The State of Customer Engagement in France in 2023

Published on August 11, 2023/Last edited on August 11, 2023/6 min read

Team Braze

Forward-looking brands have long understood the positive impact that customer engagement can have on their businesses—and now new data is reinforcing that dynamic. The 2023 Global Customer Engagement Review leverages a survey of 1,500 VP+ marketing decision-makers across 14 global markets, among other data, to reveal key opportunities for brands and their marketing and customer engagement efforts. And to provide targeted guidance, we’re focusing on French companies and what these emerging customer engagement trends mean for them.

Conducted by Wakefield Research, on behalf of Braze, the survey found that 82% of the surveyed French brands exceeded their revenue goals in the past twelve months and 86% are expecting a bigger marketing budget this year. However, when it comes to customer engagement, the results suggest that French brands have an opportunity to leverage technology and collaboration more effectively in order to achieve their goals.

Today, we’ll delve deeper into our analysis of the state of customer engagement in France and explore the ways in which brands can advance their customer engagement strategies to drive the highest impact.

Key takeaways

1. French brands are splitting their focus between acquisition and retention while displaying optimism that marketing budgets will increase

Despite challenging economic conditions, optimism is rife for French marketers when it comes to their budget predictions for 2023, suggesting a strong belief in the value of their marketing efforts. In fact, a whopping 86% of survey respondents expect their marketing budget to increase in 2023, with not a single respondent anticipating budget cuts.

When it comes to how they plan to spend that budget, over 40% of surveyed French brands are planning to spend the majority of their marketing budget on attracting new customers. However, it’s more costly to acquire new customers than to get existing customers to make repeat purchases—6-7X more expensive, in fact. With this in mind, focusing your attention on building engaging customer experiences to boost loyalty retention could be a financially savvy way to garner even more ROI from your marketing efforts and secure even higher budget increases for the coming year.

On the acquisition side there’s also ample opportunity to optimize your paid ad strategy and deliver a higher return on ad spend (ROAS) by leveraging real-time customer data. For example, with Braze Audience Sync you can sync your owned first-party audiences with top advertising platforms and use that data to trigger and suppress ads across a range of paid media networks—reaching customers with paid promotions based on their real-time behaviors, preferences, and lifecycle stage.

2. French brands are excelling with zero- and first-party data as third-party cookies crumble

As Google continues its phasing out of third-party cookies, the great news for French brands is that 48% of respondents had already planned to reduce their reliance on third-party cookies for 2023, putting them in a great position as those changes take effect. The alternative? Zero- and first-party data.

