The 2021 State of Customer Engagement in Europe

Published on March 29, 2021/Last edited on March 29, 2021/4 min read

Mary Kearl

WriterCustomer engagement teams have long known the value of their relationship building efforts. Now, there's new research to back that up. The findings of our first ever Global Customer Engagement Review reveal how excelling at customer engagement can directly result in higher customer lifetime value and lower customer acquisition costs to ultimately drive long-term, capital efficient business growth.

Wakefield Research conducted this first annual study for Braze, surveying 1,300 VP+ marketing executives from B2C companies with an annual revenue of at least $10M across 10 markets globally (Australia, France, Germany, Indonesia, Japan, Malaysia, Singapore, Thailand, the UK, and the US). Within Europe, we had 400 companies represented, with 40% based in the UK, 35% based in Germany, and 25% based in France. The results of this study show not only the huge payoff that brands that invest in customer engagement can see, but also reveal where there are opportunities for improvement.

Here's a breakout of what we uncovered about the state of customer engagement specifically in Europe, and the areas in which European brands can catch up to their counterparts in Asia and North America.

1. Customer Engagement Lives Mostly Within One Department

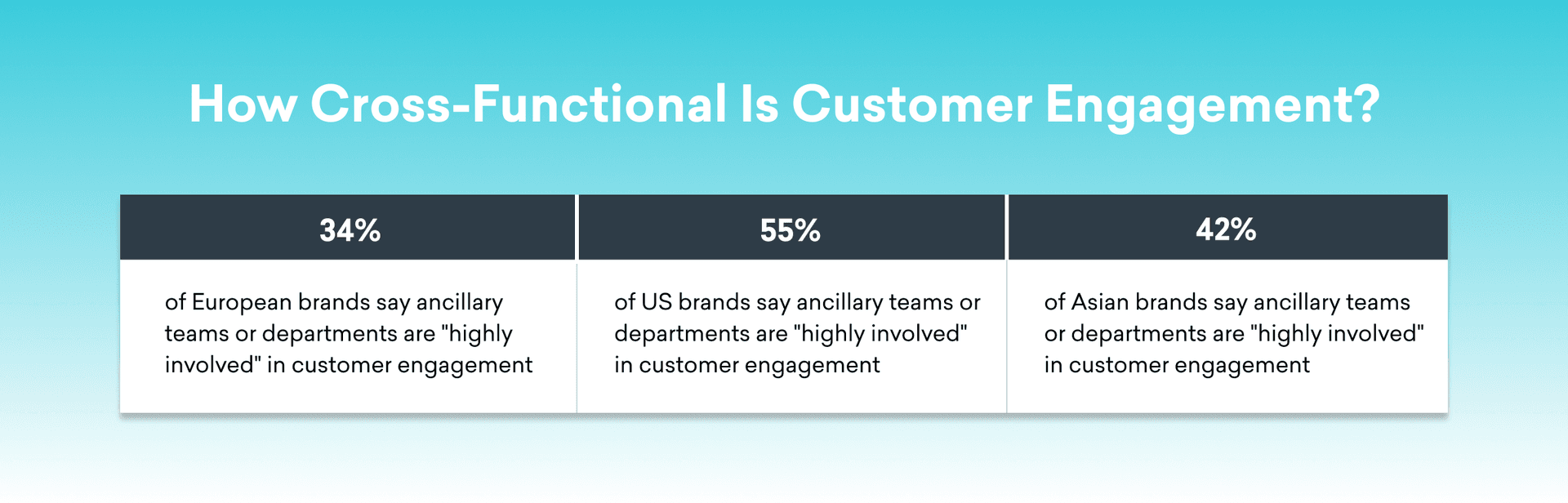

Cross-functional teamwork can help brands build authentic customer relationships, and for many companies that means marketing, data, product, engineering, and other groups coming together to optimize experiences for engagement. That's an area where European brands appear to lag behind, with only 34% of European companies reporting other departments being "highly involved" in customer engagement. This compared to just over half and just under half reporting other teams are "highly involved" in the US and Asia, respectively.

