), a comprehensive report on the state of customer engagement across industries and regions. As part of this year's fourth edition of our CER, we unveiled three major worldwide customer engagement trends for 2024. When conducting this research, and analyzing the findings, we also uncovered critical insights for the Asia-Pacific (APAC) region, Latin America (LATAM), and the Europe, Middle East, and Africa (EMEA) market.

Here we’ll look at key takeaways from our analysis of the state of customer engagement in APAC in 2024, based on our study of six countries in the region: Australia, Indonesia, Japan, New Zealand, Singapore, and South Korea.

The State of Customer Engagement in APAC in 2024: 3 Key Takeaways

Our survey identified three areas of focus related to customer engagement in APAC. Let’s take a look.

1. Technical maturity is an area of strength for APAC brands

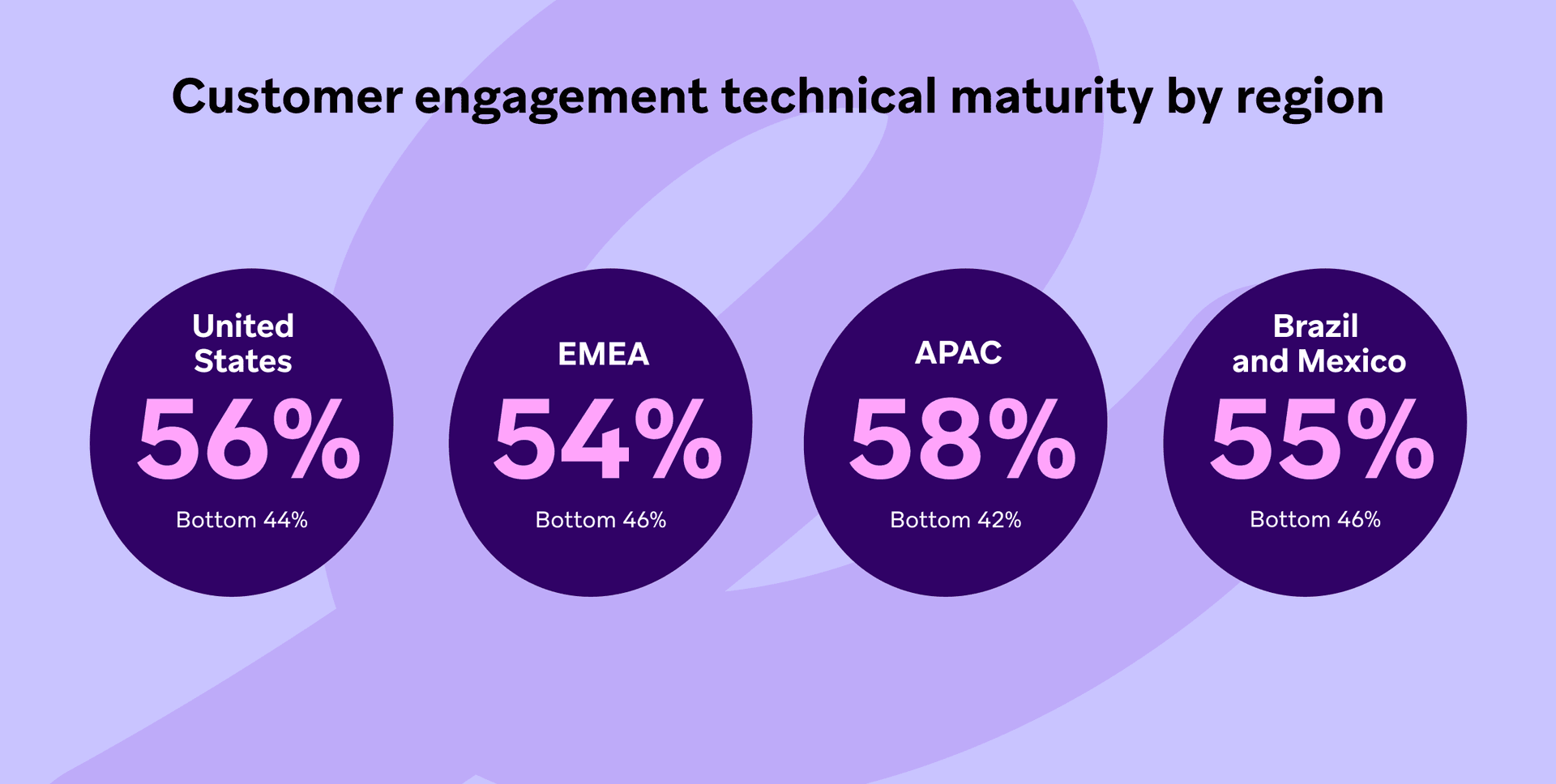

A greater share (58%) of surveyed companies earn top scores for technical maturity, compared with 56% of surveyed US brands, 55% of surveyed LATAM brands, and 54% of surveyed EMEA brands.