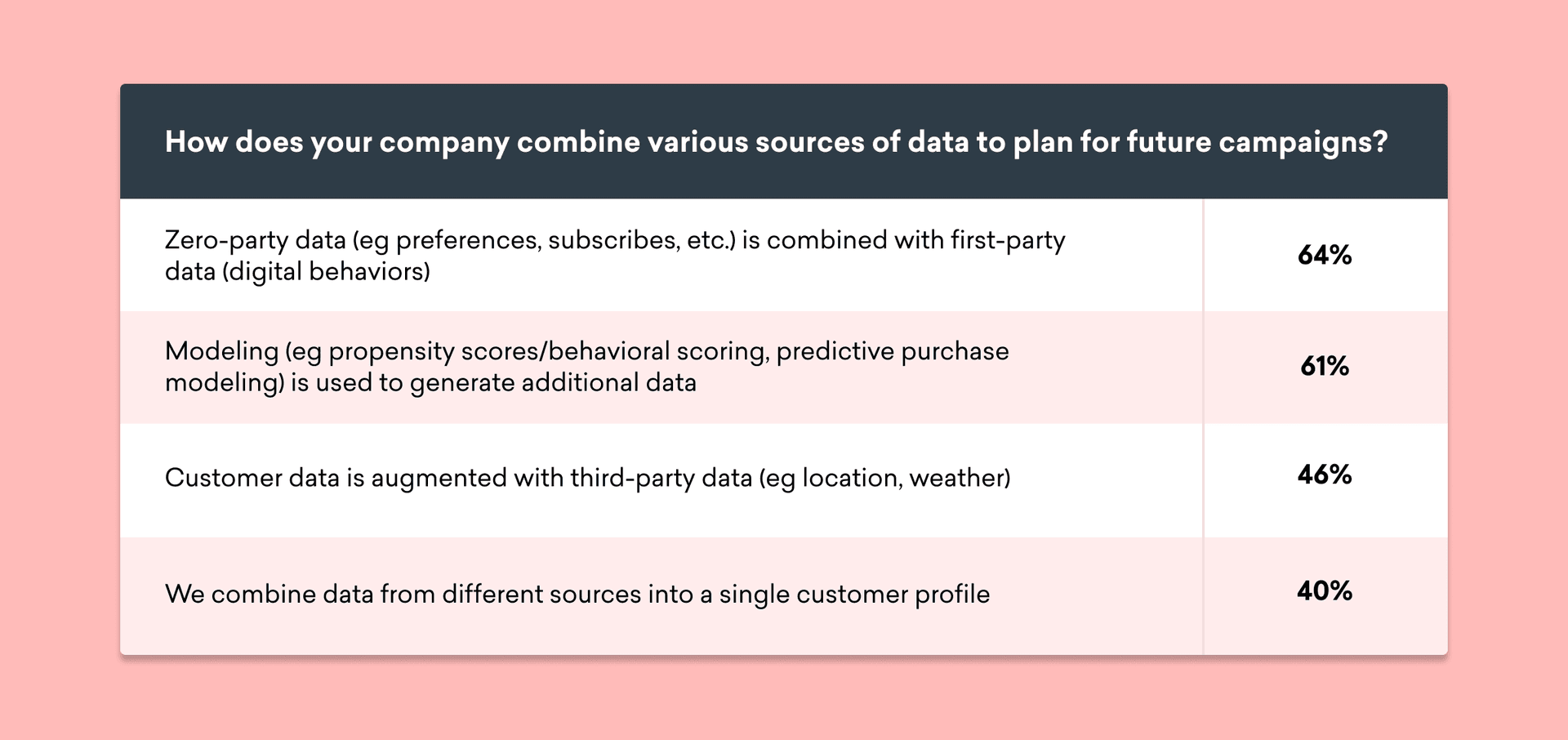

This consists of transactional data collected during users’ interactions with your site or app (zero-party data) and information volunteered by the user; for example, when joining a mailing list (first-party data). Brands that collect and leverage this information have their own source of compliant data they can use to personalize and target campaigns, with France leading the way compared to their EMEA counterparts.

In fact, 64% of surveyed French brands combine zero- and first-party data to plan future campaigns, noticeably higher than the EMEA average of 51%. However, on the flip side, 12% of surveyed French brands say that they will rely on cookies more over the next twelve months. If you are still relying on cookies when they’re phased out completely, you may be left with a gap in your customer intelligence, so the time to plan and pivot is now if you want to build a solid foundation for the future.

3. French brands rank the lowest in EMEA for collaborative ownership of customer engagement

When it comes to demonstrating the business value of customer engagement, a potential key indicator of success is the level of cross-functional buy-in and adoption across the business as a whole. After all, there is a huge delta between marketing teams orchestrating ad-hoc campaigns versus multiple business divisions collaborating together to incorporate customer engagement into their strategy planning and execution as part of the company DNA.

We asked French brands who owned customer engagement at their organizations and the results were striking: They ranked among the lowest globally for collaborative ownership (12%), but ranked highest globally for ownership by a non-marketing team eg. IT or product (41%). French brands also bucked the trend when compared to their EMEA counterparts, who indicated that customer engagement was primarily owned by marketing teams (58%).

The business impact of this? Well, it’s not uncommon for disconnected teams to lead to disconnected customer experiences—for instance, having messages originating from different teams within the organization can potentially confuse or frustrate recipients if that outreach isn’t cohesive and coherent as a whole. By prioritizing frequent cross-team collaboration and shared ownership over customer engagement goals, that alignment and focus can lead to increased efficiency and customer experiences that garner higher satisfaction and revenue impact.