2. European Brands to Increase Their Marketing Budgets, but Not as Much as in Other Regions

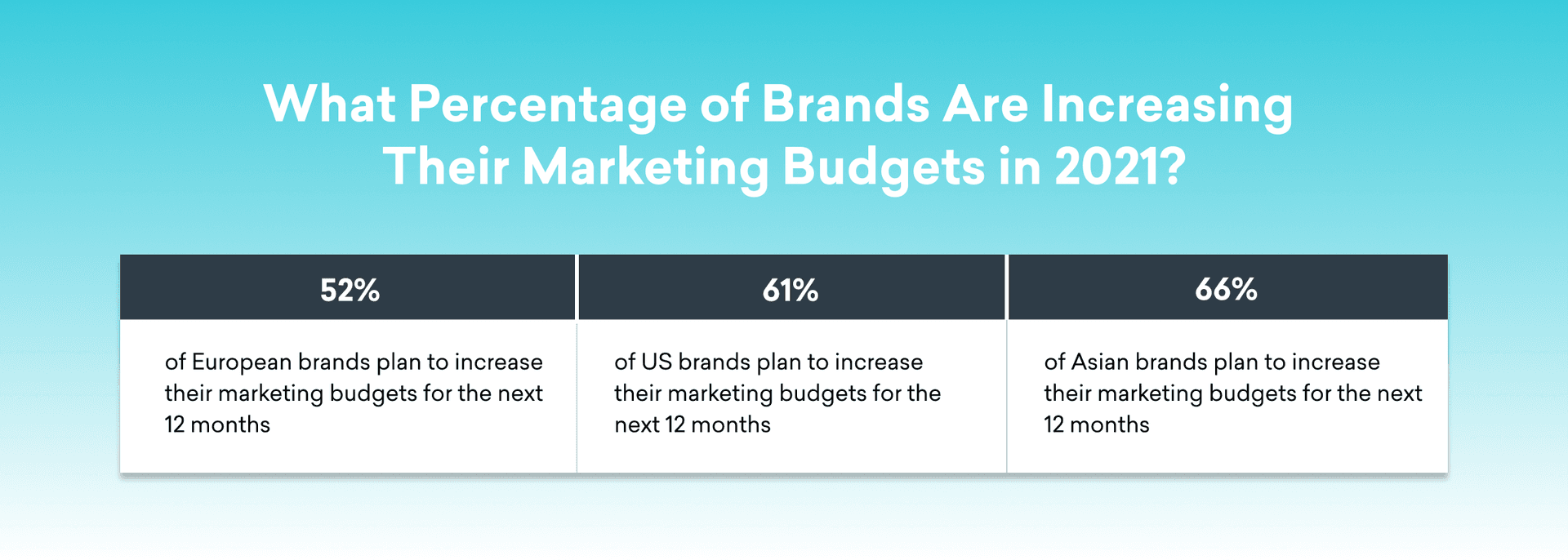

While our research found that marketing budgets were on the rise worldwide, European brands are slightly less likely to increase their marketing budgets for 2021 compared to brands in the US and Asia.

In keeping with these trends, UK companies—as with the rest of the European brands surveyed—are not prioritizing investing in customer engagement technology to the same degree as Asian and US businesses are.

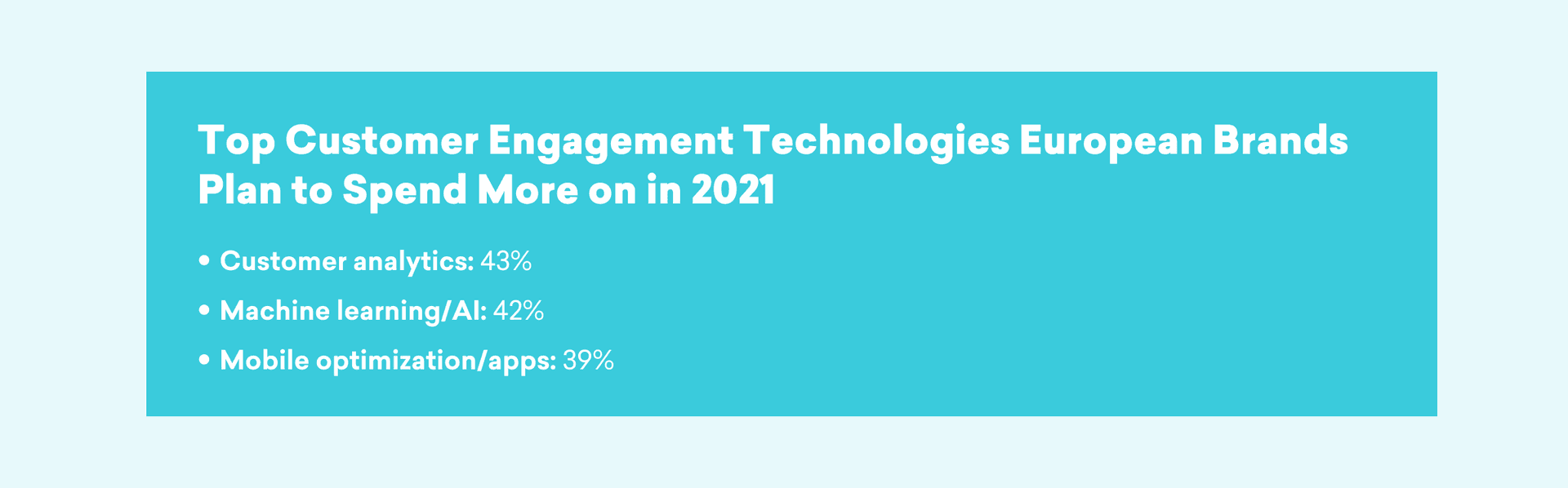

That said, the areas where they plan to increase their investment include analytics, AI, and apps.