As we’ll explore in more depth below, APAC businesses are among the most advanced for testing and experimentation and evaluating performance.

2. APAC brands have achieved a balance between investing in retention and acquisition, and it appears to be paying off

The share of respondent APAC companies that say they’re allocating 51% or more of their budget toward reaching new customers (45%) is similar to the portion that say they’re focusing the majority of their investments on customer retention (43%). Organizations’ efforts appear to be working, as 86% of brands in the region report that they exceeded their revenue goals over the past 12 months, and 74% say that they expect their overall marketing budgets to increase over the next 12 months.

3. AI is top of mind for customer engagement teams in APAC

Almost all surveyed APAC brands are using AI for marketing (99%) and more than three-quarters (76%) of our research participants in the region say that they favor AI “because it can help automate routine tasks and free up more time for creative thinking.”

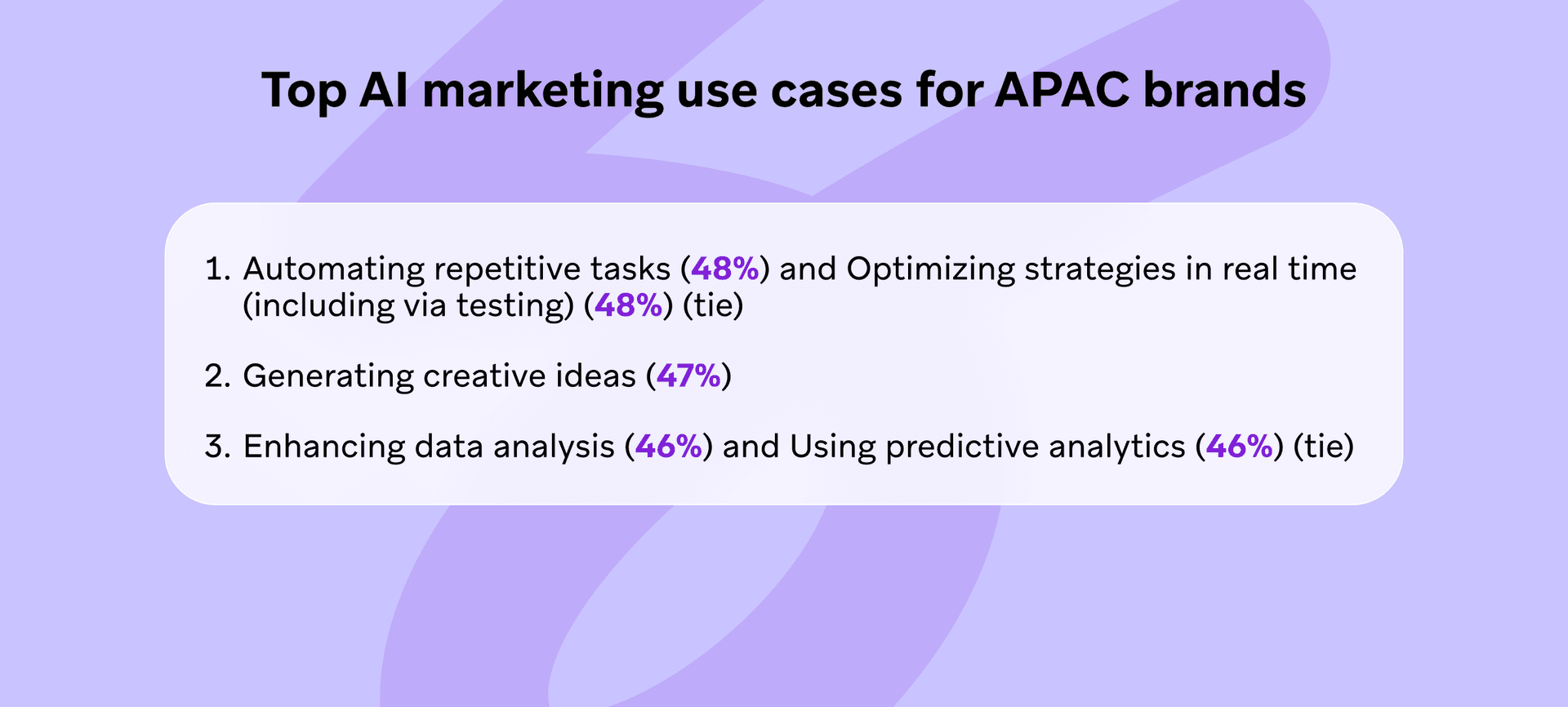

That’s one of the ways organizations are already using—or are planning to use AI. The top use cases surveyed APAC brands are pursuing include: Leveraging AI to automate repetitive tasks (48%) and optimizing strategies in real time (including via testing) (48%) [tie], generating creative ideas (47%), and enhancing data analysis (46%) and using predictive analytics (46%) (tie).

Areas Where APAC Brands Excel—and Areas for Improvement

In 2021, we introduced The Braze Customer Engagement Index, offering brands across the globe a shared framework for measuring customer engagement performance. The Index includes a ranking system with three levels of maturity based on how companies, industries, countries, or regions score across 12 key factors, including channels used for customer engagement, metrics for evaluating success, experimentation approaches, overall strategy, and more.