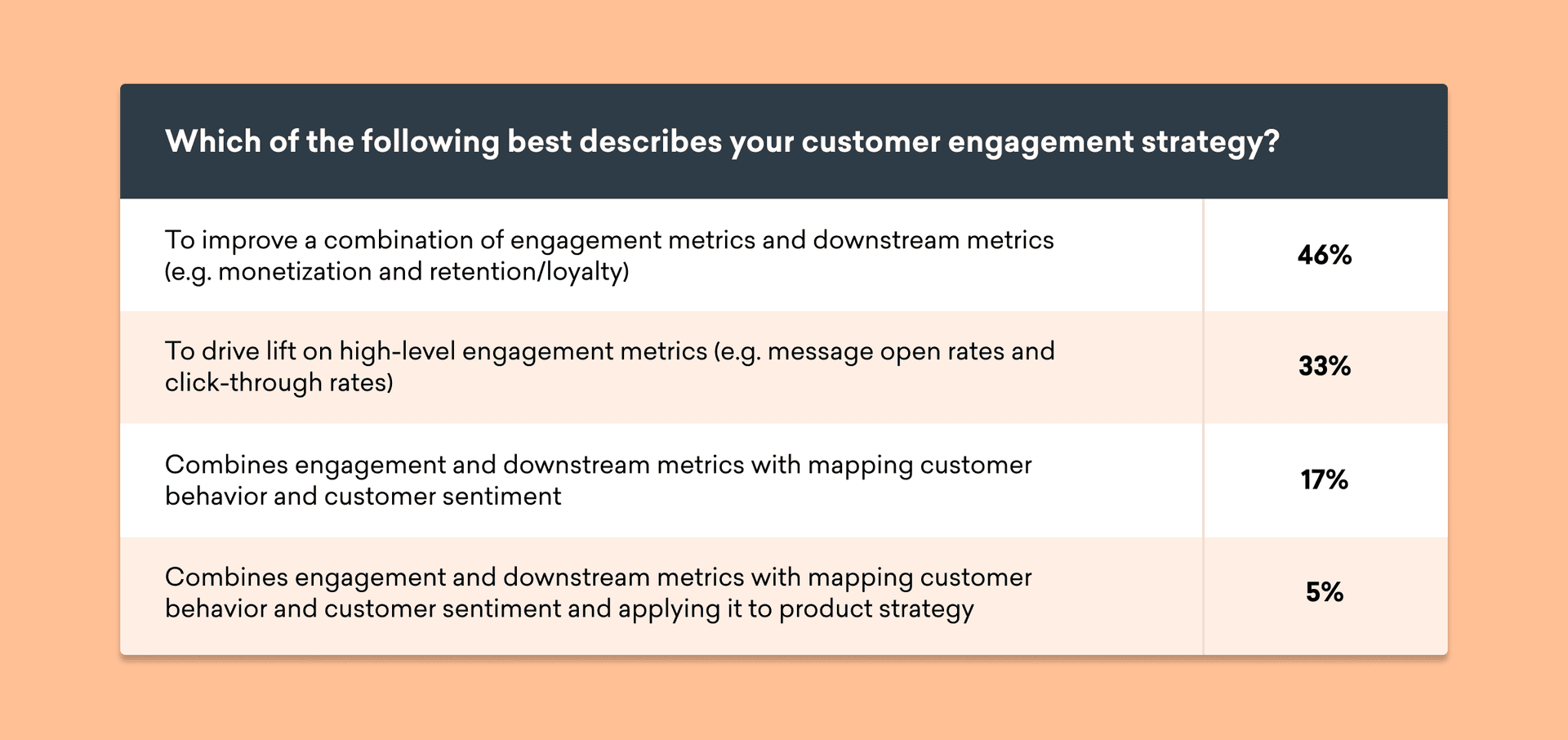

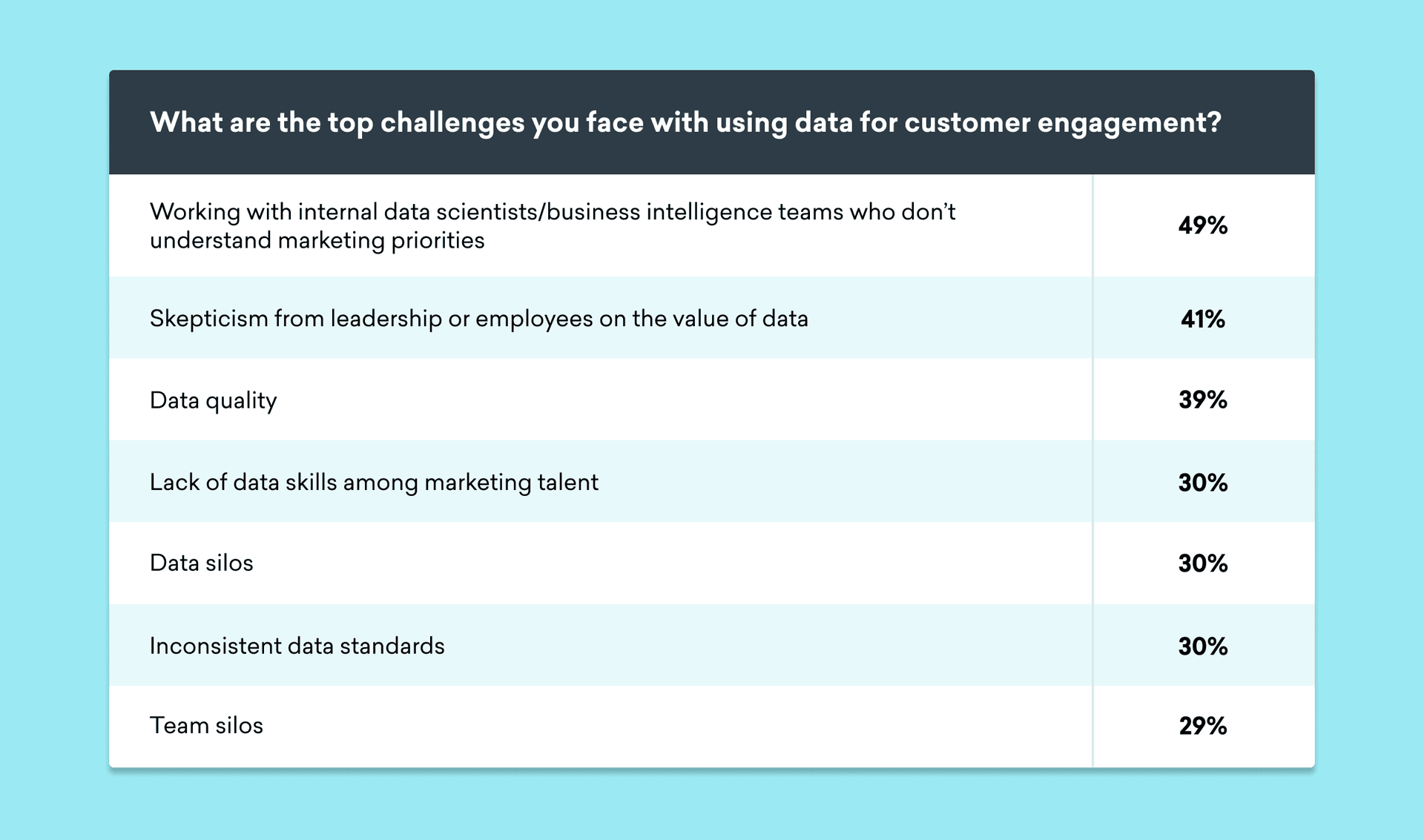

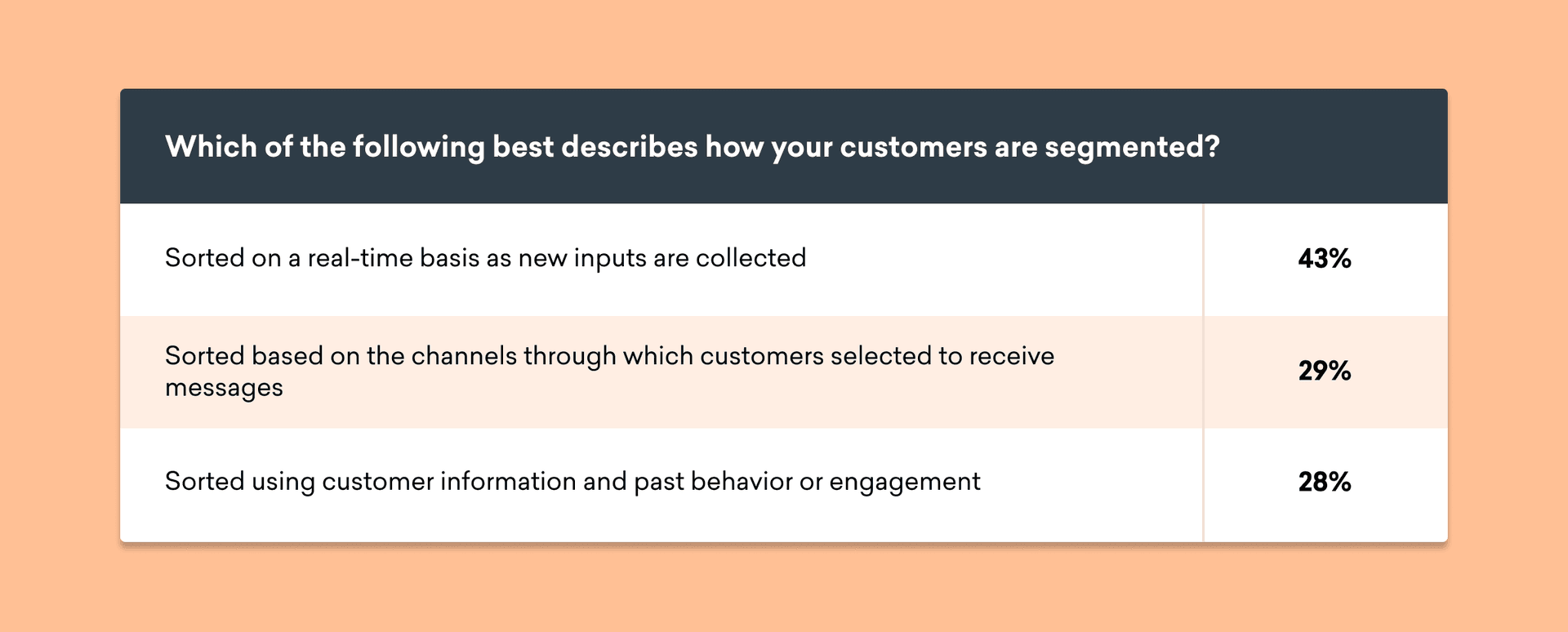

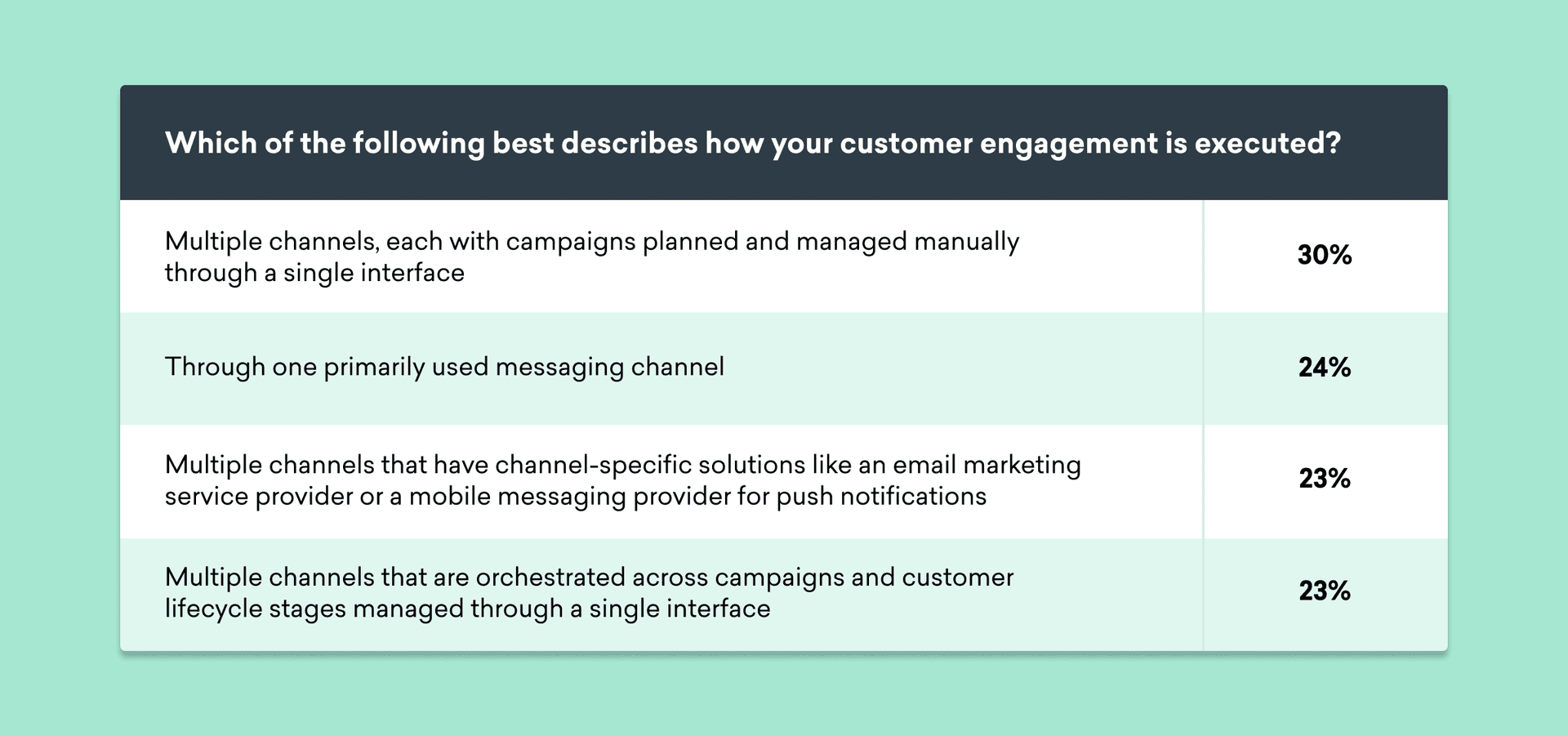

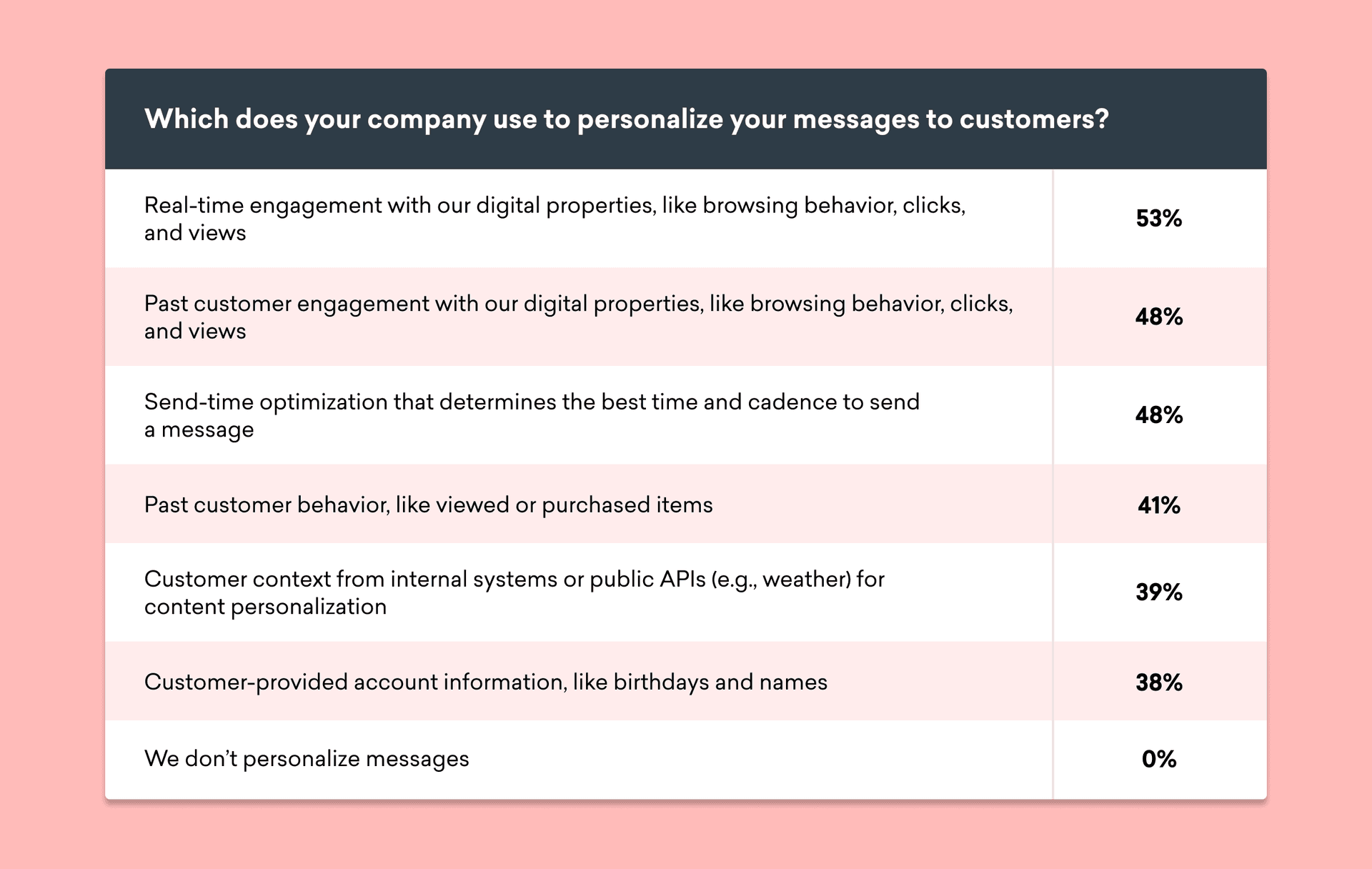

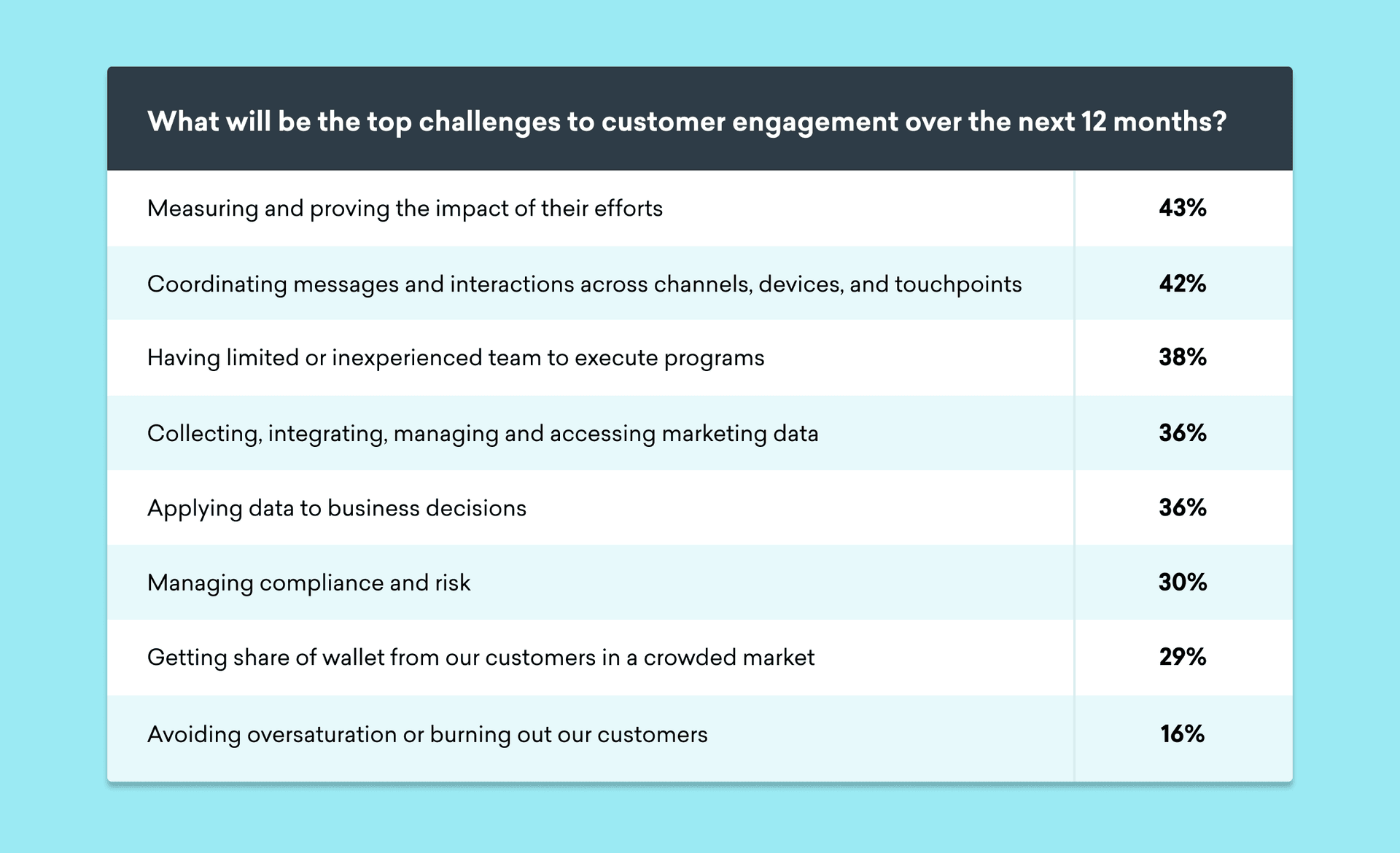

Customer Engagement Benchmarks for French Brands

Check your customer engagement strategy and execution against other French businesses. How do you measure up? Do the challenges match your own? What could you learn from your competitors?