3. Europe’s Big Customer Engagement Challenges in 2021 Include Managing Compliance and Risk and Adopting New Technologies

While every company has its own unique challenges and opportunities, our survey found some key trends when it came to the customer engagement challenges facing European brands this year. Here's what European brand leaders identified as their top challenges for the year ahead.

UK

- Breaking through or standing out in a crowded market: 43%

- Managing compliance and risk: 39%

- Collecting, integrating, and managing marketing data: 35%

France

- Breaking through or standing out in a crowded market: 38%

- Using or training employees on new tech or approaches: 36%

- Enabling cross-team access to relevant data in a timely and productive fashion: 34%

Germany

- Breaking through or standing out in a crowded market: 36%

- Collecting, integrating, and managing marketing data: 35%

- Managing compliance and risk: 30%

4. Most European Brands Failed to Exceed Their Revenue Goals in 2020, Despite Customer Engagement Efforts

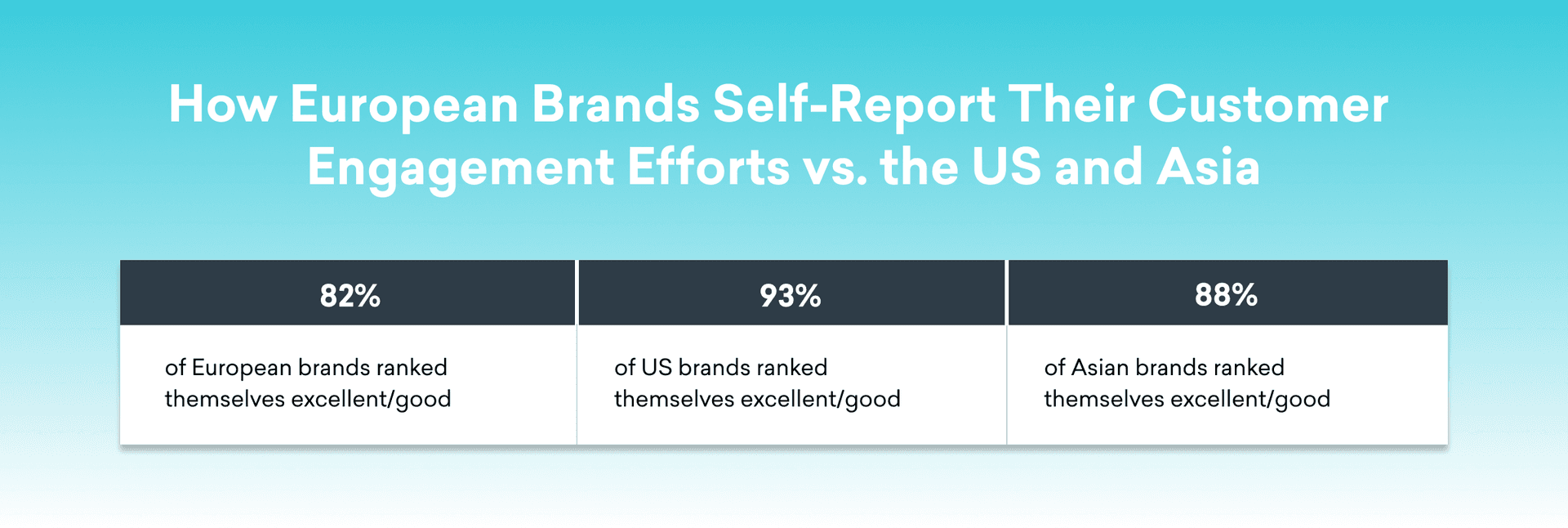

While a majority of European brands surveyed (82%) self-reported that they're doing a good-to-excellent job when it comes to customer engagement, that's still notably lower than what businesses based in Asia and the US reported.

