The State of Customer Engagement for QSR and Delivery Brands in 2023

Published on May 08, 2023/Last edited on May 08, 2023/6 min read

Team Braze

Find out the top customer engagement strategies and priorities for QSR and delivery brands, according to the 2023 Global Customer Engagement Review.

The results of our third-annual Global Customer Engagement Review are here, revealing insights about how brands across industries and all over the world are evolving their customer engagement strategies. Here are the key takeaways from the 2023 Global Customer Engagement Review specifically for QSR and delivery brands, including top priorities for the year and new findings about the most effective strategies for driving customer engagement, monetization, and retention.

To Compete, QSR and Delivery Brands Need to Stay at the Forefront of Customer Engagement

QSR and delivery industry leaders are known for their ability to leverage the latest technology to produce world-class loyalty programs that keep customers coming back and thoughtful, inventive customer engagement campaigns that incentivize users to take high-value actions, such as downloading the company’s mobile app or creating user-generated social media content.

In recent years, QSR players have taken things to the next level by anticipating individual customers’ needs (or cravings) and satisfying them on demand in personalized ways. Adopting zero-party data ahead of other industries has helped fuel this latest wave of innovation, and is an area where QSR and delivery brands will need to double down on in the year ahead.

Top Strategies for Improving Customer Engagement for QSR and Delivery Brands in 2023

For this year’s Customer Engagement Review, Braze researchers studied the user engagement activity of billions of consumer profiles for over 775 global businesses across the US, APAC, and EMEA to find out what factors drive user activity, message engagement, and purchasing behavior. We also looked at what sets “Ace” QSR and delivery brands apart from the rest to determine what teams can do to improve customer engagement, monetization, and retention results.

Ace brands claim the top spot in The Braze Customer Engagement Index—a proprietary framework used to evaluate customer engagement maturity based on the use of core strategies and technologies. In 2022, these Ace QSR and delivery brands saw a:

- 122% higher buyer rate than non-Ace brands

- 53% higher repeat buyer rate than non-Ace brands

- 36% higher user lifetime than non-Ace brands

#1: Leveraging cross-channel customer engagement and hybrid messaging

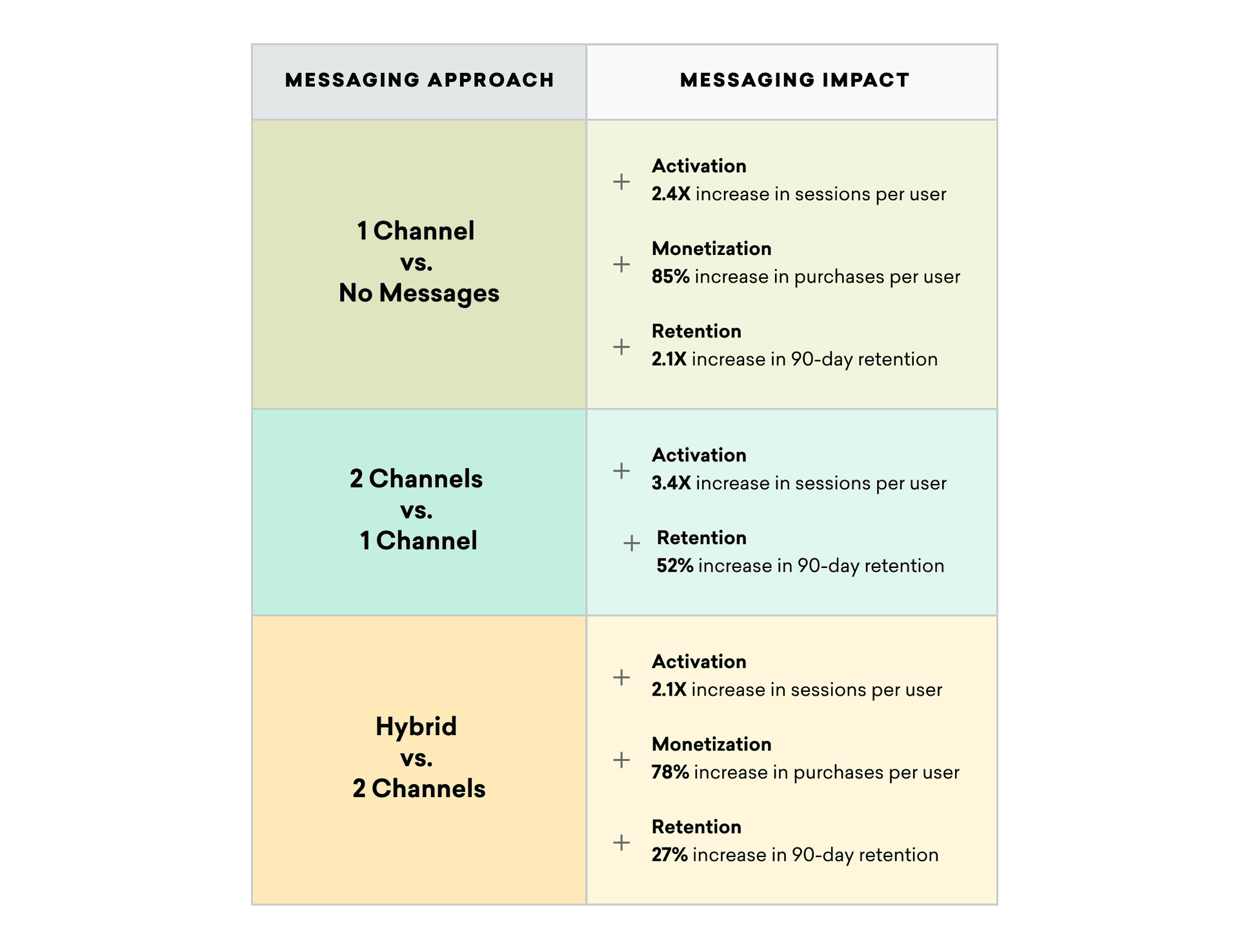

Cross-channel customer engagement paired with hybrid messaging (powered by using both in-product and out-of-product messaging) can allow QSR and delivery brands to increase sessions per user (activation), purchases per user (monetization), and 90-day retention.