Final Thoughts

Broadly, French brands are performing well amid challenging economic conditions and an increasingly sophisticated customer engagement landscape. This is especially true when it comes to being at the forefront of data innovation, championing zero- and first party data to stay ahead of the curve with evolving privacy regulations and the phase-out of third-party cookies.

To gain a competitive edge, a clear area of opportunity for French brands lies in cross-team collaboration, achieving alignment across business functions on overarching goals for customer engagement with regular communication when it comes to the campaign execution that makes those results possible.

For additional insights on the state of customer engagement in 2023 and how trends in this region compared to the rest of the world, get your copy of the complete2023 Global Customer Engagement Review.

About the Study and French Representation

The findings covered here are the result of our broader third-annual Global Customer Engagement Review, an analysis that draws insights from the following key data sources:

- Marketing decision-maker market research commissioned by Braze and conducted by Wakefield Research: We gathered insights from 1,500 marketing executives (all vice presidents or higher) from B2C companies across 14 global markets. Of these respondents, 93 represented the French market.

- Braze customer data: Our research includes data aggregated from over 8.5 billion global users from our leading customer engagement platform that powers experiences between consumers and 1,700+ brands in 60+ countries.

- Braze customer interviews: For in-depth learning, we spoke with top brands in five industries across three regions.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

Article4 min read

Article4 min readBuilding spaces for connection: Inside our Bucharest office

March 05, 2026 Article7 min read

Article7 min readData agility at a massive scale: How the Braze Data Platform supports customer engagement

March 04, 2026 Article13 min read

Article13 min readAI customer retention: Strategies, tactics, and mistakes to avoid

March 04, 2026