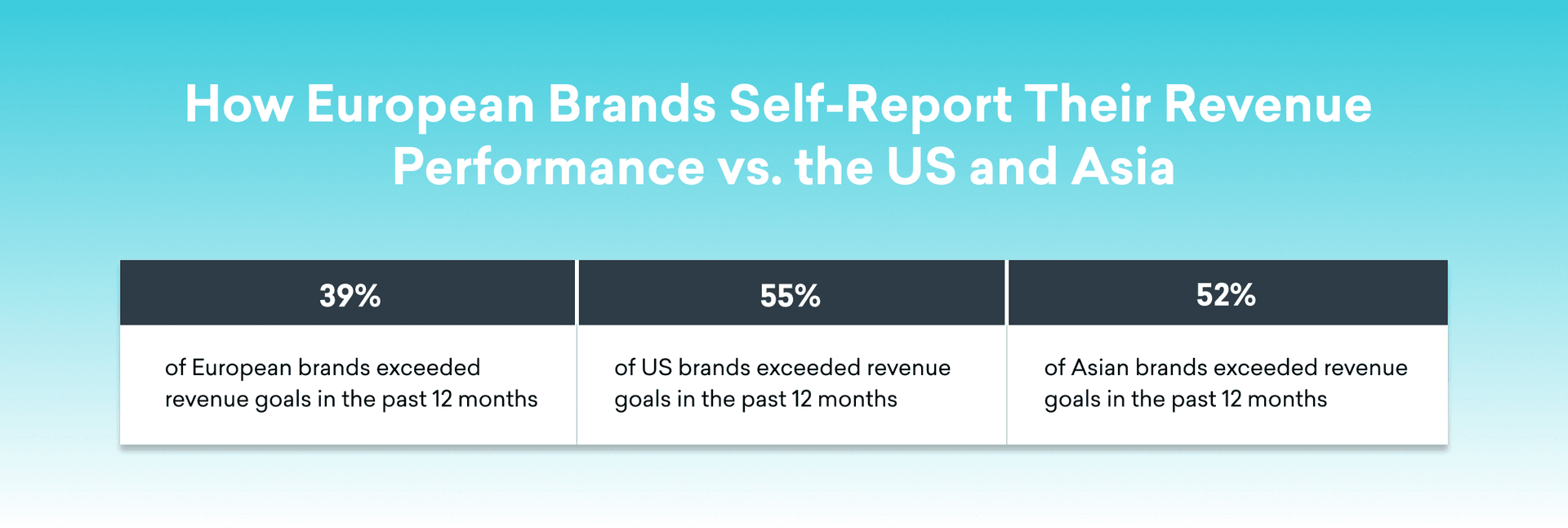

At the same time, less than half (39%) of European companies surveyed said they exceeded their revenue goals over the past 12 months, which is also significantly lower than what brands based in Asia and the US reported.