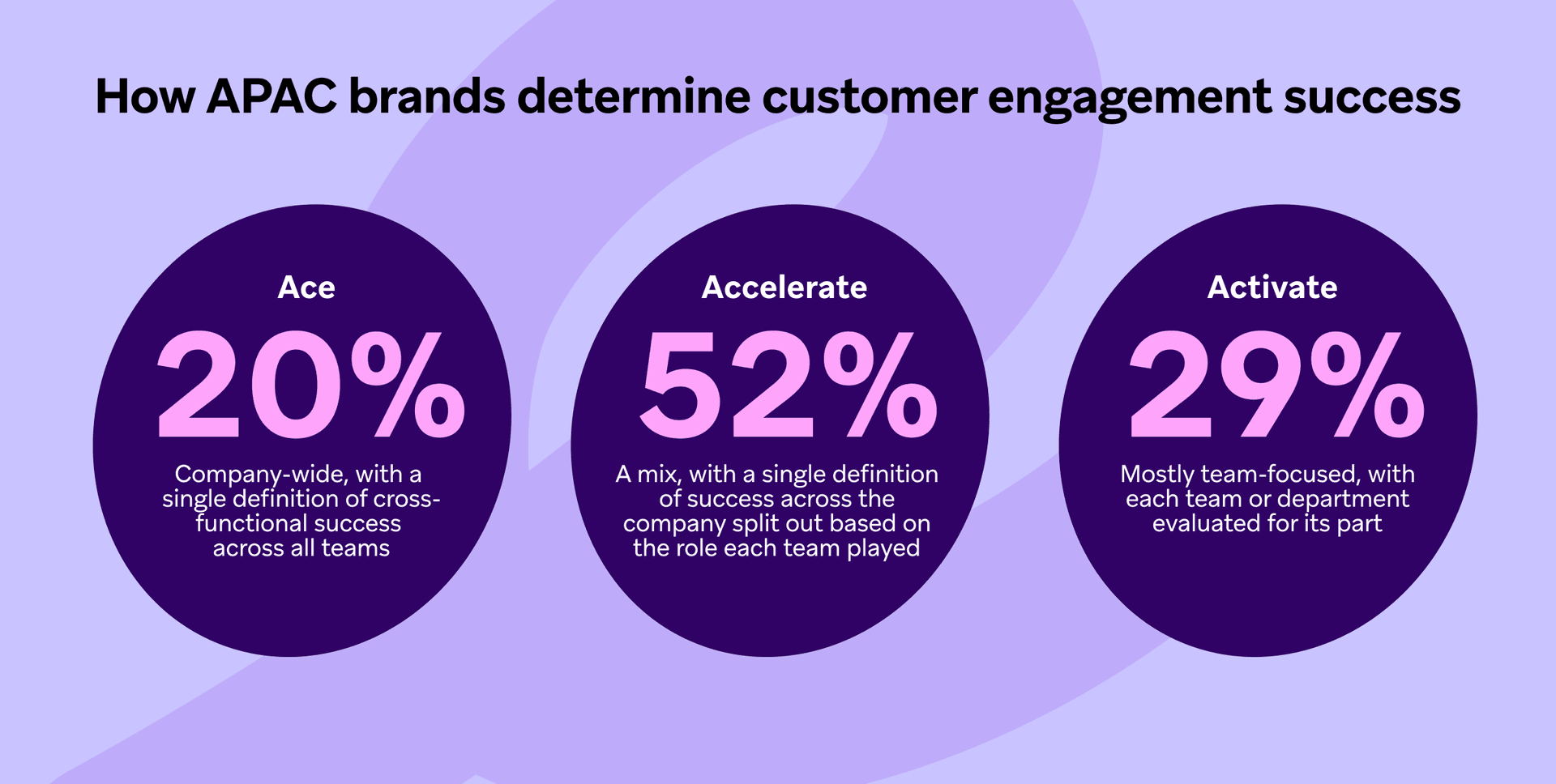

- Activate brands are those just getting started in customer engagement.

- Accelerate companies are notable for collaborating, experimenting, and employing data-driven strategies.

- Ace organizations are at the top of their field for utilizing streaming data to power full-fledged lifecycle-driven customer engagement approaches.