#2: Utilizing the right combination of channels

According to the 2023 Customer Engagement Review, QSR and delivery brands can boost purchases per buyer by 3.7X using email marketing campaigns to engage subscribers, versus using no messaging at all.

Another noteworthy finding from this year’s study: One channel in particular stands out as an area of investment for QSR and delivery brands. Top-performing QSR and delivery companies are 139% more likely to use Content Cards to achieve results, suggesting that brands who aren’t leveraging this channel might well be missing out of something big.

#3: Automating campaign optimization leveraging data-based insights

Ace QSR and delivery brands are 164% more likely to automate campaign optimization with data-based insights, using technologies such as the Braze Intelligence Suite to do so.

#4: Using customer data to personalize marketing campaigns

Ace brands within the QSR and delivery space are 15% more likely to pull in information from customer’s user profiles to create and deploy personalized marketing campaigns. That suggests that this kind of message customization could play a key role in taking engagement to the next level.

Critical Priorities for QSR and Deliver Brands in 2023

As part of a Braze-commissioned Wakefield Research survey of 1,500 VP+ marketing decision-makers across 14 global markets, leaders from QSR and delivery brands told us these are their two biggest customer engagement concerns for this year.

#1: Managing data effectively to support customer engagement. Ace QSR and delivery brands have made the shift to using zero-party data faster than any other industry. That’s a move that’s helped them better learn from and engage with their users. That said, leveraging this data to deliver greater results is still a challenge for brands in this vertical.

#2: Determining the right teams and processes to execute marketing strategies. Once again, Ace QSR and delivery brands are achieving high marks compared to companies in other industries, this time when it comes to executing customer engagement strategies. However, these QSR and delivery brands have nonetheless identified this as a key challenge, particularly when it comes to finding the right people and processes to bring their marketing ideas to life.

The Top Three Customer Engagement Trends for 2023

After interviewing 1,500 marketing executives and analyzing billions of Braze customer engagement data points, we’ve identified three clear global trends that are currently shaping how brands approach their marketing strategies across industries all over the world. Want to know what these forces are and what they mean for your strategy? Get your copy of the complete 2023 Global Customer Engagement Review for all the details.

Methodology

For the analysis included in the 2023 Customer Engagement Review, Braze pulled anonymized and aggregated behavioral data from 775+ Braze customers across our US, APAC, and EU clusters to analyze app activity, message engagement, and purchasing trends by industry. These statistics span January 1, 2022 to December 31, 2022 and include data from over 8.5 billion user profiles and 53 sub-industries. Of this data, 80 Braze customers, over 800 million users and 2 sub-industries were deemed QSR and Delivery Brands for purposes of the discussion included herein.The raw data has been cleaned using volume and company count checks so that no one brand or group of brands is over-represented. For all purchase- and messaging-related stats, only brands tracking the relevant information have been included so as not to skew the analysis. All uplift figures greater than 100% are rounded to the nearest decimal point, and all uplift figures below 100% are rounded to the nearest whole percent. When comparing two rounded numbers, percent change metrics are calculated as the difference between the two numbers after rounding.

The Braze Ace Technology, Teams, and Business Impact metrics for QSR and Delivery Brands were measured by selecting the top 50th percentile of Braze customers compared to the full data set QSR and Delivery Brands based on buyer rate, repeat buyer rate, and message engagement for the period of January 1, 2022 to December 31, 2022.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article13 min read

Article13 min readBraze vs Salesforce: Which customer engagement platform is right for your business?

February 19, 2026 Article18 min read

Article18 min readBraze vs Adobe: Which customer engagement platform is right for your brand?

February 19, 2026 Article7 min read

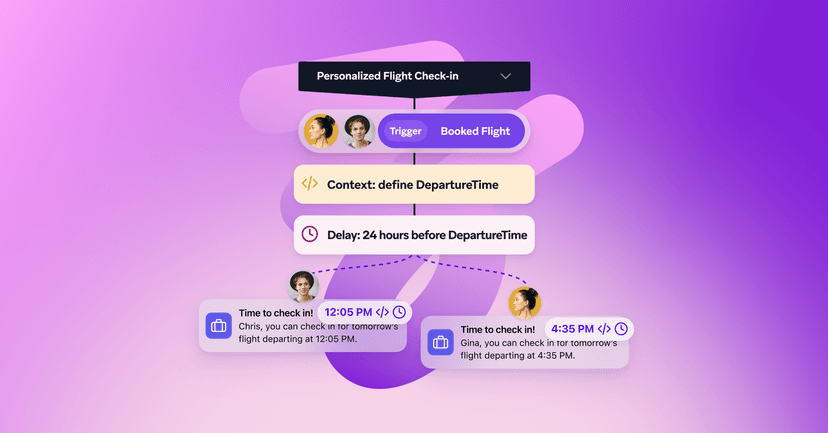

Article7 min readEvery journey needs the right (Canvas) Context

February 19, 2026