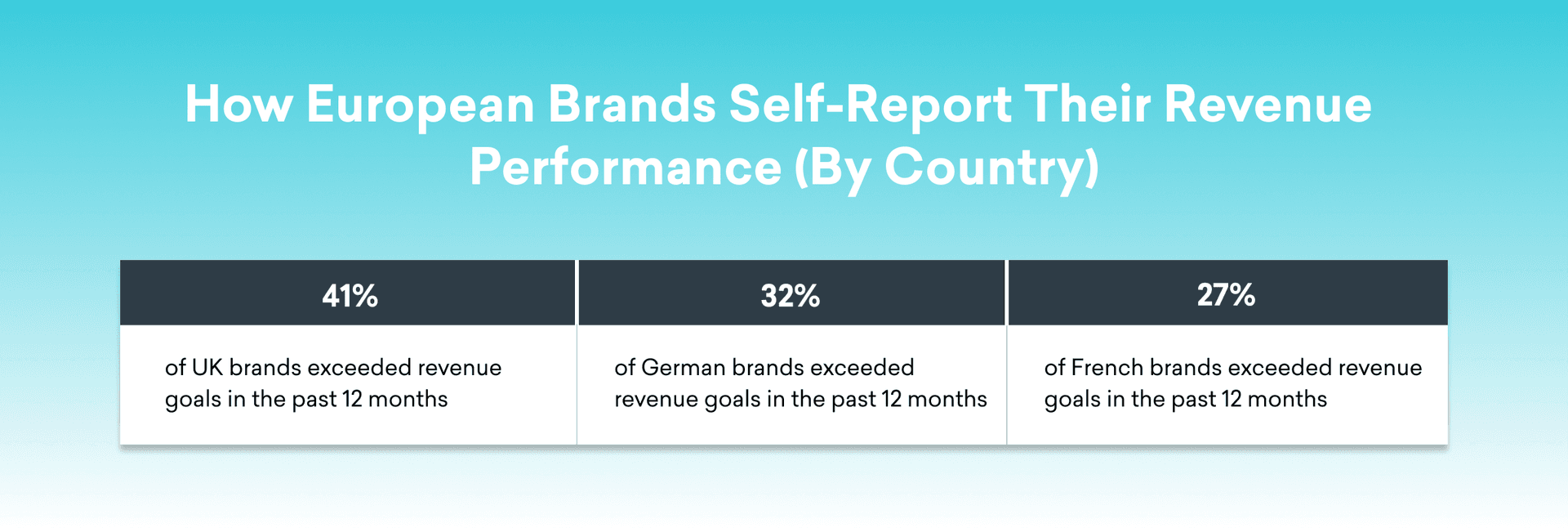

But while our survey saw European brands lagging in these categories, the results weren’t uniform on a country by country basis. On the whole, we found that UK brands were measurably more likely to report that they’d exceeded their revenue targets for 2020, compared to companies based in Germany and France.

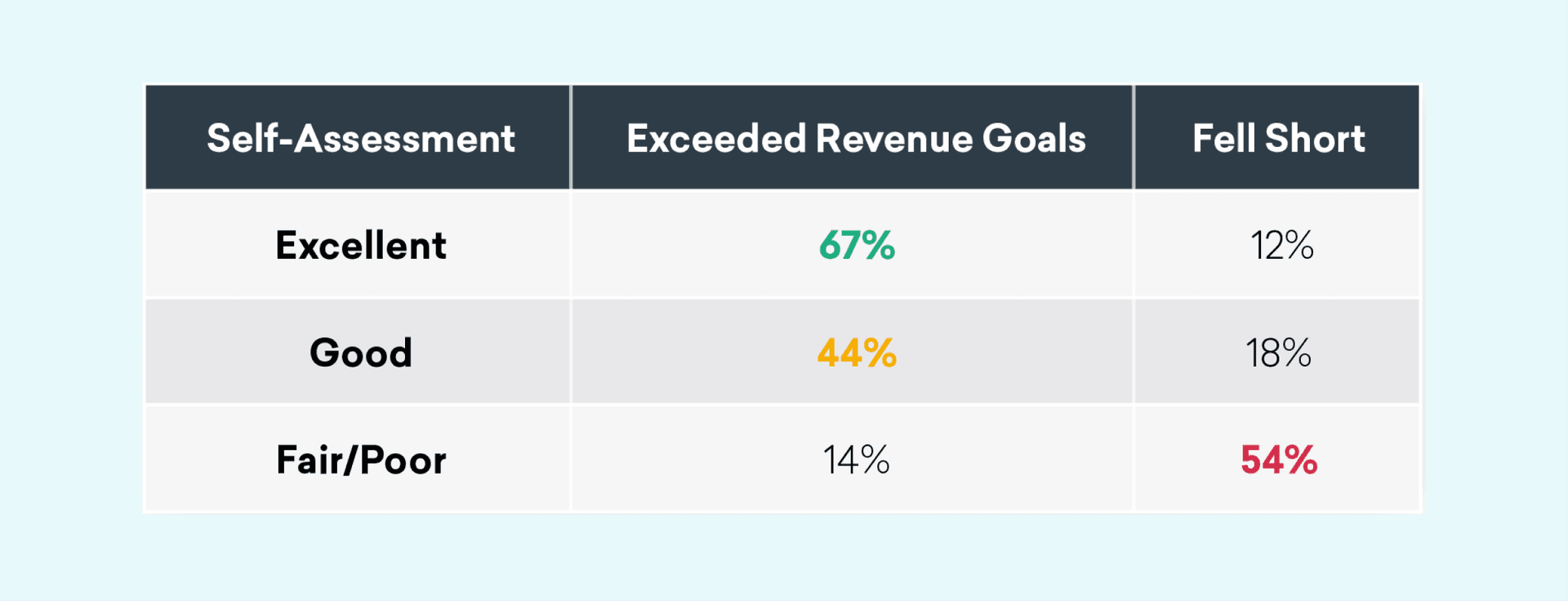

The findings from our full Global Customer Engagement Review indicate that companies that self-report their individual customer engagement efforts as "excellent" aren’t just excelling when it comes to those efforts—they’re more likely to hit their revenue goals, too, compared to brands that rated their strategy and approaches as "poor."

Final Thoughts

How does the state of customer engagement in Europe compare to the rest of the world? Get your copy of our 2021 Global Customer Engagement Review to learn about trends in customer relationship building, marketing investment in customer retention, and more in Asia, North America, and the world at large.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.