Areas Where APAC Brands Excel

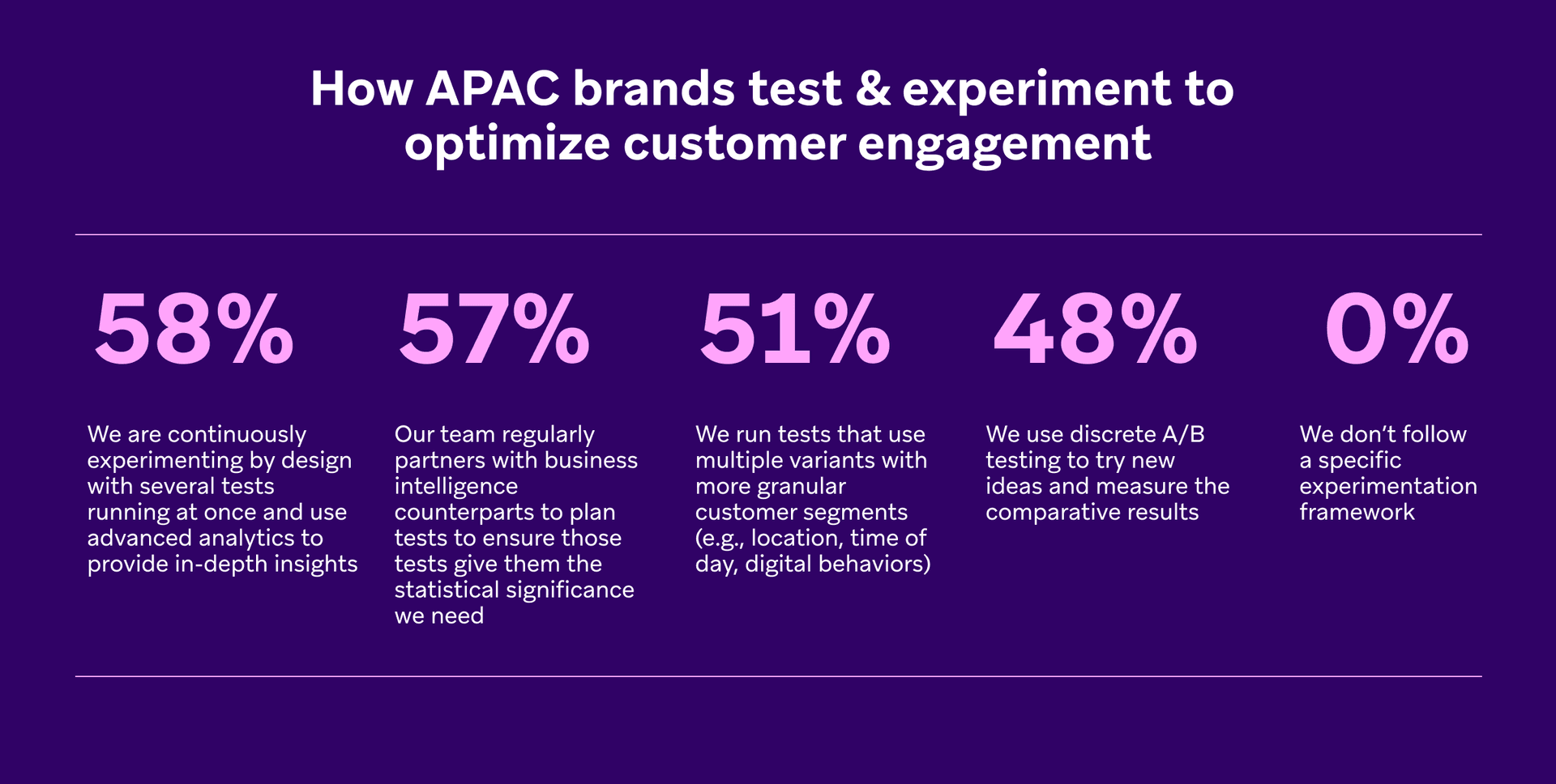

Surveyed APAC brands outperform surveyed companies based in the US and Latin America (LATAM) when it comes to testing and experimentation—87% of APAC have advanced beyond the “Activate” stage to the “Accelerate” and “Ace” levels, compared to only 84% in LATAM and 85% in the US.

A greater share of surveyed APAC brands are pushing the bounds of measuring customer engagement success compared to surveyed brands in every other region and the global benchmark. In APAC countries, 72% of surveyed brands are operating at the “Accelerate” and “Ace” levels for creating a shared definition of success and holding teams accountable to achieving the same goals, compared with only 67% of surveyed EMEA brands, 69% of surveyed LATAM brands, and 70% of surveyed US brands.

One Opportunity for Improvement for APAC Brands

While APAC brands are either operating on par with or ahead of companies based in other regions across many of the 12 factors that influence customer engagement performance, we’ve identified one key area for growth.

APAC businesses lag behind those in the US and LATAM in terms of the level of maturity of their customer engagement strategies. Fewer organizations in the region are focused on combining engagement metrics with downstream metrics as well as on mapping customer behavior and customer sentiment and applying it to product strategy and brand/creative strategy to realize the true potential of customer engagement. Only 6% of surveyed APAC brands report being at this “Ace” level of commitment, compared to 7% of surveyed US brands and 11% of surveyed LATAM brands.

About the Study and the APAC Countries Represented

These findings are part of our broader fourth-annual Global Customer Engagement Review, which draws on the following sources:

- Market research featuring 1,900 VP+ marketing decision-makers across 14 global countries in three global regions; Australia, Indonesia, Japan, New Zealand, Singapore, and South Korea represented the APAC region.

- An analysis of Braze’s proprietary data, including 9 billion global customers and 2,000+ brands in 50+ countries, via our leading customer engagement platform.

- In-depth interviews with marketing leaders from best-in-class brands in five industries across three regions.

Get the 2024 Global Customer Engagement Review

To learn more about the state of customer engagement across the world, get your copy of the complete 2024 Global Customer Engagement Review. Inside, you’ll get insights about the customer engagement programs and strategies of top-performing brands.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article16 min read

Article16 min readChoosing the best AI decisioning platforms for 2026 (across industries)

February 12, 2026 Article3 min read

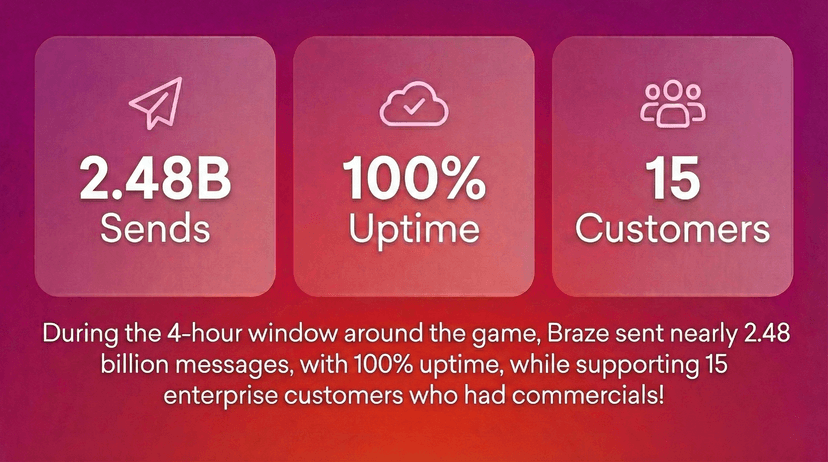

Article3 min read2.4+ billion sends, zero fumbles: How Braze supports leading brands during the big game

February 09, 2026 Article4 min read

Article4 min readBeyond Predictions: Why Your Personalization Strategy Needs an AI Decisioning Agent

February 09, 2026